Publications & Thought Leadership

Private Placement Life Insurance (PPLI) for Wealthy Private Clients – What? Why? How?

Jun 27, 2023

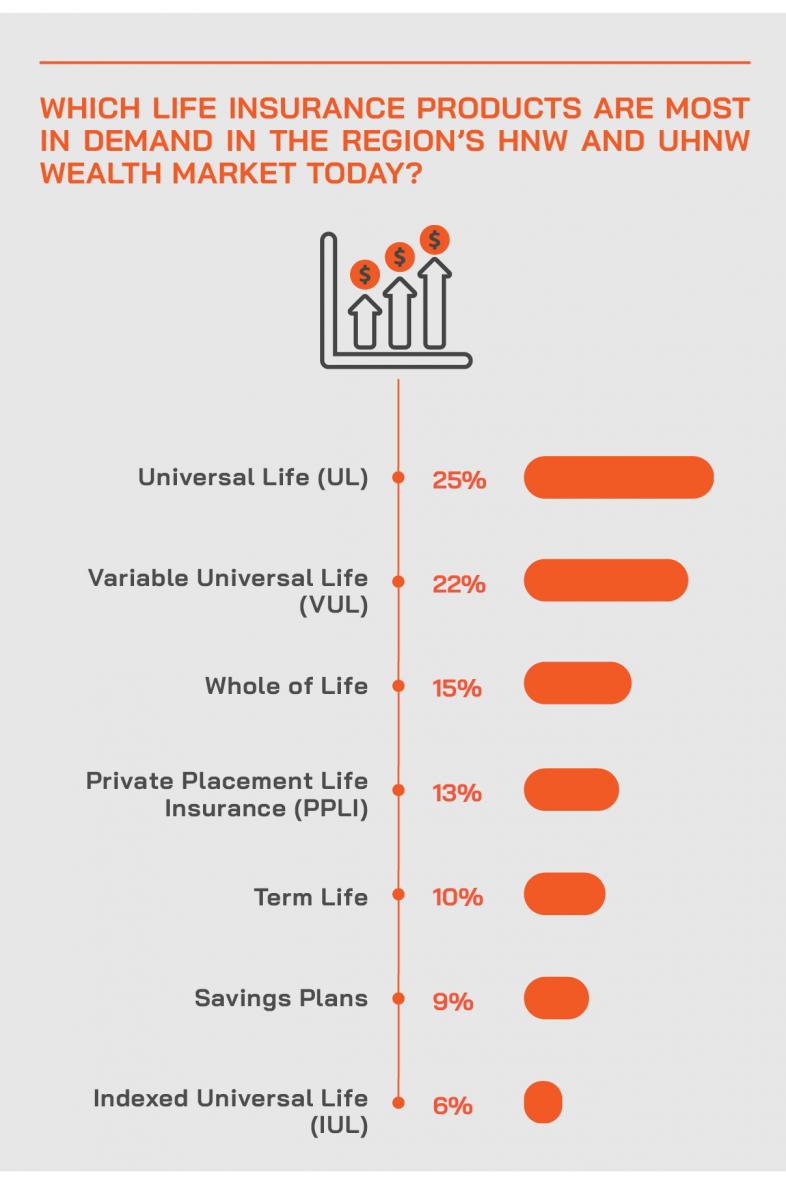

PPLI is an incredibly comprehensive solution for privacy, asset protection, tax mitigation and deferral, robust estate planning, liquidity in times of family stress, and portability. It is not taken up as widely yet in Asia or in the emerging Middle East wealth management markets as, for example, Universal Life and its derivatives, or indeed Whole of Life. Its proponents in the form of specialist brokerages and the wealth management community are busily spreading the word about its many advantages, setting PPLI in the context of broader estate and legacy planning that wealthy individuals and families should have in place. The Hubbis Digital Dialogue of May 25 saw a group of experts assemble to deliver delegates both plenty of information and many different perspectives on PPLI.

