FOAHK Survey - Family Offices to Ramp Up ESG Allocations in 2022

A recent survey by Family Office Association Hong Kong (FOAHK) found that 90 percent of respondents agree that Hong Kong is the family office hub in Asia.

The top three factors most important to driving Hong Kong’s development as a regional family office hub are:

- Unique gateway to Mainland China (66%)

- Favourable tax regime (57%)

- Strategic location at the heart of Asia (49%)

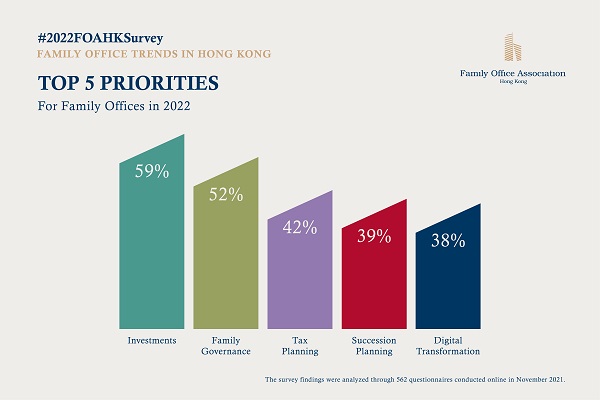

In 2022, the top five priorities for family offices are investments (59%), family governance (52%), tax planning (42%), succession planning (39%), and digital transformation (38%). Meanwhile, respondents from venture capital, investment service providers, and professional & legal service providers cited investments, risk management, and digital transformation as their top priorities.

The survey found that up to 4 in 5 respondents (79%) from the family office industry have allocated assets to ESG or impact investing in 2021. Of those who allocated, over half (52%) allocated 10% or more of their portfolio to ESG/impact investing, with 27% allocating 20% or more. This year, 85% of family office respondents expect to increase their allocations to ESG/impact investing, with almost two thirds (64%) of respondents planning to increase allocations by more than 10%, and more than one third (36%) planning an increase of more than 20%.

Commenting on the results, FOAHK Chairman Mr Chi Man Kwan said, “The shared priorities will set the course for 2022, as the family office industry continues to mature and play a significant role in society and the wider financial ecosystem. We are pleased to see that family offices in Hong Kong are already at the forefront of ESG/impact investing, and increasing the momentum this year with meaningful allocations to make a difference for our future. We look forward to facilitating the continued development of the industry and maintain Hong Kong’s competitive edge as the family office hub of Asia.”