Wealth Planning, Structuring and Family Succession for Wealthy Indians

Oct 1, 2021

Wealth, estate and succession planning solutions are key areas enjoying increasing emphasis in the wealth management market in India, where private wealth has been increasing so rapidly, even in many cases throughout the pandemic. The older generations holding so much of the ‘older’ wealth and traditional businesses are being supplanted and supplemented by the vast and rapidly growing suite of wealthy and uber-rich entrepreneurs across the country, many of them having created the new wave of technology-driven enterprises. And the younger generations are returning from overseas armed with their Western education and plans for the future, ready both to inherit some of India's vast private wealth and to build the enterprises to create tomorrow's economic dynamism. For the wealth management industry to thrive in India and to cater to the demands of these increasingly discerning private clients of all ages, there is no doubt that the quality of advice on investments, wealth structuring, and on the vital topic of estate & succession planning must all evolve. The Hubbis Digital Dialogue of September 16 discussed the evolution of carefully planned and well-executed estate and succession planning, as well as global residence planning, and all set within the context of the evolution of the wealth management industry in India.

The Panel:

- Kshitij Kulkarni, Partner, 1291 Group

- Lee Woon Shiu, Managing Director & Regional Head of Wealth Planning Family Office & Insurance Solutions, DBS Private Banking

- KT Chandy, India co-leader – EY Private Tax, EY

- Nirbhay Handa, Managing Director - Head of South Asia Team, Henley & Partners

- Bijal Ajinkya, Partner, Khaitan & Co

- Neha Pathak, Senior Group Vice President, Head of Trust & Estate Planning, Motilal Oswal Private Wealth

Our erudite panel of experts had plenty to say during the discussion, but one thing was absolutely clear from the start to the end – the Indian wealth management market is improving significantly and rapidly.

There is no doubt that the progress to date has surprised even seasoned veterans, and there was a general feeling of excitement about the rising sophistication of the advisory side and of the clients themselves. Yet there is as always more to achieve, and the experts opined on what steps must be made by the various parties – from the private sector incumbents to the regulators - to more fully set the wealth and legacy planning industry on the road to realise more of its full potential. And the panel analysed what the private clients must themselves do to expedite more optimal wealth planning, legacy and succession structuring and solutions.

The panel also noted the growing emphasis on both greater professionalism amongst the RMs and advisors, on creating dedicated legacy & succession planning teams and expertise within the private banks and wealth firms, and on the related expansion of the relevant products and solutions the industry can offer in order to keep their private clients properly organised and well set for the future.

Expert Opinion - Neha Pathak, Senior Group Vice President, Head of Trust & Estate Planning, Motilal Oswal Private Wealth: “Nowadays Wealth planning is not limited to investments, but it also encompasses wealth preservation & wealth transmission. HNIs are now looking at trust structures as an avenue of wealth protection from internal and external disputes. Wealthy individuals are forming such structures not only for their children but also for their grandchildren. Interestingly, lot of them are extending their wealth for charitable causes."

Expert Opinion - Lee Woon Shiu, Managing Director & Regional Head of Wealth Planning Family Office & Insurance Solutions, DBS Private Banking: “There is increasing acceptance among Indian HNW families of the need to structure their affairs in a tax optimal manner, including the use of family office arrangements to achieve tax certainty in tax friendly jurisdictions like Singapore, and optimising their legacy plans for next generation non-resident Indians with connections in the UK or USA.”

Planning ahead and planning properly

The issue of the possible arrival of inheritance tax was the first major taxi off the discussion ranks. “IHT is at the back of everyone's mind,” an expert commented. “But the bigger question is are structures available today that facilitate an efficient transfer of wealth between generations. The trust structure has been well used and will continue to facilitate efficient tax transfer or wealth transfers, but IHT has made people focus more on succession planning as well, for their businesses and their investible assets.”

He said all this is set within the wider picture of the globalisation of Indian families, with family members, home and investments dotted around the world. This raises many questions on the right structures, where to hold assets and how, obtaining foreign residence and visa rights, so on and so forth. “These are all difficult issues to address,” he said.

Accordingly, good advice and the right expertise is required to help people handle these matters, and compliantly, especially as India has foreign exchange regulations, it is not possible simply to send lots of funds abroad without the right procedures. a

Watch out and remediate older structures

Another expert observed that in the past structures tended to have more form than substance, but now the authorities are more alert to this and even looking back over many years in some instances.

