HNW & UHNW Life Insurance in Asia - Opportunities & Challenges for the World Ahead

Aug 12, 2020

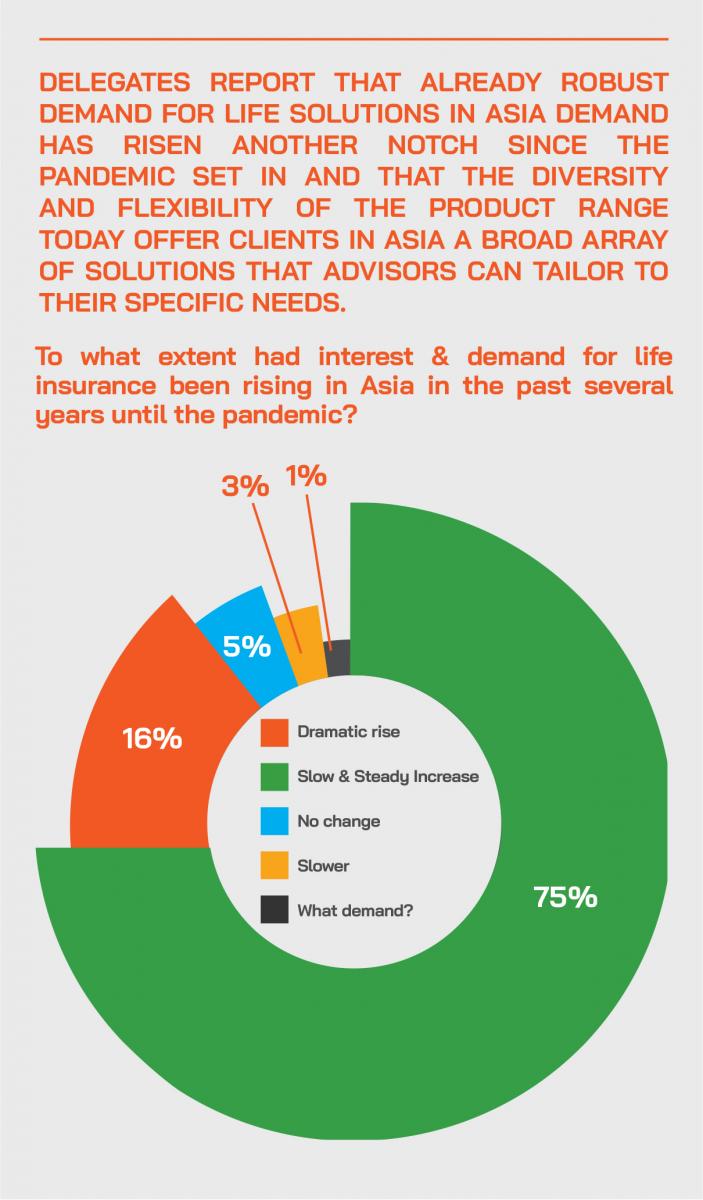

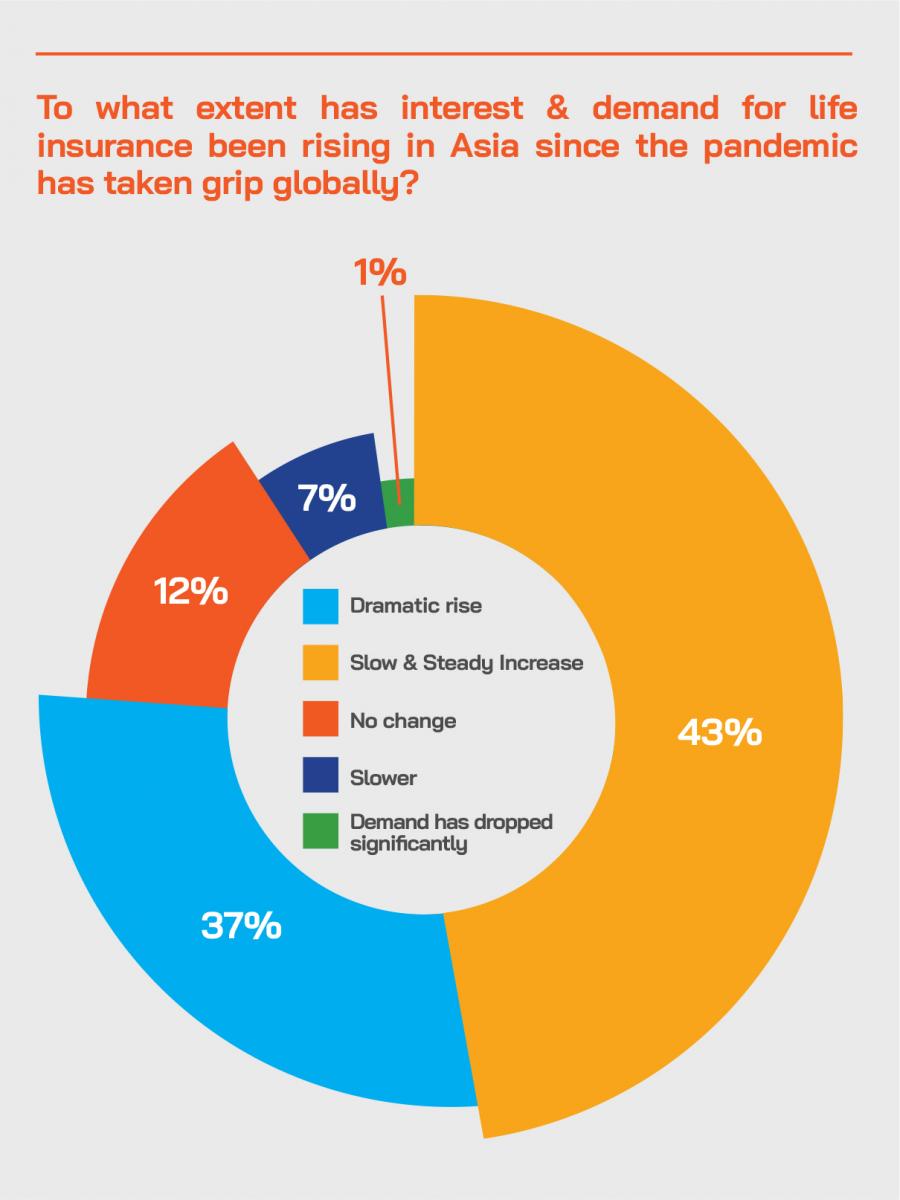

HNW & UHNW life insurance solutions have moved increasingly centre stage in Asia’s dynamic, expansive wealth market for many years, and have made a significant contribution to the revenue for many private banks, wealth managers and specialist brokerages. In recent years, the market has evolved well beyond the typical Universal Life solution that dominated the market five to 10 years ago. But has the pandemic stopped the life market in its tracks? Quite the opposite, according to the panel of six experts Hubbis assembled for our Digital Dialogue of August 6. They reported how much more receptive the clients are to discussions on wealth and estate planning, and how they have a more philosophical acceptance of mortality and the need to ensure proper succession and legacy planning for themselves and their families. The panel reviewed the mentality of the clients today, the state of the industry, from insurers to the banks and the brokers, and how vital it is for all these different elements to work closely together with external advisors such as tax, accounting and trustee professionals and then to curate the optimal solutions for the clients. The discussion ranged over the benefits of certain structures, and the evolution of demand for specific solutions. The experts were unanimous in their conclusion that the industry faces some logistical challenges due to the pandemic but that seldom has there been a greater opportunity to reinforce the value of their solutions to the client base, and seldom has that client base been more receptive to such ideas.

The panel discussion opened with the experts opining on how their firms and the industry, in general, had coped throughout this unexpected and pernicious pandemic.

Key issues raised included the impossibility of visiting clients, and the difficulty of conducting medical assessments, leading the underwriters themselves to adopt a considerably more flexible approach. An expert reported how busy his advisory firm had been, as clients have suddenly realised they could no longer put off organising their wealth and succession planning more efficiently, rather than prevaricating, as had too often been the case. “This has been a very good time to tackle these subjects with HNW clients,” he said.

Three key trends spotted

Another banker noted three key trends. “We see a higher demand for protection solutions and a higher sense of urgency for HNW families to pre-emptively seek out insurance solutions to preserve the wealth and to shelter the family from external threats. This view is actually affirmed by Ernst & Young in their recent report published on insurance for HNWIs, showing that 72% of such families believe that insurance plays a significant role in creating and preserving wealth.”

The second trend is that with many clients fearful of going for medicals typically required for the conventional ULI solutions, there has been a swing to demand for jumbo guarantee insurance plans, savings plans and annuity plans which require no medicals. “Accordingly, banks and institutions which are able to provide premium financing, even for this type of annuity and savings plans will have the upper hand in getting the sales done in this period,” he reported. “These plans used to be the secondary consideration but these days I think these are the quick fixes that clients and bankers look for to serve the client's needs.”

