The Quest for Value & Opportunity in China’s Financial Markets – Adopting the Optimal Investment Strategies

Aug 19, 2020

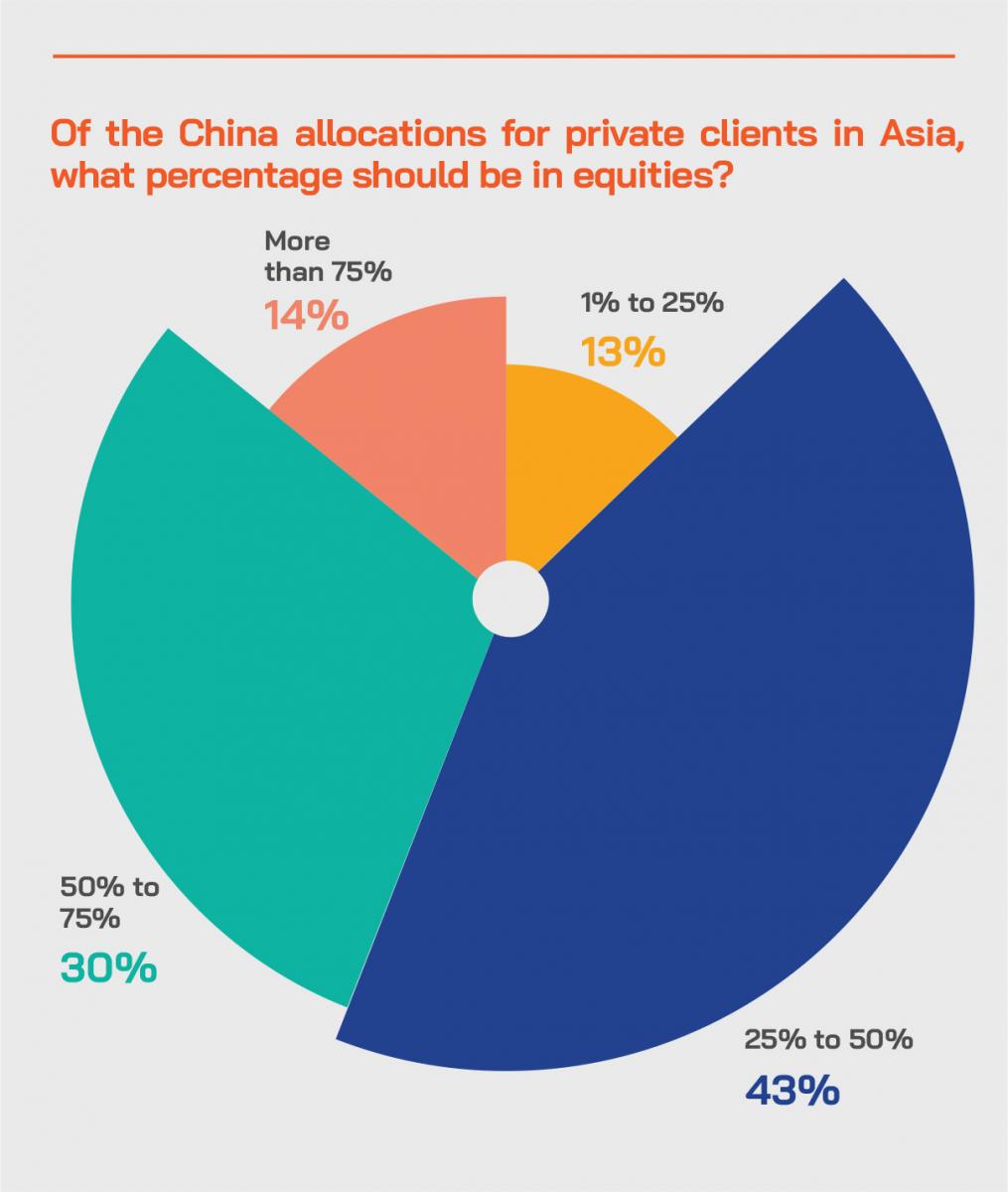

The Hubbis Digital Dialogue of August 13 offered delegates a fascinating overview of the Chinese equity and fixed income markets, as a panel of experts provided their insights into why private HNW and UHNW clients in Asia should be holding significant positions in China’s new economy growth phenomenon, as well as in the country’s broader economic restructuring and reshaping story. The experts explained why China should represent a considerable weighting of these clients’ Asia-wide exposure, and a significantly higher weighting within global portfolios than the lowly weightings China has achieved thus far in the major global benchmark indices, which are barely over 3%. The experts debated whether these private clients should be buying directly into individual stocks, or actively managed funds, or plain vanilla ETFs, or the newer range of smart beta ETFs, or perhaps should be allocating funds to DPM mandates handled professionally by their private banks. The panellists discussed the relative merits of mainland China A shares, Hong Kong listed H shares, or other avenues such as ADRs. The experts looked at equity exposures as well as the potential for fixed income investments as China’s vast debt markets gradually evolve. They considered China’s position in the world economy and the geopolitical issues such as the China-US tensions, as well as looking at China’s ambitious plans to create a new world economic and geopolitical order through the Belt & Road initiative across Asia, Africa and even further afield. The conclusion of these experts was clear – the opportunities significantly outweigh the downside, and therefore any serious investor should be building Chinese assets for the decade ahead.

The discussion began with the panel reviewing mainstream financial market activity amongst their clients thus far in 2020. An expert remarked that his bank had witnessed considerably more active in terms of their discretionary portfolio management (DPM) offerings, with clients more and more comfortable with having other people looking after their money in the face of the volatility of 2020 and the uncertainties wrought by the pandemic.

“We have seen clients who panicked so much and then got out of stocks at lows when the equity market had dropped about 25%,” an expert reported. “And those clients are the ones who suffer. Fortunately, the clients who have stuck with us have in fact seen our equity mandates turn positive. To me, it shows again the importance of strategic asset allocation and as well as focusing on disciplined investing.”

Another guest noted the decoupling between economic prospects and the performance of some stocks and certain sectors. “You can see that those investors well positioned in digital technology are doing rather well,” he observed. “People now understand when you work from home, now and potentially in the future, how important things like e-commerce, 5G, and AI, and data analytics are.”

A guest commented how their clients based in Mainland China seem to have a very, very different perspective on the pandemic than almost anyone else outside. “For those of us who are outside the Mainland, the pandemic is still very much a reality causing major disruption, whereas anyone I tend to talk to north of the border seems to think that things are more or less back to normal up there, and that things are manageable looking ahead.”

China – past the worst?

