The Drive to Improve Business Processes, Efficiencies and Compliance

Ralf Huber of Apiax

Jul 20, 2022

What are the main compliance challenges for the year ahead, both globally and also specifically within Asia? What are some of the key challenges and hurdles to overcome around compliance, and where within the private banks and EAMs are the key compliance pain points? What are the biggest opportunities for the wealth industry, and to grasp the potential ahead, what are the key organisational and strategic challenges the banks or advisory firms must overcome? What digital tools, solutions and strategies can help internal efficiencies, boost business, reduce costs and mitigate risks? These and other topics were debated in a free-flowing discussion amongst COOs and other wealth management decision makers in Asia during what proved to be a lively and engaging event at The Tower Club in Singapore on June 8.

The Key Observations & Insights

Compliance often feels it is too much about ‘suffering’, but there are solutions that can genuinely help

The COO of a well-known bank opened the proceedings by admitting candidly that he and his teams ‘suffer’ at the hands of legal and compliance.

“We are in an expansionary phase, but with downturns everywhere, there is increasing pressure on costs,” he reported. “And in down markets, risks are rising for clients. We communicate omni-channel, which results in another set of challenges. And we seek to find the balance between client experience, convenience, and try to work out how to ensure compliance is as robust as possible. Accordingly, we leverage technology and software wherever possible to help us overcome some of these challenges around compliance and controls and of course costs.”

Greenwashing is a growing concern for many fund managers and investors

As an example of some of the new layers of compliance and emerging challenges around risk management and compliance, the head of a Singapore EAM said that what keeps her awake at night these days is the risk of greenwashing, and the rising regulatory pressure from the MAS in Singapore on the responsibilities of asset managers.

“But like many issues we face all the time, there is not really very clear guidance for us from regulators,” she added. “We have to constantly adapt and anticipate. There are grey areas we encounter all the time.”

Compliance does indeed have a lot of grey areas to navigate, and business and compliance teams must align

The CEO of a private bank in the region agreed that regulations and regulators’ expectations are often not precise; the banks might be provided with some guidelines, but these do not always translate to real clarity. “It is often in the interpretation,” he said, “and that means the business and compliance sides of the bank must communicate and align, and system and IT needs to be agile, and adapt to all scenarios, including what we all went through in the pandemic.”

Regulation and compliance might be affected by ‘seasonal’ issues as well as structural issues

This guest added that there are also unexpected ‘seasonal’ regulatory issues that arise regularly – for example the spate of sanctions and embargoes driven by geopolitics. These, he reported, add yet more complexity and challenges, because the banks and others need to react very quickly. These layer on top of the typical structural compliance issues driven by new rules or the introduction of more intensive supervision.

“So, I reiterate that regulations are by nature sometimes imprecise, so we need to adapt,” he said. And he remarked that the challenges are across the board, from KYC, AML to suitability and conduct, and everything along the way. With different regulators and different markets across Asia, and so much cross-border activity, the complexity is immense.

The head of a Singapore based multi-family office (MFO) agreed, she explained that on many key issues, the regulators have expectations, rules, or guidelines, they might inform people of best market practices but in too many cases, the incumbents try to comply fully but quickly find they have left gaps that the regulators still want filled.

Unless careful, compliance all too often impedes relationships and the delivery of value-added service

Another guest, the head of a MFO in Singapore, concurred, adding that the RMs all too often have to spend far too much time telling their clients about new or changing regulations, and nowhere near enough time on advice and ideas, and connecting more thoroughly to the clients. “The RM will spend so much time talking to you about things that it cannibalises their time,” she said. In short, this requires very careful management to ensure that the industry and the front-facing bankers keep focused on the business objectives at all times.

In difficult markets, maintaining client ‘stickiness’ is an increasing challenge, so too is controlling costs and maintaining ‘friendliness’

The COO of a major European bank operating across Asia commented that in more difficult markets, there are more difficult conversations with clients, and if the banks do not manage these well, there are risks. “It is easier said than done,” he remarked.