And thirdly, he observes a heightened awareness of the benefits of predictability, liquidity and flexibility which insurance offers compared to other asset classes in the market meltdown, resulting then in the ‘dash for cash’ scenario as evidence in the March meltdown. “We saw how many investors were trying to unwind the positions at one go and often finding no ready buyers for their holdings, whereas those with UL life insurance solutions were able to unlock the cash value without difficulty at clearly determinable prices.”

“Working alongside and enhancing existing wealth planning is key – as the fiscal and regulatory environments evolve, so too do planning needs,” said another panel member. “Couple this with international mobility and family members spread across the globe, there is a need to be forward-looking, whilst remaining compliant in an increasingly complex world. Placing assets within life insurance to protect and pass-on this wealth for future generations is a key objective of our clients.”

Expert Opinion - Lee Woon Shiu, Managing Director & Regional Head of Wealth Planning, Family Office & Insurance Solutions, DBS Bank: “The Covid-19 pandemic has been a timely reminder to all HNW families that the virus respects no boundaries, and we believe this awareness of their vulnerability may drive HNW families to pre-emptively seek out insurance solutions to shelter their legacy from external threats. We see a heightened awareness by HNW families of the benefits of predictability, liquidity and flexibility which life insurance solutions offer in a market meltdown ‘dash-for-cash’ scenario. And given that their business legacy continues to be the dominant source of wealth for many Asian HNW families, we need to accelerate the drive amongst such families in using life insurance by providing dynamic solutions in addressing liquidity needs associated with business loan protection, keyman succession planning and shareholder/partnership protection.”

Expert Opinion – David Varley, Chief High Net Worth Officer, Hong Kong, Sun Life Financial: “The unclear and uncertain future is drawing clients more toward HNW Insurance Products. HNW clients are already revisiting their asset allocation and looking closer at how Insurance products can help them. There has definitely been a seismic shift in recent years from Universal Life to Whole of Life in Asia as clients demand products with guaranteed lifetime cover plus returns and upside. For the clients with Protection needs and maybe more risk appetite, then IUL (index universal life) continues to fill Protection needs for certain Asian and Middle East clients. And VUL is growing in popularity, especially for the HNW Protection client who wants more control over their investments. As well as the ‘Asset Rich, Cash Poor’ entrepreneur.”

Expert Opinion - Lee Sleight, Head of Business Development, Asia at Lombard International Group: “A key opportunity that we have all been able to draw from this unprecedented experience is the benefit of time, time to reflect and think. Through this pandemic, we have seen clients are becoming much more aware of their own mortality and, in turn, their legacy they wish to leave behind. A once relatively taboo topic, death, and subsequently, succession planning, is becoming much more widely and comfortably discussed. Already we are seeing a significant shift in UHNW families proactively tackling their succession planning needs. Wealth structuring and intergenerational planning will become more complex as increased regulation, cross-border estates within mobile families and reporting requirements add to already existing obligations. Life insurance, from pure risk through to investment-linked, will continue to evolve to become a mainstay in the wealth planning toolbox that client advisors reach for.”