The Panel

- Peter Triggs, Partner, 1291 Group

- Philipp Piaz, Partner, Finaport

- Anthony Chan, Chief Executive Officer, Isola Capital

- Lee Sleight, Head of Business Development, Asia, Lombard International Assurance

- Nicholas Kourteff, Executive Director – Insurance Industry Consultant, NicAl

Setting the Scene

HNW Life Insurance Solutions have certainly been centre stage in Asia’s dynamic, expansive wealth market for many years and have made a significant contribution to the revenues of many banks and private wealth managers across the region. And today, life solutions are even more in favour than ever before for a host of reasons.

The onset of the pandemic initially slowed the market due to the difficulty of remote paperwork, medical certificates and other impediments, but the industry and all associated distributors and partners rose rapidly to the digital and logistical challenges to meet the additional demand for security and family protection and for more robust estate and succession planning.

In our Digital Dialogue discussion on Thursday, May 25th, our panel of experts will explore the state of the life solutions industry in Asia today. They will also look at the Middle East and discuss how the life solutions market has been evolving there, and why.

The life policies industry for wealthy clients is replete with a host of acronyms, from UL, to VUL, IUL, PPLI, and Whole of Life, but for this event our panel will focus in particular on the growing understanding of the many appeals of Private Placement Life Insurance (PPLI) for Wealthy Private Clients in the region, and why this solution is increasingly in the spotlight and what it offers above and beyond other structures.

The PPLI structure has a long history, first emerging in the US in the 1960s, and it still functions today in almost exactly the same structure. It can be refined and designed for each individual client, can hold almost any assets, and in the immensely complex world of global regulation, offers clients – and the intermediaries who promote it – very significant compliance advantages and on a worldwide basis.

With the automatic exchange of information now becoming widespread, the focus for international wealth management is on legitimate, unchallengeable tax solutions that avoid conflicts of laws between civil law and common law jurisdictions, and protect clients against the progressive invasion of personal privacy. PPLI fits ideally, addressing these challenges head-on as an ideal asset-holding vehicle, and an ideal wealth planning structure, often used in combination with Trusts, Foundations or other SPVs.

These are some of the questions the panel addressed:

- What developments and challenges are we seeing in the life solutions market globally and what specific trends are we witnessing or expecting in Asia?

- Why has the life solutions market become so diversified in terms of solutions in recent years, when UL was so popular and dominant in past years?

- What assets can a PPLI policy hold?

- What are the key advantages of PPLI, such as legitimate tax optimisation, overseas assets and inter-generational/legacy planning, its role in compliantly overcoming the challenges of AEOI, CRS, FATCA and other regulations, and so forth?

- How can PPLI sit alongside trusts, foundations and other structures?

- How much flexibility is there with PPLI to tailor the solution precisely to the needs of the individual clients?

- What types of private clients are prime candidates for PPLI and why?

- How is PPLI being marketed and executed in Asia and what roles can private banks and IAMs play?

- Is PPLI growing in the Middle East, and if so, why?

The May 25 discussion delivered plenty of information and lots of invaluable insights into this growing tributary of the life solutions market in Asia, and also further afield in the UAE/Middle East.

The Key Insights & Observations

PPLI has a number of key attributes and advantages

The experts first set about a simple or entry-level definition of PPLI as an insurance contract that is taken up by individuals as policyholders, with clearly nominated beneficiaries, who might be the spouses, the children and other family members, with those people receiving the proceeds when the policy pays out.

What is special about PPLI is that it has open architecture and a structure that allows existing asset management and banking relationships to be maintained, as the assets included in the policy are transferred to the insurer but can remain as AUM of the private banks. It is also internationally recognised, which means it works across borders. Certain assets in these policies will also enjoy advantages such as tax deferral.

It provides a number of advantages from a succession planning perspective and from a fiscal tax perspective, depending on where the policyholders, beneficiaries and maybe also their legal heirs are located.

