Indonesian Wealth Management: An Update and a Glimpse into a Bright and More Diverse Future

Nov 16, 2021

An erudite and highly experienced panel of local Jakarta-based and also regional/international wealth management and digital transformation experts assembled for the virtual Hubbis Digital Dialogue of November 9 to consider how and where the Indonesian wealth management market is developing, with the progress and the prospects set against the backdrop of other major ASEAN countries. They analysed where there needs to be more progress and what additional building blocks need to be put into place in order to facilitate such progress, such as regulatory liberalisation, greater investment by the local and international players, more trendsetting by the newer JV partnerships between onshore and offshore partners, the role of smart digitisation, and so forth. Our delegates enjoyed a fascinating and in-depth discussion, which we have summarised in this report.

PANEL MEMBERS

- Djoko Soelistyo, Head of Investment Product & Advisory, DBS Bank

- Abhra Roy, Head, Finacle Wealth Management Solution, Infosys Finacle

- Jeffry Lomanto, Founder, Moduit Digital

- Samdarshi Sumit, President Director & CEO, PFI Mega Life Insurance

- Antony Dirga, President Director, Trimegah Asset Management

- Pieter Zylstra, General Manager - APAC, additiv

Overview: Setting the Scene for Robust Growth and Greater Dynamism Ahead

Indonesia is back on the growth path as well. After a 2.1% fall in GDP in 2020, the first drop since 1988, the government predicts growth of between 3.7% and 4.5% this year, a degree of optimism supported by the OECD, which in May projected growth of around 5% for 2021 and 2022.

This is an outstanding platform for the wealth management industry to continue its growth. Understanding the key drivers and current competitive environment is vital for the positioning of the local and international players as they jostle for prominence in what is certainly a market of huge potential, as the huge population keeps growing robustly and as the economy and private wealth creation keep expanding. Moreover, the demographics are very encouraging - Indonesia has both a vast and a very young and fast-expanding population.

With inflation spiking globally and with interest rates still at really low levels on a historical basis, and with the Jakarta Composite Index up around 30% in 2021 to date (mid-October), there are plenty of good reasons for private clients and mass affluent investors to be investing wisely for their and the futures of their families. All of them still have plenty of money in deposits and can recycle more of that into more active financial investments.