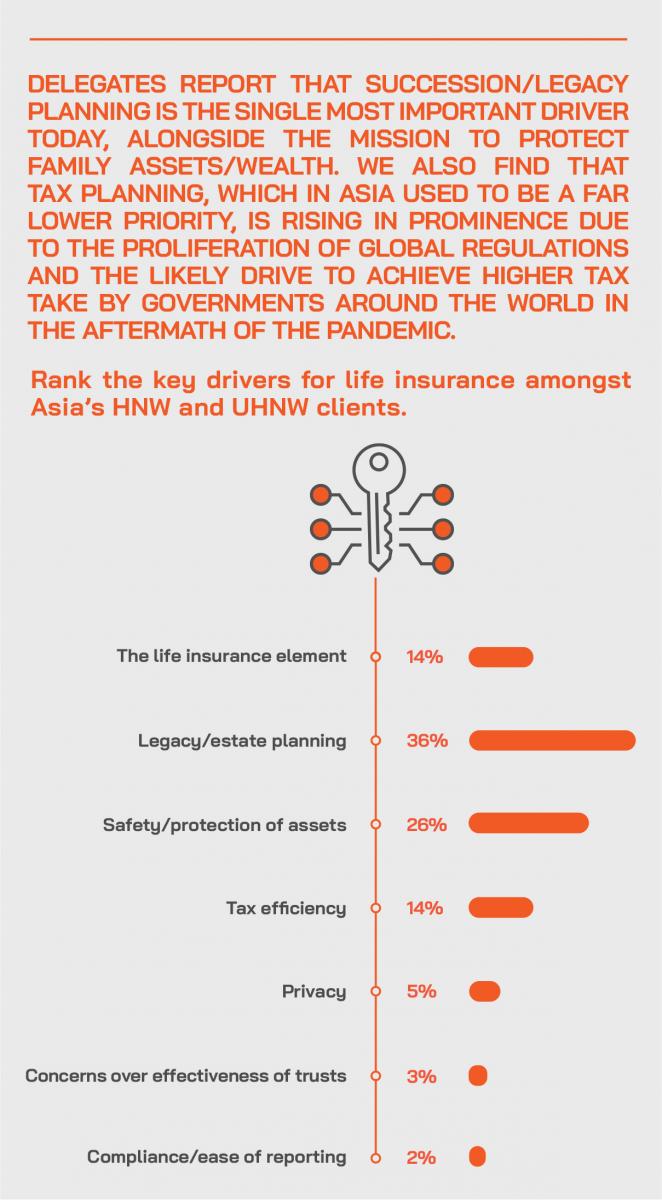

Post-Event Perspectives from the audience on the main drivers for life insurance solutions for Asia’s HNW and UHNW clients, and what impact the pandemic had produced on demand for needs-based conversations and life insurance solutions.

There was an overwhelming response from delegates, who reported that protection, liquidity planning, asset protection, tax planning, and succession/legacy planning were all vital drivers for these products. We have edited their replies to provide the following insights from the wealth management community.

In your view, what are the main drivers for life insurance solutions for Asia’s HNW and UHNW clients today, and what impact has the pandemic had on the market and on your activities?

- Valuable for protection and liquidity.

- Succession planning, tax planning, asset protection.

- Succession and estate planning and providing for loved ones.

- Wealth preservation.

- Wealth protection - the need to protect wealth seems to be of higher priority with the Covid-19 outbreak.

- These insurance solutions also help expand the range of stable income streams.

- Life solutions offer considerable flexibility of product features to suit clients’ specific nuances.

- Given the current market situation partly due to the Covid-19 pandemic and global economic decline, there is a greater need by HNWIs to consider both wealth protection and liquidity, as well as for making investment returns.

- Legacy planning and finding solutions to help pass on wealth down through a family’s multiple generations.

- Clients see the need to plan for contingencies, especially when the situation is not getting any better, and there is a gloomy outlook ahead. Mortality risk and the need for asset protection and safety, tax efficiency, legacy and estate planning, concerns over the effectiveness of trusts and their restrictions and rigidity, privacy and ease of reporting and flexibility are all offered by life solutions.

- Wealth and family protection and also backed up with financing from banks whereby clients’ resources may be deployed to wealth creation and other higher return options.

- This depends on the needs of the particular client. The needs can include capital needs upon death, liquidity, asset protection, income tax advantages, asset management, and succession planning.

- The main driver for life insurance solutions, in general, is leaving a lump sum of money to the family should anything happen to the policyholder. HNW and UHNW clients wish to preserve and transfer wealth to their next generations effectively, and they wish to have a solution that can provide family protection and mitigate the loss of income risk, as well as to cover any tax liabilities.

- These are encompassing solutions that can address various needs of clients, from legacy planning, risk mitigation, tax management, financial growth and liquidity, and confidentiality/privacy.

- Insurance is a valuable asset class and a useful tool for wealth planning, but over the years, this single insurance product (ULI) has been pushed because of its high revenue value. While it is a good insurance product, like all financial advice, there is no perfect product but the most suitable solution. Overselling can lead to subsequent client disappointment and scepticism on the professionalism of the industry. Proper education of the advisors and an open mind to understand the value of each type of insurance product will benefit the client and also benefit the industry as HNW, and UHNW individuals recognise the value of adding insurance in their asset portfolio.

- The main drivers have evolved over the past 10 years in Asia. Privacy used to be one of, if not the only main, key considerations. The changes in tax law, greater regulation of the financial industry and tighter reporting standards have resulted in Asian HNW & UHNW clients taking a more serious approach and proper advice toward their estate planning. This is good for both the clients and industry players i.e. advisors, insurers and product manufacturers.

- The current generation of Asia's HNW and UHNW clients are more open to life insurance solutions partly due to their educational backgrounds. And there is clearly a realisation from this Covid-19 situation that better planning is required for passing wealth to the next generation.