PPLI is a product that can and usually is a large policy and tidily tailored to the individual’s needs and expectations, while a major differentiator is that assets, or AUM, can stay under the management of the client’s private banks or EAMs

PPLI policies tend to be very large – and very much tailored; they are not typically off-the-shelf products. Most of the products in the insurance world are engineered by the carriers, and as with PPLI sold by agents and brokers as specific products.

Another expert reported that in his view the big difference between PPLI and other types of policies is that the assets can stay with the external asset manager or private bank, but in the name of the insurance company, not the policyholder any longer. He said PPLI is more of a concept analogous to a trust, where you put your assets into the name of an insurance company instead of a trust company and you have back an insurance contract instead of a trust deed.

He said the structures can be very carefully tailored to meet specific objectives, particularly for tax deferral and optimisation, and of course, to cater to the regulations of different countries.

PPLI might be somewhat more complicated and lengthy to forge together, but it is remarkably cost-effective and offers an umbrella solution to a variety of client needs today and for the future

“What a lot of people don’t appreciate is that PPLI is a very cost-effective way of buying life cover,” he reported. “It is actually cheaper than getting a whole life or universal life. Why? Because the cost of insurance charges goes off on a sort of pay-as-you-go basis, rather than for a single premium life insurance product, where the cost of insurance charges get front-loaded, and the result is more expensive.”

In addition, policyholders can manage their own investments in the PPLI (also in VUL, he said, which he considers a sub-set of PPLI), in the process often making more money than whatever the insurance companies do with it, which is usually buying US Treasuries.

This expert summarised that the key advantages are: clients retain the assets (although they are technically owned under the insurer), the policies are very cost-effective, and they deliver specifically tailored tax benefits.

Tax mitigation via tax deferral can lead to more efficient tax optimisation via PPLI

“Many Asian clients touch the US, touch Australia, touch the UK, and many other jurisdictions,” he also noted. “There are great tax planning benefits in those situations. Our group has tax optimisation solutions for about 45 different countries, reclaiming withholding tax. Many Singaporean clients, for example, are losing 30% withholding tax on the US stocks, they don't need to do that, they can get it right down to 10%, or even 0% if planning properly.”

He said PPLI is very flexible, you cancel at any time without cost, and it helps with greatly simplified CRS reporting.

Another expert agreed with these views, adding that PPLI is used extensively in Europe’s highly regulated, highly legislated markets, whether France, the UK, Italy, Germany, and so forth.

“Clients have tax advantages in terms of tax deferrals, but not tax breaks,” he reported. “Tax is one advantage, but PPLI is also very much a succession planning tool as well; in France, for example, it is well recognised as a solution for clients to hold wealth during their lifetime but also an efficient way to transfer that on to the next generations. More generally, it is a tried and tested and recognized solution that works across civil and common law jurisdictions.”

And a panellist noted that PPLI structures are recognised in most jurisdictions around the world. For example, he said an estimated 60% of all the residents of France hold their investments in the French version of the PPLI for precisely those tax advantages.

Open architecture is central to the PPLI structure, and the flexibility in terms of types of assets that can be housed is seen as a major advantage

In terms of assets, again it is open architecture, meaning that, for example, the policy can take shares of a private investment company into a PPLI contract, and under that private investment company the client could have a number of different private banking accounts that they set up offshore, they could have the family business or real estate.

“Clients then realise it is more than just life insurance,” he remarked. “You can add all these types of assets, which translates not only to flexibility but also a huge premium, resulting in a very high life cover. But what is reported, entirely compliantly, for CRS purposes is that you have an offshore life insurance policy of a certain value. You avoid probate, you have a distribution plan, and in short, it just seems to tick every box.”

A fellow panellist also clarified that in his view, VUL is really a subset of the general concept of PPLI, but in VUL, the insurers will stipulate what assets are acceptable, and you will find that typically, they include bankable financial assets, but with nowhere near the flexibility of PPLI.

A private company and private investment company, for example, will not fit into the definition of acceptable investment for a VUL product issued by the carriers. “In PPLI, as we stated earlier,” he explained, “you could have an offshore company or even in some cases an onshore company from another jurisdiction, and under that private company could be a family business, family office, commercial real estate, oil palm plantations, so on and so forth.”

