Taking Advantage of Opportunity in the Rapidly Growing Middle East Wealth Management Market

Sep 14, 2021

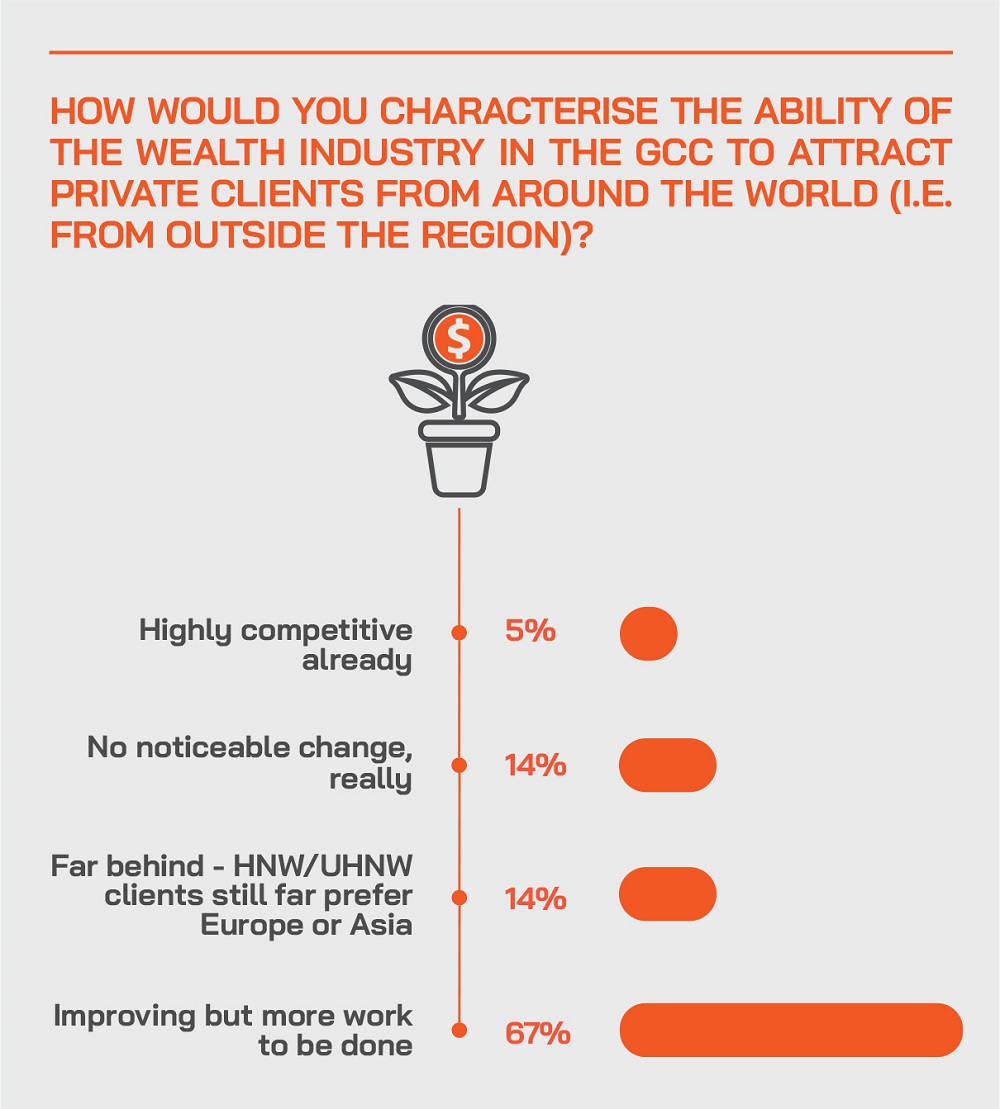

The state of the private wealth management industry in the GCC was debated in depth at the August 31 Hubbis Digital Dialogue event, with an erudite panel of experts who reviewed the evolution of the market to date, offering their views on what both the authorities in the region and by the private sector must do to more fully help the industry attain more of its full potential. Hubbis has assembled an outstanding panel of private bank and wealth management leaders to offer their insights on the evolution of the industry and of their businesses since the pandemic, and most importantly, to focus on the foreseeable future and to explain how they are positioning for success. For wealth management to thrive in the Middle East, there is no doubt that the quality of advice on investments, wealth structuring, and estate planning must improve; hence there is a growing emphasis on both greater professionalism and the related expansion of the products and solutions the industry can offer in order to keep their private clients engaged. The expanding family office proposition in the region is another interesting area for the market, as the private sector and the regulators strive to keep more of such UHNW clients at home in the region via SFOs, and also HNW clients via MFOs. Moreover, the region is hoping to draw more global money into the GCC market, especially perhaps Muslim clients from around the globe. But is the UAE yet offering a competitive service in the single-family office and the multi-family office segments, both of which are seeing a rapid expansion globally and especially in recent years in Asia? Can the GCC region compete with Singapore, Switzerland, London etc?

