Publications & Thought Leadership

Enhancing the Efficiency of the Relationship Manager in Asia’s Wealth Management Markets

Aug 21, 2022

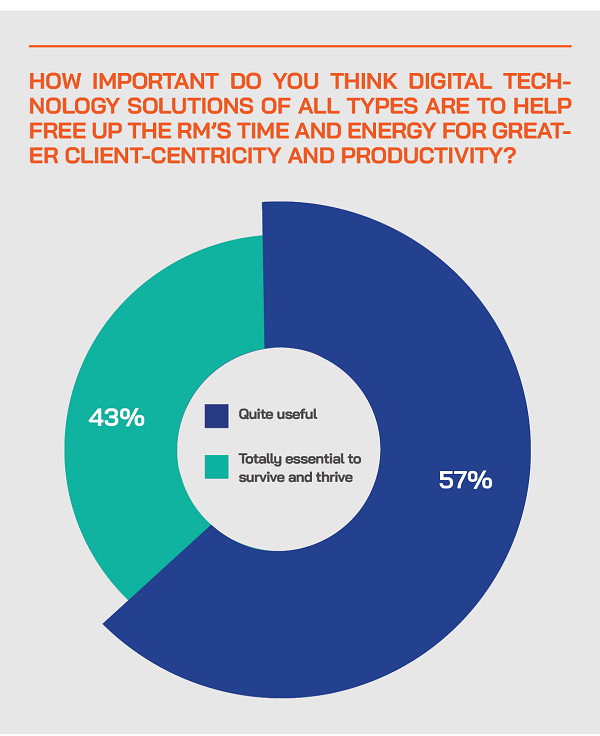

The premise for our Digital Dialogue discussion of July 28 was that the relationship manager will continue to be central to the delivery of the enhanced capabilities, solutions and enduring, productive client relationships in the Asian wealth management industry, particularly for the healthy HNW and UHNW segments. Experts and leaders in the wealth industry believe this will remain true, even in the world of diminished face-to-face communication that will likely continue long after the pandemic recedes. In short, the wealth industry is future-focusing itself and helping empower the RM community with the right strategies and the optimal digital tools and solutions so that they can deliver the best versions of themselves and the banks and wealth firms they represent. But how is this coming together and is progress moving at the right pace? The experts who sat on the panel on July 28 had plenty of insights into all these matters.

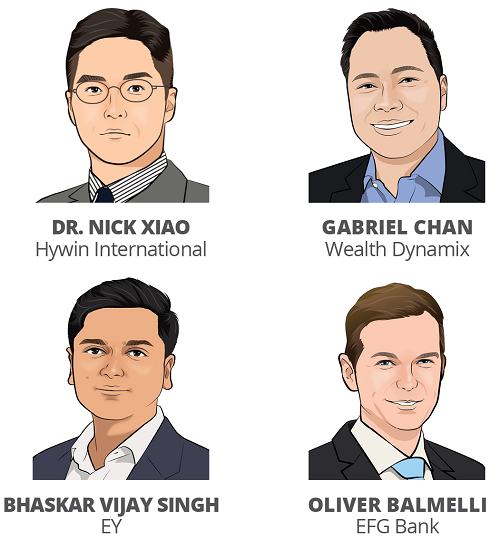

The Panel:

- Oliver Balmelli, Deputy Chief Executive Officer & Head Private Banking - Singapore, EFG Bank

- Bhaskar Vijay Singh, Director - Financial Services Consulting, EY

- Dr. Nick Xiao, Chief Executive Officer, Hywin International

- Gabriel Chan, Head Asia Pacific, Wealth Dynamix

Setting the Scene

We all know that the private client has become far more front and centre of the world of private banking and wealth management, and the experts debated how the wealth industry can align itself with the needs of those clients and the ongoing quest for client-centricity and the objective of boosting RM engagement, and of arriving at and retaining the trusted advisor status, which is so central to revenues and longevity.

