Wealth Solutions & Wealth Planning

Seizing the Opportunities for NextGen Wealth Management in Asia

Oct 3, 2022

On September 15, our panel of hand-picked wealth management experts focused their attention on the needs and expectations of the next generations of Asia’s private clients. They debated how the private banks and independent wealth management providers can tailor their offerings and their approaches to retain and/or attract those clients, and how they can maximise the opportunities ahead, for those clients and for their own wealth management businesses. With many trillions of dollars of wealth due to change hands in the coming decades from the founder generations and to the second and third generations, and with so many of the younger generations also building their own businesses, or planning to do so, the wealth management community must grasp the opportunity to forward their activities and their propositions.

The Panel:

- Lee Woon Shiu, Managing Director & Group Head of Wealth Planning, Family Office & Insurance Solutions, DBS Private Banking

- Paul Knox, Managing Director, JP Morgan Private Banking

- Zac Lucas, Partner – International Private Wealth, Spencer West

- Gabriel Chan, Head Asia Pacific, Wealth Dynamix

- Hengka (Henry) Ji, Partner, Zhong Lun Law Firm

These are some of the questions the panel addressed:

- Why do Asia’s NextGens represent such an important market potential for Asia’s wealth management community

- What assistance or advice can you give to the older generation to help them involve the next gen in financial discussions?

- How do the needs and expectations of these NextGens differ from the founder and even second-generation wealthy clients in Asia?

- What can wealth managers do to reach out to, connect to and win over these NextGen clients?

- Can the panel characterise the approach to investments amongst these NextGens and who and how these approaches might differ from those of the older generations?

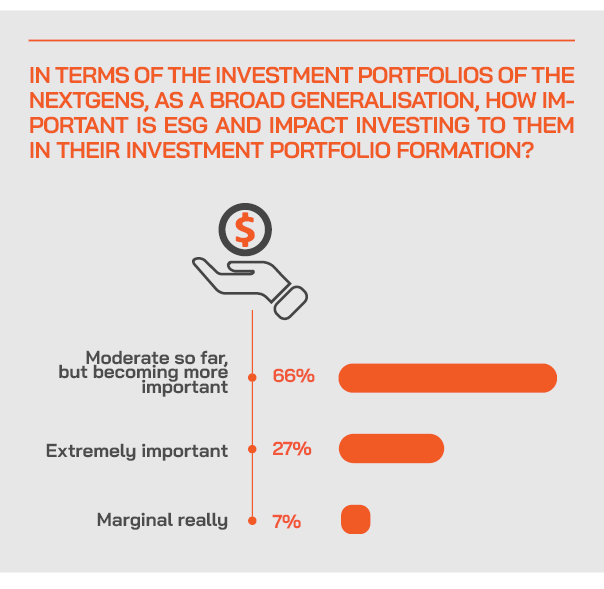

- How does the wealth management industry help deliver on the issues of sustainability and ESG-centricity that appears so important for the NextGens?

- What about life insurance, how does this feature for these younger clients, many of whom are decades away from retirement or old age?

- What role does digital play in engaging with these NextGens, or is digital simply ‘hygiene’ today rather than a genuinely differentiating factor?

- What are the major opportunities ahead in working with the NextGen clients of Asia, and how can the Asian and indeed global wealth management industry provide them with laser-targeted advice, products, and solutions?

Setting the Scene

The younger wealthy generations in Asia are set to inherit trillions of dollars of wealth, and many are also making their own businesses and adding to the region’s vast private wealth creation. The younger generations are very often highly educated, often in long-established Western institutions, and boast perhaps a wider understanding of worldly matters, and of wealth management issues, and the value of sensible structuring and planning, perhaps more so than the founder generations in the region, who have been so dedicated to starting and building their business empires.

These nextgens are more receptive not only to planning, but to business and family governance generally, and on sustainability in the family business and indeed in the family’s financial investments.

They are digital natives, and often more inclined than their parents or grandparents to adopting a more inclusive, holistic, and professional structured approach to family wealth, frequently desiring to focus on either their new businesses, their lifestyles, or even social impact pursuits.

As a result, we know that Asia’s wealth management community, and indeed the global wealth management ecosystem, must adapt their products, solutions, and services to cater to the needs and expectations of these younger generations. The family office can often help draw them in to the centre of the family’s affairs, hence we are already seeing them take an increasing role in the rising numbers of family offices in the region.

The discussion on September 15 was framed against this backdrop, and our experts drilled down into how the wealth and advisory industry in Asia can help understand and address the key differences between the generations and then help develop value, trust, and a pull-together attitude, designing products, curating advice, and helping develop solutions that suit the needs and expectations of the different generations.

NextGens can span older as well as younger family members, but what is essential is that each must be approached individually

A banker observed that it is difficult to pinpoint precisely who the nextgens are and referred for example to the recent passing of the UK’s crown to 73-year-old King Charles.