The Panel

- Alain Normand, Sales Manager, Middle East, ERI Banking

- Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory

- Prashant Tandon, Chief Executive Officer, Lighthouse Canton DIFC

- Vipul Kapur, Managing Director, Head of Private Banking, Mashreq Bank

- Ramzi Khleif, General Manager - MENA, StashAway

A market in a robust growth phase

An expert opened the conversation by reporting that his bank had seen what he termed “a massive inflow of new clients” coming into the region in the past year. “We have tripled in terms of new client acquisitions, and much of this is because people are starting to see UAE as a second home or a third home and a lot of these UHNWI clients are starting to move their wealth along with them into the region. The regulators have done a fabulous job in the country, people have found new confidence in the region.”

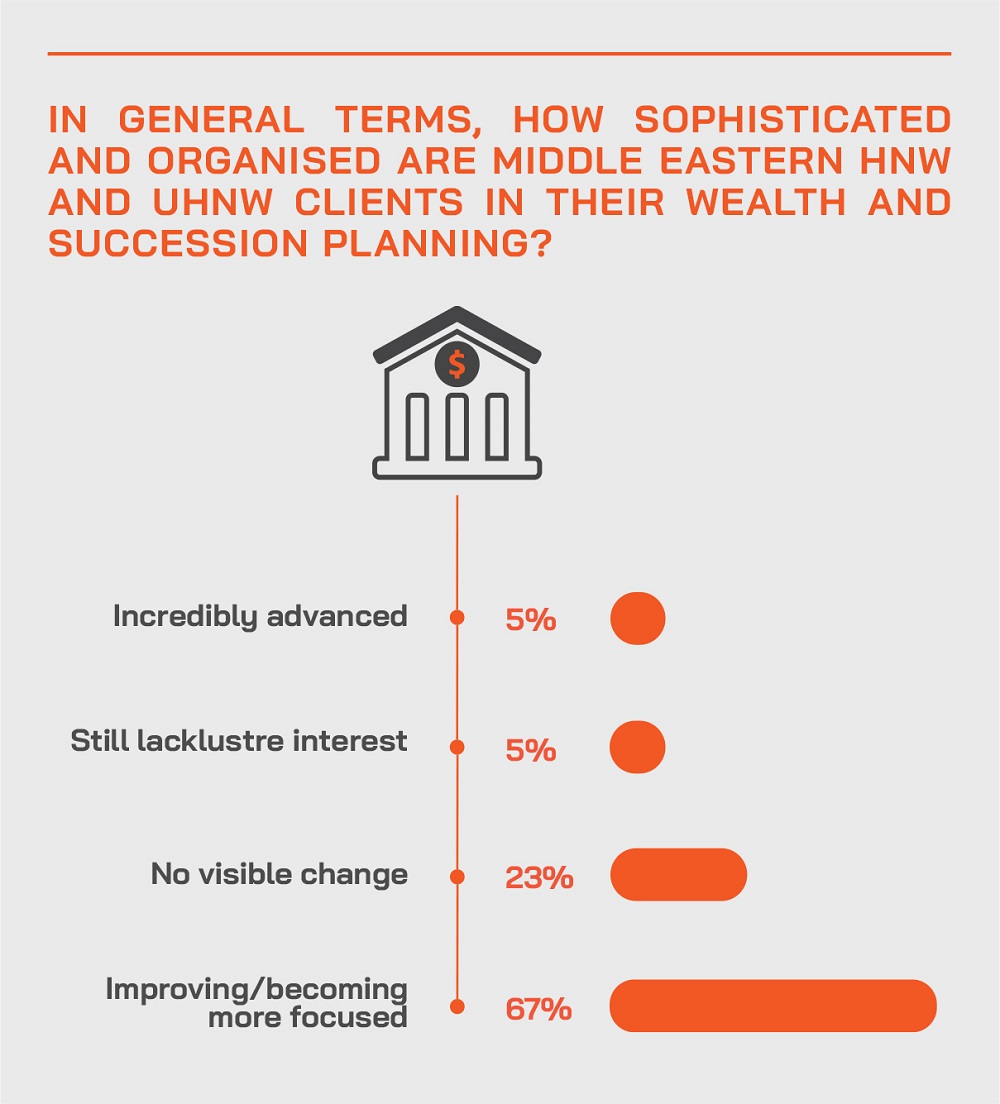

He reported that there is a more sophisticated approach to wealth management amongst clients, who are becoming less product focused, who are diversifying their assets, taking more defensive strategies, ring-fencing their assets against market weakness and wipe-outs, and looking at the widest possible spread across asset allocation.

“Investors here today no longer believe in only conventional asset classes, but are very keen to explore new assets, new ideas, themes around ESG, and are very keen to understand the impact on the society of their investment decisions, very keen to give back,” another expert reported. “The investor today has a very high EQ compared to maybe a couple of generations back, and keen to explore investment avenues outside of the public marketplace, in private equity, venture capital, and so forth.”

Regulations helping to drive growth

Another guest agreed, reporting: “With introduction of tighter regulation across other jurisdictions, with Economic Substance regulations being introduced in all countries with no taxation and coupled with CRS being in force has made lot of families revisit the existing location of their investment companies from BVI, Jersey, Guernsey to more onshore jurisdictions such as the UAE, where demonstrating substance is possible and families also prefer to visit or stay here frequently. This along with increased sophistication offered by DIFC and ADGM in UAE for various globally preferred structures to be established and operated locally has then allowed UAE to be considered actively for location of Family office or Investment office for families.”