“Increasingly, there are linkages between the agencies, and we have seen certain worrying cases of issues being raked up many years after the event,” he reported. “As Indian families look at succession planning, look at wealth enhancement, or wealth diversification, what we are also seeing is a lot of families coming to us with structures that are complex, at times convoluted, at times difficult to explain, and where we need to work with people like good lawyers, bankers, and others to try and correct what has happened, to try and put things at ease because the next generation may not have the capacity or the insight of what happened to handle all of the matters.”

He explained that with new regulations, for example the Black Money Act, there is rising fear that these regulations have really sharp teeth, and there is more likelihood of actually getting bitten.

“From a transparency perspective, getting the house in order is really vital, and revisiting past steps is important, so for man y wealthy clients there is a lot of need to work with global advisors on tax positions in different countries, on structures that have been adopted, on business incomes that are parked in different jurisdictions, on the whole succession planning edifice, and iron out any and all wrinkles. There are really serious implications for not doing so.”

You can run, but you can’t hide!

Another expert agreed. “You can run but you cannot hide, and what we've seen is that at least vis-à-vis taxes the ultra HNI may be absolutely fine paying off the taxes and, say, the penalty, but I guess what fears them the most is the prosecution notice which actually comes to them from the tax authority. The fear factor looms very large. Moreover, the exchange control regulations have always been somewhat left open to interpretation, and there could be many past actions questioned. And remember that if there is action taken here, it could dramatically impact someone’s ability to take up foreign residence, as they would have a black mark against their name. We have, for example, the Fugitive Economic Offenders Act to be wary of.”

Expert Opinion - Lee Woon Shiu, Managing Director & Regional Head of Wealth Planning Family Office & Insurance Solutions, DBS Private Banking: “When structuring trusts for Indian families, given prevailing tax rules that no investment control over the trust assets can be granted to Indian residents, the optionality of having the investment of the trust assets carried out by an independent Family Office with economic substance and management & control in Singapore is a highly attractive proposition for these families."

Expert Opinion - Neha Pathak, Senior Group Vice President, Head of Trust & Estate Planning, Motilal Oswal Private Wealth: “A majority of people earlier thought that the private family trusts are limited to the likes of industrialists. But by recognising the benefits of the family trusts, it is growing popularity amongst the wealthy Indians who are now looking at trust structures for a proper succession planning.”

A guest added that it is not only the big business families that are addressing many of these issues, but also successful CEOs, CFOs and directors who themselves see the need for creating family trusts for themselves and for their own next generations. “That is the next big thing,” he said, “as there are numerous of these professionals who need support for inheritance, tax planning and for ringfencing their assets against any problems, and also seeking future healthcare and retirement planning professionalism.”