“Whatever the actual ages of the nextgens who inherit the wealth and the businesses and so forth, you must your approach to each of those very individually and very differently,” he said. “In Asia, one of the numbers I have seen quoted is USD2.5 trillion of wealth to be transferred in Asia alone by 2030. That shows ow vital it is to have robust estate and legacy plans in place, and to be preparing those who will inherit assets and businesses for their future responsibilities.”

He explained how essential it is for the wealth management community to understand the different aspirations amongst the family members and different generations. “And families are far more dispersed in terms of members and wealth and lifestyles, so you need a multi-jurisdictional and multi-cultural approach.”

A fellow banker agreed, remarking that it is a golden opportunity to connect across the generations to ensure there is engagement between bankers and clients and between generations within families. He cited, for example, a billionaire who had created a shadow board including his nearest heir, who is only in is teens. “The shadow board allows them to pretend they are in the clients’ actual shoes and making real decisions, preparing them for the future,” he said, adding that this type of approach helps engender responsibility and makes family members feel involved from early on.

Expert Opinion - Paul Knox, Managing Director, JP Morgan Private Banking: “No two families are ever the same. It is important for the current generation to have the right estate plan, structures, and frameworks in place, but it is equally important for the next generation to be equipped and ready to inherit the assets that will eventually be passed to them. The crucial role for advisors is to stay relevant to all family members and understand the individual’s own wishes and aspirations, which may differ greatly from their parents and grandparents. This requires innovation for different types of solutions, products, and conversations. It is also vital to have flexibility in approach and important to have different team members to cover the next generation.”

China as its own nuances and peculiarities, with the younger generation more inclined to promote structured planning than the older ‘wealth creator’ generation

An expert on China noted that the nation’s wealth has been created at lightning speed in the past few decades. “The older generation and the younger generation have very different perspectives on wealth creation and wealth preservation,” he reported. “Actually, in China, it is mainly the older generation still in power over their businesses and family wealth, and their primary focus is still on generating more wealth for the businesses and family. They are actually wary of bankers and wealth managers; they trust themselves and believe in their own abilities, and they do not spend must time or thought on planning for family wealth inheritance, and for most this is still a somewhat taboo subject.”

He explained that the younger generations are more focused on wealth preservation and see a tougher wealth creation landscape ahead. They also want to help tidy up the many legal and tax risks they see in their parents’ business and personal structures, reporting and tax exposures.

Expert Opinion - Henry Ji, Partner, Zhong Lun Law Firm: “Compared to the older generation, the Next Gens usually take a more holistic and realistic approach to family wealth management with a heavy focus on wealth preservation rather than wealth creation. They embrace all different types of wealth management tools and are particularly keen on the tax and residence issues.”

“We have received a lot of legal requests direct from these younger clients to conduct reviews of their family business,” he reported. “They often have overseas educations and come back with an aim to mirror the planning and governance approaches of their rich Western friends, to achieve much more robust planning and mitigate the risks ahead. Accordingly, they usually take a more holistic and realistic approach to family wealth management with a heavy focus on wealth preservation rather than wealth creation.”

He explained that a good approach is often to form a legal advisory team with senior and junior partners who can connect more easily with the older and younger generations, and bridge certain gaps.

He explained, for example, that China’s nextgens see far more clearly that early rigorous planning can help the family to reduce the tax liabilities and also reduce legal liabilities and protect their family wealth from outsiders, hostile parties. “Our nextgen clients truly consider early planning and early wealth distribution within the family to be very sensible and valuable.”

A fellow panellist agreed, but added that more broadly across Asia, he still sees an active environment where the younger generations of very wealthy families are also highly entrepreneurial as well, so in the region as a whole it is not like a fellow panellist mentioned about China specifically, in other words more about wealth preservation, as many of the younger family members they deal with are driven to business and wealth creation as well.

Expert Opinion - Henry Ji, Partner, Zhong Lun Law Firm: “Traditional wealth growth approaches taken by the older generation focus mainly on financial return and fail to consider too much about the long-term social impact of their investments. In recent years, we do see an increasing focus of Next Gens on charities and philanthropy projects, social impact investment and environment-friendly projects.”

Looking at what is happening with wealthy and uber-rich families in the West can help point the way forward to better outcomes in Asia

Another wealth structuring expert highlighted the body of practice and research relating to wealthy families in the US and Europe on estate and legacy planning and the impact of wealth on the nextgens. He explained that understanding these key issues is central to is engagement with rich and uber-rich families.

He said the research shows that the more wealth that they're given, the less the nextgens feel they can demonstrate their worth, resulting in negative behaviour and difficulty in engaging with anyone other than super-rich nextgens like them.

He explained that more families in Asia now recognise these issues, and for example many very wealthy Indian families are putting their children through some sort of family academy to try and help them appreciate more about creating and also preserving wealth. These types of approaches help mitigate risks around future personal problems, or possibly family disputes.

Digital engagement across the generations is increasingly important, especially for the digital natives, but the human advisory is still also highly relevant to private banking

An expert highlighted the importance of CLM and CRM in private banks and wealth management firms, helping them work more seamlessly with those actual and potential future clients, and delivering solutions, products, and advice securely, omni-channel and 24/7. A banker concurred, noting that leading banks are spending a lot of time and effort on digital, at the same time as making sure that their specialists and RMs are available to support those clients as well. This type of combination approach is seen as incredibly valuable for both parties.