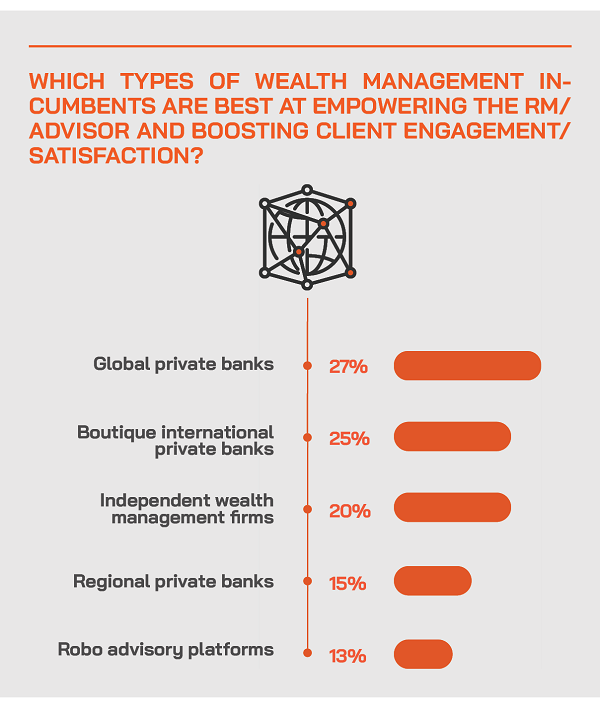

While Asia’s economic growth and private wealth creation has been truly remarkable for the past two decades, the wealth management market has in some respects lagged behind its counterparts, for example, in the far more mature markets of Europe. Boosting the capabilities of the RM is a crucial element in upgrading capabilities and productivity for the private banks and the independent wealth management sector, as they are fight increasingly tough and smart to retain and boost their share of the buoyant HNW and UHNW markets.

There are many ways in which the relationship manager can be re-invented in the decade ahead, and many steps are already being undertaken to achieve precisely that. The discussion was designed to help analyse how the RM’s time has thus far been structured, how much of that time is essentially dedicated to non-productive administrative and compliance tasks, what tools and technologies the RM can be provided with to make them more efficient, more productive and most importantly more client-centric, what the RM’s workstation should look like and what it should comprise.

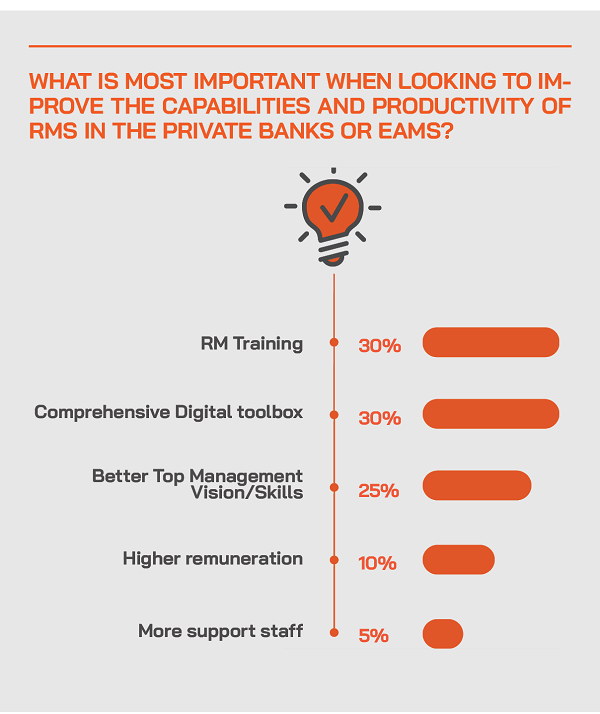

The experts also referred to how the top management of the banks and WM firms must adapt their approach and strategies to the mission to empower the RM, and how the RMs themselves must evolve and up-skill in order to improve outcomes for their clients and to enhance their share of client wallet, as well as their professional satisfaction and career longevity.

Building the right wealth management model with scalability is essential and to do so boosting RM productivity is vital

A panellist opened the conversation by pointing to the need to align human talent and cost with scalability. To achieve this in private banking, the bankers need to become more efficient and productive. “We constantly map out how bankers or RMs spend their time on anything from JYC and onboarding to playing golf with their clients,” he explained.