He also observed that the cost to serve or the cost of doing business is centred around compliance and risk control. “We are a fairly conservative [European] bank and we aim to be seen as steady, stable, and trustworthy, but that can make us appear a bit ‘heavy’, so we need to revisit the way we do business, we need to focus on how to make it all a bit simpler for our clients and for our bankers.”

This expert added that some products and solutions are highly complex and perhaps require special licenses or extra controls and supervision.

“For example, some derivatives or other products have a lot of associated costs and other obligations,” he noted. “We therefore need to really assess if we are making enough revenues to justify the cost of keeping these, and to do so we need to keep the communication flowing between business, compliance and risk management. Only by being collaborative and constructive can we find the right way forward.”

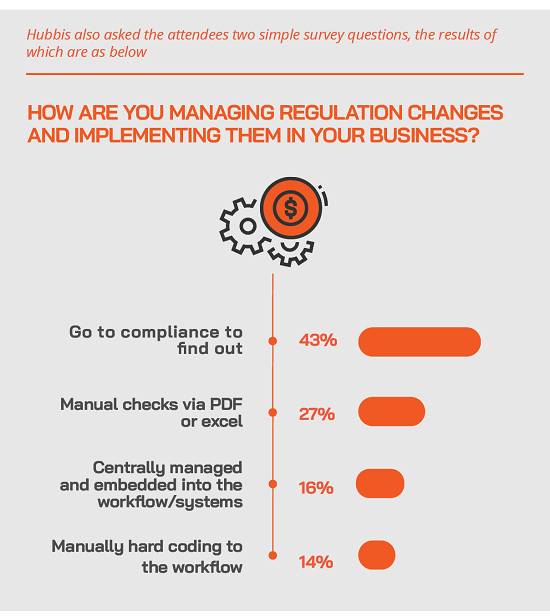

Hubbis also asked the attendees two simple survey questions, the results of which are as below:

There are constant challenges and roadblocks, and the wealth industry’s approaches need to evolve rapidly

Another guest observed that dealing with the custodian banks is remarkably difficult these days. She wondered why digital signatures are so disliked, when she said it is probably easier to fake a hand-written signature than a digital signature and electronic trail.

She also noted that the difficulty around connectivity between different software and systems is a constant challenge, especially between the larger banks and smaller MFOs, EAMS and other firms.

“We are a multi-family office with a licence for fund management, and we have funds, and we also have managed accounts,” she reported, “meaning that we have complexity on both sides. The issue is really getting the data in a format that is compatible. It would be nice if everyone adopted the latest technology, including the cloud, us included honestly. Mentalities need to change, and we need to make sure that it all connects easily, but it is also entirely private.”

The C-suite leaders are expected to be fully cognisant of all the regulatory requirements

A guest remarked how the regulators today expect the C-suite business leaders of banks and wealth firms to be fully up to speed on compliance challenges and their internal solutions. “The expectations from the regulator are very, very high,” she reported. She said she had her ex-CEO grilled by the inspection team from the regulator and although it was a friendly conversation, it underlined the need for a high level of technicality at the CEO and CIO and COO levels.

“I think it's healthy,” she said, “and I am perfectly fine with it, but it is a constant challenge. Another issue we face is the minutes of compliance meetings, because there are so many different points of view and so many challenges, as those minutes then go to the regulator. It is healthy but it is another major challenge.”

And when the regulators pay a visit, it can be a difficult time for all concerned

This same guest highlighted the challenges of getting an inspection visit from the regulator. “It is an eye opener when you have the regulator come in,” she said. “It is painful, you too often burn out, but at least for 18 months, you have them on your side afterwards.”

A banker added that this will become more prevalent, as the experience he has from Europe is that regulation will only increase, and supervision and checks will only proliferate.