- The pandemic has created more opportunity and increase demand on the scalability and the need to look at long term planning for liquidity and protection when the pandemic has changed life perspective. This whole series of tragic events have highlighted the absolute need to plan for contingencies, asset protection, legacy and estate planning.

- While this pandemic has raised more awareness and created more demand for life insurance amongst our clients, the current border closure to travels has limited our current onboarding of new business to only in our country of residence. This has impacted our new business income by 50%.

- We actually see no impact from the pandemic as far as our clients are concerned as they do not believe in life insurance. Regardless, if mortality was of concern, to begin with, life insurance should have already been put in place accordingly. As opposed to only rushing into potential life insurance options now, taking necessary precautions to avoid Covid-19 should be what is on the top of everyone's list.

- Universal life will be very much affected as clients are generally not willing to go for medicals during this period.

- Like in any crisis, clients become more conservative and cautious in any investment or decision-making process. The crisis also leads clients to focus more on risk management rather than growth.

- The pandemic has created fear and instability in the economy and geopolitical situation, these have made the HNW clients more aware of the need to seek proper advice on most appropriate solutions to structure their wealth to safeguard their assets and preserve value.

Another guest agreed with these views, adding that clients had been looking increasingly beyond the standard assets that would have been held. Aside from the standard bonds and equities,” he reported, “we see a greater interest in non-traditional classes such as private debt, private equity, and other much longer-term investments. Clients are looking longer-term and more as a succession planning tool; they see they must put this in place and that these plans should not be affected by the ups and downs of market movements. They are also increasingly receptive to a wider range of solutions, exploring more of the options in the insurance toolbox.”

Adapting to today’s financial world

Another expert remarked that the incredibly low and often negative government bond yields – for example 10-year US Treasuries - caused all insurers around the world, especially in Asia to really look at their products and focus on which segments they can compete in properly.

“We saw we needed to focus on being very good in high net worth when it comes to protection and savings and complement that with easy to do business with local service,” he reported, “which helps to be in Hong Kong which generally houses the best available guaranteed Whole of Life products. We therefore see significant demand for these guaranteed cover, guaranteed return type of products. Whole of life products last for life, and also the guaranteed savings products. You can still get products in Hong Kong where you can get a 2.3% guaranteed return on a savings product, which when you're getting nothing in the bank is still pretty attractive. For us, therefore, it is about making sure we have the right products on the shelf.”

He added that financing of such products is now of course cheaper, whether for protection or savings products. “So, even though this Covid situation has caused a lot of concerns and issues, there are opportunities that have come from that and it is moving and creating more opportunities in all different types of products, and from the viewpoint in Hong Kong and for HNWIs that is definitely in the guaranteed Whole of Life where the Hong Kong insurers really focus on and the savings.”

Weighing up the pluses and minuses

He remarked that the HNW solutions tend to have a lag factor, so many of the cases resolved in the first half of 2020 dated back earlier when normal life and business prevailed. “This means that the lockdowns will have reduced the pipeline but on the other hand, the pandemic is also driving more conversations. Yes, it is harder to do the business, but yes also the conversations are easier with regard to protection and liquidity planning, and broader wealth planning.”

“I’m certain that I won’t be alone saying that one of the most obvious challenges faced in this current environment are the restrictions on travel and the subsequent impact this has had on the face to face interactions,” came another opinion. “Overnight, we have gone from a mobile society to a digital one – this takes some adapting to, and whilst technology can greatly speed up and enhance many daily tasks, personal contact is key in our business. We are seeing a much structuring groundwork being conducted, with solutions being prepared in anticipation of travel restrictions being relaxed.”

Engaging with technology

He explained that technology, video-conferencing and the ubiquitous internet have been key in how they engage with prospects, adding that as lockdowns ease and then reappear, daily interaction and contact can be maintained. “We are fortunate that our strong relationships with advisors and institutions in Singapore and Hong Kong have allowed us to continue our discussions. Interactions with trustees and corporate services providers, acting on the clients’ behalf, has continued relatively seamlessly.”

Selling step by step

A banker remarked that their most successful RMs in terms of selling the largest solutions are those who conceptually planted the seeds of need for wealth protection but avoided the discussion on insurance itself or actual solutions. He explained that Chinese clients, in particular, warmed to the approach of talking about CRS, transparency and how their domicile and residence status would not necessarily protect them from residual global income tax risk. Then by the second meeting, the bank could go full scale into the solutions or protection, life insurance but always focused on the client’s needs and expectations.

“Here I should again refer to the 2020 Ernst & Young report, where it appears that only 13% of high net worth entrepreneurs have business loan protection to life insurance, and only 33% of such entrepreneurs use keyman insurance to facilitate continuity,” he reported. “Given their business legacy continues to be the dominant source of wealth for many Asian high net worth families we serve, there's a real need to accelerate the drive to such families to use life insurance provide dynamic solutions, to address issues linked with business loan protection, keyman protection and shareholder partnership protection issues.”