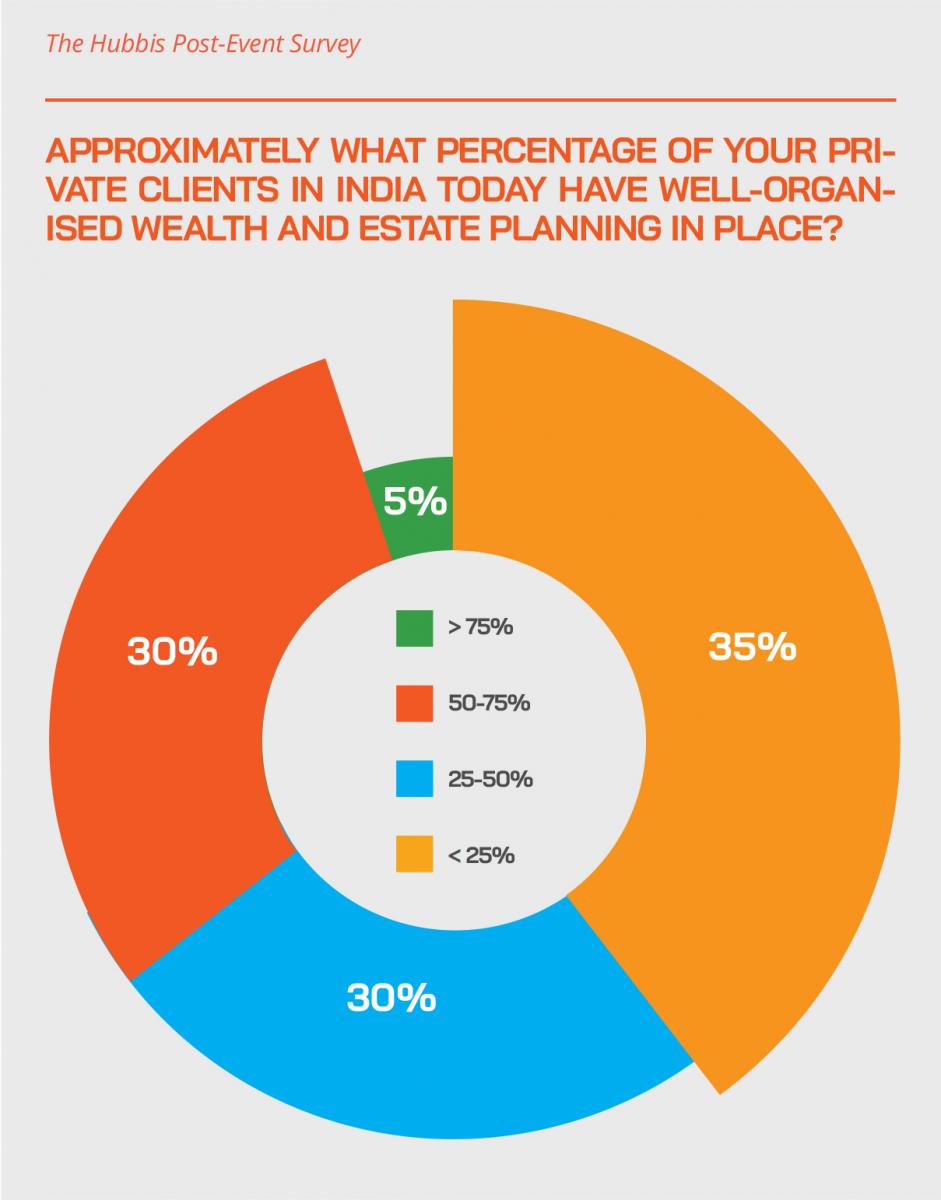

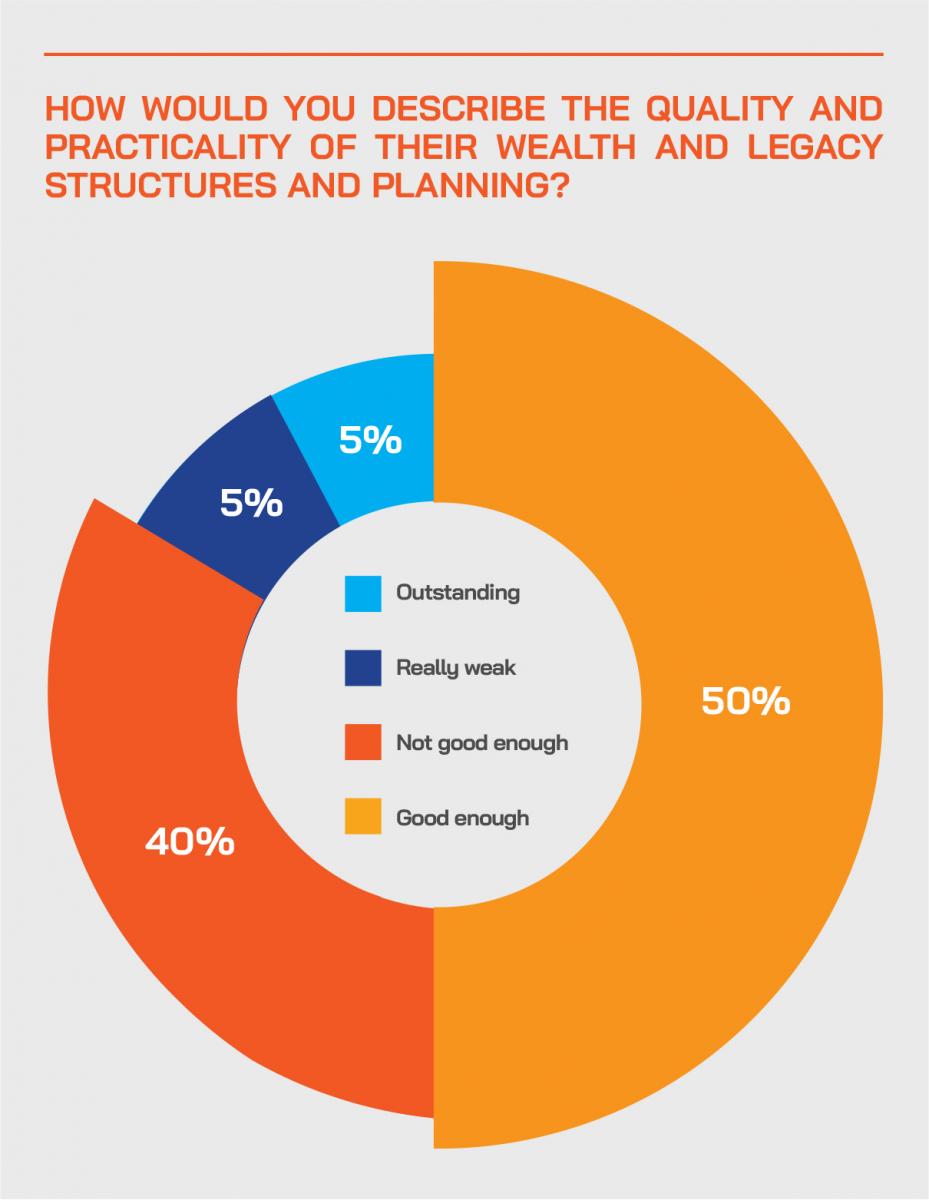

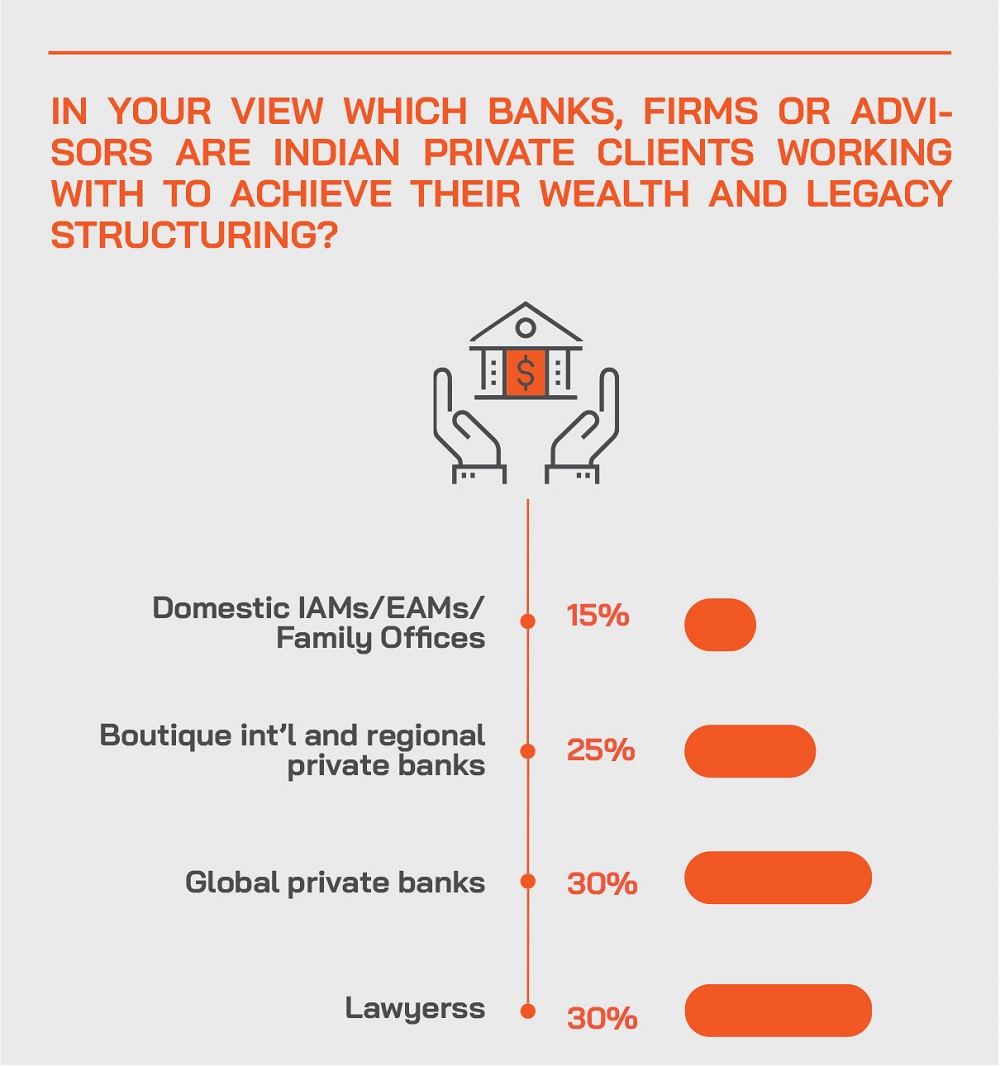

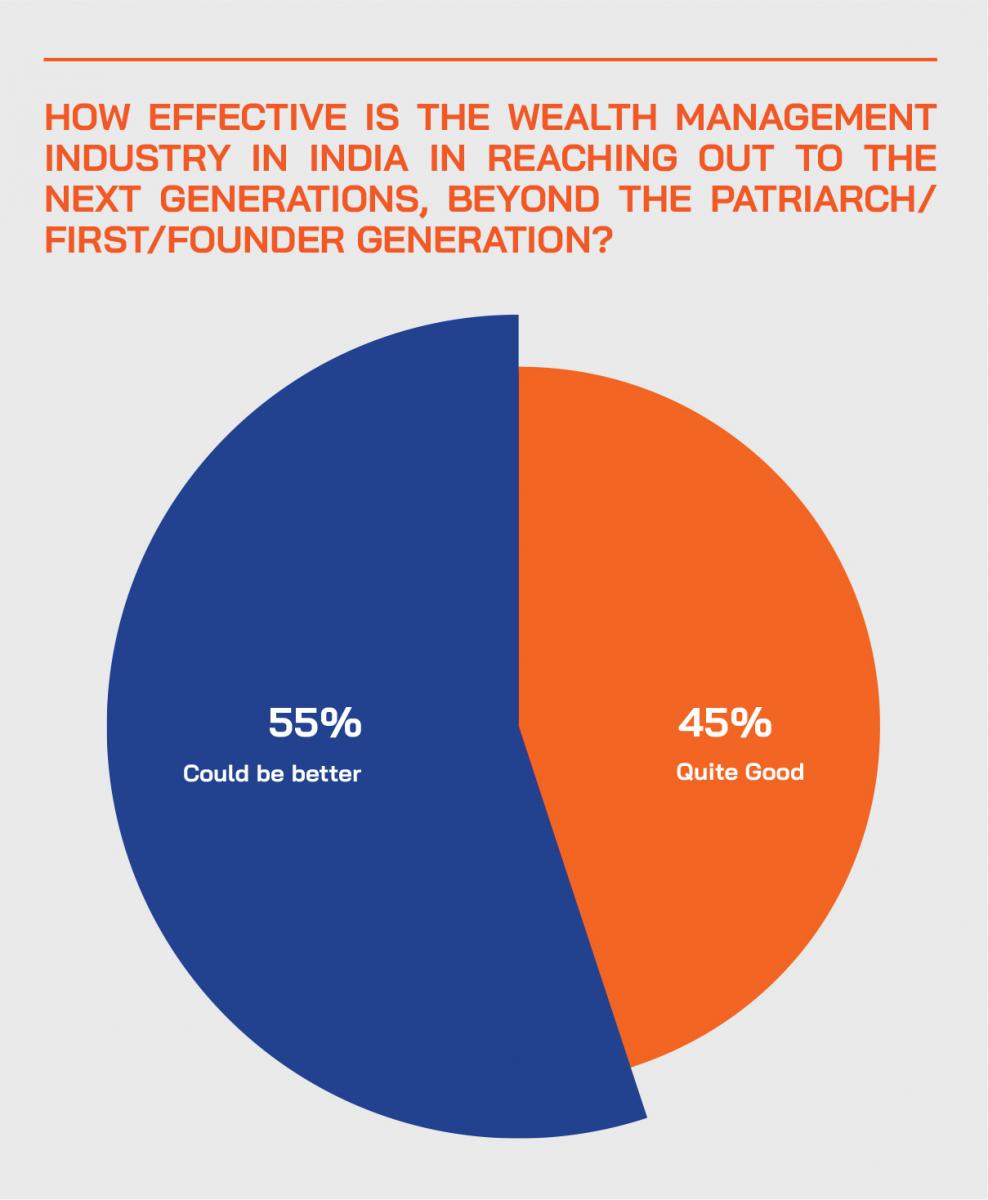

The Hubbis Post-Event Survey

Do you think there is a much more active drive nowadays towards professional wealth, legacy and succession planning amongst private clients in India? Why, or why not?

- Yes, with the growing affluence and more offerings from the bank to this segment of clients.

- Yes. The global pandemic has really shone a spotlight on mortality, risk and understanding that things can go wrong. Private clients are now more willing to engage in and have some of the difficult and sensitive discussions.

- Yes, many clients are at the stage of their lives where they are considering how best to pass on their assets to the next generation and this has been accelerated by the covid situation, which has given time and forces a lot of families to slow down and think about these difficult issues. Global changes, regulatory and tax wise, is also making clients more active in seeking professional advice and as such, they become more aware of these planning issues. This is also helped by a more educated younger generation, who may be nudging the older generation to plan and also thinking about planning for themselves.