A ‘friendly’ environment

Additionally, overall safety, the promise of good healthcare system, excellent infrastructure and changes to its residence visa regime (offer of long term 10-year visas, and so forth) have all increased the attraction for the UAE to be one of the choices for location of the families. “Further,” this guest reported, “with KSA opening it will offer new opportunities. In view of all of above, there has been increased demand for services from families in UAE and Middle East as a whole.”

Expert Opinion - Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory: “On the overall scenario of the wealth management market in the region, over the course of last 18 month through the pandemic, global markets have been generous and have benefited all those who stayed invested. Overall, the Middle East has tackled the pandemic a lot better, particularly the UAE, keeping most activities open with proper precautions and focus on getting its population vaccinated all this while guaranteeing a free treatment to all those who contract the virus and needed hospitalisation. As a result of it being accessible when travel to all other parts were not possible, this has benefited UAE to be considered as a promising location.”

An expanding proposition

An expert reported that the demand for legacy and estate planning is also rising across the DIFC and ADGM. “The succession planning tools available are more varied than ever,” he reported. “We have seen more foundations being set up by families for succession planning, doubling from last year. Local Muslim families have started opting for setting up the foundation for succession planning and other things. So, all of this has somewhat changed the dynamics and therefore it has made it better for all the players within the industry to start looking at this new demand and new requirements.”

Evolving wealth demographics, evolving demand

A guest observed several trends in terms of the evolution of the client base. One trend is the growing flow of money to the nextgens from the older generation, resulting in many new clients asking for wealth management support. “We must therefore recognise that statistics show that relationships with providers change some 70% of the time, and as a growing private bank, to be able to capture that flow of money that will come into the new generation is a great opportunity.”

Along with this, he noted that the new generation expects different products, services and delivery, with elevated digital offerings expected. “It is not just the simple processes and connectivity that are needed,” he said, “but we need to adapt to the knowledge economy; these clients want information quicker, and that is more pertinent to their requirements and specifically tailored and targeted to what their needs and expectations,” he said. “So, our relationship managers are in need of many more digital tools today.”

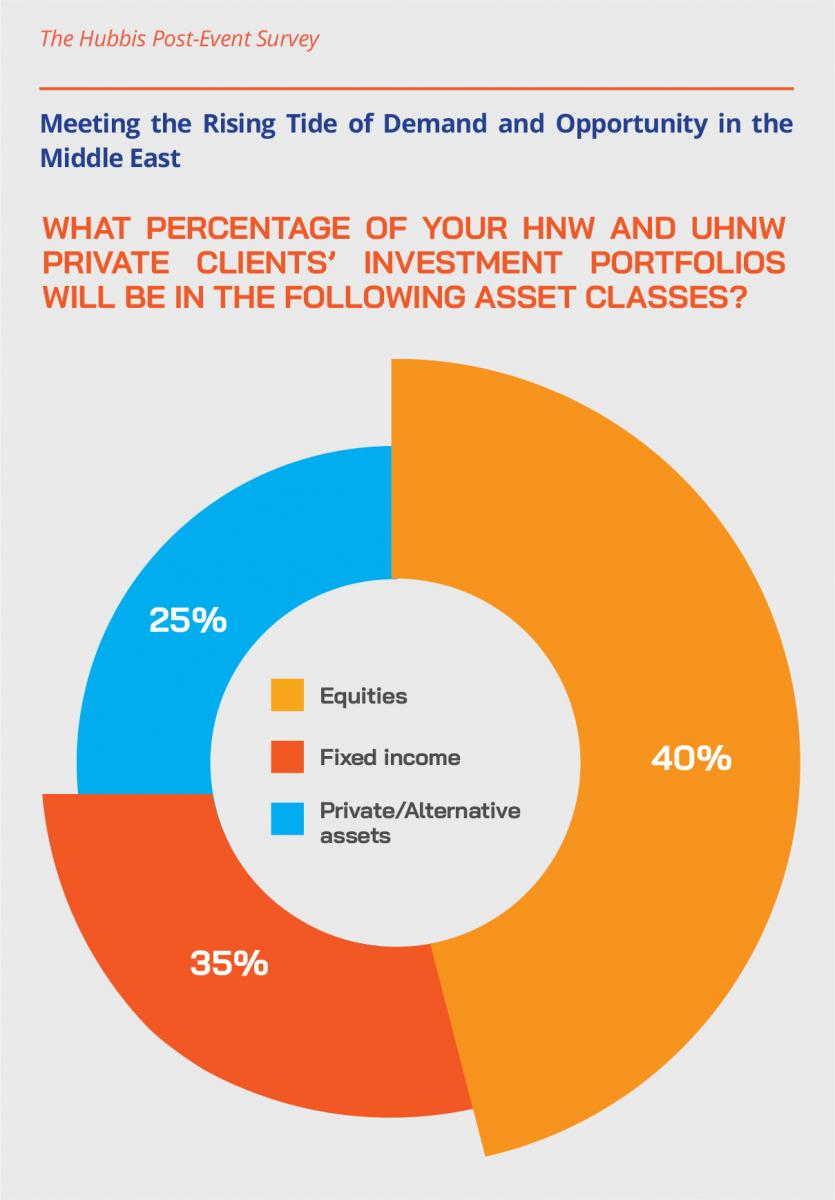

Secondly, the market historically was very fixed-income focused market. “That is still the case today,” he reported. “However, we have started to see significantly higher diversification, especially where the markets have done very well. So, whether it is on the fund side, whether it's on the private equity side, or whether it is specific tailored products, or the discretionary portfolios that we may be able to offer, clients are looking for a lot more of that diversification.”