Scanning the solutions on offer

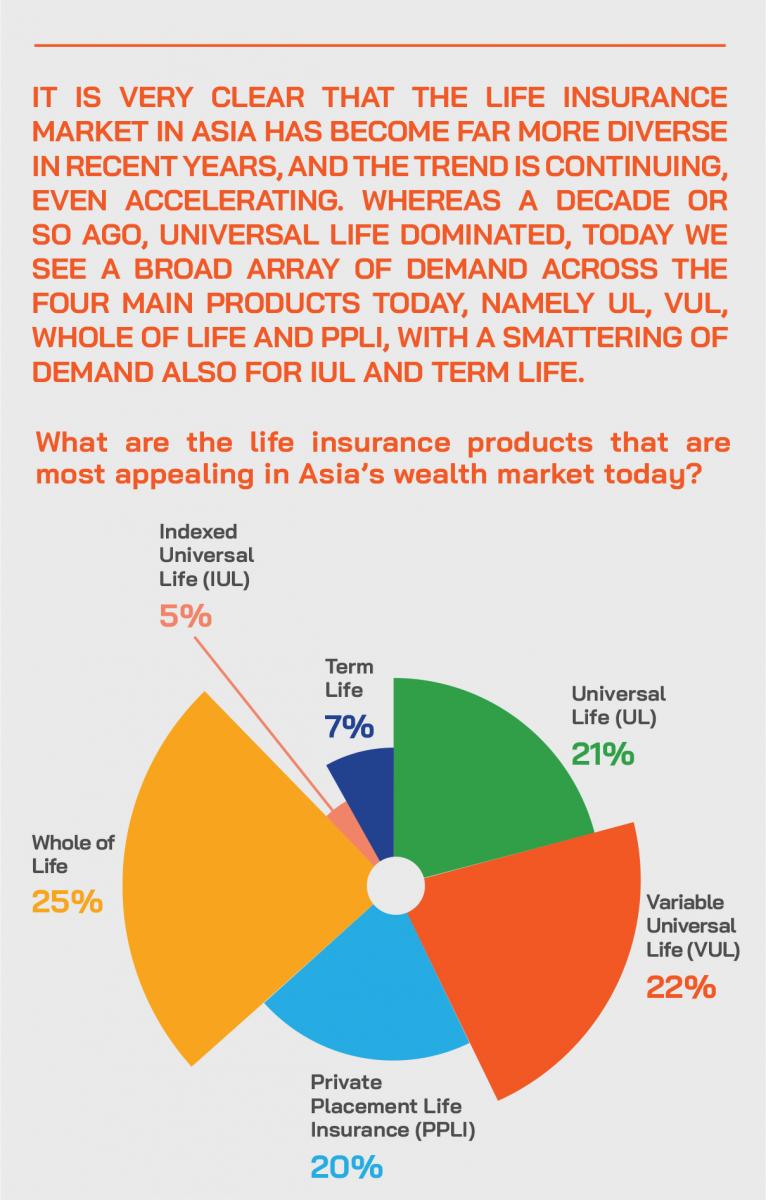

The discussion moved on to the current solutions on offer, with a guest reporting strong demand for VUL and especially for PPLI, a strength of his particular firm, particularly for clients with high levels of inheritance tax (IHT), such as Japan or Korea.”

Another guest explored UL compared with Whole of Life, the second of which has become more popular in recent years. “Going back probably 10 years, it was UL that dominated in Asia, and there wasn't much PPLI or VUL or Whole of Life term being in the HNW and UHNW segments,” he reported.

“But the past three to five years have seen a wider range of solutions,” he continued, “and also specialist brokers and advisory firms promoting such a wider range of solutions. ULI remains a fantastic product as it meets the needs of a certain type of client, but as crediting rates have come down that's put more stress on the product and therefore the cover might not last forever. Whereas with Whole of Life, the cover is guaranteed forever, there can be a capital increase, and you can get some liquidity and returns out of the product as well.”

Expert Opinion – David Varley, Chief High Net Worth Officer, Hong Kong, Sun Life Financial: “The low interest rate environment, and Covid concerns, has emphasised the need to focus on what we do well as a Hong Kong HNW Insurer, which is HNW Protection and HNW Savings Products, complemented by agile local customer service. Hong Kong is a leading global player in the Traditional PAR Protection and Savings plans, and clients from all over Asia still demand these products. And the general feeling of mortality and enhanced risk driven by Covid has pushed HNW clients to more guaranteed types of products. Especially the Whole of Life type of product with guaranteed cover and guaranteed returns.

Also popular are the high guaranteed Savings Plans, some of which can be financed. There is peace of mind in buying these products from safe, secure insurance companies with strong solvency ratios. Some of these products even guarantee a cash/coupon return of 2.3% per year, plus upside. If anything, the uncertainty and low borrowing rates have invigorated sales opportunities with Private Banks and HNW Brokers for these unique solutions. With Savings Plans becoming a more core part of the HNW suite of wealth planning solutions.”

Accordingly, with clients becoming more conservative and with Whole of Life prices similar to ULI, he reported a seismic shift from ULI to Whole of Life in the last several years. He reported this to be especially the case for clients from all over Asia and the Middle East coming to Hong Kong as it offers the best pricing and overall solution.

Expert Opinion - Lee Sleight, Head of Business Development, Asia at Lombard International Group: “Alongside what I would term default planning tools used by wealthy families, such as trusts and offshore structures, we are seeing an increasing demand in Asia for unit-linked life insurance, or Private Placement Life Insurance (PPLI). This is also reflected in the growing demand we have seen in Europe and Latin America for PPLI as clients look for a bespoke planning tool to enhance their existing wealth planning, making it future fit.

The ability to maintain trusted advisors within a widely recognised, yet sophisticated and tailored structure is particularly powerful for families who are looking to both preserve the wealth they have amassed, whilst at the same time ensuring that it is enabled to be passed on in a structured, compliant manner. Whilst not a product innovation per se, the emergence of family offices and external asset managers to service these clients underlines the fact that they seek a secure, portable and personalised solution to protect, preserve and pass on their wealth.”

He added that the specialist brokers that have come into Asia, largely from Europe, have opened up far more VUL, PPLI and IUL (indexed universal life) demand, with the last of these particularly popular with Middle East clients.

Post-Event Perspectives from the audience on the evolution of demand in Asia’s HNW and UHNW wealth markets for particular life solutions. It is very clear that not only is there a far wider range of structures available today, but that the advisory community and the individual clients are far more receptive to tailoring the solutions precisely to their clients and to their needs. We have edited their replies to provide the following insights from the wealth management community.

What particular life insurance structures (such as UL, VUL, IUL, Whole of Life, PPLI, or Term Life) do you think are best for your clients, and briefly why?

- Whole of life, which provides guaranteed returns and liquidity.

- UL is good for large life protection and premium payment terms are flexible, can also have premium financing.

- VUL offers life protection with investment opportunities.