He said they need to be liberated with the right technologies and approaches to save time on daily chores and focus their skills and time on advisory and delivering the right products and concepts to clients at the right times and in the right ways. And he added that the right bankers need to be in front of the right clients, with the seasoned bankers handling the bigger and more sophisticated clients and younger RMs handling clients with lesser demands and expectations, and thereby learning their trade. In this way, the wealth industry will be able to attract and remunerate talent and building the skills and experience along the way.

Nurturing talent is central to the future of the private banks playing their trade in Asia

An expert observed that they generally hire bankers with 10-plus years of experience to handle their typical HNW clients. “These bankers have an existing portfolio, they have a certain level of competence and experience, and they understand the rules of engagement,” he explained. “To help them we look at the client lifecycle, and we start with the prospecting, then onboarding, then servicing the client, and of course, we need to have efficient processes.” And he reported that especially since the pandemic hit, they had been aiming to digitise many or most of the processes, including client acquisition, onboarding, the product platform, transacting/execution, compliance and so forth.

He explained that these days the advisors spend too much time in administration, due to all the regulatory demands on their time, so whatever time and efficiency can be redirected to those bankers to free them up, the better the overall outcomes for the clients and business for the banks and wealth management firms.

“My desire is that every banker is successful, because their success is our success,” he said. “I see myself not as the boss but as the facilitator, trying to help high performers overcome difficulties and work through market fluctuations. We introduced a balanced scorecard, so it is not only the result the bankers deliver, but also the behaviour and the added value they bring, such as bringing about an increase in advisory services and DPM. We sit down regularly with the bankers, we review their portfolios, we review the profitability, the risk matrix, at compliance, and we look at a wide variety of indicators. And all this helps us identify opportunities to help clients upgrade their portfolios.”

Expert Opinion - Oliver Balmelli, Deputy Chief Executive Officer & Head Private Banking - Singapore, EFG Bank: “As to the digital solutions being introduced to enhance RMs skills, capabilities and productivity, we consider that digital solutions and capabilities are key to the future success and competitiveness of a private bank. Seamless integration of all channels (on- and offline) and an open architecture within the digital environment are prerequisites for a successful client experience. Such a digital platform leads to reduced costs and accelerated processes: clients benefit from quick and easy access to tailor-made products and services through the automation of back-office and internal processes, while CROs can fully concentrate on providing advice and support.”

The human advisor remains central to the private bank proposition, but there is a dearth of talent as demand outstrips supply

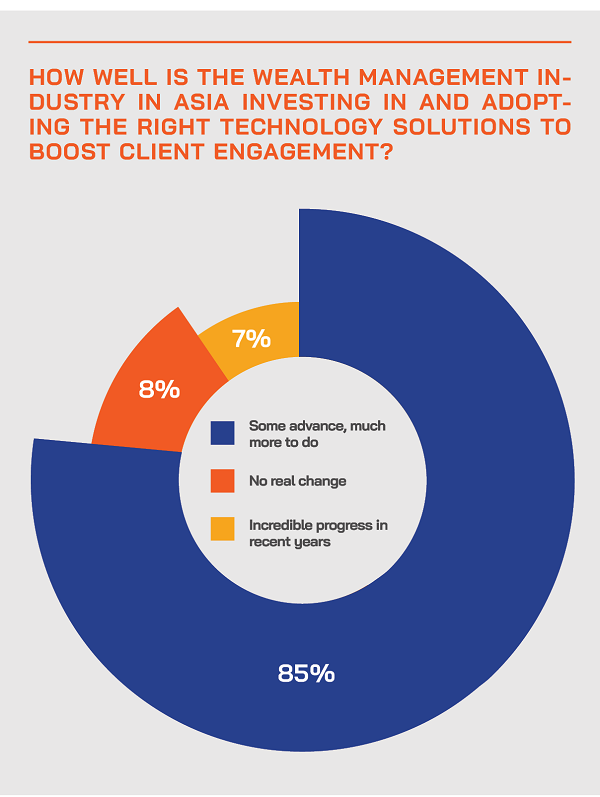

Another guest observed how the business model had not changed – essentially it was and still is about smart RMs making connections with wealthy individuals and deepening those relationship, winning over more of their friends and families to sign up for their banks. “But the issue is that growth of private wealth has outstripped the supply of talent, resulting in talent wars, especially as see news of more major banks trying to hire thousands of RMs in the region,” he said. “These talent wars then end up increasing the cost base for the banks and causing scalability challenges.”