Liberalisation and forward-thinking

Additionally, the local regulators have encouraged world class products to be available locally. “Before, you never had so many options,” a guest reported. “Now, the regulators want to remove the ownership restrictions which they used to have for local operations. So, if you couple all these things together, they don't have ownership restrictions, they don't need to engage an Emirati or local sponsor for ownership purposes, you have access to all the latest and available structures, which are available anywhere else, say in Singapore, or London or Geneva.”

Add to this perspective the world class infrastructure, connectivity, the time zone, the ease of establishing substance, availability of skilled resources, access to Africa and the rest of this region, to India nearby and the attractions of living in Dubai and the ease of access to long-term visas and it's hugely attractive for any corporate, any family to have operations and bases here. And while much of the developing world flounders with the pandemic, there are more world class events happening, expos opening up and the property market is very buoyant.

The expansion of the family office

A guest reported how there are more wealth families and family offices coming into the UAE, which is now increasingly being looked at as a safe haven for the Middle East and the wider GCC, rather like Singapore to Asia.

“These family offices are now starting to look at diversifying part of their assets from other geographies and into UAE, so, both on the high-net-worth space and the family office side, I think the region is starting to pick up a lot more momentum,” he reported. “And I think this trend will continue. Indeed, we started to see a lot of that flowing into the real estate side, but more importantly, when people move into a geography, money follows them. And I think that's where most banks, asset management companies, EAMs will start to see the benefits flow through.”

Many appeals for families and UHNWIs

The GCC time zone, plus the rising tide of appeals and skills in the region have lured more family offices to set up there. “Very importantly as well, the way this region has managed the pandemic has really helped,” said one expert. “Business owners and families have noticed how proactively the regulators, the government stepped up their vaccination efforts, how efficiently they've handled the pandemic. Added to that, the regulations around 100% ownership of business in the mainland, and the arrival of the foundation regulations in the DIFC and the ADGM are all positive steps in the right direction. And most of the large families and businesses we speak with are actually either actively exploring or have already initiated the process of building a footprint in the region.”

