Developments in Wealth Planning and Structuring, and Family Succession in the Middle East

Feb 3, 2021

The state of the wealth management industry in the GCC, and the evolution of carefully planned and well-executed estate and succession planning, was debated in depth at the January 28 Hubbis Digital Dialogue event. An erudite panel of experts reviewed the progress to date and opined on what steps must be made by both the authorities in the region and by the private sector to more fully set the wealth and legacy planning industry on the road to realising more of its full potential. Which jurisdictions do GCC based clients prefer to utilise for their wealth planning and trust structures? Is the recent availability of common-law trust structuring through the DIFC, resulting in a boost for business there? Are wealthy clients remediating older structures, with the arrival of the CRS, economic substance and Mandatory Disclosure Rules, amongst other new regulations, and if so, what structures and concepts are in favour? How does life insurance fit into wealth and succession planning in the region these days? How well do the local wealth and advisory players fare compared with other leading international wealth management centres, and can the region keep its home-grown clients onshore by continuing to improve regulation and professionalism? What about investment migration trends as families in the region seek options overseas, and as international clients seek options in the region?

The Discussion

The demise of the suitcase banker who used to chase the petrodollars was the first comment from one local expert. “But today things are rather different,” he reported. “We have business empires that are not necessarily the by-product of royal handouts, that are not based on oil, we have businesses being run by women, by expats, by the next gens. And, importantly, we now have families who are shedding their emotional attachments to their legacy businesses and looking at them as to whether they are efficient or inefficient pools of capital. This did not happen overnight - private client advisors, bankers, regulators, family business practitioners, lawyers and others have been moving towards this for years, coaching and guiding and mentoring families.”

A region moving ahead

He remarked that regulations had improved markedly across the region, including Saudi Arabia, new company laws have emerged, foreign ownership rules have evolved, labour reforms are evolving, and clients in the region are increasingly contemplating or acting on structures, and are far more ready to engage with the advisors and the private client practitioners.

Expert Opinion - Laurence Black, Regional Director, Client Solutions, EMEA, Asiaciti Trust: “While it has been challenging working the backdrop of a global pandemic which has impacted clients and markets, we have remained relevant by keeping abreast of economic developments and constantly adapting to the changing needs of our clients. Indeed, the global pandemic has brought into sharp focus the critical need for our clients to have robust wealth and asset preservation plans in place. There is a heightened awareness that succession planning and the transfer of wealth should be carried out as a structured long-term strategy as soon as possible, seamlessly with communication, trust and support among all parties. Since the world is in constant flux, there is also a need to review these legacy plans on a regular basis. Engagement and dialogue with multi-generations.”

Another guest lauded that introduction, adding that even throughout the pandemic since 2020, there has been a further flurry of legislation and new regulations in the region. “That has kept us very busy and the clients very engaged,” she said. “We must always analyse the impact of these changes and communicate before we actually implement them. In terms of private clients and families, we had some very significant legislation brought in, for example, the new Family Contract Law in Dubai and that in fact, applies to any families.”

Expert Opinion - Sunita Singh Dalal, Of Counsel, Stephenson Harwood: “When helping clients protect their assets and prepare a succession plan, it simply doesn’t make sense to advise in isolation; one must create the very best advisory team. Issues such as tax, residency, domicile, knock on effects on the underlying operational business etc, are so often overlooked. Putting together the best advisory team at the outset and co-operation between advisors, are key to a successful result. I believe in guiding all relationship managers and gatekeepers, so that they in turn advise their clients on the most appropriate asset protection and succession planning options available in the Middle East, Africa and South West Asia. During the Pandemic, we have seen the introduction of effective, robust and internationally compatible wealth planning solutions that are hugely versatile and beneficial for clients with assets in the Middle East.”

The Hubbis Post-Event Survey

Progress Being Made, Challenges Ahead, Opportunities Aplenty, Plenty of Business for All