- Whole of Life for those clients that need more guaranteed features.

- PPLI for those clients that have a lot of existing long-term investments with the bank.

- UL is still very dominant. It has been around for a long time and there is more awareness of the product.

- VUL offers flexibility, with a client say in the investment strategies.

- With interest rates low and falling, it seems like Whole of Life with its guarantee portion is today more appealing to clients.

- As a trustee, PPLI is of interest to us as we can wrap it under a trust.

- VUL, as this offers clients the flexibility to choose what they want to invest in. Term Life offers a high sum assured, with cheap coverage.

- PPLI and VUL provide clients with asset protection. Clients assets are no longer legally owned by the client but will be owned by the insurance company and hence protected from creditors. The advantages include retirement planning as clients get to enjoy retirement benefit such as liquidity through their lifetime and tax efficient withdrawals. They are good for estate/legacy planning - the nomination of beneficiaries in a confidential manner, avoiding probate and for sophisticated distributions. They help achieve tax optimisation as well as ease of reporting with consolidation of multi-jurisdictional assets for a consolidated reporting by the insurer.

- My preference is for Whole of Life (WOL), given that economic conditions make UL uneconomic at the moment. WOL is also easy to understand, and it grows in value over time. It has guaranteed whole life protection plus a definable cash value. It is also transparent, simple and elegant.

- All have their place, depending on the particulars of the situation. Here is my general categorisation. UL offers flexibility (death benefit and premium), VUL offers flexibility plus client control of investment management, Whole of Life offers guarantees but needs to be carefully structured with regard to 'short pay' policies, 'and with regard to first look' for trusts and other fiduciary situations, as surprises with death benefit and premiums are not welcome. PPLI offers custom solutions for special assets, but handle with care as these can be quite tricky.

- UL and IUL offer the best outcomes for simple legacy planning. VUL and PPLI offer a more comprehensive asset wrap.

- Whole of Life due to inherent features of the product (including guarantees, participating bonuses - meaning less dependency on crediting rates as in the case of UL) and PPLI due to its flexibility.

- PPLI should be the over-arching solution for the client to address the core needs, followed by the rest of the insurance products to address the various needs related to the clients’ financial goals.

- PPLI, as more clients work and live in different areas worldwide and their families’ needs, a long-term insurance wrapper with trust function and the open architecture platform is significant.

- The choice of solution totally depends on the client's needs, comfort level and type of assets (traditional or alternative). All these can be addressed with using life insurance solutions and together with other financial planning tools. Education is still key for the HNW/UHNW client base to understand the solutions available, so they can appreciate how some of their sophisticated investments/assets can be combined with of a simple life insurance contract to bring forth the best protection and benefits for their estate planning.

- It depends on what the client needs. If the clients are more concern about the protection, then term life or a whole life policy will be much more suitable, offering higher protection with lower premiums. If the client wishes to have a combination of protection and some investment, then VUL or PPLI are both more appropriate.

Another expert said that his clients are especially interested in VUL where they can actually have the flexibility and have a say in what they want to do with their investments and where the firm can also proffer its advice. “For example,” he reported, “in this period, clients want to play safe, they want to be in investment-grade assets, they want to wait till the Covid-19 vaccine is out before they become more ambitious and aggressive again. Overall, I would say that people need flexibility and that one of the best solutions for them if they're not looking at tax would be the VUL, so we are moving in that direction.”

Open to open architecture

An expert then delved into open architecture trends and flexibility around custody issues which provide some of the more boutique Swiss private banks a competitive edge as they can hold a wider range of assets, for example privately owned assets, private company assets, even single stock positions in some cases.

With that, the discussion then centred on PPLI, or private placement life insurance, a product that is becoming increasingly prominent in the Asian market. PPLI, an expert elucidated, has a number of key benefits for clients, including more discrete CRS reporting, avoidance of probate, a viable distribution plan, the flexibility to cancel, withdraw funds, reduce life cover, the opportunity for tax deferral, worldwide recognition, creditor protection, possible high life cover and (under a private investment company) the option to hold multiple asset types.

PPLI’s advantages

For bankers, he explained, the PPLI offering helps retain assets for the bank, attract new assets and new clients, provides revenues on non-bankable assets and even assets with other banks, brings upfront fees and trailer fees, and assists with differentiating the bank with clients by bringing a new product offering into focus.

Expert Opinion - Yannick Haeni, Chief Executive Officer, Asia, 1291 Group: “Trust or insurance? This clearly is the wrong question! A trust is a fantastic estate planning tool and ideal for complex multi-generation succession planning, especially in common law countries where a trust may also be effective to reduce estate tax. Increasingly, however, it can be looked through from an income and capital gains tax point of view, and there is very little to no protection of privacy. A combination of a trust with life insurance, especially PPLI and VUL, is most powerful and effective to hold not only financial assets, but also various non-bankable assets which allows families to benefit over generations.”

“A lot of people are often asking what is now better – the trust structure or PPLI -but my view is that if we look at the US or the UK, the trust and PPLI planning can be conducted together because they have different advantages and they are comprehensive, they support each other. Maybe some people think it’s too complicated, but it's actually a very simple, very lean structure. In fact, I always say also to the trustees, instead of using an offshore holding company, which has nowadays a lot of disadvantages, as a trustee you just directly hold the PPLI which has many particular advantages and great flexibility, especially with wealthy families that are geographically fluid these days. This is great for multi-generational planning, legacy planning.”

Expert Opinion - Yannick Haeni, Chief Executive Officer, Asia, 1291 Group: “In our new and transparent world, wealthy families need to plan, structure and protect their wealth in a legal and compliant way. Often, family members and investments are spread throughout the world, which makes this task even more challenging. Insurance (PPLI /ULI) is the most complete and well-rounded wealth protection tool in the world. It is known and accepted in all jurisdictions, no matter if the client is in a civil or common law country, and it is supported by one of the strongest industries in all countries: the insurance industry.”