He explained that is bank makes a lot of effort at finding different ways of interacting with the next generations, such as in small events, connecting them to experts and also to people with similar challenges and issues to address. He explained that the greater the engagement and the EQ delivered by the wealth management institution, the greater the probability of positive connection and the better reception for the advice they can deliver.

A panellist added that finding the right RMs in Asia is tough and therefore it is increasingly vital to empower the existing talent with digital tools that allow them to see their clients more holistically and provide the right advice and ideas at the right times through the right channels.

“What we advocate is the use of technology, not just digital technology, but the platform to really capture to help them to capture all the requirements and the idiosyncrasies of the family, and then continue to engage with them, whether it's traditional family or the nextgen client. Insights are vital, and the right information is essential to help clients make informed decisions. What we advocate is to make sure that regardless of the channels that the wealth managers deploy, whether it's online or platform, it has to be persistent.”

He said that when banks acquire a client, they can capture all the information upfront, and with the right digital solutions they can more easily see that everybody has different goals and different values. “The more you can make this type of information visible to your RMs and advisors, the closer you will be to delivering them insights and advice that is consistent and reliable and entirely relevant,” he explained.

Family offices are excellent vehicles for coordinating a collaborative and consistent approach to family wealth preservation and to robust legacy and succession planning

A banker highlighted the growing role of family offices in articulating the longevity of the family businesses and also the nurturing of the nextgens in Asia’s wealthier families.

“We see a lot of families, especially those coming from Greater China region, where they're very active, still very much in the process of constantly thinking about wealth creation, even as they try to ponder about the better things to do for wealth preservation,” he told delegates. “Because of that thirst and hunger for constant wealth creation, they're constantly encouraging us to find them solutions, to find them a framework to encourage the next gen to be able to step up to do other things in terms of looking for next deal flows, interacting with their peers to find the next deals that could make family wealth even more in time to come. So, that desire to really want to use structures such as family offices really incubate some of these ideas, has really gathered momentum from what we see.”

He explained that the tools available to clients these days had moved beyond the typical trusts and foundations. “The family office is an ideal structure to help accelerate the momentum of creating wealth, even as the families go through the process of enhancing and tightening their wealth preservation procedures and policies for the next generations to thrive,” he stated.

Tune in to the nextgens to make sure you deliver the right ideas and the right approaches

The same panellist added that the bankers and advisors need to be attuned to the nextgens in terms of the way they think, the types of investments they prefer, including the new world of digital assets, and they must take a holistic approach, and steer far clear of the product pushing mentality. Additionally, they need the right bankers with the right levels of experience and to help, often working in more of a team environment of aligning senior bankers to younger bankers that are better able to engage the younger generations of clients.

Additionally, he said it was important to involve the nextgens in topics beyond just normal banking, with topics like philanthropy, sustainability, and others. “Some of these areas may not be primarily revenue generating in the first instance, but we need to be able to communicate on these issues and nurture those ideas, in order for us to be relevant in the future,” he opined.

Aligning private banking expertise with professional services experts is vital to ensuring the best outcomes

A banker reported how in order to properly service very wealthy clients, especially when family offices or complex and multi-jurisdictional structures are involved, means working closely, collaboratively, and transparently with professional services experts such as lawyers, accountants, trustees, and others.

“We come up with a summary sheet of the key information that every banker covering the market must be aware of, for instance, tax exposures. matrimonial exposures or issues, bankruptcy issues, asset protection, so these clients are aware of all these challenges. But we do not give tax or legal advice, and we then involve external experts who we carefully handpick to provide the right advice and solutions for each situation and jurisdiction,” he reported. We tell the clients, who we have already briefed about the key issues and challenges, to engage these external experts who can cover onshore, offshore, and midshore. Everything must be covered holistically.”

In short, he indicated that bankers need to have the training that helps their confidence in reaching out confidently and speaking about these issues in a manner that is both competent and also highly professional, and with that comes the confidence to bring in hand-picked external experts to take matters to their more formalised conclusions.

It is not only about structuring and planning, working with the nextgens is also about helping them engage with their families, their peers, and their futures

“And we also need to be able to engage the nextgens in conversations about their roles in the future, not only tax issues, but how they can fit in to future structures and planning,” tis same banker added. “For example, we held an interesting event where we actually have five sets of father and son, mother and daughters sitting together, and bouncing ideas amongst each other in a very safe environment. Private bankers who are trusted advisors to their clients can engage in this type of nurturing so the families as a whole feel they can trust the bank to help them with their future affairs.”

A fellow banker concurred, adding that their bank sees their role also as hand holding clients through these challenging concepts and issues, noting that armed with the right empathy and understanding, they are far better placed to help those families devise and refine the right structures for their estate management and legacy planning.

He explained that there are many different ways to staff and organise family offices for example, so engaging the families in discussions from early on helps ensure that the right approach is put in place to suit each family situation.