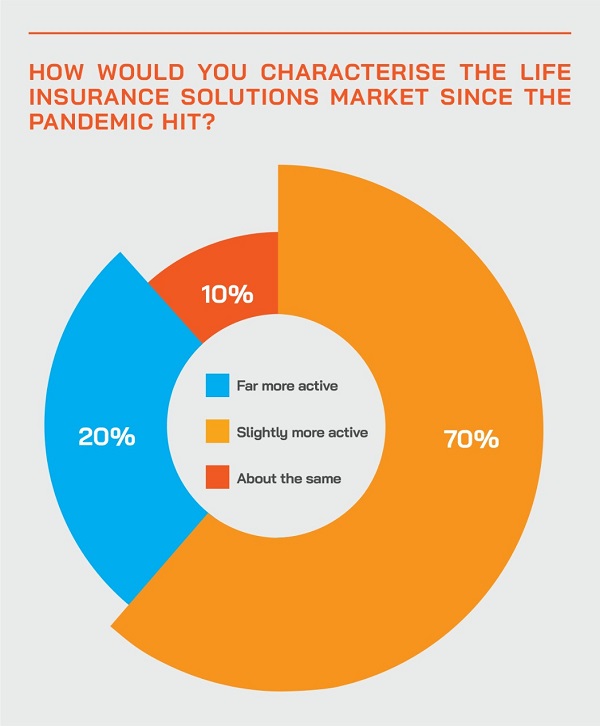

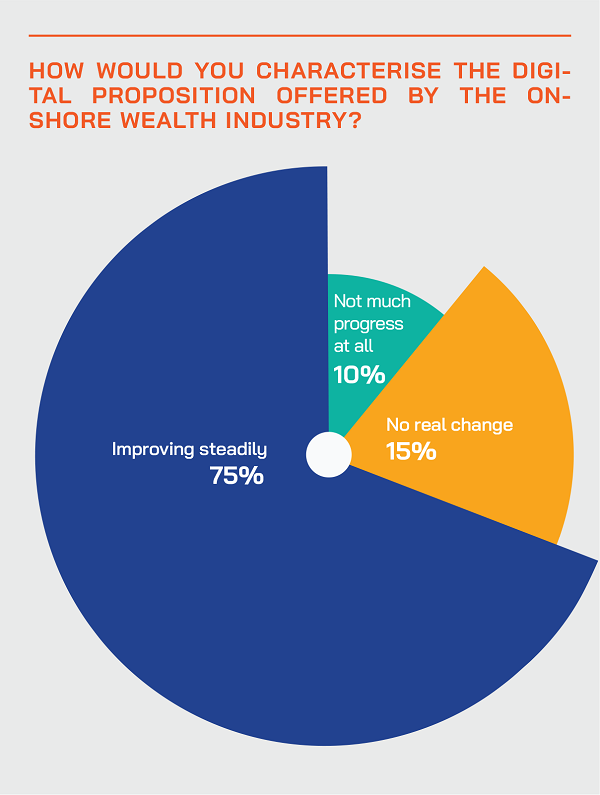

The panel of experts we assembled analysed the latest state of the wealth market set against these backdrops and delved into the development of the onshore offering and how the onshore wealth industry is trying to compete against the offshore opportunities. The onshore market is now better regulated, and the range of products has been expanding gradually, although progress is not as rapid as many would like to see. All in all, there is today cautious yet mounting optimism that the private sector, the regulators and the government are more aligned than ever in wanting to promote the financial sector. The life solutions sector was hit hard by the pandemic, but is perhaps in better shape than ever today as people focus heavily on protection, liquidity and stability.