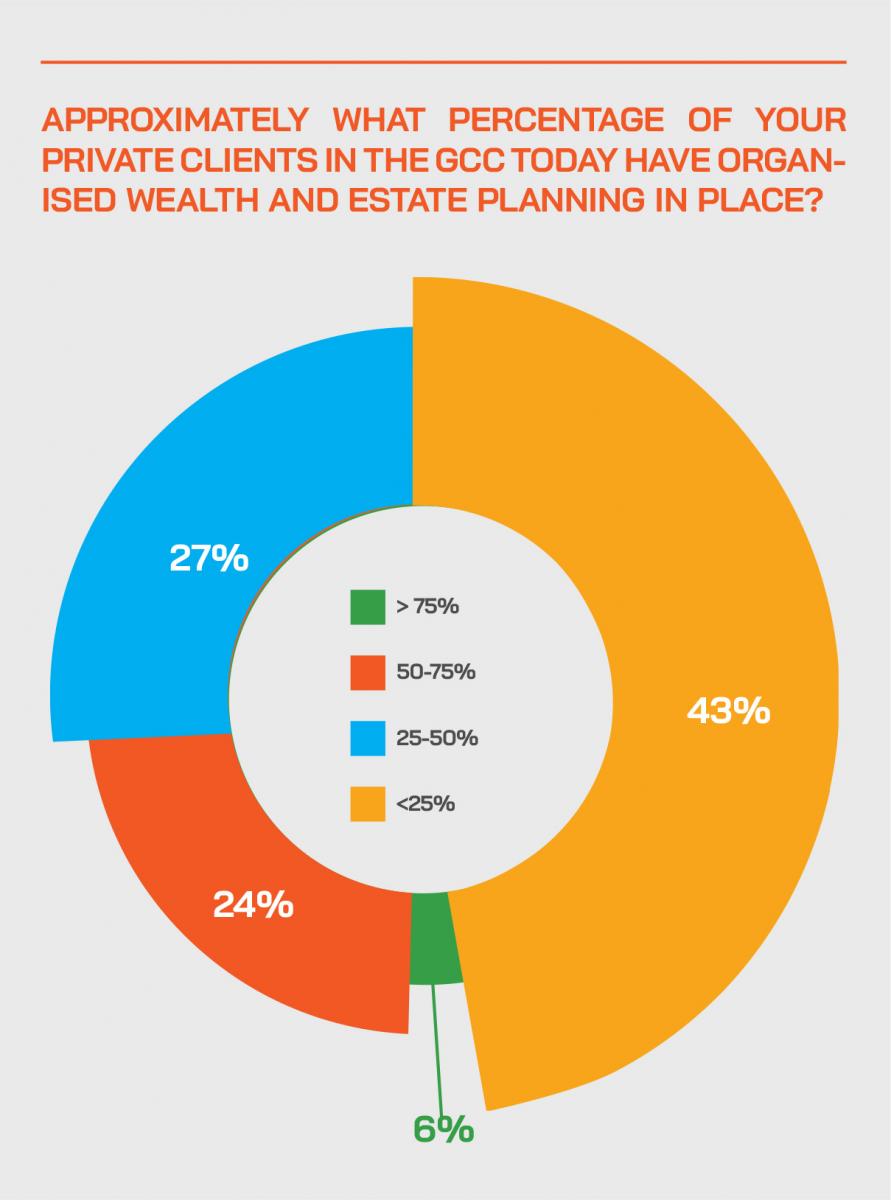

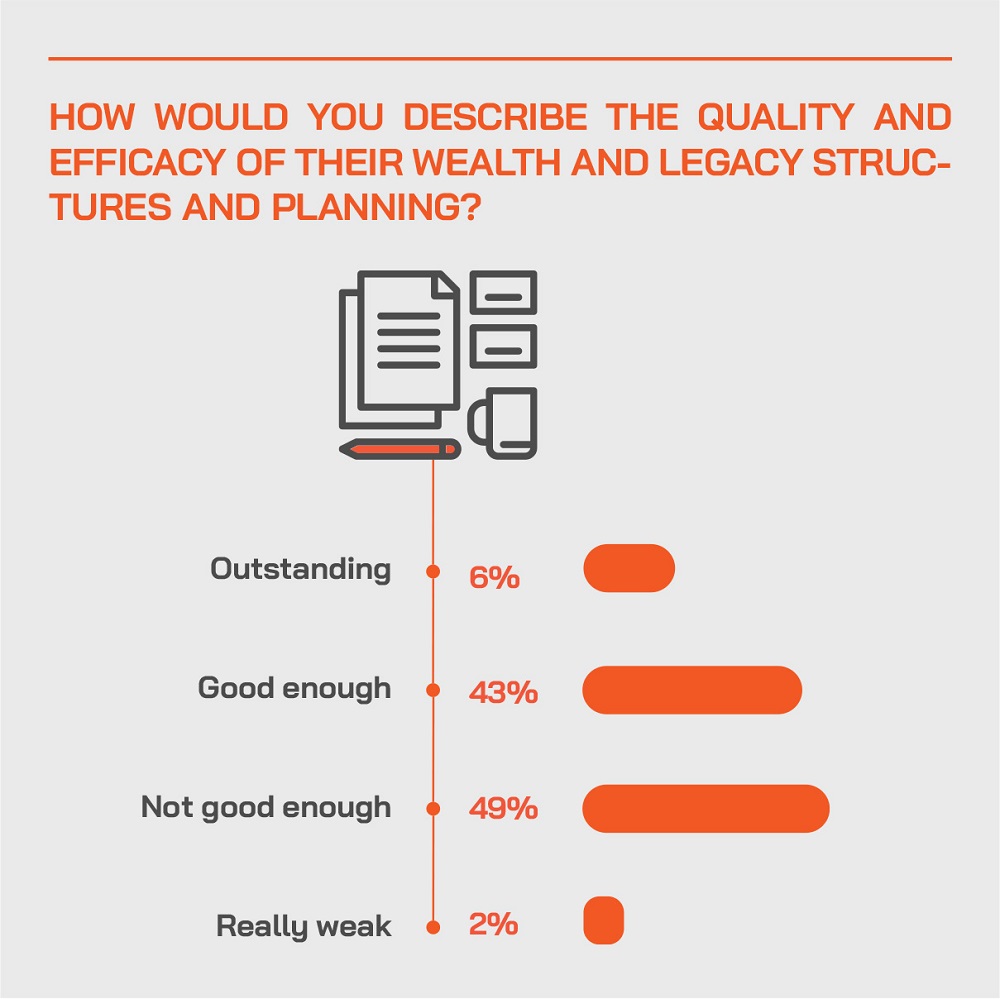

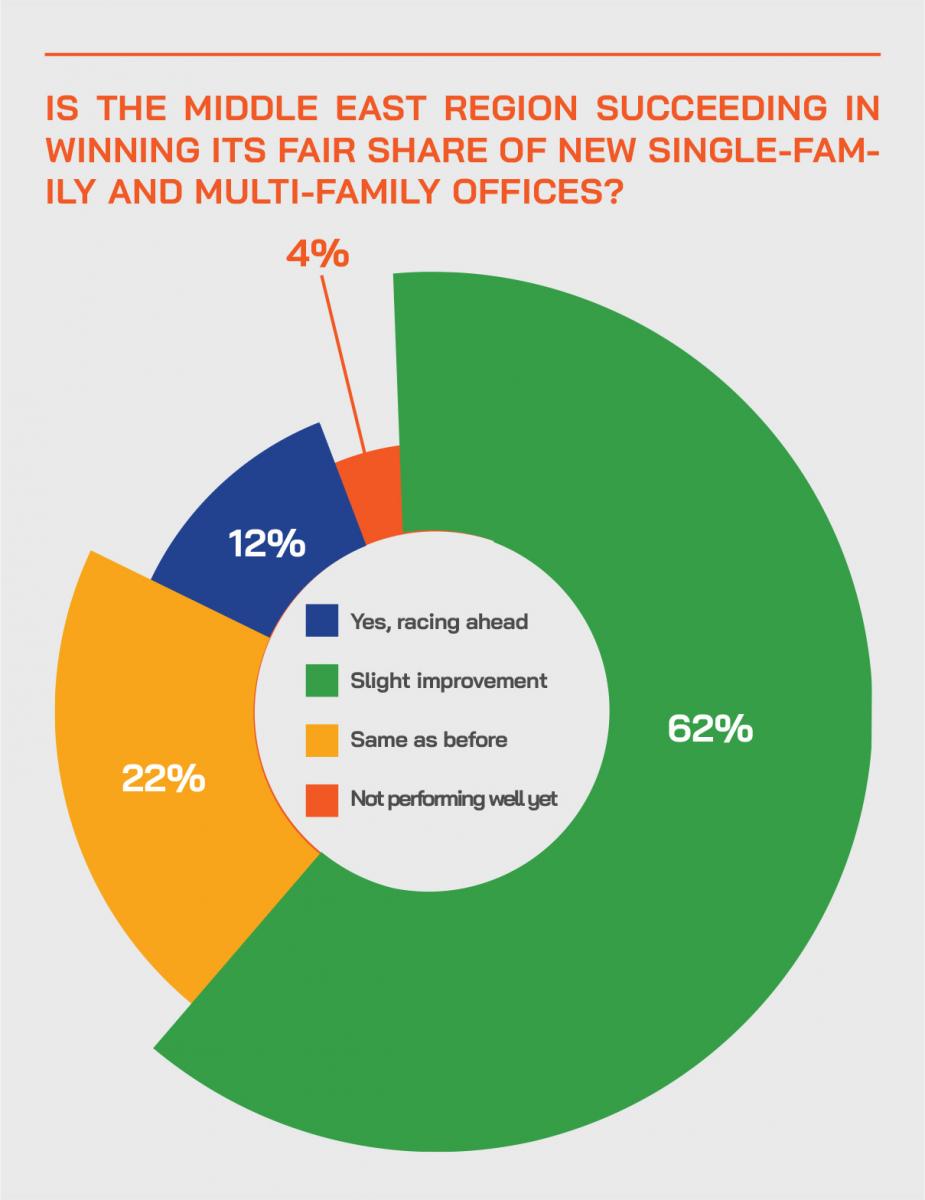

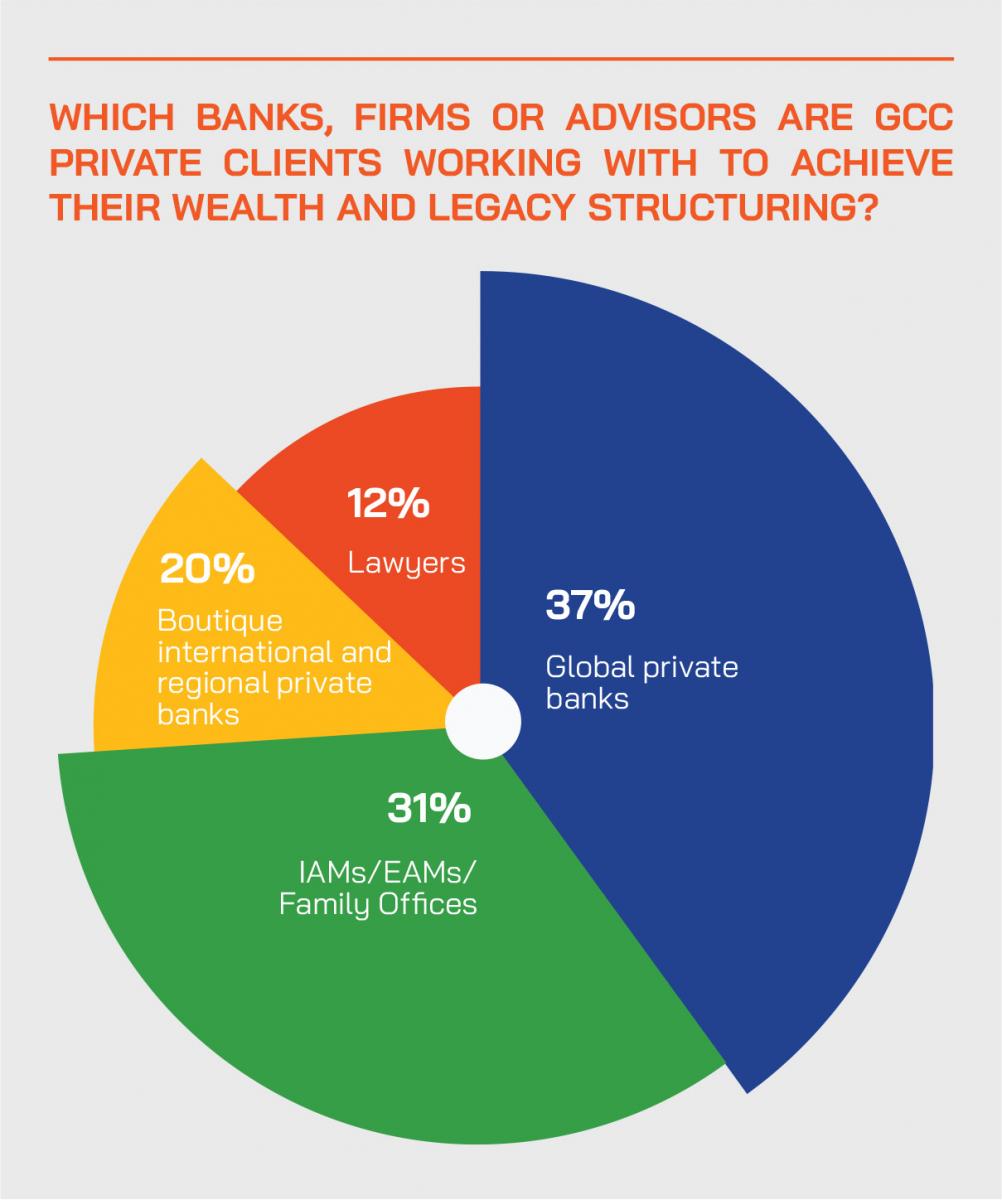

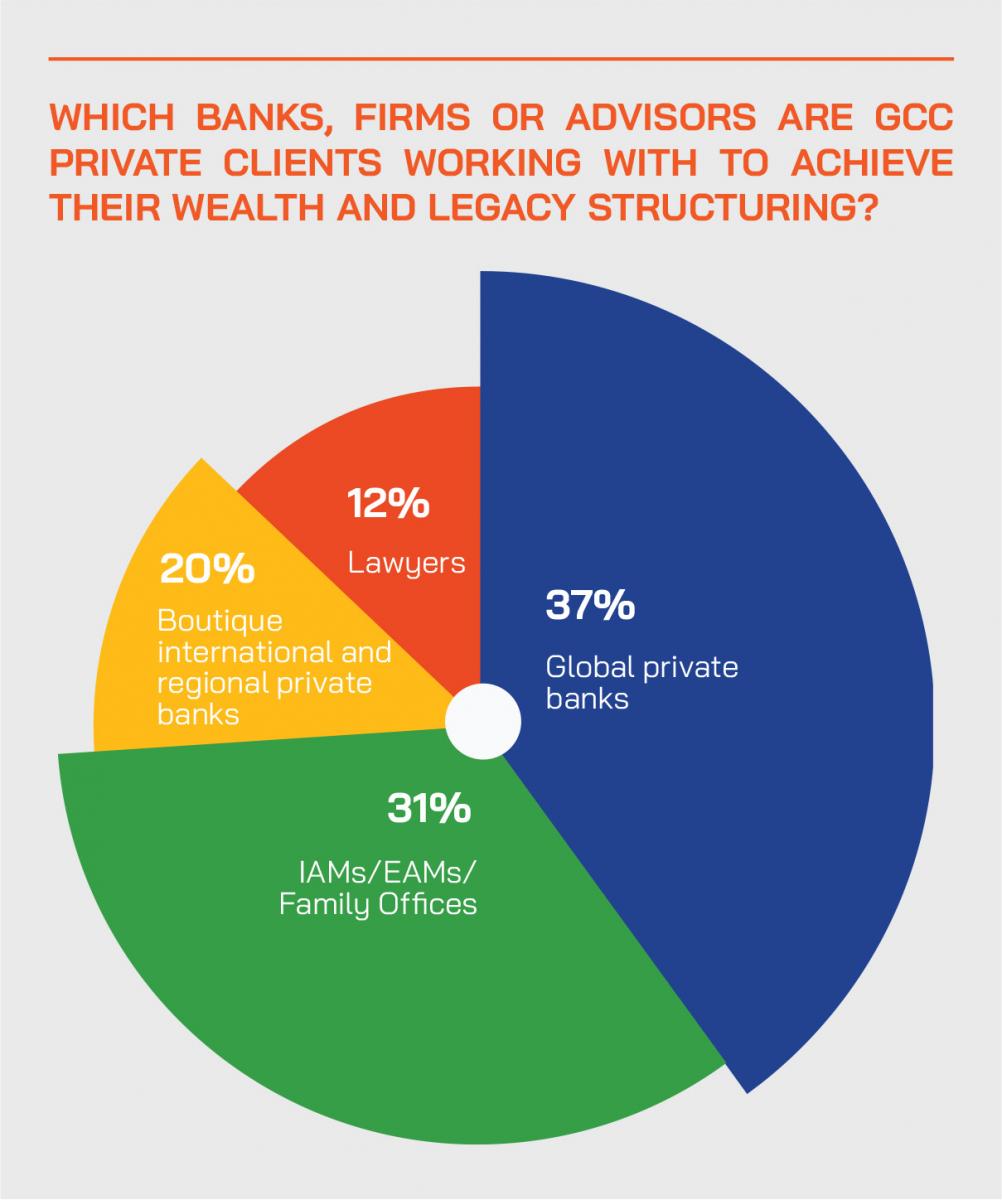

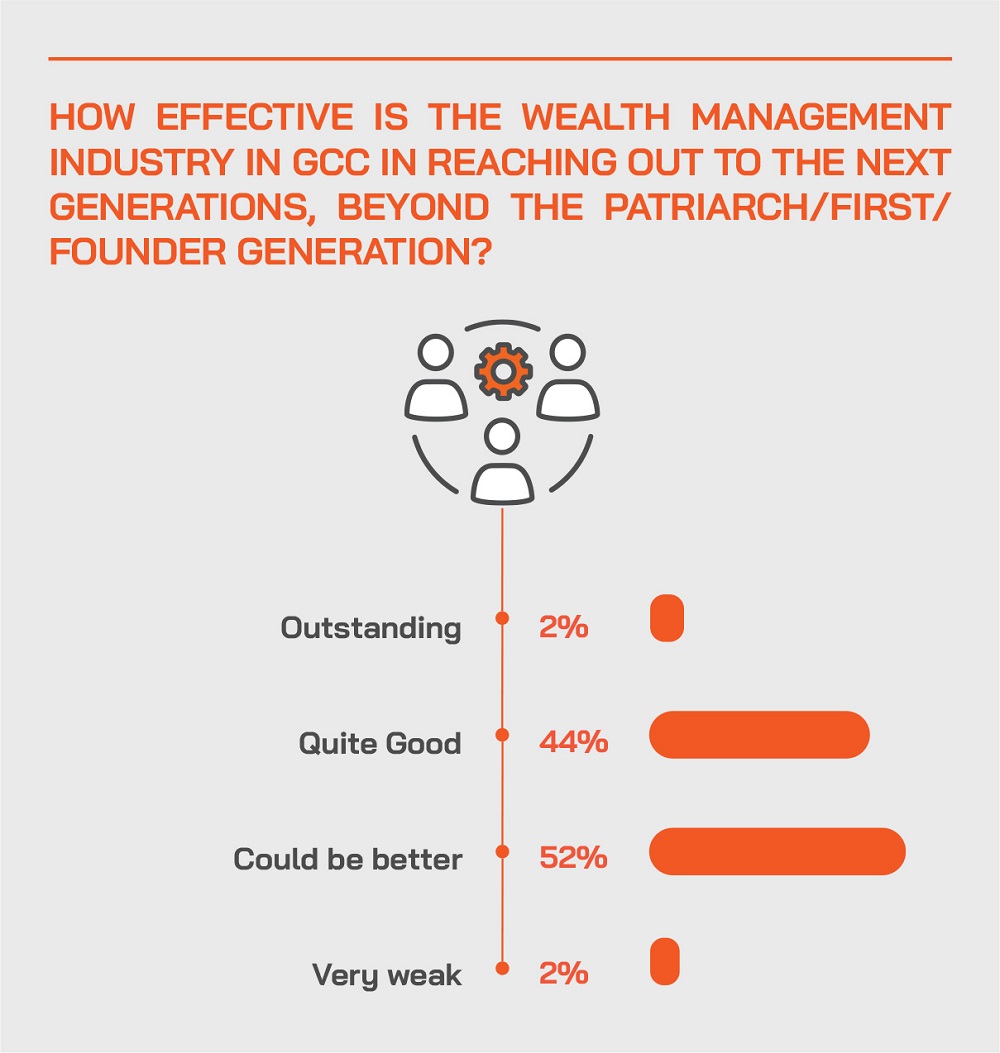

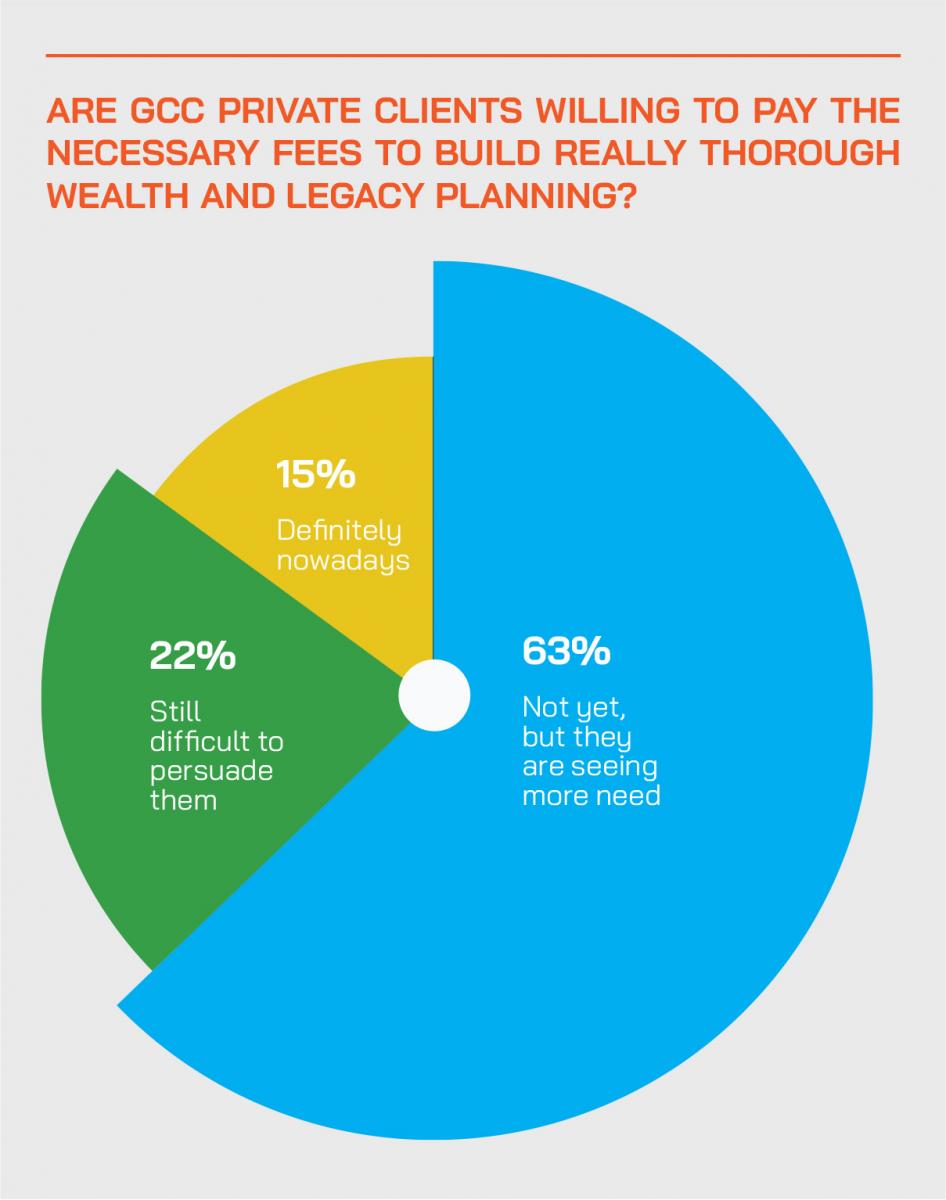

Hubbis conducted a survey immediately after the discussion, asking delegates their views on the state of the wealth and legacy planning market in the region. We found that the overall environment is improving and there are very encouraging signs, but that there is plentiful opportunity ahead for either structuring or remediating solutions for what is an increasingly receptive and engaged client base. We discovered that the family office ecosystem is gradually building out in the region, but much more potential lies ahead. We learned that the wealth and advisory community is building more bridges to the future generations