Technology can help alleviate some of the compliance burdens, but there is no total solution, as these are moving targets

The same Singapore-based private banker said this is good for anyone offering technology and software solutions to these challenges. “That is about the only hope we have, to remove part of the burden by using technology,” he said.

But he added that on the IT side, it is a constant challenge, as no matter how much the banks upgrade and automate, there are always new challenges. “You are always chasing a moving target at the end of the day,” he stated. “If you hope IT and technology will resolve everything, I don't believe it. Maybe I say this because I'm a risk manager and I'm always pessimistic on everything, but that's my view.”

But the first step is to ensure that the business leaders at the banks provide the right strategies

“But to help mitigate these problems, the business side of the bank or firm must be careful with their strategies,” he continued. “The upside of products and ideas in terms of scale needs to be clear, so that the burdens of compliance and the associated costs are worthwhile. He indicated the private banks need to be bespoke in terms of what they offer, but also need to offer products that are viable from a business viewpoint when compliance issues are factored in.

“When we decide to enter a business or new market, a new product, we take all the costs into account,” he added.

The wealth industry can and perhaps should regularly lobby the regulators

The experts debated to what extent the wealth industry could or should lobby the regulators on key issues. “They never listen to everything because some points raised are ludicrous, some are valid, but they usually still have their own ideas,” a banker commented. The general consensus appeared to be that the wealth industry players need to come together closely in order to put their views to the regulators, working through associations and different bodies.

The shortage of talent in the Singapore wealth industry, especially compliance experts, is a problem and is contributing to escalating costs

The guest discussed the shortage of talent available locally and the difficulties around obtaining visas and employment passes for overseas talent. They pointed out that the difficulty in hiring had created a situation where people move in order to obtain a higher salary, with one guest estimating that pay hikes of 30% are not uncommon. “It is rather unsustainable,” one banker reported.

Moreover, a guest noted that the digital assets industry, robo-advisories and digital banks were all opening their doors and expanding, leading to a further shortage of talent for the private wealth industry. Many of these are funded externally and have seemingly few limits on their ability to buy in the talent they need.

As some of these new age enterprises are less traditional than the private banks, they also draw in more of the younger talent interested in new ventures and new industries, and who want to participate in those new entrants’ rapid growth in terms of their work and their financial status.

“And I think people are also moving because they have been away from work, for instance, home working for so long, and they don't have loyalty to their colleagues and their team that they used to, observed one guest. “They have no connectivity to the brand, to the institution. That's a huge factor, as well.”

A private banker concurred, noting that all the banks are facing these issues. “We have a bunch of long timers that will always stay, that don't jump ship so often, and they are taking on the extra burden,” he said. “Meanwhile, it is difficult to attract new talent and very challenging to make sure that the key people stay with you, so we have to really take care of them.”

The experts agreed that retention is a headache, and it's not only about money. The younger generations are mobile, they want to be flexible, they want flexibility, and they want to be in organisations that reflect those needs.

“But it is a bit of a bit cliché to say everyone wants to work for Google,” a banker stated. “Many people were very interested in the digital asset businesses, and suddenly when the whole crypto market crashed down and many decided to come back to banking. I actually think the job market will normalise in some months ahead; many people realise that the grass is not always greener elsewhere.”

“In short,” this banker added, “I don't think people are really moving away from private banks, but also the private banks must adapt in many ways, including significantly improving our technologies, so that the burden on these jobs is lowered, and so that it is a less labour intensive and more enjoyable working environment.”

There are also many and increasing demands on the IT and technology budgets

“At the same time, this banker reported, “while we need more funds for more technology, for compliance solutions and so forth, there are more and more areas to address. Cybersecurity, and data protection are eating into a major part of the budgets, and the business side do not always appreciate this, as they do not fully realise what happens behind the scenes. And the regulators are tougher and tougher on data protection and these areas. The truth is that whatever you spend on management, on cybersecurity, on data protection, you're not spending to improve client experience and outcomes.”