“We are very positive,” said another guest. “China has managed the pandemic better than most, and amongst the major economies, China will probably be the only one to register positive GDP growth this year. In terms of the market, I think the liquidity is still very strong, momentum is very good. We also see some megatrends in digital transformation, which can offer some major returns ahead.”

“There is clear visibility that production and consumption are normalising in China,” another expert added. “We see a strong consensus with regards to upwards earnings revisions, with some expectations for growth of 17%. So, all in all, we are positive on China and our clients are very active in that space.”

“China has been transitioning from an old economy to a new economy and has been moving up the economic value chain,” they added. “We see technology innovation, rising consumer power, and strong government policies. We see prices that are still not expensive, with PEs considerably lower than the MSCI World. China has transformed and become leaders in IT/technology, online retailing, e-payments and social media platforms, even in social gaming. And there remain many tier two and tier three cities that are still a little bit backward and offer significant growth potential.”

Post-Event Perspectives from the audience on their positioning relative to China in Q2 after the worst of the equity market sell-off around the globe, and whether they continue to recommend private clients buy China today. We found a broad array of replies, ranging from abject negativity to major positivity. We have edited their replies to provide the following insights from the wealth management community.

Were you promoting China during Q2 and do you continue to recommend China to your private clients, and why?

- No, there were/are too many uncertainties.

- Yes, China offered the best potential for investment gains.

- Yes, China for portfolio diversification.

- Yes. We have our own All China Equity Fund, and we recently launched a China A Fund.

- Yes, because China New Economy will continue to outperform Old Economy.

- Yes, we see long-term structural growth opportunities.

- Yes, as valuations were not demanding then and China was the first to emerge from Covid-19 in Asia.

- Yes. We are momentum investors. The trend is up, and we will remain invested in China until the trend breaks down.

- Yes, the market is undervalued.

- Yes, the question becomes more one of China direct or China indirect, i.e. companies listed in lv`HK/Taiwan with China exposure.

- Yes. China has demonstrated the most effective control of Covid-19 pandemic and post-lockdown recovery.

- Yes, decent PE levels, a good story line and suitable for this pandemic.

- Yes, we have increased our exposure to china in the Equity and Fixed Income space. We are looking to benefit from a strengthening of the CNY in the next 12 months.

- Yes, exposure to China is vital as it presents huge growth opportunities.

- Yes and yes. In terms of the macro outlook, China has more policy room to cushion growth risks. Relative to other major economies, it is still growing at a reasonable rate. From an investment valuation standpoint, it is also relatively more attractive to developed markets. Prospects in 2021 are also better for China.

- Yes. We simply cannot ignore China as the 2nd largest economy globally. Besides, China is doing a better job than others in fighting the Covid-19 virus at the moment.

- Yes, as we see it, the first in first out theory applies; the China economy will recover faster than other country.

- Yes, we believe equities in China will perform and grow well. They showed great resolve in managing Covid-19 and were systematic and clinical in their approach to managing the pandemic thus gives rise to great confidence.

- Yes, for the long-term. But we are selective on the type of vehicles/instruments and companies. China's growth prospects deserve a weighting in a well-diversified portfolio.

- Not during Q2 but we started in Q3, as there are signs that China is entering into bull market after years of a bear market.

- Yes, as the economic recovery was faster in China than rest of the world during Q2. China continues to remain opportunistic, but will advise clients of the higher risks involved given the bull run in the stock markets and potential increased US-China tensions with upcoming US elections in November.

- We do not actively promote or recommend China to our clients, but there has been a lot of interest from our clients with regards to how to take advantage of the gains from Chinese equities through their primary US listings and secondary listings in Hong Kong or Shanghai.

- Yes, firstly China continues its stable GDP growth with good control of its Covid-19 spread in comparison with other countries around the world. Second, the China market is changing from its manufacturing driven model to domestic consumption driven economics, a pattern that could also bring in structural changes in its economy.

Expert Opinions – Diversity, Opportunity & Focus

The expert panellists we assembled for the discussion also offered a number of on-the-record opinions to flesh out the perspectives they offered panellists during the Digital Dialogue. Hubbis has assembled some of these views below to reflect the depth of their enthusiasm on China in general, as well as their thinking in terms of precisely where China’s markets are today and how best private investors might access those opportunities.

Expert Opinion - Arjan De Boer, Deputy Chief Executive, Hong Kong Branch and Head of Markets, Investments & Structuring, Asia, Indosuez Wealth Management: “We continue to be positive in China Equity space as China is in the first country to recover from Covid-19 with clear visibility of production and consumption normalisation. There is a solid earnings recovery shown by strong consensus earnings revision momentum and 1H earnings announcements. There is a strong earnings growth recovery trend in 2021 given sooner than expected global recovery led by China. Consensus earnings forecast for MSCI China and CSI 300 in 2021 show expected growth of 17%, supported by normalisation of activities from both industrial and consumption sectors.”

Expert Opinion - David Lai, Partner & Co-Chief Investment Officer, Premia Partners: “US China tension and Covid in many ways have fast tracked the structural transformation of the Chinese economy, with areas especially related national security and strategic goals receiving earlier and bigger support from both the public side in terms of policy support and stimulus package, as well as private sector funding from both retail and institutional investors positioning for such strategic tailwinds. New economy stocks in the business of e-commerce, gaming, cloud, AI, big data, 5G network, industrial automation, EV and biotech, are benefited from the pandemic. These innovative companies are able to adapt to the new normal and grow their business in the challenging environment whilst the companies operating in traditional ways see substantial deterioration in earnings.”

Expert Opinion - Tariq Dennison, Wealth Manager, US-Asia, GFM Asset Management: “As in any other market, your ‘value’ strategy has to be smarter than just buying stocks with low PE or PB ratios. China is still a growth market, and value is about buying that growth at a reasonable price.”

Expert Opinion – Matthew Tham, Head of Discretionary Portfolio Management, BNP Paribas Wealth Management: “We are now entering an interesting era of economic cycle in China. As the country shifts from an ‘old’ to a ‘new’ economy and moving up the economic value chain, we are keen to seek out winners and capitalise on these new secular growth trends. Some of the growth drivers that we have identified in these secular themes includes Technology Innovators, The Rise of Consumer Power and Beneficiaries of Government Policies.”