and that the existing clients are ever so gradually accepting the need for the payment of proper levels of professional fees, with a small percentage already stepping up to the plate willingly. And we see that the work is being spread fairly well amongst the global private banks, the more boutique internal banks, the independent wealth advisors and the law firms.

Liberalisation and improving regulation

She added that there had been clarification of issues surrounding Shariah law and legacies and their application. And pointed to a very exciting development in the form of the application of common law in the DIFC and the ADGM, as well as the accommodation of domestic assets in local structures, and foundations in both markets. “In light of all these positive changes, we are really flat out busy,” she concluded, “it is a very positive environment.”

Another expert pointed to the increasing prominence of STEP in the region, which started back in 2004. STEP is the global professional association for practitioners who specialise in family inheritance and succession planning. STEP members help families plan for their futures, from drafting a will to advising on issues concerning international families, protection of the vulnerable, family businesses and philanthropic giving.

Expert Opinion - Sunita Singh Dalal, Of Counsel, Stephenson Harwood: “The private wealth community need to understand that wealth planning solutions in the Middle East, can be truly effective whilst remaining Sharia' compliant, if that is what is the client requires.”

Planning ahead

He explained that back then in 2004, there were only three estate planning practitioners in the region. “We've structured over the years often with some offshore and onshore solutions working together, but we've never had the comprehensive range of solutions here that we have today that truly complement each other so that we can assist these families with many more options available to us for their local assets that actually complement what we do often with their foreign assets and for these structures work simultaneously,” he reported.

Expert Opinion - Sunita Singh Dalal, Of Counsel, Stephenson Harwood: “There is no standard "off the shelf" solution; it takes expertise, insight and time to analyse issues and create an optimal succession plan for the client and even then, it requires consistent monitoring to ensure that it all remains optimal and appropriate. Take time to get to know your clients and understand who they and their family are. Understand their culture, their fears, aims, objectives and needs, before you jump to conclusion. Awareness of the bigger, long term picture is vital to the exercise. The details behind the motive must never be overlooked.”