Data management and analytics are also taking increasing slices of technology budgets and, to some extent, also lead to additional cyber risk management challenges

Data management and data analytics to help curate better client offerings and greater relevance or suitability are also demanding more money from the incumbents.

“We have these new people, this new resource, data analysts wearing jeans and funky clothes coming here and telling us how we need to manage our data,” this same banker commented. “This is great, but at the same time the more data we use the more exposed we are to cyber risks and the regulators are getting ever tougher on this area. And as we interface with the EAMs and family offices, we are using all types of channels, with risk management practices needed to protect in those areas, as well.”

Another guest agreed, noting that this raises the whole issue of cross border data sharing and the associated – and very necessary – data sharing agreements between different parties and counterparties.

A guest noted that this can be particularly cumbersome when data centres are overseas, or when there is M&A or consolidation in the industry. “In one case, we had to physically go there [to Europe] to get the approval by the regulator there, and we had to physically go and put the data into hard drives, then have people transport those in a private flight and bring the data to Singapore,” he explained.

Compliance teams need to spend more time making decisions and less time gathering data

The same expert commented on where they would like to see improvements in compliance protocols and also reduced costs. A guest noted that they have numerous compliance officers in their bank, but that half their time, at least, is spent on gathering data, not making sense of it and making decisions.

“We need technology for the compliance front-end,” he said. “Tools are available that help you to get all the information you need from different systems in different part of the bank into one platform, so that you save on the time, save costs and make decisions faster. We don’t want to pay people to gather information, we should pay people to make decisions.”

He added that the same is true right from onboarding of clients, with technology immensely valuable in reducing the burden on team members throughout this difficult process, thereby also reducing time and saving money.

Compliance must be independent but not isolated from the commercial imperatives

The same banker also remarked that compliance needs to be conducted in partnership with the businesses.

“Even though compliance is an independent function, it needs to also work hand in hand with the business to ensure that there is coordination in the processes, the tools, and we construct things together, and so that there is a bigger vision, so we can also make sure there is flexibility and agility. Compliance actually needs to be closer to the business, to the clients, as that will help simplify things, and help better manage risk.”

He added that this type of internal collaboration needs to extend throughout the back-office and mid-office as well as at the front end in order to enhance compliance outcomes and to help enhance the business generation side of the institution.

“We have as an industry in the past looked at digitalisation in a very siloed way,” he said. “This is why recently in the last two to three years, we see a lot of titles such as Head of Transformation, Head of Digitalisation, Chief Digital Officer, or whatever you may call it. But basically, this person tries to look across to the business, compliance, and risk operations. We all need to be better coordinated and better connected, in terms of practices, views and also systems.”

“I agree,” came the final comment. “We have touched upon many interesting questions and topics today. For me, compliance is not actually just a function in its own; it's always driven by business, different business activity, you are all selling something. The better the internal connectivity and collaboration the better the efficiencies and the better the outcomes for everyone, including your clients.”

A Brief Word on Apiax

Apiax was represented at the June 8 event by Ralf Huber, Co-Founder of the firm. Very briefly, Apiax helps financial institutions around the world to overcome regulatory challenges, realise business opportunities, and reduce the cost of compliance by embedding compliance into their applications and processes. Customers essentially use Apiax to bridge the gap between compliance, business, and technology.

Hubbis has worked closely with Apiax in recent years. For more detailed insights into Apiax, its solutions and its mission in Asia, please click through to the following Hubbis articles:

Apiax’s CEO on Building Upon Past Tribulations, Successes, and the Developments on the Horizon

and:

RegTech Apiax on Digital Solutions and Rising to the Global Regulatory Challenges

The Hubbis/Apiax Survey on Data and Cross-border Compliance for Asia’s Wealth Management Community

Co-Founder & CRO at Apiax

More from Ralf Huber, Apiax

Latest Articles