A guest added: “PPLI is a concept much more analogous to a trust, while VUL is a product issued by certain insurance carriers.”

PPLI can be a very long-term planning solution and can endure beyond the life assured with the participation of trusts and other structural nuances

This specialist added that PPLI does not, however, last as long as a trust, it only lasts as long as the life assured. Accordingly, he usually recommends that a trust be the beneficiary, and that of course then significantly extends the duration potentially.

He concluded: “For wealth managers and advisors, why would you not use this for countries where there is worldwide income tax like Indonesia, the Philippines, or China, countries that will tax you on your offshore income but will not look through insurance contracts because they generally are not captured by controlled foreign company rules?”

A guest added that there is strong logic in putting the assets in the hands of the life company, for confidentiality reasons, tax efficiency reasons, for bankruptcy remoteness, for distance from family disputes, and so forth.

PPLI is ideal for many wealthy clients’ estate and legacy planning

Another panellist commented that regarding wealth transfer – a huge topic and theme in Asia – the right structuring gives peace of mind but also great tax optimisation. “The client sees that and when they understand it properly, will be willing to pay the particular fee to receive that inherent value.” He said for the wealth industry, PPLI is not as revenue-generating as other potential life policy solutions, but the value is easy to understand.

Another guest explained that a key hurdle to overcome is who owns the assets, but once clients are comfortable with that concept, then they can focus on key advantages, for example, the ability of their trusted asset manager or managers to help them manage the underlying assets, the ability to distribute a certain amount of distribution, very tax effectively, every year, the ability potentially to even lend to themselves, if they have any sudden needs for additional capital.

“There are many ways for them to benefit from being inside the PPLI structure for assets that will grow significantly in value over time,” he said.

A guest added that they tend to consider PPLI for sizes of USD20 million and above, noting that most families in Asia that they deal with and who have that type of investable wealth would have family members in high tax jurisdictions, the UK, parts of Europe, Canada, Australia, New Zealand, and so forth, making the appeals of PPLI for estate and succession planning even more relevant.

Fees might appear to be lower for advisors and intermediaries for PPLI than in other policies, but first impressions can be misleading

Another panellist added: “Maybe I could just add one thing that yes, the percentage fees for PPLI are much lower than the percentage on ULI and whole of life, but the asset sizes can be much, much larger. A large percentage on a USD5 million IUL policy could be lower than a small percentage on a far larger PPLI. And we are often talking about far larger deals in PPLI.”

A wealth management veteran added that the lower fees are positives for them as advisors, as they are positives for their clients.

“We see ourselves as a partner of the client,” he said, “and we are being paid by the client. Our main focus is finding the right solution for the client rather than getting paid as much as we can by selling whatever products. But we see PPLI as a very clean and clear way and option for a client to purchase life cover. What from a pure fee viewpoint is not so positive for a banker or salesman is in fact very positive for the client. And my experience of working on such solutions, and including other structures related to PPLI, is very positive.”