“Agreed,” said another expert, “this is especially valuable in Asia where our clients from a trust point of view typically want a lot of control, which can then remove any tax advantages that a trust may have, even if the trust is actually recognised in the jurisdiction in which the client is resident, whereas it's more likely that the insurance policy will be recognised in the jurisdiction of the settler, who is going to be reported on for the CRS requirements.”

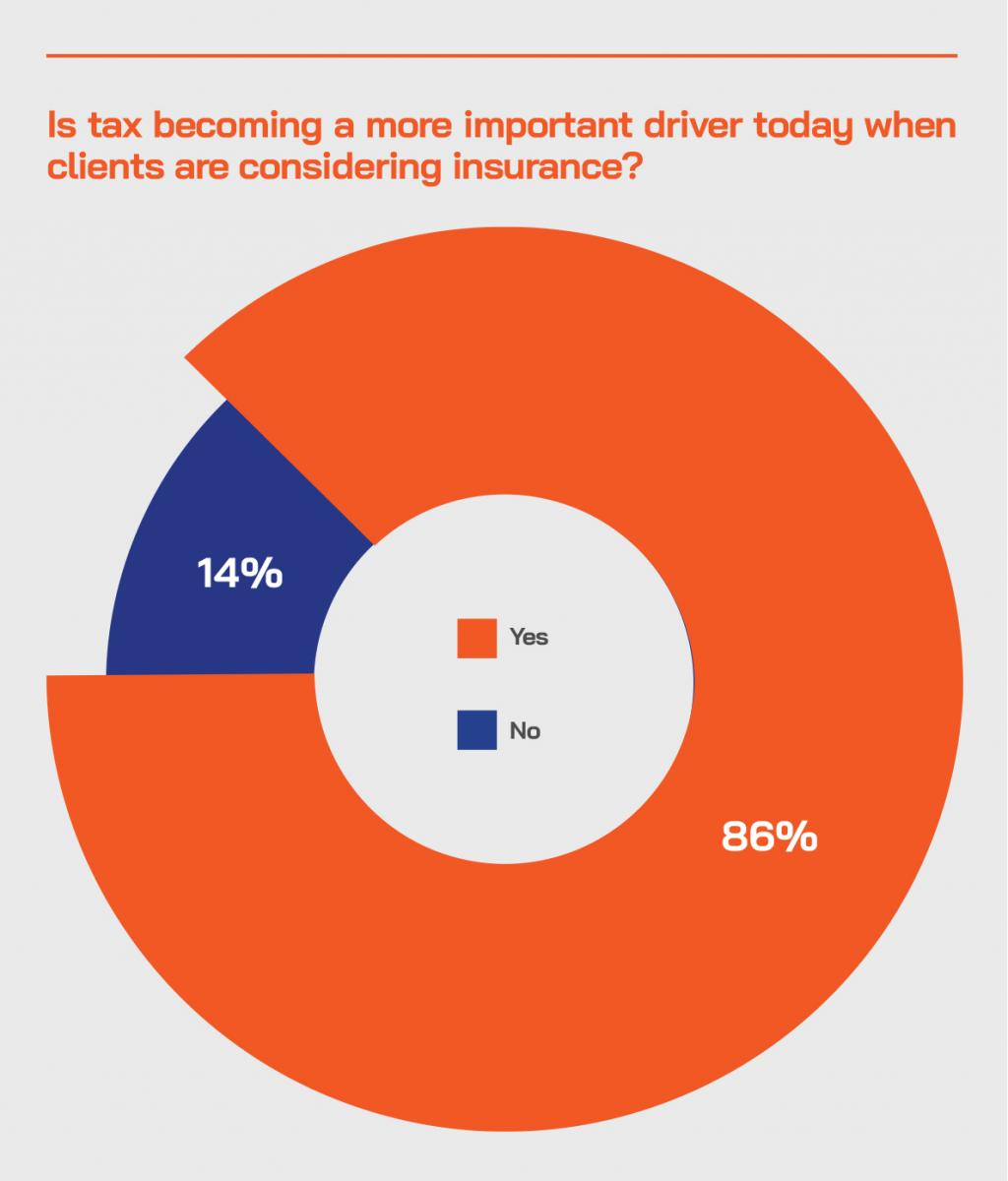

The new world of tax compliance

The panel also minded down into the rising importance of tax planning and mitigation, especially as governments the world over need money to repay the trillions they are spending on rescuing their economies. “We are expecting globally to have a surge in taxes in terms of both wealth taxes, asset and IHT taxes in many countries,” commented one expert. In the world of CRS and global transparency and monitoring, there is nowhere to hide. We therefore encourage our RMs to understand these core issues and have basic conversations with the clients about these tax exposures and issues, and then refer them to tax planners, wealth planners, trustees and other experts required to really resolve the clients’ core issues.”

Another guest agreed, noting that the discussions need to be initially around liquidity planning, succession planning, estate planning, inheritance tax planning, all the different needs, planting the concepts in the clients’ minds and then delving down into the right solutions. He explained that to achieve the best outcomes, a range of experts and specialists should be involved, leading ultimately to the optimal outcomes for the clients.

Experts must work collaboratively

“We certainly believe that the best approach is working together,” anther expert observed. “These transactions often take 6, 12, maybe even 18 months to put together to understand the client's needs, so we need to work with all the parties involved. I liken this to starting with the lump of clay, which needs to be shaped roughly, then very finely to give exactly what the end client really needs. Tailoring often means bringing in a wide range of experts to address each of the key issues; there really is no one size fits all in this industry.”

“Yes,” said a fellow panellist, “the relationship between the RMs and the wealth planners within the bank's platforms is very important because really, there needs to be central control and coordination.”

“We certainly believe that working with the banks, the quality brokers who have genuine expertise and breadth of understanding and relationships will help the banks deliver for their HNW and UHNW clients,” another guest commented. “The specialist brokers often have a range of in-house expertise such as a legal background, or a trustee background, and so forth who can work closely with the banks, the RMs, the wealth panning teams, exchange ideas, work on conveying and delivering the right messages to the clients, and ultimately deliver the optimal solutions. It also looks so much better if you have different parties involved in talking to the client, so they see there is not just one person trying to sell a product.”

