The ‘father of advertising’, David Ogilvy, once said “The consumer isn’t a moron; she is your wife”. Of course what the advertising tycoon was insinuating was that consumers are everyday people, with everyday needs that must be met. But meeting these ever changing personal requirements and offering these at their time of need has always been a challenge, particularly in the world of banking and investments.

The last few years have seen business intelligence (BI) software and, more recently, artificial intelligence (AI) enable brands to directly target existing and new customers with their products accordingly to behavioural profiles and analytics. And, overall it’s worked well. But no matter how accurate this approach is, these brands were often limited by one important aspect; range. The financial (or non-financial) products that they offered their customers didn’t always fully meet the customers need; these brands were limited to only offering the products that they had. This limitation may have been down to capability, manufacturing costs or regulation (or all three). That was until APIs.

Technology enabling any product, anywhere

An API (Application Programming Interface) can enable brands to offer any product they wish by embedding it into their consumer platform. In the context of financial services, an API enables data between customer accounts within regulated financial institution, FinTech companies, and non-financial companies to be connected and communicate with each other. The process of embedding these regulated services is known as ‘embedded finance’ and within this, the concept of embedding investment services into any brand platform is often referred to as embedded wealth or embedded investing.

At additiv, our conversations with our clients in both financial and non-financial brands has identified a huge number of use cases where investment services in particular can be easily embedded and thus address a consumers need to ‘get more from their money’. And from a corporate perspective, embedding wealth management products represents a USD100 billion revenue opportunity that pension, employee benefit, life and health insurance providers can access as well as banks, asset managers and IFA’s. However, one particular use case that I believe is significant in both Europe and Asia Pacific is that of ‘retail wealth’, which is being enabled by embedded wealth (as I will explain later). But enough about the opportunity, let’s get back to consumer needs and what’s changed to make investments so alluring.

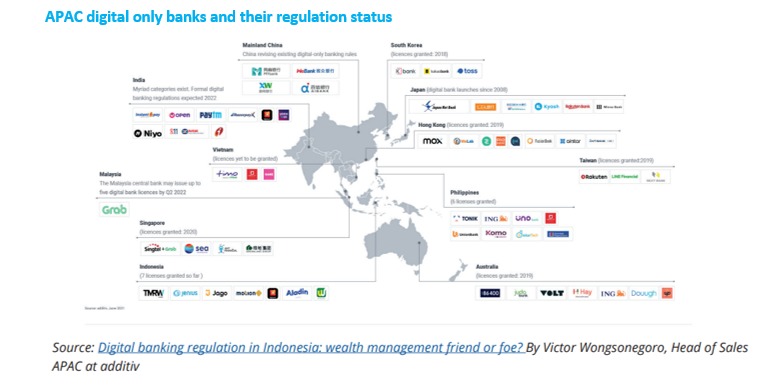

Retail wealth in APAC

When I referred to ‘retail wealth’ earlier, I meant offering investment services to consumers who traditionally don’t already have an established relationship with a private bank or wealth advisor. By embedding regulated wealth products, these consumers can now gain easy, affordable access to investment products at their point of need; be this through their traditional or digital only bank (often referred to as neobank or challenger bank), a consumer platform or a super-app (such as Grab or WhatApp). Grab in particular recently started offering their AutoInvest solution; an investment solution which links to Grab customers GrabPay Wallet enabling them to invest every time they make a Grab transaction and starting from as little as USD1.

At additiv, we are now seeing huge demand in Asia for ‘retail wealth’. This is often combined with some insurance aspects because what people are looking for, especially in emerging markets, is an opportunity to create a legacy for their children. They may want to combine insurance products such as life insurance with savings to finance the education of their kids or ensure long term that they are provided for by putting money aside in a more meaningful way than putting it onto an account.

So that’s why more and more in Asia want to save. And with a growing mass affluent consumer base, they can afford to, however, until recently putting money into an account for many wasn’t previously an option due to limited branch access. Therefore, the tradition of transferring funds from a current account to savings isn’t a habit that investment providers have to try and crack. It therefore comes as no surprise that clients with small investment capital, who have never been considered highly important by wealth managers, are now collectively forming a market — particularly in countries within the region where their middle class continues to grow (for example China’s middle-class population represents more than half of the market’s online wealth management clients[1]). Add to this the fact that digital banks have experienced over 300% customer base growth compared to traditional incumbents[2], as more and more digital banking licences are granted throughout the region, and it comes as no surprise that investments are taking off in Asia.