Expert Opinion - Arjan De Boer, Deputy Chief Executive, Hong Kong Branch and Head of Markets, Investments & Structuring, Asia, Indosuez Wealth Management: “China is the first to come out of the Covid-19. Caixin manufacturing and services PMI has risen for three straight months since May. While growth in retail sales has only improved moderately, exports surged 5.7% MoM in July. Industrial profit rose 6.5% MoM in May and 11% in June. GDP has rebounded swiftly from negative 6.7% in 1Q20 to +3.2% in 2Q20. That said, with President Trump remaining weak in the polls as the election nears, and at the same time, with President Xi keeping firm policies despite international concern, it is quite clear that US the US and China decoupling will continue. In sum, with risk aversion likely to stay elevated through to the run-up of the US election and China’s accommodative monetary policies, A-shares should outperform HSI, MSCI Asia Pacific and MSCI World in the coming months.”

Expert Opinion - Tariq Dennison, Wealth Manager, US-Asia, GFM Asset Management: “The very low percentage of foreign ownership in onshore Chinese stocks and bonds is likely an opportunity for investors ready to bring a perspective different from how onshore investors are looking at the same asset. Small-cap A-shares are the opposite of the S&P 500 in terms of attention and efficiency.”

Expert Opinion - Arjan De Boer, Deputy Chief Executive, Hong Kong Branch and Head of Markets, Investments & Structuring, Asia, Indosuez Wealth Management: “Picking a good actively managed fund is the best strategy to access the market because it can generate alpha over the passive ETFs and not every single stock can be accessible by foreign investors through ‘Stock Connect’.”

Expert Opinion - David Lai, Partner & Co-Chief Investment Officer, Premia Partners: “Valuation-wise, China A-share is rather attractive in both absolute and relative terms. The market is now trading at a forward PE of 15.3x and 1.9x in book value. It is hardly a bubbly level when comparing to its own history. On a relative basis, if putting the major stock markets’ valuation into the context, A-share is indeed trading at a decent discount.”

Expert Opinion - Arjan De Boer, Deputy Chief Executive, Hong Kong Branch and Head of Markets, Investments & Structuring, Asia, Indosuez Wealth Management: Regarding the A-H share premium, this essentially tracks the price premium or discount of A to H shares for the largest and most liquid Chinese companies. The higher the index, the higher premium of A-shares over H-shares, and vice versa. Since the launch of AH premium index in early 2007, A-shares have at most instances traded at a premium over H-shares. Given different market environments, inconvertibility between A-shares and H-shares, and different investor mix, A-shares should continue trade at a premium over H-shares. Longer term, the divergence should diminish if China is on its way to properly opening up its financial market.”

Expert Opinion – Matthew Tham, Head of Discretionary Portfolio Management, BNP Paribas Wealth Management: “China is the only major economy expected to have positive GDP growth in 2020. It showcases the strength of the country’s ability to withstand headwinds and the numerous fiscal and monetary tools it has on hand to support its domestic economy. China equities have traded at a discount to global indices and offers good valuation relative to the rest of the world. In view of the innovation and contribution to global growth, it should trade at a premium, or at least on par given its higher growth differential compared to the rest of the world.”

Expert Opinion - David Lai, Partner & Co-Chief Investment Officer, Premia Partners: “China A-share is outperforming because of successful control of virus and strong fundamentals in macro recovery. China GDP expanded 3.2% in the second quarter this year, reversing a 6.8% decline in the first quarter and beating the median forecast of 2.4%. It is expected to be the only major economy that manage to grow in 2020 whilst the rest of the world is yet to see the green shoots.”

Expert Opinion - Arjan De Boer, Deputy Chief Executive, Hong Kong Branch and Head of Markets, Investments & Structuring, Asia, Indosuez Wealth Management: “We like consumer staples, healthcare, construction machinery in the A-shares space and prefer IT, property management, consumer staples, construction materials (cement) within the H-shares.”

Another expert commented that he and colleagues spend considerable time focusing on comparisons between the US and China, and most recently between tensions between the US and China. “I don't for a minute doubt that part of the discount in PE ratio is partly due to sentiment and especially sentiment amongst US and European pension funds, who even today look at the FTSE All World Index and only allocate about 3.5% to China, despite the fact that China is the second biggest economy, the biggest actually by some measures, and the second biggest stock market, as well as the second biggest bond market.”