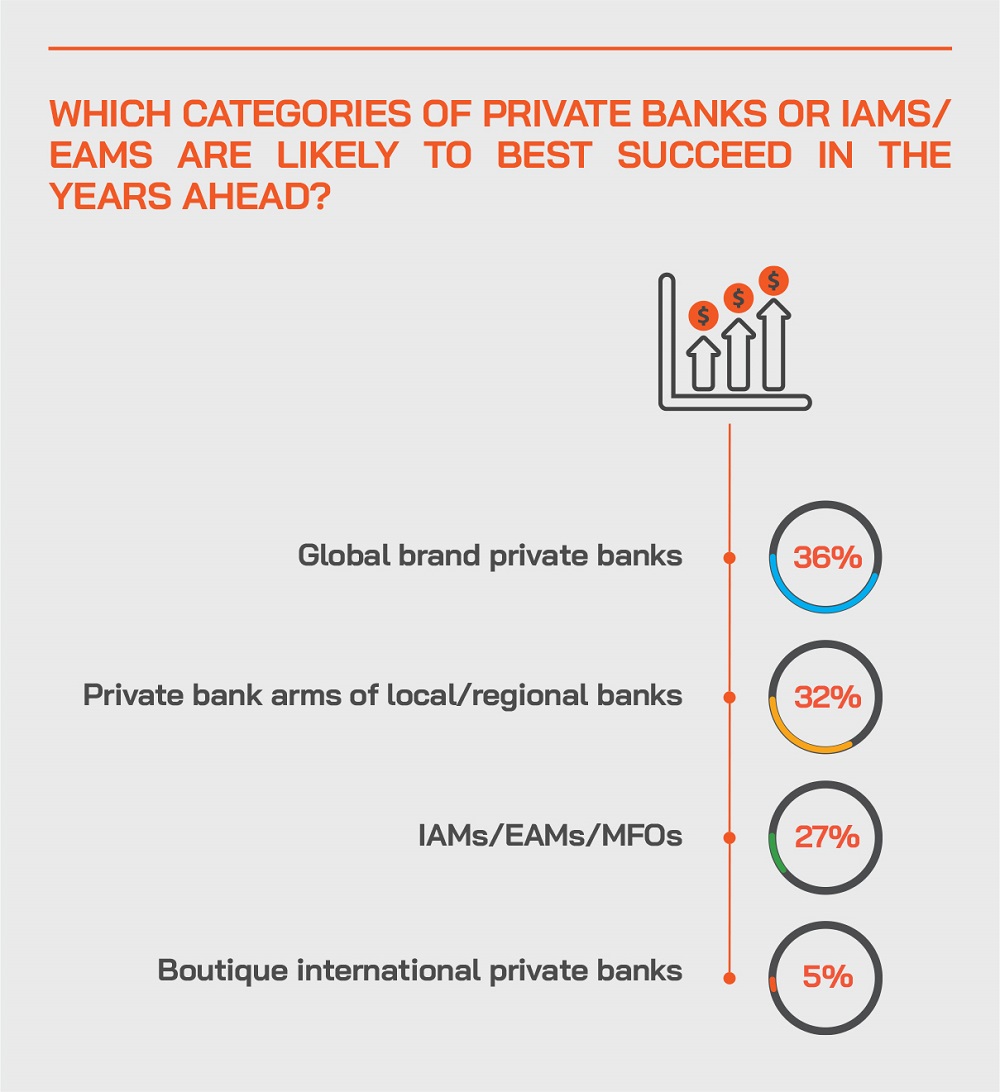

Expert Opinion- Prashant Tandon, Chief Executive Officer, Lighthouse Canton DIFC: “A noticeable shift that we see in the wealth management space is the democratisation of the landscape. With the advent of new age independent advisors, wealth management and investment advisory are no longer the bastion of bulge bracket banks alone. Adding tangible value and providing holistic offerings, while balancing the unique and distinct needs of the client will become more imperative as clients become less keen on paying for mere execution and focus more on clarity and control over their investments. Leveraging digitization and tech enablement, coupled with their alignment of their client interests, enables new age independent advisors to look beyond the limitations of certain platforms or institutions and provide true blue-sky access to solutions.”

Expert Opinion - Ramzi Khleif, General Manager, MENA, StashAway: “Approximately 45% of total wealth in the GCC is held as cash in the bank, a very high percentage by any standard, presenting a massive opportunity for investors to deploy their capital and generate returns rather than having their money sitting idly."

Expert Opinion - Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory: “Regarding the major evolving market trends and strategic developments that the private wealth industry is witnessing and predicting for the future, we see increased participation from nextgens into investment management. Further, the families are also looking to diversify from normal equity, funds and bonds to crypto and other assets, and building at least small exposures to that asset class.”

The family office as a centre for consolidation

“Why is the family office necessary and how should it be structured?” a guest pondered. “Given the complexity of the investment world, given the complexity around governance, the institutional nature that a family office brings is very important. But there are issues to consider. Not every family office might be to a scale and complexity that they deserve to have a full setup in-house. And attracting and retaining top talent is tough as that talent tends to hit a glass ceiling very fast, and you risk losing them or losing their motivation. But if you go to a professional multi-family family office, which is independent, from a professional’s perspective, they see a career path, they see a growth trajectory, and they see a possibility to engage with a myriad set of clients across a different spectrum.”

Regulatory consolidation is also vital

A guest highlighted the vital importance of international tax structuring and planning for families and corporates, including succession planning and other solutions across jurisdictions. “In the past 18 plus months we have been busier reviewing existing structures given that the entire tax landscape has changed the world over due to the OECD initiatives, CRS, AEOI, BEPS and other initiatives. It is all becoming very, very challenging.”

Accordingly, many families and companies have reviewed older structures and adapted them to fit the current and anticipated regulatory landscapes. “They often need to revisit those, to simplify, as substance requirements at each location are increasing, compelling a major review of how people and businesses operate. A lot of these things have kind of percolated down to where you can be based which is easy to operate, easy to demonstrate substance, easy to get in, get out, and lot of other things. The world class infrastructure, connectivity, the time zone, all of that and other factors have helped the Middle East and the UAE in particular, to come up with that pretty unique proposition.”

Expert Opinion - Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory: “The wealth industry here is seeing the establishment of more IAMs/EAMs and family offices in the UAE, with the actual fund management still largely in European and Asian centres. We need to further evolve the product offering, evolve local regulations to allow funds to be managed locally without any issues, we need transparent fee structure regulations, which will then allow the market to develop further. Middle East clients expect more of their providers in the region, they want better advice, better services, long-term value creation and long-term investment strategies.”

Differentiation and agility

A panellist explained that despite the rapidly growing market size and potential, differentiation is vital. “There is a lot of competition, right from the well-known private banks through to the new FinTech entrants. It keeps us all on our toes. As an established bank, considered more traditional, we have to adapt very quickly. Fortunately, we are a lot more agile as a banking organisation, a lot nimbler today. We're able to face some of these challenges and evolve much faster. There's not necessarily one or only a few winners, because the pie is growing in fact, the UAE is growing at roughly double digit growth rates year on year at to AUM – but for sure, we as an organisation need to continue to be at the cutting edge of both technology and the knowledge economy and also be able to fend off some of the big tech that are going to be coming into this marketplace.”

As to exactly how the bank will adapt, this guest explained that the bank must elevate its capabilities to offer the best possible advisory services and to be able to deliver them consistently, and to be able to work with the regulators to make it a lot easier to provide services to customers not just in the Middle East, but also overseas.