The discussion refocused on the shift from single premium business towards more multi-pay. “Our clients are actually normally quite happy to make multiple payments instead of single payment,” a guest observed, “and these days, people would prefer to be in the multiple payment if the banks are willing to do that.”

Leverage also works, but be selective

A banker added that they direct their clients towards leverage only if it suits their specific circumstances. “Not everybody needs financing, but we find most clients in the private banking space that we have worked with are very sophisticated, and they understand how the careful use of leveraging and credit can enhance returns. So, for those clients who understand the risk and rewards balance, then they are more often than not willing to take financing, even to purchase income plans. So, with that sort of premise in the situation, I would think that most RMs wouldn't object to actually be working with clients to purchase guaranteed income plans and annuity plans for that matter.”

Returns in a low-return world

Another insurance expert reported that with interest rates crashing down, his firm was seeing huge amounts of single-pay financed protection products, mainly Whole of Life and also single-pay finance savings products. “If the customers are borrowing at 1% or slightly over 1%, and getting 4% to 5% returns, it's very attractive,” he commented, “so, that business is still very strong. But there are still clients who want to pay over 2 years, 5 years, 10 years, get a nice guaranteed return because getting a 2.3% guaranteed return plus upside in this kind of market - which the insurance can provide, especially out of Hong Kong - is very attractive.”

Expert Opinion – David Varley, Chief High Net Worth Officer, Hong Kong, Sun Life Financial: “Choice and flexibility will be key as the HNW clients demand a wider range of HNW Insurance options to meet client needs. Not just in terms of product, but also in term of jurisdiction. It’s important to be able to offer HNW Insurance solutions from multiple jurisdictions, be it in Hong Kong, Singapore or Bermuda. This is a key part of Sun Life’s overall HNW strategy. The insurance companies that can offer a wide range of HNW products from multiple jurisdictions will win. From a Hong Kong perspective, while there is and has been challenges of late, the opportunities from China Long term and more immediately in the Greater Bay Area as financial services open up should be significant for HNW insurers in Hong Kong.”

Expert Opinion - Benn Ng, Managing Director, Head of Southeast Asia, Raffles Family Office: “For the insurance industry to become more competitive and efficient, they should work with the medical community to accord ‘medical ratings’, just like the Credit Bureau accord credit ratings. With this ‘medical rating’, individuals will be able to get quotes from different companies for their insurance in a more efficient way. Insurance companies will also save lots of time and money on medical examinations and be able to be more transparent. The industry will be more efficient and competitive.”

Expert Opinion - Lee Sleight, Head of Business Development, Asia at Lombard International Group: “Tailored, unit-linked solutions are, in my opinion, the best way to reassure clients that they remain firmly in control of their wealth and its future. After a lifetime of building up wealth, there is often a reluctance to relinquish complete oversight – regardless of their relationship with and trust in their appointed asset manager.

An open architecture solution, such as the tailored unit-linked products we provide at Lombard International Group, allow for the ability to choose and adapt bespoke portfolio management strategies, which is key. Expanding the choice of investments to access non-traditional assets, such as private equity, private debt and real estate, as clients seek longer-term investments with greater returns, is very much in demand. Couple this with deferred taxation, compound growth and clear succession planning benefits and you have a powerful, yet simple tool available to the family advisor.”

He added that another factor is flexibility on jurisdiction. “We can also direct clients through Singapore or Bermuda, rather than Hong Kong, if they prefer,” he reported, “so it's not just the choice on PPLI, VUL, Whole of Life, UL, or IUL just from one jurisdiction, it's about trying to offer from different jurisdictions because jurisdictions will go in and out of favour, as we have seen with the troubles in Hong Kong, for example. Flexibility on product, great service, and doing what you do best as well as offering those different jurisdictions is going to be key to a successful high net worth insurer in the future.”

A somewhat different view came from a panellist who argued for the arrival of medical ratings, much like credit ratings. “For example, let's say now you want to buy insurance and you approach three insurance companies, they need to do three medicals, but instead, we are looking at just one medical and for the medical institution to give you a medical rating whether it is BBB or AAA and from that point, all the other institutions will give it to you based on your medical rating, will be able to give you such a cost, and from then the medical will be more efficient and more competitive, and this also avoids travel across borders if such travel might normally have been required.”

The closing words – seize the moment

The final comments centred around the panel encouraging delegates to seize the moment, to begin or extend the conversations with their clients. “They often have more time on their hands in the lockdowns, and also more cognisance of mortality and the need for robust planning for themselves and their families,” said one guest. “We want to have a proper solution for the clients, so they are not worried about themselves or their families.

Another expert advised greater flexibility, not just promoting one product, but helping the clients find the best outcomes for their specific needs.

Expert Opinion - Lee Sleight, Head of Business Development, Asia at Lombard International Group: “Technology, regulation and globalisation have advanced, and the demographic profiles, needs, wants and expectations of UHNW individuals and their families have transformed. This means that client’s expectations around the availability of choice and degrees of flexibility, to meet their specific needs, is going to increase. With increased regulatory and tax requirements, HNW individuals and families will need to future-proof their structures with both PPLI and VUL, together with simple, yet powerful, pure risk solutions that can generate liquidity when it is most needed – irrespective of market conditions.”

“Yes,” came the final word, “meeting the client's needs is first and foremost, because if the client wins the insurance company wins and all parties to the arrangement win. We all need to do the right thing there. The insurance companies need to focus on what they do best, and make sure they work closely with the brokers and the banks and the family offices to ensure that everyone is educated in these matters and the best outcomes are achieved. We also need to be especially flexible in our service because in this Covid environment, people are looking for flexible solutions, as it's not as easy to do business. There are real needs, and there is real business to be done. Insurance has an incredibly important and central role to play in the months and years ahead.”