Passive or active? Both have their merits

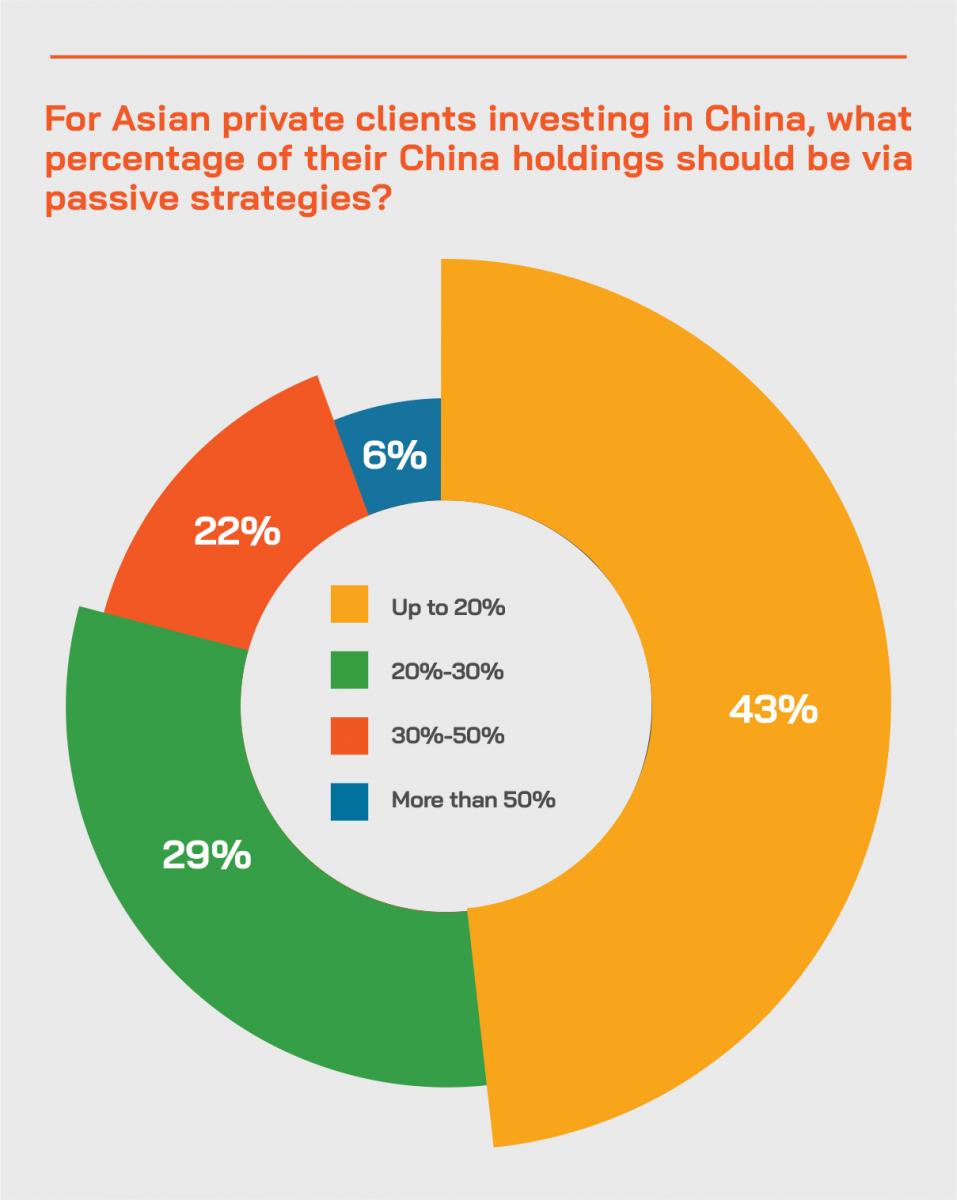

A keen advocate of the ETF market offered his perspective that for those buyers who truly understand the China market, the direct holdings of Chinese stocks via stock picking might be logical, but those types of buyers are few and ETFs can offer the exposure as well as liquidity. Smart beta ETFs, he advised, for example focusing on the China new economy including stocks selected within healthcare, IT, urbanisation, domestic consumption, AI, and cloud computing.

The same ETF expert argued that there is now greater diversification, whereas before most of the ETFs were simply tracking the mainstream index. “But nowadays we have more of these types of smart beta ETFs that are focused on some major themes that investors really like, for example, AI, cloud computing, biotech, technology advances, and other key themes. We have been outperforming the active funds this year, by some 20% we estimate, and with a charge of 50 basis points in total expense ratio, that represents value and as the ETFs are listed on the exchange, they offer governance and transparency.”

Expert Opinion - David Lai, Partner & Co-Chief Investment Officer, Premia Partners: “Premia CSI Caixin China New Economy ETF (3173.HK) sees increasing interests from investors with substantial inflows in the past few months. It covers a diversified set of major trends including technology advancement, urbanisation, rising middle class, consumer upgrade, education, aging population and healthcare. Besides, it emphasizes light-asset model, profitability and R&D investment in screening and weighting the stocks – so rather than simply chasing tech stocks through rallies, this is a basket of new economy players with more robust fundamentals and quality growth DNA to weather market cycles.”

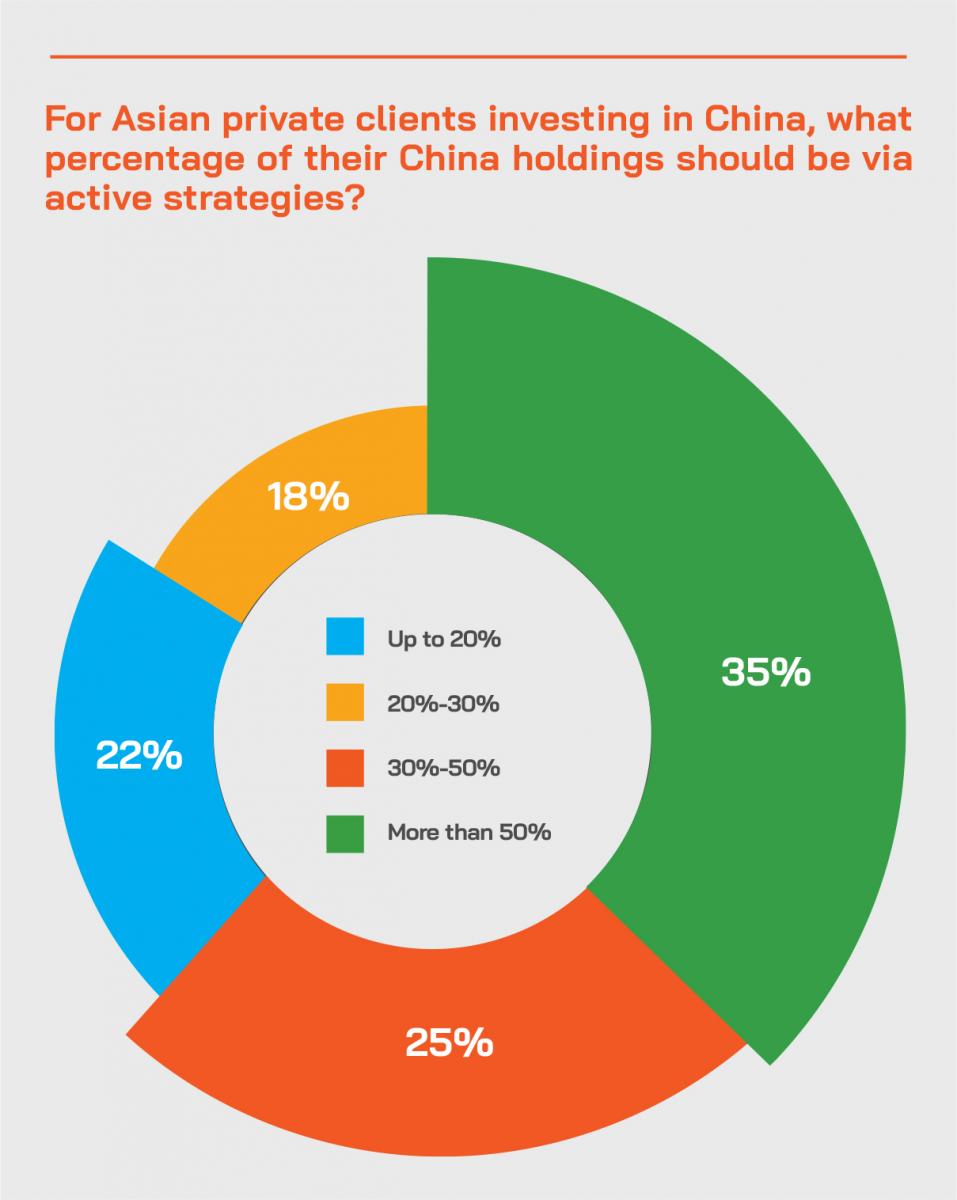

Another guest had a somewhat different view. He felt that although for the mature major markets such as the US, passive strategies such as ETFs offer greater opportunity to match market and even active fund performance, and at very low cost, but that for China, a far less mature and less transparent market, active strategies offer the better option, with active, bottom up, very defined and selective stock picking better than buying broadly across the market.