- Yes, there seems to be more active drive these days towards professional wealth, legacy and succession planning amongst private clients in India based on the discussions of today's speakers that even if the G1 members may deem it inauspicious to be discussing estate and succession planning matters, certainly, the G2s who are more affluent, having been educated abroad, wish to establish asset protection structures and plans for their next generation.

- Yes, certainly in the NRI segment in UAE, where we work.

- Yes, I do, I think this is a worldwide trend, and the pandemic has just fast-forwarded things. The regulatory environment adds to the uncertainty and the urgent need to plan.

- Yes, exacerbated because many of the Indian clients have relatives who have moved offshore, or 2nd generation who are living or planning to live overseas.

- Yes, because more and more next generations are taking over the role of their parents to manage the company or the wealth of the company.

Which jurisdictions in the region or worldwide are benefiting most from these trends, and briefly why?

- Worldwide, as wealthy Indians are spread out, living and working around the world.

- Countries with good regulatory and tax systems would draw a lot of these families to consider parking themselves or their assets in these countries. Countries which offer alternative residency or citizenship programs would also draw a fair share of interest going forward as the world moves into global tax transparency.

- Singapore stands out as an important jurisdiction for Indian families wishing to establish businesses here, e.g., business inversion plans to divert certain businesses from India to Singapore from a tax perspective (as there are tax incentives which are attractive for Indian businesses in Singapore) and also, in the process they may be able to obtain PRs, for example under the Global Investor Program administered by the Economic Development Board.

- Singapore to a large extent for family businesses because of their 13 X/R tax incentive schemes and PR offering. And other countries like Canada and Portugal because of their alluring immigration schemes.

- Politically stable jurisdictions with clear laws and legal precedents as to the use of structures or arrangements that are used in succession planning will benefit.

- Singapore, due to both proximity and also culture.

With improving regulation and a more sophisticated and comprehensive wealth management ecosystem, are more of India’s HNW and UHNW investors moving more money back into India, or is more going offshore? Why?

- Perhaps more offshore at this stage in my opinion as there are greater offerings from international banks to make better and more diversified investments. monies.

- A mix of both.

- More heading offshore.

- We see more staying onshore, where they are familiar with companies and opportunities, and where the markets have performed so well.

- We see more of the younger generation are moving money offshore while some of the older generation who still have strong ties with India are more domestically focused, or even considering bringing money back onshore.

- We see this as a 2-way flow. For Indian families who wish to globalize their operations for optimum tax efficiency and having an alternative place of residence/domicile, they will be moving funds offshore to jurisdictions like Singapore (e.g., setting up NBFC to remit funds to Singapore and managed by a licensed Fund Manager approved by MAS) and equally, for those Indians who have businesses and are tax resident in Middle East, they are also moving funds back to India where they may also have operations back home.

- More going offshore. As discussed by the panellists today, it is more of a lifestyle choice than anything else.

- I think the trend is still to keep money offshore (not due to the wealth management

- capabilities in India but more due to the other uncertainties - political, regulatory, economic). Nowadays, this is being done in a much more compliant way now given the increased need for transparency and regulatory vigilance.

- We see a lot moving into India because the ecosystem is increasingly sophisticated and there is improving risk management available onshore.

- Offshore, due to security and wealth diversification.

What are the trends you are seeing around residency and citizenship planning for wealthy Indians?

- They are seeking safety in foreign shores.

- Many like the UK for safety both in health and legal processes.

- Many families would have next generation family members with links to the US or UK, hence planning for future generation needs to take that into consideration. Some families are also seeking alternative citizenships - while Singapore is a popular choice, it has a relatively high bar to hurdle, hence some families would also consider other countries with more attractive and lower cost programmes.

- Wealthy Indians are looking to obtaining PRs or residency in Europe, places such as Greece, Portugal or Malta, so that their next generation children could easily go to higher institutions of learning in the European cities. They see this as a good option for their future generation to potentially enjoy preferential school fees enjoyed by residents as opposed to higher fees which are imposed on foreigners.

- Many clients are looking to move to the UAE, for a better lifestyle and setting up foundations for their succession needs, as well as for tax efficiency.

- There is lots of interest in looking at alternative residency, but not citizenship, as dual passports are still not allowed in India and giving up citizenship is still a major challenge.

In your view what needs to happen to boost the success of the India’s NHW and UHNW wealth, estate and legacy planning offering in the years ahead?

- Greater transparency and more international names onshore to provide a better network and elevated offerings for NHW and UHNW clients.

- Improved transparency and clearer regulations.