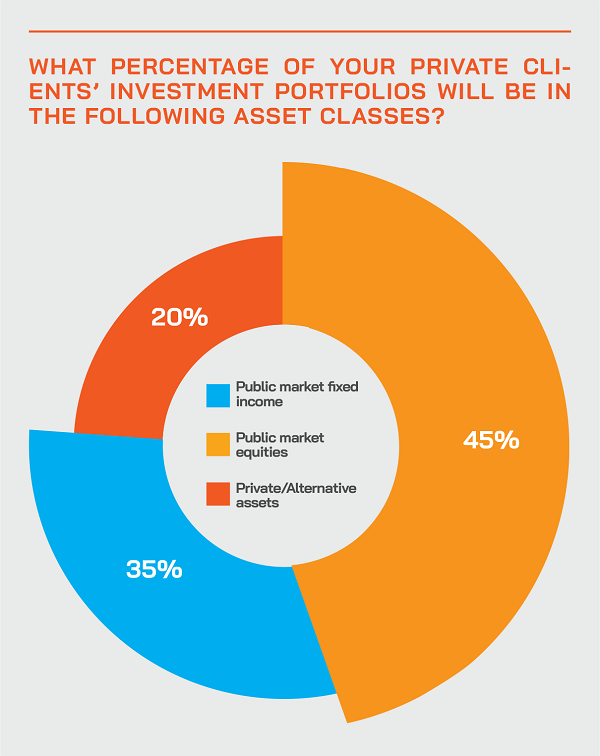

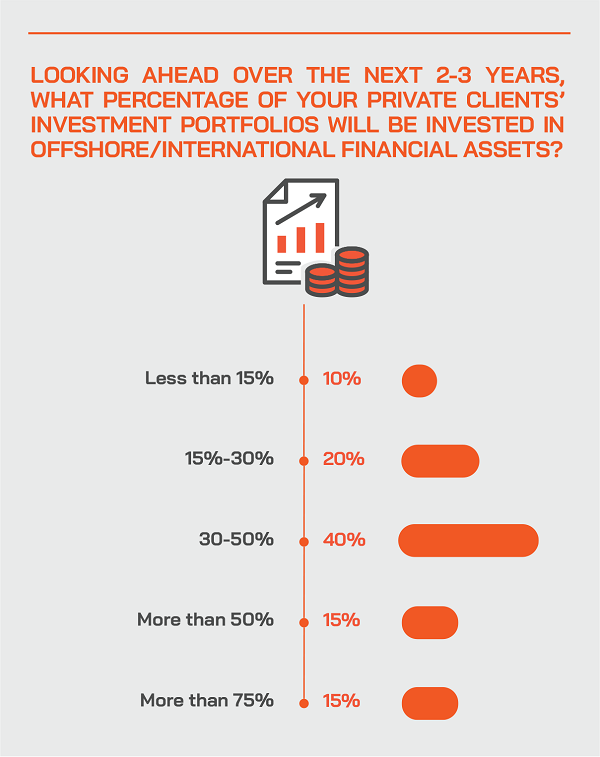

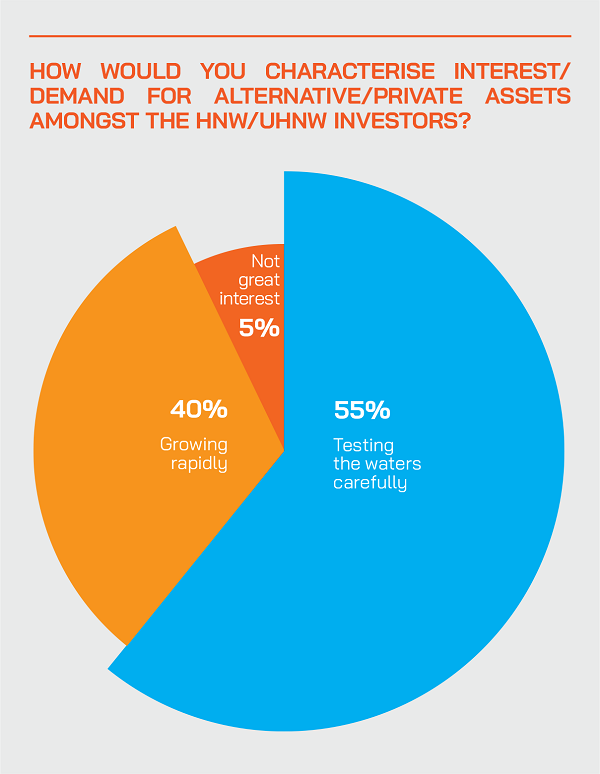

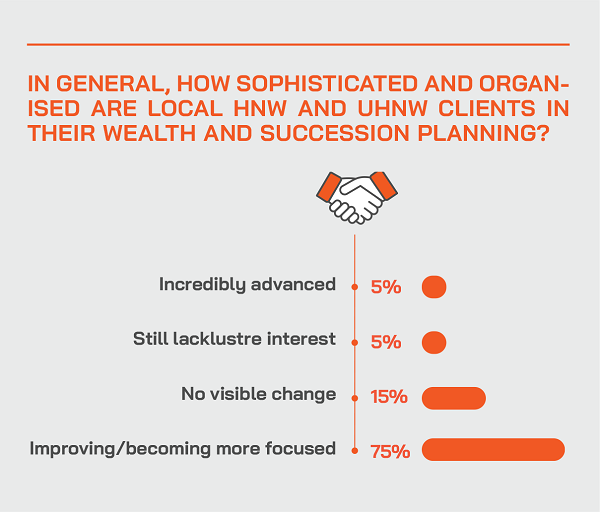

The result is a gradually more diversified range of products and solutions onshore and a broader range of private banks and independent wealth firms, some of the alliances between international names and powerful local financial institutions with the reach across the country’s vast lands and many thousands of islands. Moreover, there is rising interest amongst the wealthy in estate and legacy planning, in alternative assets, in globalising investment portfolios and in generally enhancing both the risk management and also allocation strategies they adopt.

The Panel’s Key Observations & Insights

Life insurance market – hit by the pandemic but fighting back to full strength

The life insurance industry in Indonesia has been hit hard by the virus due to significantly higher and earlier mortality, an expert reported, and also renewals weaker due to people losing their jobs and the ‘worry’ factor over economic stability. However, this is also a major opportunity. “I look at it as a moment of truth, because although there are higher claims and others, there are so many people who have bought insurance and who are getting the benefit of insurance, and that is something which is going to be in the long term a lot more beneficial for a market like Indonesia, where the penetration of insurance had somewhat plateaued in the last few years. This is an opportunity for people to really understand the importance of protection as part of the wealth management, and it would definitely be a positive in the coming years.”

While volatility is an issue for the insurers and the insured, there are pockets of opportunity, especially in offshore assets

The same expert also remarked that volatility is a natural concern as the insurers are investing for the longer-term and it is especially challenging to manage a unit link portfolio during these times, with the Jakarta Composite Index flat over a three to four year perspective, despite the bounce since the April lows of 2020. “The fixed income and government bond market remains more attractive, but equities are clearly a challenge,” he said. “We have managed to introduce some interesting opportunities, for example an offshore US Global Opportunity Fund, which has attracted a large volume of new money, right up to the current regulatory 20% cap.”

Flight to quality in the equity and fixed income markets, smart strategies to outperform

A guest highlighted the flight to better quality stocks and bonds since the pandemic, especially in terms of the creditworthiness of the corporate paper investors are buying. Despite the lacklustre equities market locally fomr several years, there are opportunities to outperform, for example in the balanced absolute return strategy this firm had launched, similar to a hedge fund although no shorting is possible locally. “We have been able to beat the JCI by 50% plus cumulatively,” he reported. “So a drive to quality in the capital markets and smart strategies can help investors navigate the domestic markets and achieve decent returns.”

Expert Opinion - Samdarshi Sumit, President Director & CEO, PFI Mega Life Insurance: “These are challenging times for the insurance industry due to the raging COVID pandemic. Challenging as the pandemic slows down new business & renewals as it impacts income and livelihood of our customers and claims are significantly higher. But this is fulfilling in many ways as we get a chance to make good our promise as a life insurance company to be there for our customers at this difficult time. This reinforces the role and importance of Protection in wealth Planning.”

Diversification into foreign assets continues

The same expert highlighted the ongoing trend to foreign markets for diversification and return, although this tends to be in Syariah format, as there is no cap on foreign outflows in Islamic finance products. “Syariah products are the most flexible, as you can invest outside of the country up to 100% as opposed to the very limited 15% constraint for the conventional funds,” he reported. Another guest agreed, pounting to strong interest in in offshore US dollar Syariah thematic funds.