“Actually, some 30% to 40% of our client base lives outside of UAE but has some connection with the UAE,” he reported. “Accordingly, we need to be able to provide them with seamless engagement in terms of providing them with access to knowledge to make decisions fast on their portfolios. And we are already well up there, and we see the next three to five years are going to be really quite interesting as we continue to build on this.”

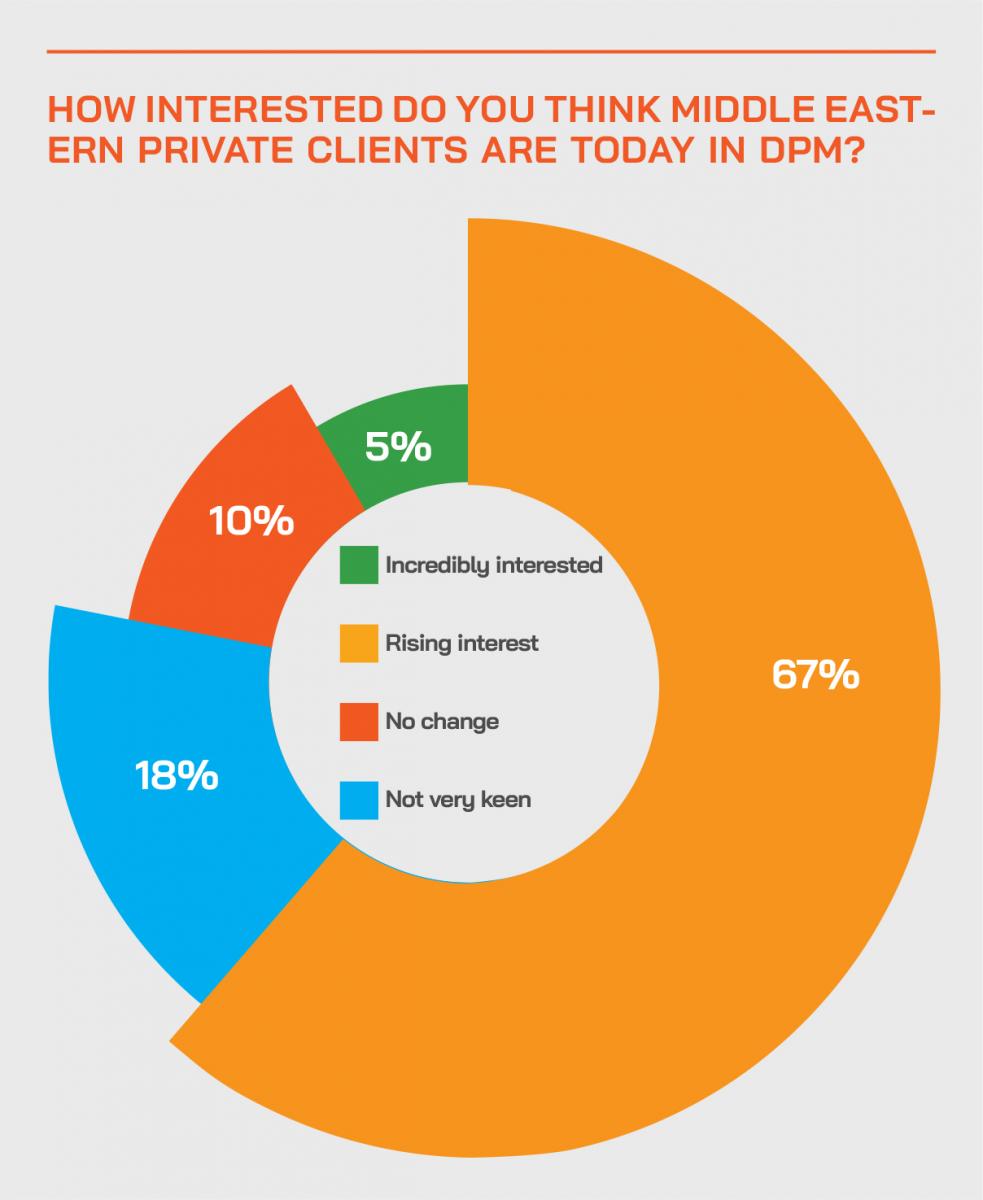

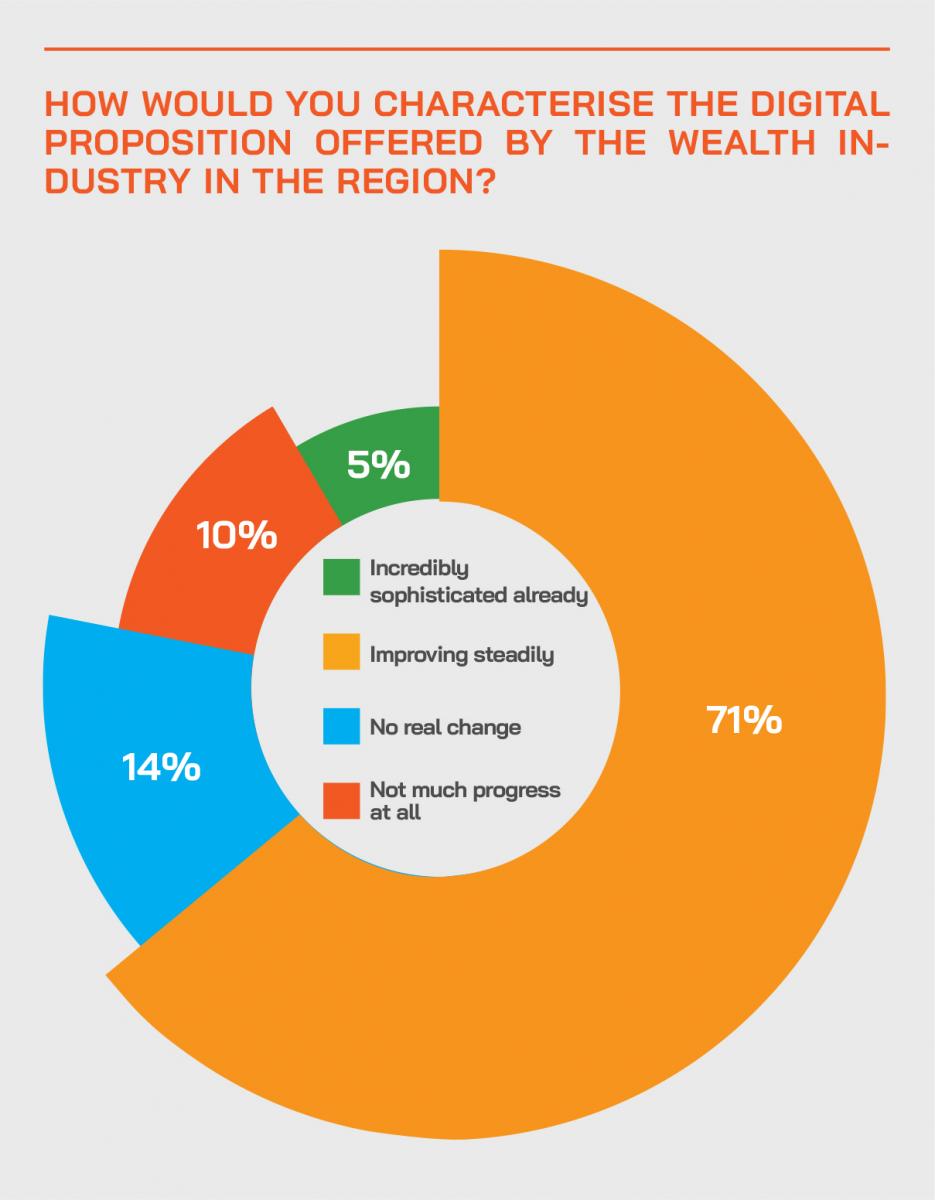

Digital transformation – don’t ever relax

“Something like a decade worth of digitisation effort has been put through by all stakeholders in the wealth management ecosystem over the last 18 plus months,” a guest reported on the subject of digitisation. “And with the new age of entrepreneurs and investors, we also see a huge democratisation of the entire landscape, at least from the financial services industries perspective, where clients are no longer keen on paying for mere execution but are looking for a whole suite of value-added services, a better and more comprehensive client experience, and a far more elevated digital interface with their advisors and providers.”

Looking at the digital journey, another panellist reported that their institution is undergoing a “massive transformation” on the technology side, working with several FinTech partners, both from Europe and from Asia, from Singapore in particular, in order to be able to revamp the bank’s entire system.

“We adapted to remote access and working within days,” he reported. “We can talk to a client sitting anywhere in the world and engage with them as if we are in the same room, and that gives us not just the ability to talk, but also to open accounts. We are working with regulators to see how we can eliminate wet signatures, for example, in order to open accounts, we are talking to them to see how we can directly access databases that the government has today in order to do verifications of customers. There are dramatic changes in the UAE particularly because the government is extremely keen to make these processes digitised.”