Expert Opinion - Laurence Black, Regional Director, Client Solutions, EMEA, Asiaciti Trust: “Independence is very important. As a family-owned and fully independent company with no affiliation to financial institutions, Asiaciti Trust is able to focus on every client’s best interests. Being a boutique fiduciary and corporate services provider without any conflicts of interest is a huge advantage because it gives us the flexibility to always provide the most appropriate, enduring solutions for private clients, intermediaries or corporations. For over 40 years, we have provided unparalleled, quality service to generations of international clients, their families and businesses across multiple jurisdictions. We were among the first trust and corporate services companies to establish operations in key locations that offer the best wealth protection and estate planning opportunities.”

Going (more) local

Another guest added that there was a great need to go to offshore wealth markets to organise these matters in the past, but the range of options in the region is today dramatically better. “Families in terms of succession planning and estate planning have lots of options available locally now,” they remarked. “Before, for example, you had challenges registering the local Middle East assets into structures, but now, because your structure is available locally, you can easily put those assets into the structure. This has opened up a lot of families to start exploring the local options, how best to use them, and the best way to move forward. The result is we have been very busy, including on foundations, holding companies, trusts and other solutions.”

The Hubbis Post-Event Survey

We asked our delegates to offer their insights into the evolution of wealth and legacy planning and structuring in the Middle East. Many interesting views emerged, which we have distilled here.

Do you think there is a much more active drive nowadays towards professional wealth, legacy and succession planning amongst private clients in the Middle East? Why, or why not?

- Yes, increased complexity globally from a taxation point of view.

- Yes, as there are more affluent clients in the Middle East.

- Yes, due to increased compliance and regulations across different locations, this is now becoming a topic that clients need to address urgently.

- Yes, the Middle East is starting to open its financial markets and expand its financial product and advisory offerings.

- Yes, absolutely, not only driven by the second and third generations, and their more international worldview but by the first generations, partly to protect against internationalisation and more global regulation.

- Yes, and there is a rising interest in professional advice needed to help plan for these matters.

- Yes, clients are now more aware of the importance of estate and succession planning which they used to dismiss as a matter of least priority previously. Also, with more business interests across various countries, there is now a new urgency for this.

- No, we still find that people lack the sense of the needs of wealth management and estate planning.

- Certainly, yes. The clients here today are more well informed and clearer in terms of their needs and expectations.

- Yes, we find that the younger generations are more aware and educated; this is particularly true of women who often lead such discussions, directly or indirectly.

- Yes, private clients nowadays pay more attention to professional wealth, legacy and succession planning. Compared to some five years ago, there seems to be a generational shift with those in their 40s and 50s, especially being in a position to instigate planning. There are more wealthy expats in the region, so the clients are not only local families.

- From the outside looking in, as well as anecdotal observations, I would say that there is, yes. This is common to almost all jurisdictions in 2021, and the ME has benefited from substantial catch-up - driven by qualified advisors with the right motives.

- Yes, the pandemic has brought things more urgently into focus as crises tend to do. Also, having large families holed up together for vast durations of time has accelerated this trend.

With improving regulation and a more sophisticated and comprehensive wealth management ecosystem in the region, are more of the region’s HNW and UHNW investors moving more money back into the region? Why, or why not?

- Yes, we see money moving back due to western countries’ regulations and due to rising caution on tax issues.

- The money and booking centres still remain Singapore and Switzerland, or the UK. More and more of these which were earlier managed also may be from those centres are now being managed from a UAE or similar based manager. So, it is more about fund managers and professionals being available in the region who assist those clients with management, but traditional booking centres continue to remain effective and attractive.

- Yes, as they want to be organised better for the safety of their legacy.

- Not really, as most prefer to diversify where they keep their money and may prefer to keep their wealth in so-called 'safe-havens'.

- Yes, due to CRS, FATCA, regulation, wealthy people will move their assets to more sophisticated and less regulated regions.

- Yes, but this is also because centres such as Switzerland are less attractive these days.

- In my opinion, they only move money back subject to their confidence and if they see good political stability, to offer an established financial infrastructure and if they see they can obtain professional expertise to help them with managing their funds.

- Yes, but it will be a gradual process as they still prefer tried and tested jurisdictions. However, with more countries in the region taking the necessary steps to improve their regulations, there is a great opportunity.

- No, compared to other regions like US, UK, Singapore, Hong Kong, the region is still lacking experience in wealth management and product choice and advisory services are still not well diversified.

- Actually, there is still concern about political risk and, in some cases, forced heirship and potentially what some see as discriminatory rules. Families will often have one structure for their local business wealth and another for international wealth. The structuring may be similar but is separate.

- Yes, they are because a more sophisticated and comprehensive wealth management ecosystem can now provide them with better protection and accountability.

- Not at the current time, other financial hubs remain more stable and more sophisticated.

- Not really, as they will want to diversify their money offshore as well or probably for their business.

- Money will mostly still be kept out of the Middle East for perceived safety. This might change over time, but not yet really.

In your view, what needs to happen to boost the success of the Middle East WM wealth, estate and legacy planning offering in the years ahead?

- Better communication and education.

- Improvements in the laws and regulations.

- Many of these building blocks are being put in place. The structures offered have expanded, they allow the choice of common law as governing laws and with the DIFC courts upholding the effectiveness of that it is becoming preferred. As more structures get established here, the jurisdiction will then move towards greater maturity in the years ahead.

- More investment choice and better regulations for the protection of their assets.

- Developing the wealth management ecosystem in terms of diversity, talent, professionalism, products and regulation.

- To offer more in-house expertise and better awareness, especially when dealing with civil law and Syariah matters in the wealth, estate and legacy planning offering.

- Greater transparency.

- Easier and more flows of information and data.

- Greater liberalisation.

- Improved political stability and outlook.

- Greater depth of the regional financial markets and financial infrastructure.

- More transparency and protection for client's interest to bring their funds back to the Middle East.

- Greater transparency and speed of execution are vital, and also more awareness that such opportunities do exist, meaning the clients, bankers and family offices need to be advised accordingly on the many options available.