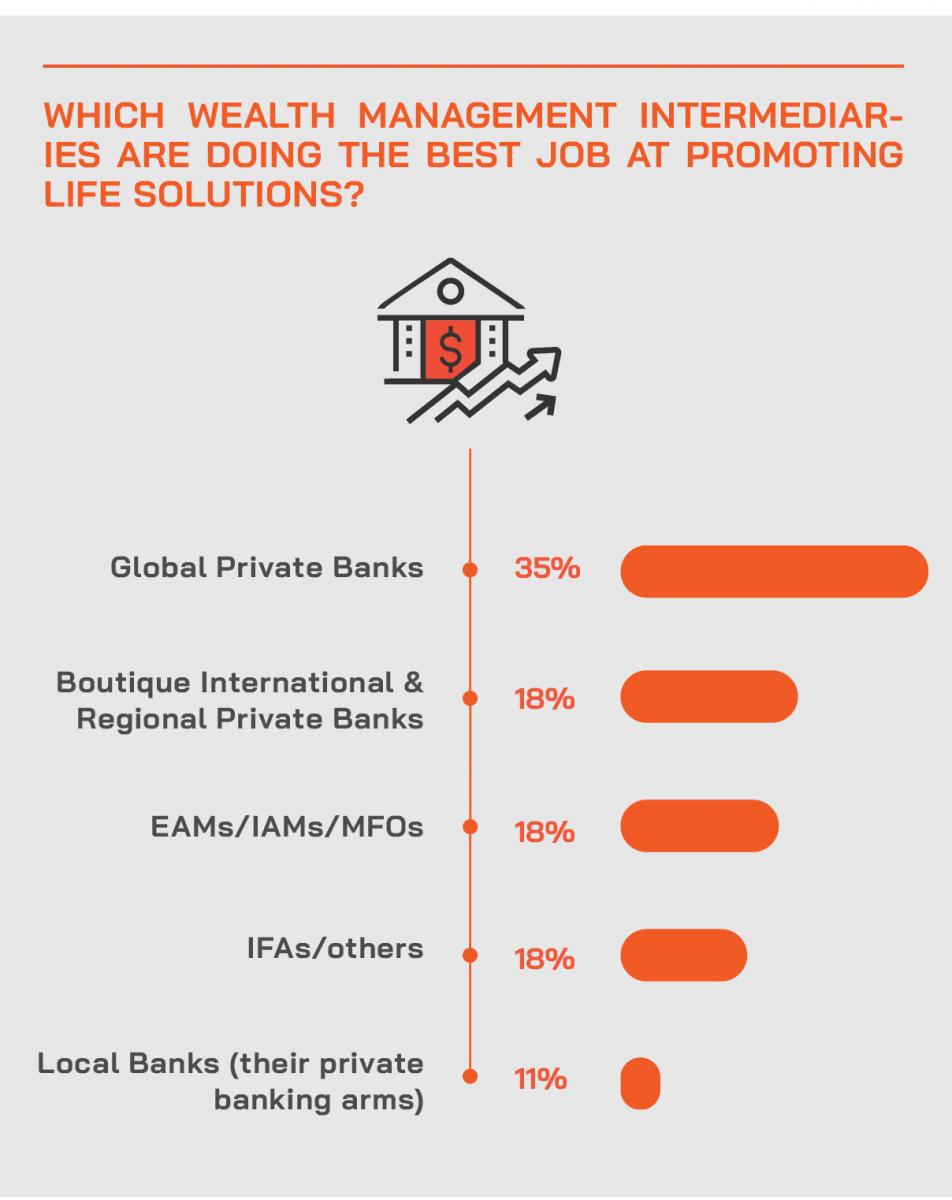

An expert noted that in Singapore, by way of example, so many brokers, IFAs and others have been selling Universal Life as their default product for a decade or two, without truly appreciating the other solutions and their value. “Seeing things properly from the client’s viewpoint is the most important factor,” he said. “The right policies must be aligned to the clients and their family situations.”

Assembling the final PPLI solution will take time and attention, but once created, it is both a policy to assure and also a robust and long-term planning solution

A panellist explained that the carriers must conduct their extensive due diligence on the clients and the assets, before they sign off on deals, to protect their reputations, and make sure there is no AML risk.

He said they are concerned about AML, but also whether they are able to value the assets in the policy effectively, and whether, if a company or companies are included, they are properly audited. Another mission is to check that there is sufficient revenue from those assets to pay the annual cost of the insurance. Accordingly, if commercial property is involved, they might be looking at the rents coming in, to make sure they will be sufficient to cover the annual cost of insurance.

However, he added that, unlike a trustee, the insurers have no fiduciary responsibility to delve more deeply into the companies or structures. “Sometimes, carriers will take assets that trustees will not take,” he explained. “But note that trustees are not being carved out of the picture altogether, because in nearly every case, the trust should be the beneficiary of the PPLI; to have the two together becomes a very powerful combination.”