“We prefer active strategies that can really create alpha and where fund managers are very knowledgeable about what they actually invest in,” said one of the panellists. He explained that his firm operates a dedicated China DPM mandate through Hong Kong, the ideal gateway for what remains a more difficult and still somewhat opaque market to invest in; this type of selective, professionally managed strategy, he said, has in fact proven to be very popular even for European clients or Middle Eastern clients to obtain access to China.

Another expert added that Hong Kong continues to be the main gateway to China, through Stock Connect, or Bond Connect, and until it suddenly starts becoming a lot easier for foreign pensions and others to open accounts directly at Shanghai or Shenzhen, Hong Kong is going to continue to be that gateway.

Post-Event Perspectives from the Audience

As set out below, we asked delegates for their views on whether they advise passive or active strategies for China, and also how they think China should be accessed, in other words via the offshore markets or onshore markets.

We first asked the audience whether they advise their clients to adopt passive or active strategies for accessing China. There was perhaps a modest preference for active, due to the lower research coverage on Chinese stocks, the difficult in interpreting some of the financial data and reporting, and inefficiencies in the markets that should allow more alpha generation from both selection and also arbitrage opportunities. But passive and especially smart beta ETF strategies were also strongly recommended to selectively capture certain key trends, for example the China new economy momentum. We have selected a few of their comments here.

Hubbis: Which is the right approach to China, active or passive?

- An active strategy will create more value.

- Our top choice would be direct equity selection, followed by a smart beta ETF, followed by a passive ETF, with active funds being the last choice.

- Active strategies as the China market is volatile.

- Active equity funds can generate significant alpha in China.

- As the country is poised for major changes in the coming future, we would recommend a passive fund strategy.

- Active, because passive funds and indexes in China are full of weak banks.

- A smart Beta passive strategy, which is essentially a low-cost vehicle with the potential to outperform broad market cap-based benchmarks.

- There are significant alpha generation opportunities in China.

- A mixture of both will be good as funds provide a wider range of A shares exposure.

- For the majority of clients, we actively prefer ETFs as they are cheaper than mutual funds. We do sometimes buy US and Hong Kong listed Chinese stocks.

- The China market is still underdeveloped and less efficient. Active strategies should still have a lot of room for arbitrage.

- Active. Why take passive exposure to poorly run businesses in sectors in need of reform?

- Active because they are still not a stable or developed market.

- Active, as there is no excuse for not outperforming. The market is not efficient.

- Active funds/strategies help cover in more depth the good companies that are not in the passive index funds/ETFs.

- Depends on knowledge and access. We are familiar with H shares and prefer to pick individual stocks, but less knowledge on A shares, so would invest via ETFs.

- This depends on the investor type. We put risk averse investors into ETFs, risk tolerant investors into active equity strategies.

- I prefer active equity funds strategies as market are volatile now, active strategies should be able to generate more return.

- Both, it depends largely on the clients we deal with and their preferences and appetite.

- A combination of both active and passive.

- We weight towards active as there are too many ‘games' for most passive approaches.

- Passive as the cost of active is not always justified.

- Usually a passive ETF approach. Not many managers can outperform the markets consistently.

- Passive investing strategies due to transparency, the diversified nature of indexes, low commissions/fees and low transaction costs.

- Active strategies to pick the stock winners, as many sectors will take a long time to recover and will underperform.

- Active strategies are preferred, given the volatility of China’s markets, a result of retail investors being the largest proportion of market players.

- Active, as most of companies in China in terms of accounting systems are still not transparent.

- I generally prefer active equity funds in terms of strategy as they seem to provide larger gains. But our clients seem to take a more risk-averse approach for this portion of their portfolio and tend to leave the active strategies to other aspects such as making their own single stock investments, structured products, and so forth.

- We take a combination of active and passive equity investment strategy. For those companies that are not transparent enough (either not easy to understand the financial statements or not many analysts covering them), I would rather go with passive strategy such as ETFs to invest, and for companies with transparent data released in the market, I don't mind to recommend clients to invest via the active strategies.

Then we also asked delegates how investors should access China equity exposure, in other worlds via A or H shares, ADRs or others. The MSCI China Index at the end of July consisted of 711 constituents capturing large and mid-cap stocks across China A shares, H shares, B shares, Red chips, P chips and foreign listings such as ADRs. With 711 constituents, the index covered about 85% of this China equity universe, and the index includes Large Cap A and Mid Cap A shares represented at 20% of their free float adjusted market capitalisation. As we had anticipated, we saw a wide variety of replies to this question, from which we have selected a few comments below to put these views in context.

Hubbis: How do you recommend investors access China equities – A or H shares, or ADRs/others, and why?

- H shares offer more liquidity.

- ADRs.

- H Shares off the best opportunities for capital gains.

- All classes.

- All of the above, as some names are only available in one form and not others.

- All three for a bit more diversification and choice.

- A shares are our most preferred avenue, as they tie in well with the themes of domestic consumption and internal circulation of money.

- No particular preference, although A shares will give a wider exposure to AI and cloud computing companies in China.

- We use ETFs.

- It is still difficult for foreign investors to invest in A shares. H shares remains a good choice as many leading companies in the mainland will list in Hong Kong.

- A shares offer good upside potential. H shares offer more liquidity.

- We are focusing on the A-H disparities and arbitrage trades.

- A combination of A and H shares in order to gain a more holistic access to sectors and companies with good track record and growth potential. Also, for companies with dual listings in A and H format, there could be price arbitrage opportunities.

- Both A and H shares, although we are less knowledge on A shares, and prefer to invest via ETFs.

- For us, a combination of A, H, ADRs, ETFs and mutual funds, depending on investors’ risk appetite and investment availability/liquidity.

- A shares, as there is a huge inflow of funds both domestically and internationally.

- A shares, through Stock Connect and H shares directly in Hong Kong.

- A shares give direct exposure to China markets, and to diversify the risk investors can consider funds or ETFs with this focus.

- If we must recommend, H-shares seem to be where investors can take advantage of the trading volume and volatility, seeing as most Mainland Chinese, who have sole access to A-shares have always opted to invest in the H-shares side for a share of the pie. On another note, not ADRs because these seem to make investors feel as if they are a step behind the action.

- Due to FX controls still not being relaxed, investors access China equities will still remain in H shares and ADRs, there are not too many A share buyers amongst our clients.

Fixed income – flawed but with potential

The discussion shifted to fixed income. Although China’s fixed income market is estimated to be the second largest in the world, it is hardly on the radar for most institutional or private client investors. A guest noted, for example, that foreign investors, even recently, made up less than 2% of the vast China onshore bond market.