- Global regulatory and tax changes have already started the wave of pushing families to seek out professional advice and plan actively for succession. It will be helped further with greater access to competent advisors and the use of digital technology which can bring a host of advisors together to advise a client remotely.

- Access to professional advice and expertise in the areas of tax, law and the regulatory framework so that these can incentivise them to engage in estate and legacy planning for HNW and UHNW families.

- Clearer interpretation of laws and applicability especially in case of offshore arrangements (whether by way of trust/insurance), ore liberalisation and greater clarity on Indian foreign exchange regulations.

The Case for Investment Migration

The discussion also centred on investment migration, as there are many wealthy individuals and families in India who want to be temporarily or permanently residence in other locations once they have made their wealth.

An investment migration expert explained how active they had been in India, and where today they have eight team members in situ. “India historically has been a great place for wealth creation, but now families are looking outwards from a wealth preservation point of view and as a result of that, there is a rise of a more transnational and cosmopolitan mindset. Indians are keen to diversify their wealth offshore, and that is a key driver for our services,” he reported.

He explained that historically, people physically wanted to move to other jurisdictions, but that has completely changed. Now, families are looking to acquire an alternative residence largely to build resilience in what is considered a volatile macro environment. And whereas they were US-centric, they are now much more diverse as to countries of preference. “Families are realising that getting an alternative residence could also open a lot more options for their children from a mobility point of view,” he said. “And this is also a plan-B to hedge sovereign risk.”

And as to tax, he reported that most of the European jurisdictions have something called resident non-domiciled taxation, allowing most families they work with to live in India, to continue to be Indian tax residents, freeing up their key motivation to principally give their children another option for the future, whether Portugal, Greece, Malta, or another jurisdiction.

Another reason is the incredible cost of real estate in the big cities in India, such as Mumbai, Bangalore, Chennai. In European countries, there are options that are far cheaper, and come with additional benefits of residence in that country.

This same expert explained that they ratcheted up their India operation from 2018 onwards, and work closely with the wealth management community, many of whom are speaking regularly to HNW and UHNW clients. “Most of our business in India is institutional, we work with top law firms, we work with private banks, we work with family offices, and that's how we go about developing our business on ground in India,” he reported.

The need to understand the clients

Another expert observed that it is essential to properly understand the clients and their objectives when it comes to their overseas residency ambitions. “That families are even thinking about the entire succession planning protocol, I would say, is a big change,” he reported. “Perhaps 10 years ago, we would never have had a conference on a topic like this. A lot of families considered it a bad omen to really talk about transmission of assets and one’s demise. But things have changed rapidly, opening up a lot of dialogue and opportunities.”

Keen interest from NRIs in the UAE

A guest reported how they had garnered a lot of interest from Indian families who are based in Middle East, citing a tax tiebreaker rule announced between the UAE and India as a result of which a lot of very wealthy Indian entrepreneurs who are based outside of India with limited ties to India are considering the citizenship by investment option, because they just want to hedge against anything radical from a taxation point of view that may come through on the basis of citizenship, for example, as the US taxes you on the basis of citizenship.

“If India wants to do that,” they observed, “then obviously these people want to have a plan in place. And as a result of that, we're seeing a lot of interest from wealthy Indian families who are based in the Middle East. So, that would be another market that as a business we're really focused on.”

Other key programmes that are popular are Portugal, Greece, both for residence by investment. The Australian Global Talent Independent Visa, which is catering to high calibre Indian tech entrepreneurs who are willing to take their businesses global, has been popular, allowing people to obtain an Australian PR in some three to six months. “Those are the three most important programmes for onshore clients, but as I said, for non-resident Indians, they tend to be more receptive to the citizenship concept.”

Get the right advice, be smart

A guest advised that in all cases it is sensible to really mine down into the tax and other implications, hiring the best experts wherever possible and making sure that all the nuances are addressed properly.

“The due diligence standards for these programmes have become exceptionally rigorous,” a panellist also warned, “so be aware that there is a multi-layered process that everybody has to go through before they acquire citizenship or residency anywhere in the world. If you have any negative flags, there's no way we can work with you, and many of these countries are being really careful, employing multiple agencies to do these background verification reports before a citizenship is awarded. There is today a lot of pressure on these governments to ensure their due diligence standards are up to mark, it has become far, far tighter over the last five years.”

Reaping the rewards

But there are great advantages if successful. They cited a variety of examples of families having obtained residence and citizenship in Europe, with their children dotted happily around the EU for education, often free, and for other reasons. “Just to add,” this expert said, “if you are an international student in university, you're paying four times of a local student in most jurisdictions, but you get a PR from a certain jurisdiction, and now you're paying the same student fee as the locals are. So, it can also make a huge difference if you're planning your children to be educated abroad. That's a major appeal.”