Adapting with agility

The representative of a digital solutions provider specialising in the design, development, implementation and support of an integrated, real-time banking and asset/wealth management software solution, explained how much the local WM community in the region requires the latest and most accurately targeted banking and asset/wealth management software in many countries that is used and seen in the most developed private banking and asset management jurisdictions.

He noted how a lot of the banks in the region have archaic core systems and to buy into a modular offering that upgrades the core and offers optional modules as their needs evolve is a highly efficient and highly flexible offering that ideally suits the needs for customisation and adaptability.

Smart investment required

To achieve the goals of smart and also secure digitalisation, this expert remarked how wealth management customers clearly need to invest wisely in the requisite technologies that can also be upgraded and adapted easily and cost-effectively in the future.

This particular firm’s offering is a fully integrated, digital, front-to-back, parameter-driven banking solution, with the system supporting a broad range of functional domains and business segments through its flexible conceptual design. Applications are especially suited to private banking, wealth management, funds & trusts, e-banking/brokerage, treasury management, corporate banking, retail banking, and central banks.

This comprehensive software solution for the private banking and wealth management environments offers a core banking platform, which has modular components around it. This allows them to provide a front-to-end type solution that banks can use in multiple locations, languages and across different currencies. As it is in the ‘cloud’ it is remarkably adaptable and can be made operational in a very short time frame.