Short-term government bonds also in demand

Another guest pointed to strong demand for short-term government paper, as the hunt for yield and liquidity continues. “The Ministry of Finance has been quite active at the shorter-end, and we have seen deals selling out quickly,” he reported. The yields are fairly attractive at over 3%.

Technology is boosting the wealth offering as democratisation of the investment universe gathers pace

“We can see that the technology, digital transformation has played a big role to support the growth of the wealth business especially in terms of communicating with the customers and then supporting them with execution and reporting, as well as information flows.” He explained that their bank has improved its digital solutions in two key areas. First in terms of the customer facing platform, they now have a digital banking interface, with access to the full gamut of wealth products and allowing for rapid account opening and then end to end transacting by the clients. Secondly, internal communication, processes and automation is helping deliver greater job satisfaction, productivity and ending up with a better experience and outcome for the clients.

“We do have to admit that some customers basically still are quite reluctant or maybe have difficulties in doing transactions through the app, for example, but we also offer access to advisors by phone to either help them to do so, or to transact,” he reported. “In short, digital is for the teams we have as well as for the clients, with these two sides actually correlating with the other, supporting each other.”

The Hubbis Post-Event Survey

Among HNW and UHNW private clients, what are the main investment themes and products (including equity and debt, public and private market assets, active funds or passives/ETFs, etc) that are popular today, and briefly why?

- Structured products and alternative solutions for income-driven investments.

- Main interest is to protect assets from governments.

- Equity, Smart Beat ETFs, Private Equity, High Yield Funds, Cryptocurrencies – investors are looking for interesting ways to achieve better yield and capital appreciation, and also hedge themselves against rising inflation.

- Nowadays, most of these investors are favouring very thematic products, especially in the field of disruptive technology, ESG and also the pursuit of carbon neutrality trades. The main reason is that these are that day in and out these subjects are broadcast everywhere and promoted actively.

- The local market has been lacklustre for a while now. Clients have a strong desire for offshore offerings. Given local restrictions, this can be achieved using Sharia fund structures. It is abusing the original intent of the rules, but it is ongoing and growing rapidly.

- Diversified array of funds.

- My clients are still largely focused on traditional value and growth although there is an emerging tilt to thins such as renewable energy, sustainability and so forth. Regarding the products, they are buying fairly plain vanilla such as single lines in equity and credit, ETFs and mutual funds with a few looking at alternatives. For Indonesian clients specifically given the issues surrounding liberalisation, the choice of product offering is slowly increasing but still largely tied to indigenous offerings in stocks, funds and government paper.

- Unit trusts locally are more popular, with an increase of retail participation to chase better yields and returns. The outlook in the long term is positive.

- The unit linked offering is a strong revenue producer. So, insurers in particular focus on insurance linked products rather than protection products. Regulators should probably step in soon as the scales are getting out of balance. The 'protection' products being offered are also quite a serious mis-selling and there are no guarantees about the protection, so clients might be confused about what they are really buying.

- Business has been active, but the insurers now are having issues as there is a cap of 20% on what they can use to invest in offshore investments. Business thus has slowed or stopped in many instances.

- The insurance sector is recovering since the slump in 2020, and at the heart of this growth are unit linked products which would continue as a core focus in the future.

Is the Indonesian wealth management market improving its ability to compete more effectively with Singapore or even Hong Kong? Why, or why not?

- No, Politics and economic risk are still higher than developed countries like Singapore.

- Indonesia is a very promising market and large young population which can significantly contribute to capital market growth, but it would need significant regulatory changes to implement to compete with Singapore and Hong Kong. Also, the per capita income of Indonesians needs to rise significantly.