“Firstly,” he remarked, “the Renminbi is a controlled currency, and secondly, I don't think any of us here would argue that China's credit market is even half developed. It is untried and untested, so for example, we haven't really seen many properly expedited bankruptcy cases, and certainly nothing like we see in proven Chapter 11 process in the US. But having said that, there are some opportunities in such a vast debt market.”

Another expert commented that there are, for example, plenty of Chinese companies, mostly state or partially state-owned, that issue in US dollars offshore and which offer essentially government-backed paper at appealing spread versus the normal US or European US Dollar bonds.

“Agreed,” said another guest, “we prefer the offshore market in that sense to the onshore market, simply because we think the premium for the onshore market is not high enough compared to the offshore markets.”

Nevertheless, the consensus appeared to be that although there might be some yield pick-up over apparently similarly rated dollar bonds in the US or Europe, generally the lack of transparency on financial data and the lack of liquidity in these issues were deterrents from the wealth market community promoting China’s fixed income market to their private clients, other than on a very selective basis, for the time being.

Expert Opinion - Arjan De Boer, Deputy Chief Executive, Hong Kong Branch and Head of Markets, Investments & Structuring, Asia, Indosuez Wealth Management: “When we compare onshore RMB bonds of the same issuer, one is better off buying the offshore USD bond. The onshore bond market is often more for fund managers to seek out names that may not be issuing offshore, and current levels for an onshore-offshore premium are not looking very appealing. An issuer of a BBB standing in the USD bond market is usually perceived as AAA in the onshore market. Typically, anything below that of AA onshore, will be a high-yield name offshore. This is why the RMB bond market is good funding source for issuers, but not so much for investors at this point.”

Post-Event Perspectives from the Audience

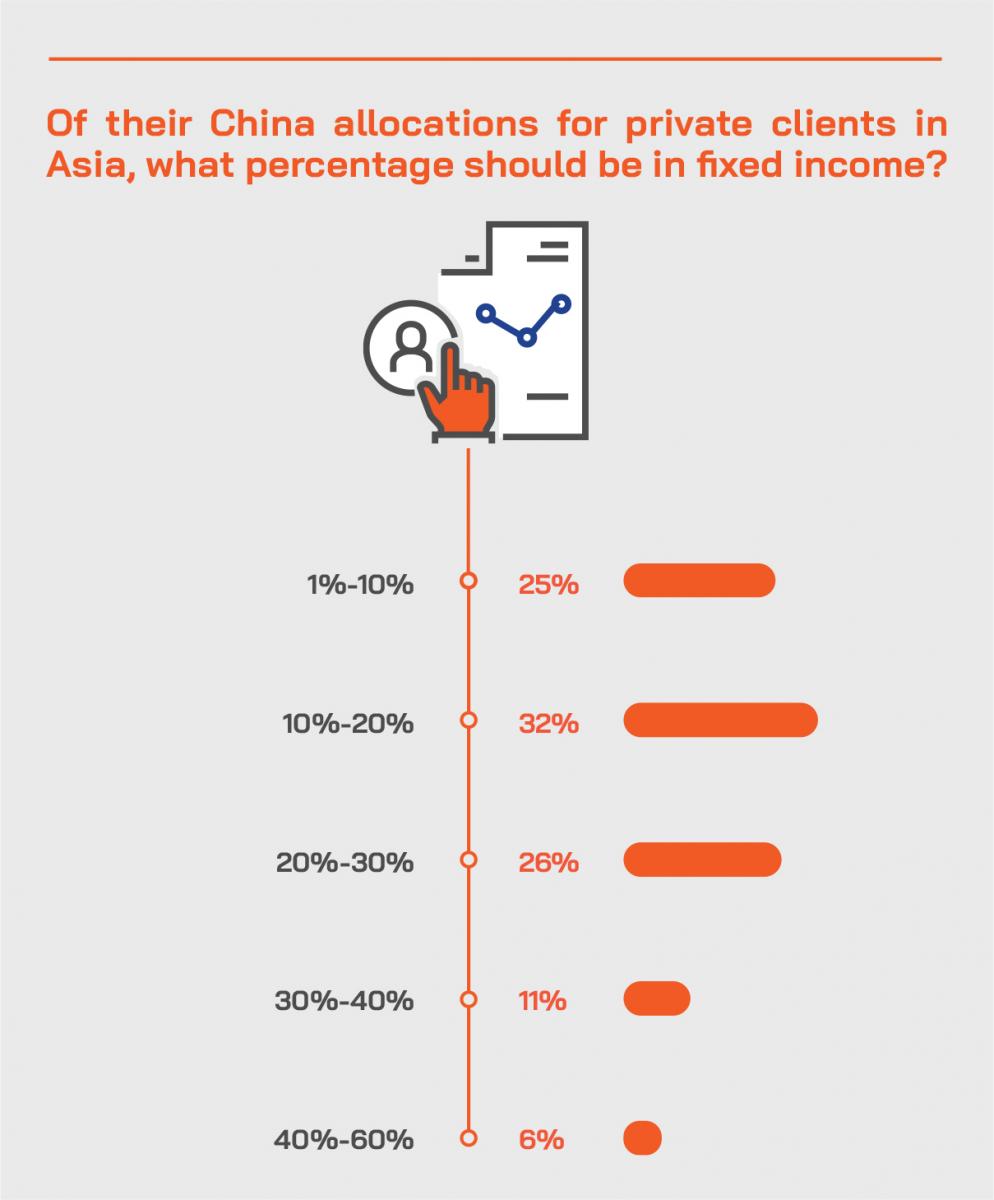

We asked the audience their views on demand for China’s fixed income assets. We found that mostly the respondents indicated lower or very modest interest in fixed oncome. We have selected a few comments below to out these views in context.

Hubbis: Are you promoting China fixed income, and if so what segments and how should investors access this?

- No. Poor risk to reward trade-off. There is a lack of transparency on the credit side.

- Yes, but only the property development sector.

- Not yet, due to different standards on ratings and investment philosophy.

- Yes, but mostly Chinese government bonds, with some views on credit, mostly via ETFs.

- Yes, we have a China Bond Fund.

- Yes, onshore China sovereign and corporate bonds.

- Yes, passively.

- Yes, but we prefer offshore bonds and those state enterprise issuers as China is still a developing market. Access through the offshore market offers issues and sectors such as property and infrastructure related companies.

- Yes, but selectively through our Asia Income fund.

- Yes, some Chinese bonds are offering good yields.

- No, largely due to liquidity challenges.