The growing popularity of online trading in APAC

But the growth in ‘retail wealth’ isn’t just being fuelled by online financial platforms, it’s coming from digital trading platforms. According to a recent market research report by Fortune Market Insight, these online platforms were already valued at being worth USD8.59 billion in 2021, and are expected to reach USD12.16 billion by 2028 at a CAGR of 5.1%. And it doesn’t just stop there, these trading platforms are expanding beyond being offered as standalone services, or by traditional wealth providers alongside their personal advisory services. And, as I’ll explain later, embedded wealth through platforms like additiv is enabling this.

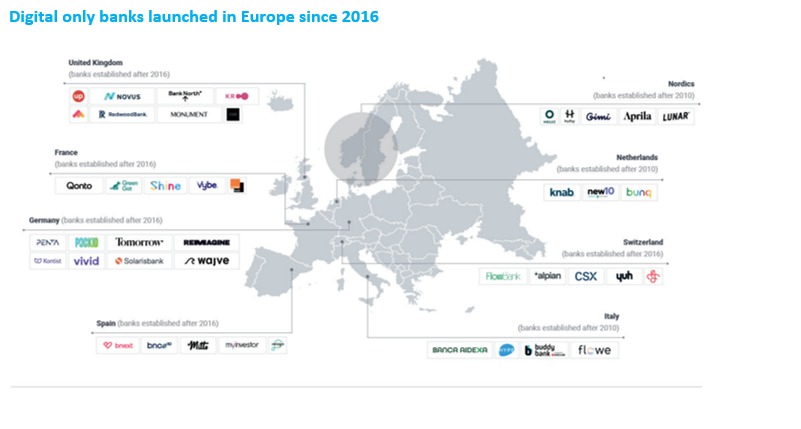

Consumer investment in Europe

Like in APAC, consumers in Europe are increasingly using digital banks (neobanks/challenger banks) and investment platforms. Originally actively encouraged by governments, regulators and customers, the pandemic fuelled demand so much so that there are already around 80 private neobank “unicorns” each with a pre-money valuation of over USD1 billion[3]. However, according to research conducted by additiv’s partner Bricknode in March 2022, only 44% of Europe’s top neobanks offer investments to their customers, with 54% listing more than one asset class. These neobanks offering investment products have adopted different business models. One third of neobanks, utilised proprietary or parent company technology, and notably, most of these were owned by large incumbent banks. However, the other two thirds utilised API technology through providers like additiv to embed wealth services into their channel.

Digital only banks launched in Europe since 2016

However, investment product popularity with consumers doesn’t just stem from easy access through neobanks. Over the past four decades, employers across the world have steadily moved the pension responsibility to individuals. This has coincided with a growing life expectancy and falling pension asset yields, creating a structural and growing deficit in Europe standing around 2.5% of GDP today and this is projected to increase to 4% of GDP in the next three decades[4]. Add to this nominal interest rates available on savings and investments represent the only option if consumers are to ‘make their money work’.

In addition, during the pandemic, while a high proportion of individuals were ‘locked in’ their homes, without an opportunity to spend but continued to earn through government subsidies, many turned to online trading platforms as a way to utilise this money and also as a form of entertainment!

Overall, the popularity of digital investments is particularly appealing to brands in Europe. Recent research[5] highlighted that customer experience improvements would encourage 63% of European brands to accelerate the introduction of services. Over the next five years embedded finance is expected to add 171.78 billion Euro to the revenues of consumer marketplaces in Europe. The result will be more seamless consumer and business experiences, and an additional 720.78 billion Euro of revenue for European brands by 2026[6] .

Servicing consumers ‘jobs to be done’

A new breed of digital WealthTech platforms can actually be embedded into any financial or non-financial brand and channel, allowing consumers to access investment services at their point of need and contextually relevant. In essence, ‘embedded wealth’ the opportunity to invest comes to the consumer rather than the consumer having to search out and go through extensive identification and verification processes. There is too much unnecessary friction today; dealing with off-the-shelf products in the first place hampers self-discovery. Consumers are not looking for investment products, but solutions for their needs (their jobs-to-be-done).

The route to doing so would be embedded wealth, partnering with Banking-as-a-Service (BaaS) platforms who could allow them to offer these services, embedded directly into their offering, without having to provide the services themselves. For the first time, consumers can be offered financial services that are tailored to their context, delivered when and where they need them, and adapted to their needs rather than in a pre-determined format.

To discuss how additiv is helping and can enable your business to embed investment services, see our latest report and please get in touch.

To discuss how additiv is helping and can enable your business to embed investment services, see our latest report (https://www.additiv.com/thought-leadership/embedded-wealth-management/) and please get in touch.

WRITTEN BY