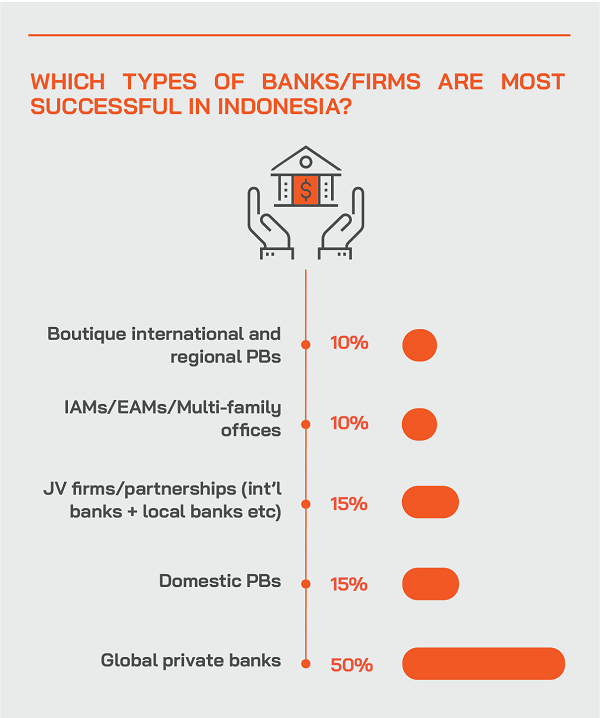

- In actuality, most of these wealthy investors are already offshore in the region especially Singapore, and as the GDP per capita rises further, Indonesia is a vast market, with a population of nearly a 300million people. Under the leadership of Wijoyo, Indonesia is really an economic miracle not recognised by the world. But the domestic market, while improving, is not as effective as Singapore or Hong Kong. It is a domestic market for retail investors. The wealthy from Indonesia have their arrangements offshore already.

- No competition at all, and it would require a dramatically different legal system.

- Very simply, wealthy Indonesians who can do so, still go offshore like Hong Kong and Singapore for investment and other solutions.

- Apples and pears. The onshore market can only offer so much and is hampered by regulation and the need to protect less sophisticated local investors and to help develop the domestic financial institutions.

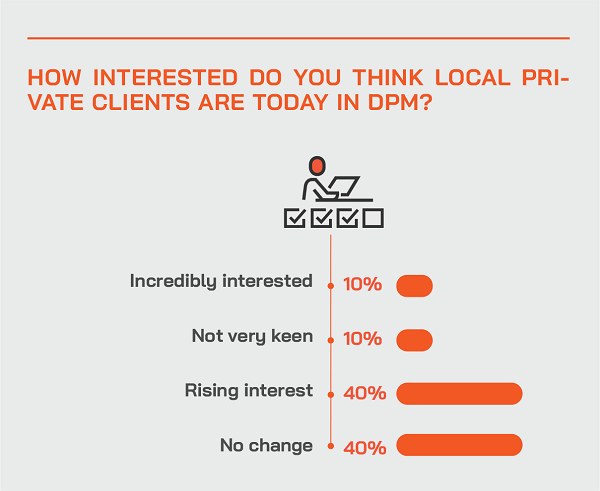

- The potential for the market in Indonesia is huge given the population size and the relatively youthfulness of the financial sector when compared to the main regional financial hubs. There are developments locally, including the growing activity in fund investments, more clients are showing interest in DPM, but it is slow and from a low base. To increase the pace of growth, regulatory and government liberalisation would be required along with a dramatically broader product offering.

- We would need a more robust regulatory framework, less capital controls and allow more participation in the global markets, a bigger and better capital markets infrastructure, more transparency and price efficiency, digitalization of the financial sector. In short, a long way to go…

- The only real area of true competition with offshore is the Syariah investment market, but actually many investors are using that route to send more investment money offshore, ironically.

- The authorities need to really look carefully at the capital market here, for example some group and family controlled listed stocks are totally illiquid due to such tiny free floats. Corporate governance in general in Indonesia is also not strong so market generally lacks appeal. The general malaise is best demonstrated in bond yields, ironically, with the 10 year bond offering just over 6% YTM, far higher than other ASEAN markets with similar credit ratings – we see that as a clear signal but not such a positive one.

- We need far more talent, better training to the front-facing bankers and advisors and far more focus on suitability and relevance. Moreover, the clients themselves need far more education on products, solutions, structures and proper wealth planning.

- Greater competition allowed by liberalisation will shake things up, but that is not likely any time soon.

- The growth of the Syariah market has been quite good when compared with neighbours such as Brunei and Singapore, and there is far greater adoption locally. More recent launches of digital offerings where access is made more available to a wider audience through lower minimum investments is also a plus and would be a key factor to further broad-based adoption going forward. For the very wealthy investors, they are using Syariah as a means of moving money to offshore investments, as there is no cap on Syariah products, so that is creating significant growth, although that was not the regulator’s intention.

Digital is of value for all segments of wealth in Indonesia, with some differences in needs and expectations

This same expert explained that digital transformation is adding value across all segments of wealth, from the retail/mass affluent upwards. “Digital has been sort of forced on the clients due to circumstances, but now they are mostly much more comfortable with it, and mostly across the wealth categories, and as a result, we are intently focused on keeping up the improvements and enhancements. Through our digital platform we can access all these segments.”

Intuitive and hybrid wealth platforms for the much wealthier clients, driving towards hyper-personalisation

He also explained that although digital is really important, for some segments, especially the high net worth clients, no matter how intuitive the digital interface is, they still need and expect the human touch, especially when they want to ask about the interpretation of some information. “Accordingly, we also make sure that we have human advisors, but also armed with AI and machine learning support to drive hyper-personalisation and relevance,” he explained.