- No, we are not really promoting China fixed income at this juncture as the fixed income market is not as developed as in other regions. We observe high rates of corporate default, and our clients are not too keen when it comes to China fixed income.

- Only for those blue-chip real-estate companies that have issued offshore in dollars.

Governance and transparency – could do better

A guest highlighted the well-documented transparency concerns in relation to financial disclosures, most visibly of foreign especially US-listed Chinese stocks. He cited the US-listed Luckin Coffee, which is to be de-listed from Nasdaq following allegations of accounting irregularities.

“There are always such issues, and after all the US brought us Enron and WorldCom, to name only two, but the question then is to what extent does this type of example show that many top Chinese companies’ numbers not quite up to scratch. Do these situations indicate that they really do deserve a major discount, for example does China Mobile deserve to trade at little over half of the PE ratio of AT&T?”

“Yes,” agreed a fellow panellist, “we have to remember that China is not a developed market, but still a developing market, and many valuations are at a discount to international peers, for a variety of reasons. We do need to acknowledge there are those inherent risks that come with investing in developing markets where the accounting standards are not internationalised, where there is less transparency, and there are also other risks that we have to take notice of, especially on the macro side, including tensions in the South China Sea, the trade war between the US and China, even the possible shift of supply chain from China to other Southeast Asian or low cost countries.”

But the key, the panel appeared to argue, is that the differential in valuations will gradually diminish and for those smart, active managers these types of arbitrage opportunities are also exactly where they can generate some real alpha.

Expert Opinion - Tariq Dennison, Wealth Manager, US-Asia, GFM Asset Management: “China’s data quality issues can be an opportunity for investors willing to do some work and take some risk. Alternative data will be a huge area for China investors in the 2020s.”

Expert Opinion - Arjan De Boer, Deputy Chief Executive, Hong Kong Branch and Head of Markets, Investments & Structuring, Asia, Indosuez Wealth Management: “The upcoming US election may lead to more conflicts between US and China as The US president may use the conflicts to increase his chance of re-election. US-China tension is expanding beyond tariff and audit compliance issues to involve broad sanctions of major Chinese financial institutions and/or other geopolitical escalations.”

Post-Event Perspectives from the Audience

We asked the audience which sectors investors should focus on for their China equity exposure. We have edited their replies to provide the following insights from the wealth management community.

Hubbis: Which equity sectors should investors in China be focusing on, and very briefly, why?

- Energy, due to the rebound of economy.

- Technology and Healthcare (Pharmaceutical/bio).

- Technology.

- ESG and Sustainable - foods, telecoms and infrastructure.

- Consumer and e-commerce.

- Mostly those sectors catering to China's ageing demographics.

- IT, Consumer Discretionary, and healthcare, as these are all tied with domestic consumption and internal money circulation.

- Technology, consumption, AI and cloud computing. Covid-19 has changed the consumption trend towards more online and China is also focusing more on AI & cloud computing investments.

- We mainly focus on highly liquid large cap stocks.

- Biotech and new economy stocks to cater for the new normal after the pandemic.

- Construction and Banking, because of their development and population.

- Promotion of the digital economy.

- Technology - many are online global conglomerates, not just the traditional sense of the definition of IT. Structural changes as businesses remodel and become digitised and harness the digitalisation of business opportunities to achieve economies of scale will be supportive of the tech sector. Nested in technology is the renewable resources component, which in the coming years will be more important in response to finding energy sources that are more sustainable for China's industrial growth.

- Healthcare and insurance as both serve the aging population and rising sophistication amongst affluent younger Chinese population.

- Infrastructure/industrial sector - China's Belt & Road Initiative will drive growth to a lesser extent, selective financials that continue to do well and have higher level of governance with a good earnings track record.

- IT, especially in AI area as China has declared they would like to be the global leader in a few years’ time.

- IT, Mobility, Health Care, e-Commerce as China has some interesting companies being successful in the definition of megatrends.

- Technology, which is benefitting from government policies.

- Domestic consumption and manufacturing. Due to the scale of the domestic economy and the ongoing growth in manufacturing capacity.

- Technology, but I also watch the undervalued traditional sectors.

- TMT and e-commerce, as the pandemic changes the consumption habits to online spending.

- Consumer staples for resilience despite pandemics and crisis. Health care and technology for growth.

- For the moment, the technology and auto sectors as that's where China has been diverting their attention and effort to modernise and progress to be on par with the rest of the world. The bulk of the recent IPOs have had to do with these sectors and there will be more to come as 5G-enabled devices and alternative-energy-powered vehicles are trending.

- The new world order is that the traditional brick and mortar business are sunset industries and the new world is all internet based for work, business, and leisure. This will become the new world order.

- E-commerce and internet related sectors (the so-called New Economy) is the new driving force for China and the world's economic growth momentum. E-commerce and internet development in China is very mature which brings tremendous changes in consumer's shopping behaviour and the corporates' sales strategy, that has become a huge production force in economics.

“We need to be careful on valuations,” he added, “and I am somewhat old school when I say I prefer to look at the simpler metrics of book value, earnings per share, dividends, and so forth. Yet I also recognise that while PBV makes sense for a mature bank stock, Pes do not make much sense for some technology businesses whose profits are later set to blossom. So, in reality, smart measurements of value need to take into account a variety of metrics.”

Another expert agreed, adding that the selection of stocks even into ETFs should also be determined by a wide variety of metrics to help ensure that the individual stocks represent both quality and integrity as well as being in the right sectors and at the right sort of nominal valuations. We should not simply be buying the beta, buying the largest companies, we also conduct some financial check when we pick a stock into the portfolio, for example looking at the debt coverage ratio, profitability ratios, liquidity, projected revenues and so forth. All these additional factors offer another layer of comfort to the investors.”

Another guest highlighted traditional measurements for value stocks, and additional metrics for others, for example the PEG ratio, which highlights PE over EPS growth. “Just imagine a stock with a PE of 25x, yes it could look very, but if your EPS growth is 25%, your PEG ratio is only 1x, and technically that is not very expensive, in fact we consider anything over a PEG of 2x to look expensive. So that is how we gauge the valuation for growth stocks, and as a result, sometimes you can see us holding stocks that are up 150% because they continue to look relatively cheap, or good value, because they continue to have appealing PEG ratios.”

The panel drew the discussion towards a close by asserting that unless an investor is remarkably knowledgeable it is more optimal to invest via ETFs, active funds, or specifically targeted DPM in order to capture the wide variety of growth and new economy stocks available.