- Education of the needs of clients and the wealth management community to hire more internationally skills and experienced professional wealth managers.

- More events & seminars to promote through different channels.

- Continuing training and education. It is also important to have top quality experts more involved in advising families on a tailormade basis.

- Further Improvement on the regulation and more comprehensive estate planning.

- An improved financial framework and infrastructure for global banks and asset managers.

- Greater trust, closer relationships and increased transparency with their bankers.

- Proven stability.

- The continued dialogue with HNW/UHNW clients and families, promotion of the new regulations and communication of the range of solutions are available, education on structures such as trusts, foundations, the use of life insurance, and better coordination between key stakeholders on all matters such as legal, trusts, tax, and so forth.

- The continued improvement in professionalism, and communication via word of mouth of success stories to bolster interest. Time will also be a factor as the second and third generations will be more open to planning and more interested in proper structures.

- As more information and greater transparency come into the process this will boost the activity levels. Being seen as a partner and not a service provider will be key to client confidence and the expansion of structures and solutions.

- Greater knowledge and professionalism and then hand-holding the clients through the process.

- More marketing via events, more discussions with banks, family offices and other players who have access to the client base.

Which jurisdictions in the region or worldwide are benefiting most from these trends, and briefly why?

There were many replies here, with replies highlighting the importance of Singapore as a stable jurisdiction with a well-established financial and advisory services ecosystem, as well as a low tax rate and welcoming culture. The Middle East itself is increasingly offering solutions which did not exist earlier and hence the UAE is benefiting, alongside the more robust jurisdictions like Singapore, or Hong Kong. Europe – Zurich, Geneva, London and the Channel Islands - are far from out of the equation, as they offer a strong historical connection, close proximity to the Middle East, and strong financial and regulatory environments. One reply said that Singapore, Guernsey and Jersey are generally viewed as the most ‘neutral’ of the offshore jurisdictions, while the Caribbean, even though it has some excellent asset protection, is tarred with the EU blacklist brush, although the Caymans are holding on to and actually improving their reputation. Within the UAE, Dubai is considered the most robust and diverse market for structures and legacy planning in general.

Life insurance solutions

An expert introduced his firm, explaining their role in structuring tailor-made international insurance and wealth protection solutions, leveraging a global network of professional partnerships including private banks, independent and external asset managers, family offices, wealth planners, tax advisors, and law firms to assist wealthy families with their wealth planning needs. He explained that the firm had been founded as an insurance broker, focussing heavily from the outset – and still today - on working with families with a US nexus, and now with 13 offices worldwide.

He explained that perhaps 20 years ago, foundations and trusts were the tools for wealthy families and they still are but said that PPLI or private placement life insurance or Variable Universal Life or perhaps other high death benefit insurance solutions can help clients to manage either inheritance taxes, or enable or offer a lot of other benefits.

“For example,” he explained, “withholding tax reclaim has been a huge issue in the Middle East, but with insurance incorporated into the structures, there is plenty of room for withholding tax reclaims, making a super cost-efficient if the structure is designed correctly.”

A great planning tool

He added that insurance does not fall under the remit of controlled foreign corporation (CFC) regulations. “Many of our UHNW clients transfer holding companies underneath the insurance, and without CFC issues. Moreover, insurance bypasses probate, which is quite important for Common Law jurisdictions, and the insurance has to pay out 30 days after the person insured passes away. Insurance is still in the US one of the top planning tools for wealthy families, albeit for this purpose, it is quite new in the Middle East.”

He explained that it is very important to set up a structure that is first of all, portable. “An insurance structure works in both civil law and common law jurisdictions,” he explained. And he added that it is important to understand that the firm keeps an eye on the insurance arrangements regularly, as things change in terms of the family situations, the regulations and so forth. “We see that maintenance on these contracts is absolutely key,” he said.

Keeping up with change

He explained that his firm in the region often works closely with the family lawyers, and together help clarify the structures and the advantages. “A lot of service providers are really only familiar with high death benefit insurance, but they have no clue about actually using insurance as a holding structure,” he reported, “and of course I could go on for a long time, but I shall simply comment that 95% of all the structures that are being set up are without including insurance, which I believe is a mistake. At the least, one should properly consider the insurance structures and advantages, to discover whether it makes sense or not for particular clients.”

Intimations of mortality

The discussion migrated briefly to the pandemic, with a guest highlighting that naturally this had concentrated the minds of many families on mortality and therefore organising wills and sorting out their affairs. And he explained that more people realise that they need to sort out their family business assets and potentially restructure. “These are some of the key areas that are now gradually being resolved with more focus,” he reported.

Expert Opinion - Dominic Volek, Member of the Executive Committee and Group Head of Private Clients, Henley & Partners: “Given the pandemic and threat of similar disruptions in future, the possibility of relocating to a country with access to world-class healthcare and enhanced safety is a massive drawcard. There’s been heightened interest from European clients for second citizenship programs in the Caribbean, or residence programs in Australia and New Zealand - as these countries are appealing given its much smaller population and tighter border control.”

Expert Opinion - Sunita Singh Dalal, Of Counsel, Stephenson Harwood: “During the Pandemic clients have been made acutely aware of their mortality and are keen to put succession plans in place to protect and preserve their wealth. Cost is not necessarily the prohibitive factor for advisors, I find that what clients have very little of is not money, but time. Time has become one of the most precious commodities available today and to create an effective and viable succession plan, we need clients to invest their time. And circumstances change as a family evolves and events unfold. To be successful, a succession plan must similarly be capable of adapting to such change and evolution so that assets reman protected regardless of unforeseen situations.”

Expert Opinion - Laurence Black, Regional Director, Client Solutions, EMEA, Asiaciti Trust: “It is vital to understand the clients and the culture, to feel the pulse. Impeccable client service is at our core; we understand the unique challenges of our clients’ family dynamics, evolving needs and aspirations because our experienced professionals and specialists engage in extensive consultations with them. Asiaciti Trust’s unique proposition lies in being a fiduciary that always offers best in class services and customised, long-term solutions for protecting family wealth and assets because we are a wholly independent, family-owned business not affiliated with any financial institutions.”