Expert Opinion - Pieter Zylstra, General Manager - APAC, additiv: “We foresee that Indonesia will become the biggest digital wealth market in Southeast Asia, in terms of absolute numbers, where traditional wealth managers will be increasingly competing with new digital-native players who will use their digital distributor power to upsell embedded wealth solutions to an existing customer base of millions throughout the archipelago at significantly lower customer acquisition costs. This “democratization of wealth” has already started with the financial services ambitions of the various super-apps, who have the potential to become the largest digital banks.”

Wealth market digital disruption is taking place, but the real growth in AUM is still ahead

A wealth technology enabler added their views on the domestic wealth market, observing that the domestic banks dominate the market. “There are newer online operators like us going into the market aiming to unbundle the wealth management business from the traditional channel like the banks in the past few years,” he reported. “We have in fact enjoyed tremendous traction in terms of user acquisitions, all of us registering a total combined roughly million individual users in Indonesia. Nevertheless, in terms of the overall AUM, it is still a tiny fraction. We estimate it to be around 2% compared with 985 for the traditional channels. However, we have made a good start and there is plenty more to come. We put the clients as the centre stage of our business, we get to know them very well, understand what they want and then we build our infrastructure and capability around them. We are optimistic about the coming years.”

The incumbent players are also looking to fight back against each other and the disruptors with end-to-end transformation

Digital transformation must result in end-to-end advances throughout the organisation and right through to the client interface, a technology expert reported. “Change is far deeper down and as we have heard, streamlining the entire process is very important. Digital is certainly not all about channels, it is that entire end-to-end journey where you start a customer transaction, and you make your back-office operations, your processes so simple and easy and straight-through that the front-end transaction goes through as smoothly as possible. And that's what builds a great customer experience. So, it's not having a great UI/UX that defines digital. Digital is that entire process right from the start to the end of the business.”

Leveraging the right tools, partners and solutions is essential for full digital transformation

This same expert also pointed out that global technology companies cannot expect to cover every single nuance and aspect in every country, and therefore work with fintechs and their clients work with the fintechs as well to curate the best overall solutions. “You need to see the areas of specialisation, work with partners, build and be open to that ecosystem,” he said. “When I go into a country, as long as I make my technology which is so good that it can work with any other provider in the business, the entire ecosystem, building that ecosystem, is what we would consider the right approach to digital.”

Expert Opinion - Pieter Zylstra, General Manager - APAC, additiv: “We are already established in Indonesia as a key wealthtech platform, powering the rapid success of PT Commonwealth Bank’s ‘SmartWealth’ launch as a pioneer of digital wealth in Indonesia. Using additiv digital wealth library of over 450 APIs, we empower the digital wealth journeys from HNWI to mass-affluent markets. As part of our strategic APAC plan, additiv continues to invest in the growth of digital wealth platforms to address the needs for digital wealth solutions for the Indonesian market.”

Digital can also be tailored to access all the wealth segments, with hybrid layered on for the HNWIs and above

He added that digital transformation must be tailored to all segments, with the tools and protocols relevant and suitable to each category, and as the clients become wealthier, so personalisation shifts to hyper-personalisation, supported by AI, contextual data, ML and so forth. “Robo-advisory is more suited to the scale end of the market, while the hybrid model is of course better for HNWIs, who expect high touch and a personal relationship,” he observed.

Smart digital platforms should also be product enabled and highly flexible

He added that the smart digital platforms should be enabled to support more and more products of all types and diversity. “The banks and firms in this market cannot be scrambling for another platform just because the regulation opened up some new product,” he advised, “so make the platform entirely flexible, agile and future ready, and that is what we are continuously doing with our clients.”

The embedded wealth journey and the expansion of the super apps is happening in Indonesia, and now!

Another technology expert observed that we are entering into the new world of embedded wealth. “We are prominently playing a part by supporting banks and other brands in their embedded wealth journeys,” he reported. “Embedded wealth is closely related to embedded finance, so for example the concept is that you book a flight with Garuda Airlines, and you can immediately get a short-term loan to finance your ticket, or you go to Grab in Singapore to taxi and automatically part of that payment is going to some bank account, some investment fund. We are seeing this with big brand companies, companies that have millions of users who want to offer these wealth services to their existing population.”

These, he explained, are companies that obviously are not necessarily in the traditional wealth management space. He cited Bukalapak, a very strong ecommerce platform, and Tokopedia, and Gojek. “These are players that have, I would say, up to 100 million customers annually, they offer services that we all use on a daily basis for those living in Indonesia, and now they are able with these new technologies to embed new wealth propositions into the existing services they offer. So, you can imagine from a customer acquisition point, that is a very important aspect. So, what is embedded wealth? It is essentially allowing the provisioning of wealth services to totally new distribution channels outside of the traditional finance markets.”