China – the weightings must rise

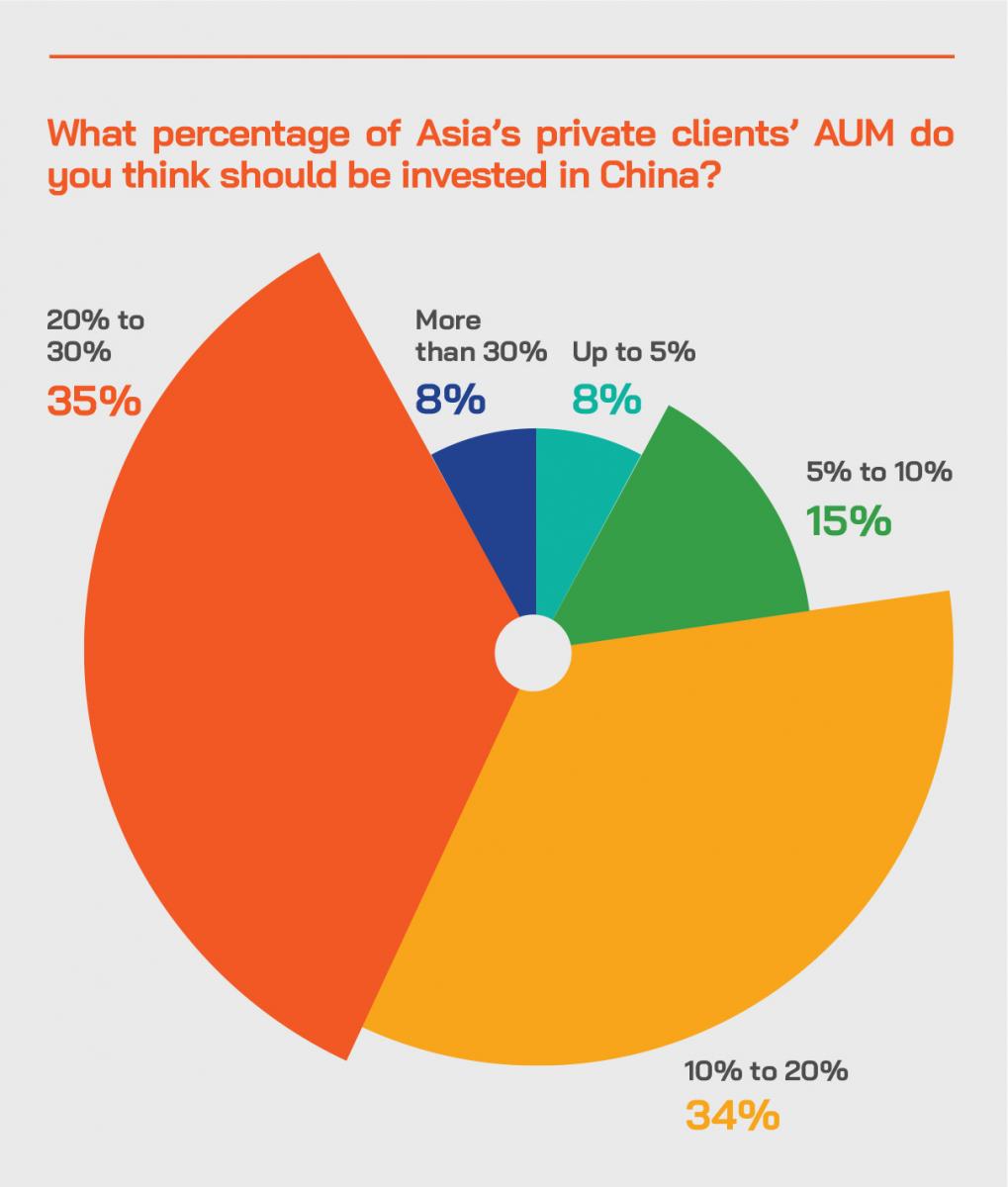

“I would say in general that for Asian private clients with global equity, they should have about 35% invested broadly in Asia, to be in line with GDP worldwide and future growth potential. And of that there should be perhaps 50% in China.”

A fellow panellist concurred, adding that such a strategy could then be directed to capturing the new economy growth potential in China, as well as the gradual revaluation of Chinese stocks on a global basis.

These numbers are of course far, far higher than the mainstream allocations of China in the main global indices, for example China’s weighting in the MSCI All-World Index is little over 3% whereas actually China’s actual total weighting is closer to 17% of world indices. It means China as a whole had a lower weighting than Apple stock alone at the end of July and was less than 5% of the more than 66% weighting of the US market as a whole.

“We generally have allocations in China between 15% and 25% of world portfolios,” said another guest. “The China weightings in the global indices are way too small, we believe.”

He explained that the weightings are partly technical related to fee floats, and partly driven by crisis scenarios, for example US-China tensions escalating so badly that there could be a real crisis for the Chinese economy, setting back globalisation several decades. He offered that this is extremely unlikely, but in his view, it is also unlikely that the Democrats, should they win the US election, would be pro-China.

“I think the one thing both parties can currently agree on is that blaming China for what's going on in the US is a winning strategy, that is the one thing that both parties can get behind. Accordingly, I think you're going to see the Belt and Road project continuing to expand, China continuing to make its investments and its alliances throughout Central Asia, Africa and essentially moving towards a second Cold War.”

Another perspective came from an expert who said that despite the US-China tensions, ongoing for the past three years, both the US and China equity markets had in that time been the best performers amongst the major markets, outperforming the rest of the world significantly, one by 40%, the other by 20%.

“Investors,” he said, “have to differentiate what the noise is and see through to the underlying evolution in both economies of significant advances, particularly with the fundamental technologies, automation, the digital, new economy and so forth, in both countries.” He added that this China new economy potential is well represented in the Premia China New Economy ETF, listed in Hong Kong, and which has performed well this year – up 22.4% in the six months to August 13 - and that is up some 34.4% since inception in October 2017.

Closing words – China’s star is rising

Whatever the position anyone might adopt on China’s politics and on its geopolitical machinations, whatever qualms one might have about the lack of transparency and lack of global standards throughout the economy and the financial markets, it is very evident that China’s vast equity and debt markets will in the future be more widely reflected in institutional and private asset allocation of investors across the globe. A very small upwards shift of global money towards China’s mainstream public markets will have a significant impact on valuations and on the professionalisation of the market, as surely investment banks, brokerages, research analysts and more professional fund managers will follow, as sure as night follows day. For Asia’s private wealth market clients, China is the elephant in their room, and cannot be ignored. For those who grasp the opportunity in the right manner, there is great diversification potential ahead, as well, hopefully, as great potential for both gains and income.