He expanded on this, remarking that technology had not yet been well enough understood and adopted to help achieve efficiencies and the necessary scalability. “We know from other industries, and also from the wider financial services industry, that technology is the secret ingredient needed to achieve that scale, to achieve that scalable growth,” he said. “Hence we are having more and more conversation on digital solutions, with the RM very much at the very forefront of this proposition, how to make them more effective, more efficient, and more productive.”

Personalisation is central to the process of enhancing the RM’s capabilities

The same expert explained that personalisation is also at the core of the RM offering, with the objective of targeting services, products, and interactions based on individual profiles, and nowadays employing smart algorithms, data and analytics, all driving towards customised propositions and offerings.

“The complexity is as this requires new types of data to be captured about the clients, new types of information to be captured about the relationships, and new types of analytics, which banks have not typically employed, especially private banks,” he explained. “This requires new types of computing capabilities, new processes and procedures from front to back.”

However, he explained that these days, there is easy and relatively cheap access to powerful computing power through the cloud.

“Data is cheap, the algorithms exist, all the segmentation models that we see employed successfully in other industries can easily be transportable,” he said, adding that this all requires a two-way flow with information and data coming both from the clients and their activities, and also from the RMs about their clients, all feeding into the algorithm.

“It is about using both structured and unstructured data efficiently,” he reported. “And the RM is a lynchpin, because they understand their clients the best, and the information that they can provide and capture around that will lead to ultimately more personalised, more unique propositions for the clients.” But he also warned that this is easier said than done, as to achieve all these goals, it is a matter of cross-functional, multi-divisional, front to back change, and that is often tough for established organisations such as private banks.

The drive for scalability and efficiency comes from technology, and also from the right strategies and approach

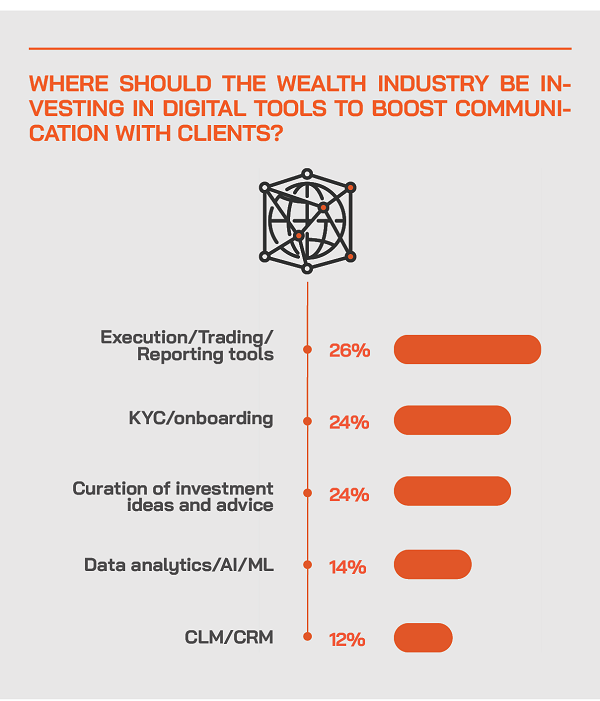

“The need for efficiency and effectiveness, to drive productivity and also reduce costs, all these goals are precisely what we help with,” a guest explained. “We integrate, we optimise, and we simplify by providing what we call the RM workbench, which allows them to really have full visibility of the clients from onboarding, servicing, and also acquiring new customers. This singular platform for them to engage is like a cockpit, with the RM piloting the plane.”

He explained that, for example, the convoluted and lengthy onboarding procedures can be significantly improved and shortened by optimising all the processes with technology. “We have a workflow engine, so we basically capture all this information upfront that is reusable, meaning that the RM, the client, and the back office have full visibility of this information, and are updated with alters,” he explained. “We put it all together in a process and a workflow so that it is all optimised and the customer can open that account a lot quicker.”

He added that technology that is siloed is nowhere near as optimal as having an integrated platform for servicing, onboarding, as well as customer acquisition. “Customers come to us because we provide a customer lifecycle management solution and not just a silo solution.