This phenomenon of embedded wealth will lead to new alliances and partnerships

It is one thing to look at direct distribution channels, but the technology and underneath the technology, the APIs, and other tools and connectivity enable a much more fertile interplay between banks and stronger brands, this same expert commented. “And Indonesia is in that respect, I think is leading a little bit that development, because we see here something phenomena we don't see in the Middle East, and we don't see in Europe, we see these well-funded super apps, native digital super apps here, and they are now going for digital banking licenses. And I think we will find that new partnerships will arise between the traditional banks with the super apps and new brands that want to embed these wealth journeys.”

Digital transformation is also boosting the life insurance market

An expert highlighted the adoption by both clients and the regulator of digital delivery of products such an unit-linked policies. “The greater adoption we saw was good but perhaps not as much as we would have liked, as very often you have to build the relationship, sometimes talk to the whole family before a decision is taken; face to face is very convenient and ideal for a customer who's half ready and wants to understand everything. But we are encouraged, and we see greater adoption at the back-end too where more than 80% of our customers’ service transactions will now go through a chat bot where customers can get basic fund queries, fund statement requests, as nobody wants to come to the branch or go to their bank branch and ask for these questions anymore. So, more and more people are adapting to this.”

The hybrid approach will endure beyond the pandemic

In terms of how this will evolve in the coming years, he explained that the hybrid approach will endure long beyond. “Insurance companies have had, in the past, a very siloed approach that this is my digital channel, this is my agency channel, and this is my bank channel, but the channel is in the mind of the company, not in the mind of the consumer, and people may want to see your sales illustration and want to know about your product on the website, even before they meet your agent. So, all those changes are going to happen at a more rapid rate, which requires insurance companies to understand really what the customers want and be close to them. In the past, it was very easy to let the distributor do that final leg, but I see a huge opportunity in good quality digital advice where a specialist can come in, because one of the banes of the industry has been that there have been far too many part-time agents, bringing these products to the customers for many years, and then not sold well, for example they often do not understand the risk difference between a traditional insurance product and a unit link insurance.”

Funds and fund distribution – improving, but not as fast as many would like

The discussion turned to the evolution of the fund market, with a guest noting that it is all highly regulated and very strict, actually even tougher today because of some recent past scandals. “We are a producer of products, working with our distributors and partners in selling our products, and generally we are making best progress with rising retail participation, which has increased sharply since the pandemic. The number of fund investors in the past one and a half years or so rose to over 6 million, at the same time as individual stock trading rose as well. As to distribution many are creative, using digital platforms that are easy to use and compliant.”

He explained however that with GDP per capita still only around USD4200, the real growth leap had not yet come. “When we see the figure more at USD5000 and above, we will see a major leap forward in the funds coming into wealth management,” he reported. “Actually we expect this to increase exponentially. Nevertheless, the pandemic has set GDP back, so we are still waiting.”

Expert Opinion - Djoko Soelistyo, Head of Investment Product & Advisory, DBS Bank: “YTD October 2021 the millennials have dominated activity amongst individual investors. The wealth management business has been impacted positively by technology and it will keep strongly supporting the business especially in the growth of new investors in the coming times ahead.”

Trust is absolutely essential for the democratisation of wealth management

The same expert also commented that trust is vital to developing thr wealth market. “We saw a lot of our clients need liquidity since the pandemic, so we actually managed to supply a lot of liquidity. When you provide mutual funds, or when you run a wealth management platform, you must make sure that when your clients need access to their money, you're there to give it to them, because it's their money and at a fair price. Our assets under management went down actually last year during COVID-19 and only rebounded a little bit. But this year, we are really growing a lot, 40% ahead of everybody else. The client sees when they need the money, we're there to support them.”

The fund industry’s growth is being spearheaded by younger investors

A banker agreed with those comments, adding that the number of retail investors in unit trusts had risen some 90% this year, and most of them are Millennials or younger. “We see great growth potential for unit trusts, bonds, and unit-linked, so from our perspective, it is really important we put all of these three products to our customers, so that our customers can understand the product easily and also conduct the transactions easily. This is our challenge and it also comes down to the trust issue. The reality is that with digital that trust element is more difficult to achieve, it is like there is some piece missing, but we must work to overcome that.”

Regulation probably needs to be more adaptable and more global in outlook

A guest commented on the need for regulators to be flexible and more liberal in their approach. “Yes, our regulators are rightly quite strict here to protect the customers as well as the distributors, but I do think they also need to adjust with the global market condition. There are many new products and solutions that we could deliver here in Indonesia, and if so, that will support the growth of wealth management onshore. We are very positive but the industry also needs additional support from the regulators to help achieve these goals.”