New age entrants

The representative of a FinTech digital investment platform offered his perspectives on the market and where such firms that offer a digital first approach can compete in the region. “People like it as it is fully transparent, easy to use, has a great customer experience, you're able to onboard and complete everything in less than 10 minutes, you don't need to meet anybody in person, all the verification is kind of done digitally. Then you have access to a sophisticated investment framework. The fees are much more reasonable than compared to a lot more of the traditional players, with our highest fee at 0.8%, and then reducing to 0.2% as your portfolio size increases gradually, so we are a lot more competitive on that front.”

The access opens the door to what he described as a sophisticated investment framework that normally would only be accessible to a certain very wealthy individuals or family offices, and at much higher fees. “So, we democratised wealth management to a certain degree. And since we launched in the Middle East around a year ago, we've seen very strong growth. And there is a massive opportunity. There's a massive amount of cash just sitting idle, I recall figures of 45% of wealth in the region that sits in cash that's not even deployed.”

Digital first, leveraging omnichannel

To win new clients, he explained the approach is also digital first via online marketing, paid channels, social media, and so forth. “And we also do a lot on education in personal finance, so we make our content available, we invite guest speakers to webinars, we offer advice and education on financial planning, retirement planning, diversifying wealth, and so forth. There is a huge younger population here, with increasing demand for innovative products and digital players offering new ways of doing things. Moreover, people are a lot more conscious also on the fees that they're paying as well; we all know that upfront fees, management fees, platform fees, exit fees, they eat into your returns quite quickly, and maybe you don't realise it as much when markets are kind of growing strongly. But even then, it has a long-term impact on your portfolio and your potential growth as well. The trust, the value proposition, the brand equity is building quite quickly for us now.”

Democratising the offering

Another expert pointed to the rising mass affluent market in the Middle East as well as the very large and wealthy expatriate market, demanding all sorts of goals-based wealth management advice and solutions, including life insurance solutions as well as part of their estate and retirement planning basket. “Technology helps bring many of these solutions quickly and efficiently to these types of clients,” he explained.

Expert Opinion - Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory: “As to the impact of the pandemic, many providers have indeed seen their UHNWI clients, some of whom are no doubt getting elderly, show more interest in succession planning. More families are aware of this issue, and they are taking professional advice on proper options available. Foundations within DIFC and ADGM has increased by almost 100% in the last 12 months, and the DIFC has been more popular. Overall, 288 foundations are established to date and demand is increasing. So, yes, succession planning is at the top of the agenda.”

Expert Opinion- Prashant Tandon, Chief Executive Officer, Lighthouse Canton DIFC: “The next-gen and new-age entrepreneurs in particular, are increasingly looking beyond isolated investment advice in the public space and are, equally if not more, keen to understand the ESG impact of their investments or how they can give back to their own ecosystems. As such they seek advisors who can align to their interests with private and co-investment opportunities that integrate well with their own philosophies, business plans and growth ambitions.”

Talent – vital but in short supply

Talent of course is essential to the continuing growth of the Middle East market. “Having worked in both Singapore and London for many years, and then in the Middle East, for the last 15 plus years, I've seen the way these countries have evolved and have generated the kind of talent that they have in the wealth management space,” a panellist commented. “In our private banking world, and in high net worth family office management, the RM is going to continue to play a central role along with his team-based approach that we've put in place, the advisors, the FX specialists, the trade specialists, and so on.”

Government support across the board

He reported that the Government of the UAE is very cognisant of the fact that talent development needs to increase and improve and therefore the UAE needs to be a recognised place for attracting the best talent in the wealth management industry. There are some streams in progress as we speak to help bring that vision to life,” he reported. “There are two parts to it. One is what is it that the government can do, not just the central bank, but the entire ecosystem, and secondly, what the individual partner banks can do towards this goal. The government is really giving us a free rein as banks and professionals to be able to build that talent.”

He explained that at their bank, they have a stated mission to attract and retain the best wealth management talent in the region. “That's an easy thing to say, but it's very difficult thing to execute, and we've developed a bunch of internal training programmes, we have tied up with certain international organisations and universities to be able to provide our best RMs the kind of growth that they expect in our organisation,” he said.

Empowering women

“And at the same time,” he added, “the government is very emphatically helping with the opportunity to develop women’s talent. “That is going to be critical as this region grows. And what has taken decades in other more mature markets in Europe, or Singapore, is being achieved much faster here. Already we have RMs with an average working span of approaching eight years with us, so talent retention is also potentially very good if the right approaches are maintained.”

Conclusion – grasp the opportunities ahead

A panellist concluded the panel by remarking that in the 25 years he has lived and worked in the UAE, the development has been both extremely rapid and incredibly impressive. “We are even seeing some key talent shifting from Singapore and even Europe to here for a variety of reasons. This is a massive region between Singapore and London, we are beautifully placed between those two massive markets. And growth abounds all over, whether directly here, or Egypt, or Oman, Saudi Arabia and so on. So, we are seeing a lot of that activity flow coming in into Dubai. You will see a lot of excitement in this region, a lot of new talent coming in into this market from other regions, and a lot of growth ahead.