Elevating the wealth industry’s economics is essential to the competitive capabilities of the incumbent players

New entrants are arriving in the wealth industry all the time. There are incumbent players such as major regional banks that are ahead in the digitisation stakes. “We are lucky in that so much of our business and profitability comes from portfolio curation and management for a rapidly growing client base, but we do not have USD1 trillion of AUM across which to spread our technology costs, so it is very important that we spend our limited IT budget where it's needed, it's required, and it also creates a value,” he reported.

He added: “We also have to be astute in terms of generating sustainable rather than ad hoc business. But most importantly, technology is a solution in that it can lower certain tiers of your cost structure so that your overall economics improve.”

Nevertheless, he conceded that nobody has yet arrived at the ideal solution. “I think everybody is still really groping in the dark for the right answer,” he told delegates. Meanwhile, he explained that elevating the RM’s capabilities, efficiencies and productivity is a vital element of improving the overall economics of the business.

Training and analysing performance are also vital factors in enhancing the RM’s skills and capabilities

A specialist explained that they had recently partnered with LinkedIn Training to boost RM skills but also to improve the bank’s ability to retain key talent, as well as working with the Hubbis training platform. “And the RM and personalisation of the offering are not only about investments and advisory,” he added. “They involve the clients’ families, their health status, their succession planning, their hobbies, for example if they play golf, and so forth. In short, the RM is still key and very central to the offering and the more we can assist them with technology, the more it will help to the critical issue of maintaining a profitable business.”

He explained that over the years, with this approach and based on key indicators to measure performance, the bank had managed to reduce the number of RMs while at the same time increasing AUM significantly, meaning that AUM per banker was significantly higher.

Another speaker highlighted the importance of measuring performance and comparing benchmarks across comparable organisations. But he warned against only using the bald metrics. He cited a client that takes 7 to 10 days to open an account versus another that takes longer, but said that might be only a partial picture, because perhaps there's more operational support for that RM in that organisation.

“Comparisons need to be balanced across a lot of other metrics, but they are useful in helping nudge the organisations in the right directions,” he said. “And then comparing these micro interactions or these more granular aspects of the servicing capability of course we have to do a deeper analysis.”

He added that to really boost the RM productivity, re-skilling and up-skilling were also vital along with technology, in order to help the RMs offer a wider range of newer and complex products and advisory, for example in the realm of digital assets. He also remarked that younger talent can be attracted to the wealth industry as it embraces more of the products and concepts of the new world, such as cryptos, digital assets, the Metaverse, ESG, sustainability and so forth.

“These younger talents can then help guide the clients who are interested in these and other propositions, and that in turn will help more younger people come into the wealth profession,” he explained.

Expert Opinion - Oliver Balmelli, Deputy Chief Executive Officer & Head Private Banking - Singapore, EFG Bank: “The skills and expertise the RMs/advisors need to be effective and productive today and for the future generations of private clients centre around building trust and fostering personal relationship with clients, which will continue to be crucial to succeed in private banking, where high-quality, tailor-made advice remains at the forefront. Nevertheless, as clients are becoming more tech-savvy and sophisticated, CROs [Client Relationship Officers] should be able to combine digital solutions and personal interaction to improve the overall experience, for example through semi-automated advice, and to respond to specific requests of each client with a hands-on approach and can-do mentality. Besides this, CROs need good skills in financial markets, products and investment solutions.”

The technology is available today to empower and enhance the RMs, but harnessing it all is the key to success

The final word went to an expert who said that the technologies are available today to help the wealth industry work more effectively and efficiently with their clients, to improve outcomes for them as well as to mine down further into personalisation and enhanced and more diversified offerings.

“For instance, there is a system called Relationship Intelligent Technology, that actually allows institutions to link people within the organisation and thereby broaden the ecosystem of the relationship,” he explained. “And we have machine learning and an AI propensity model that helps organisations understand what to propose next to the client; help even with conversations and next best actions are available today on our platform. In short, the technology is here today, it is about understanding how to harness the data and the insights, and thereby through client lifecycle management, and not just CRM, to help optimise the client relationships.”