Investor demographics are evolving fast, and investors are younger and more adventurous

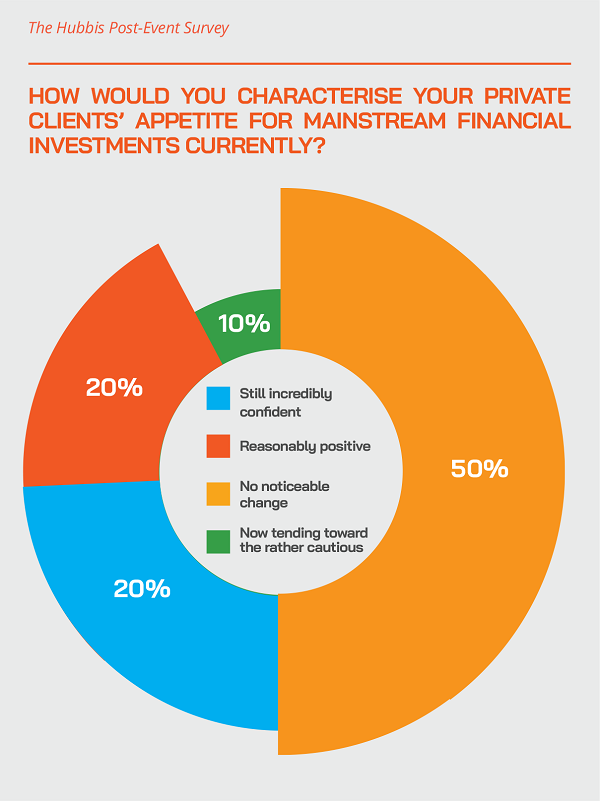

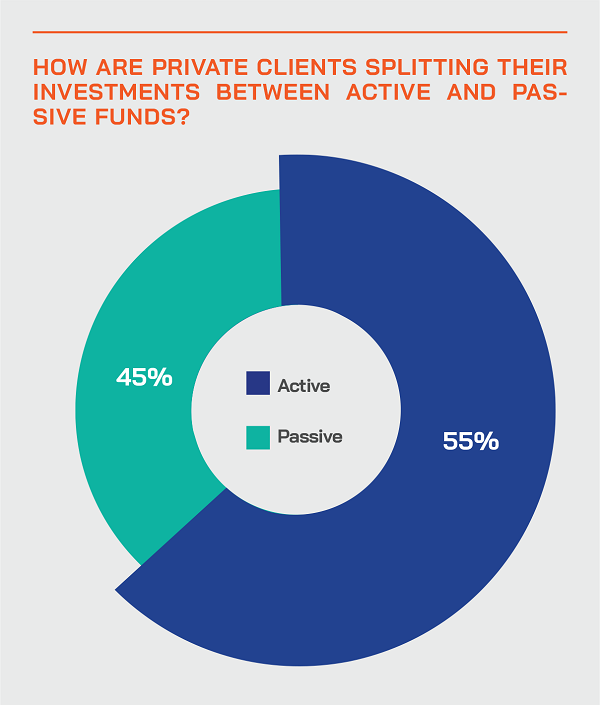

A digital wealth platform expert agreed that more younger investors are entering the fray. He reported that especially since the pandemic, the profile of the clients has been changing, and so is the appetite of their investment. “Currently in Indonesia, the demographic of investors is some 70% the ‘boomers’ generation, 20% are Gen X and 10% are millennials approximately. We saw their appetite shift into two extremes, one incredibly conservative, such as cash deposits and other protection funds, and at the other extreme, you can see investors are keen on the thematic investment and also the alternative investments. The demand for thematics played out in technology with clients looking for the aggressive active funds rather than the passive funds. Alternative investments include new areas such as crypto investing, and other private investment instruments.

For trust in a remote working world, you also need state-of-the-art digital solutions

Returning to the theme of trust, a technology expert highlighted the importance of seamless onboarding and JYC right at the outset of the client journeys. “There is great scope for improvement in these areas here,” he reported, “and part of it is the regulatory approach, as human intervention is still considered vital for this process to be completed. Can I get a customer onboarded, his account opened, everything online? Yes, it is possible digitally. But is the regulation fully capable of allowing you to do everything digitally? Probably not.”

He also remarked that trust is not easy to build on a digital channel. “This comes more from the reputation of the institution, you do not really have technology to build trust,” he commented, “but what you can do is to be transparent, for example offering product information fully and concisely in your own channels before a customer takes a decision, selling the customer products and solutions that are highly relevant and within his or her risk profile. Right now there is perhaps too much data going out, which is not contextual to the customer, and still too much product pushing that erodes trust.

Financial inclusion will expand apace, but high doses of trust and digital integrity are essential

A guest drew the discussion to a close by commenting that the huge and rapidly growing population along with advances in the financial and wealth markets will result in far greater financial inclusion, but as many such investors try out their first steps in their wealth journeys and as those journeys are today mostly digital, the wealth market must align trust and digital integrity to achieve those greater goals.