On the subject of wills, another guest said that they often despair when they so often hear from clients that they had been told by their trusted family advisors that actually a will is the be-all and end-all, and that's all they need.

“That is not the case,” they said, “as a will is not a succession planning tool, especially if you have operational family businesses across borders. What you've actually got to do is sit down with the client and really engage with them and make them understand that to be successful, there are a few core elements that you really need to engage and take onboard and understand. And that involves buy-in from the entire family across generations, understanding and communicating the aims and objectives and making sure that those aims and objectives are completely consistent across the board as far as possible, but also, they are revisited time and time again.”

Expert Opinion - Dominic Volek, Member of the Executive Committee and Group Head of Private Clients, Henley & Partners: “In our line of work, any type of uncertainty, be it political, economic or security, usually propels interest in our services. We’ve seen this with the unrest in Hong Kong, Brexit, Covid-19 and more recently Capitol Hill in the US. Interestingly, in the last 12 months, the US has become our single biggest market as clients realised that putting all their eggs in one basket from a citizenship or residence perspective wasn’t ideal. This has also extended now to US expats in international hubs like Singapore and Dubai.”

Expert Opinion - Sunita Singh Dalal, Of Counsel, Stephenson Harwood: “A Will by itself is not a succession plan, or a solution to estate planning, especially when operational businesses are involved – it can do more harm than good!”

Being open to ideas

They added that it is quite discouraging to be sometimes faced with a client who comes with preconceived ideas. “But I am understanding and seeing a lot more engagement and positive engagement to the second generation and the younger generations coming to the table. It is refreshing, they bring with them a whole new perspective. In the Middle East today, the statistics show us that the second generation are far better educated and aware in terms of diversification of portfolios, ESG investing, which is actually almost identical to the concepts that we have in this part of the world in terms of philanthropy and charity, just an extension of that actually. But there is much work to be done in all these areas of investment diversification and other ideas. We are seeing lots and lots of positive developments, and I think we're all going through a learning curve, and a secret is to handhold the client through the process and keep reminding them that, when they do lose patience, this is for the greater good of the next generation and the rest of the family.”

Stress test the structures

Another expert agreed, adding that in 2020 the minds have become more focused, with more clients taking the right steps, or perhaps stress testing structures they already have to make sure that they still fit for purpose. He cited a family he knows who have recently made the effort to choose structures and had selected Singapore as the jurisdiction with their family office sitting in the UAE.

“Importantly,” he said, “they have chosen the way forward, they have lawyers on board, family coaches on board, trustees, and consultants in various other areas, including insurance and immigration specialists. In short, we are engaging with more clients with a long-term commitment to provide them with the best solutions, and working ever closer with the various professionals such as on this panel today to bring together the best solution across borders to be fit for purpose, not just now but for the future generations to come.”

Investment migration appeals

An expert in residence and citizenship by investment offered his insights, explaining that there continue to be many Middle Eastern private clients who seek alternatives for themselves and/or their families via investment migration programme around the world. “We have been pioneers and experts in this field for more than 20 years, and both work with governments on their programmes and with private clients to expedite their investment migration requirements,” he reported. “In my role as head of private clients, I work with our offices and clients across the world, from Montreal to London and Zurich, and obviously here in Dubai and into Asia, in Singapore and in Hong Kong. Because of that role, my move to Dubai is to try and be as sort of central as possible.”

He explained that he and his firm had worked with Hubbis for quite some years, connecting to and working closely with private banks, independent asset managers, family offices, in fact any firms or parties representing private clients and who might seek have clients seeking advice and expertise on the options available.

Expert Opinion - Dominic Volek, Member of the Executive Committee and Group Head of Private Clients, Henley & Partners: “The travel freedom afforded by a strong passport has always been the driving force for our industry particularly in emerging markets and here in the Middle East. But post-Brexit, we’re having a lot of discussion with Brits not only in the UK, but in destinations like Dubai, Singapore and Hong Kong. As these UK nationals have now lost their EU settlement freedom, they’re keen on golden visa programs such as Portugal or Greece.”

Plan B in focus

“We have seen since 2020 a slight shift in motives amongst private clients, as they consider an alternative or second citizenship or residence as a plan B, which has really come to the fore in a lot of clients’ minds.”

Accordingly, following the arrival of the pandemic, more clients are looking at having different eggs in different baskets. He explained that the travel restrictions have obviously impacted these trends, but with the vaccines, there is more hope of travel ahead, and the key trend towards making investment migration part of a wealthy family’s diversification strategy, part of their wealth and family planning is very robust.

Get ready

“Many programmes we promote, particularly in Europe, require the client to travel there in order to submit their application, so people cannot get to places such as Malta, Portugal or Cyprus, but our client onboarding is aided by people having time at home to organise what is often extensive paperwork, and we can prepare things for when there is a more normal situation,” he explained.

He explained that visa-free travel is a strong motivation for many people in countries with passports that do not offer such a wide range of non-visa travel.

Working with the wealth industry

He added that his firm is not a tax advisor and does not attempt to advise on any areas that any of its partner firms would work on, whether tax, trusts, insurance, investments, property or any other areas. He explained that the firm works closely and collaboratively with such experts in their different fields. He also explained that some situations can be highly complex with families with assets and family members dotted around the globe, and that it is very important to work openly with the families and the other advisors and experts, from the outset.

“The US has actually become our biggest source of clients in the past year,” he reported, “as people worry over the handling of the pandemic and politics,” he reported. “And many UK citizens are more interested due to Brexit, and are keen on Dubai, Singapore or perhaps Hong Kong, for example, as the options to retire in Europe are no longer what they were as part of the EU freedom of movement, so on places such as Portugal or other European countries they now need to look at the types of golden visas or golden residence programmes.”

And there are other well tried and tested options like in the Caribbean, in places such as Antigua, Grenada and St. Lucia, all independent commonwealth countries and offering good programmes and actually good passports. And he added that there are more expensive options for all types of people, including the UK, Switzerland, Australia and New Zealand.

A highly positive environment

The discussion closed with the panel agreeing that the momentum towards greater liberalisations, better regulation and a more professional wealth management market in the region is well and truly established. Assuming that stability in the region can be maintained and that the collaboration between the private sector and the authorities continues to be so positive in the GCC, the outlook for wealth, estate and succession planning in the region is very encouraging indeed.