And then there is pure lifestyle. One family for example are heavily into yachting and they decided to get a residency in Malta, which is a major yachting mecca. Lifestyle is extremely important to these families as well; it is not all about tax, or education, or even the Plan B, as many decide that they simply prefer being in another jurisdiction to enjoy their lives, and they can afford the tolls required.

Singapore as a family office centre

An expert extended the migration discussion to the potential for UHNW families to open a family office in Singapore, explaining that the jurisdiction has a host of welcoming corporate and trust entities and government incentives, including an inviting low tax environment.

“With the right advice from ourselves and fellow professionals, we can organise the best structures,” he reported, “tailored to the client needs. And Singapore also offers an appealing residence for individuals and families, with the Economic Development Board receptive to the right people and families and offering appealing incentives.”

He reported that people are quite surprised, as the EDB has extended its plans and its programmes for next gen UHNW families, so for some of them they do not even have to own the shares of the business themselves as long as they can demonstrate that they were part of the C-suite of the family business, or they are on the board of directors and their immediate family owned 30% of the equity of the business.

Assemble a team of experts

This expert then offered some practical advice as to how the application process might develop, some of the technical hurdles, for example remittance of funds from India to Singapore, and the typical time horizons to consider. Some families, he reported, go the route of effectively shifting their businesses to Singapore, which is relatively easier for example for high tech. He called this process the inversion of the business, with Singapore becoming the HQ rather than India and that HQ obtaining favourable tax status (13R and 13X) and serving as the vehicle to allow the family the incentives and immigration green lights for their family members.

If a family brings in or builds investment assets of more than SGD200 million, they can apply for the Singapore EDB’ Global Investor Programme, allowing them to apply for immediate permanent residency.

He also called on clients to obtain the right advice, both in India and in their target jurisdiction, for example Singapore, cautioning that without assembling the right level of expert professional advice, the right bankers and other parties, they risk poor decisions, the wrong steps, and potentially stuttering applications.

Life solutions

The discussion shifted to life insurance solutions and their role in estate, legacy and succession planning.

An expert from a Swiss-based insurance distribution specialist explained that their mission is effectively the business of structuring, helping wealthy individuals and wealthy families structure their assets, and structure their businesses in a manner where there is high degree of asset protection, there is tax optimisation, there is succession or estate planning, sufficient liquidity available at times of potential stress, and so forth.

“We help families create structures, which could be a combination of trusts, foundations, depending on common law or civil law, and insurance and passive investment companies,” he reported.

He explained that most wealthy clients have similar problems, and that life solutions have been a vital or integral cog in the wheel for many wealthy Indian clients. “It started before as more savings based but is now more coverage for liquidity in the event of a demise, so that the gap to the family members and next generations is covered, including potentially the transfer of business from one generation to another. “Premium financing at extremely low rates today adds to the package,” he reported.

PPLI in the spotlight

As to the products in favour, he explained that Indexed Universal Life with premium financing was popular, and more and more clients are taking or considering private placement life insurance (PPLI) and Variable Universal Life (VUL). He briefly elaborated on some of the key appeals of PPLI, which he described as a very bespoke product, specifically designed for the client’s requirement, and excellent for coverage of globally diversified Indian families, with estate duties in different countries all covered potentially within a structure, along with other risk mitigations that could be incorporated, if assembled properly.

He explained that PPLI has been around for more than 60 years, and was a product invented in the US around the time when the Controlled Foreign Corporate rules were introduced. “It has been very popular in the US and Europe, but less so in Asia,” he reported. “That's something that we're trying to change. We are one of the largest distributors of PPLI. As I said, it is a very bespoke situation, it typically works well in high tax jurisdictions or across jurisdictions, so, for example, a client moving from the UK to the US, the moment he goes to the US, he's going to be taxed on his worldwide income, so how do you shelter his income outside the US from taxes in the US.”

Or perhaps a NRI family based in the UAE, who might have homes and residence around the world, and PPLI can be structured to help mitigate tax exposures in those other jurisdictions. “PPLI is very tailored and bespoke,” he elucidated. “You can decide what you want to put in it, it could be bankable assets, it could be non-bankable assets, you decide who's the asset manager.”

The discussion closed with the panel agreeing that the Indian estate and wealth structuring market had advanced in leaps and bounds, and that given the highly global nature of many Indian resident and non-resident families, as well as their sheer numbers, the potential for the wealth and advisory community is genuinely remarkable.