Wealth Solutions & Wealth Planning

Wealth Advisory Services Expert Yann Mrazek Highlights the UAE’s Rising Global Prominence

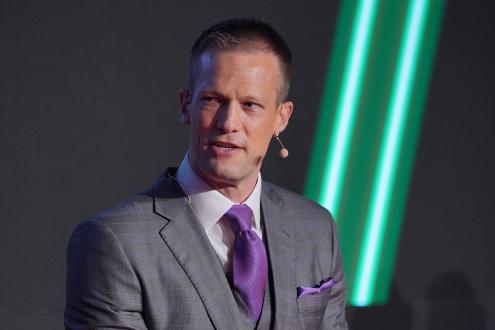

Yann Mrazek of M/HQ

Feb 13, 2023

Yann Mrazek, Managing Partner at UAE multi-services advisory firm M/HQ is a keen and consistent proponent of more professionalised succession and legacy planning amongst the GCC’s wealthy private clients and their families. Hubbis met with him recently in Dubai to hear his latest perspectives on the evolution of wealth and estate planning and structuring in the region, and to learn of the progress around foundations, which had quite recently been introduced in the UAE when we last interview him in 2020 during the dark days of lockdowns. His basic premise is highly encouraging- that Dubai has gradually upgraded itself from a third-tier financial centre to a tier one financial centre, and the UAE has become a top 10 FDI destination, and all since the 2008 global financial crisis struck.

“The UAE has successfully positioned itself among what we call the top five super jurisdictions globally, all Common Law Centres, and comprising the US, the UK, Hong Kong, Singapore, and now the UAE,” Yann reports, with genuine enthusiasm about the region, his home since 2005 and where he and his wife have raised their two children, now aged 14 and 12

He observes that the pandemic helped accelerate this rise, with HNW and UHNW individuals and families drawn to the region due to the perceived safety, common sense regulations and pragmatism, its time zone, its infrastructure and facilities, the lifestyle, and also the improving financial sector and professional services ecosystem.

A compelling story

“Today, this confluence of appeals and the overall quality of the proposition is so compelling that people not only come here, but stay here,” Yann says. “And more and more of them are organising their financial affairs and managing their wealth from here, which 10 to 15 years ago was quite rare. We see more single- and multi-family offices, either to complement their other offices elsewhere, or as standalone entities. These are exciting times for us all here.”

A virtuous circle of growth

Additionally, there is a vibrant real estate market with a lot of high-quality stock at what remain quite reasonable prices compared to major European centres. “

The ability of a small rich country to apply the right policies means more and more HNW and UHNW wealth is coming here, and staying here,” he reports. “That creates further momentum, as these families invest both here and from here, and they can manage their global businesses and wealth from this incredibly sane, safe and attractive hub.”

Yann explains that M/HQ positions itself as a leader in the family holding company and family office space. The firm is licensed in both the DIFC and ADGM.

Solving issues for HNW and UHNW clients

“M/HQ offers a multi-services platform catering first and foremost to successful individuals and their families,” he reports. “We offer a unique access to integrated corporate, tax and legal services, so whatever the complexity of the situation faced by our clients, we aim to provide them with simple, practical yet innovative solutions. We are a private wealth platform that can execute, or we can outsource our services to single- and multi-family offices; but we are not investment managers, all of which makes us rather unique.”

Yann explains that regulations across the world have become more consistent, with less variation to distinguish between different centres.

“It is all a much more level playing field today whether you are in Singapore, Dubai or London, and as so much new and serious wealth is coming here, it is a great place to come, and of course it is set within an incredibly dynamic region that is evolving rapidly in so many ways.”

Big steps ahead

Yann comments that the next phase for the region will be to improve the quality of existing domestic custody solutions and increase the range of players in the field, whereas much of the custody, especially for offshore assets, is presently conducted outside the region.

Yann also notes that Dubai has a stated ambition to become one of the top four financial centres in the world by 2030. “I think it is a realistic objective and that they are on track to achieving that goal,” he states.

Key Priorities

Commenting on his key objectives for the coming few years, Yann says that work began in 2021/2022 on building the firm’s capabilities and reputation in the single and multi-family office markets.

“We want to be known as the go-to firm for family holding companies, single family offices, and multi-family offices, and we want to increase our market penetration amongst local families in both Dubai, where we are already strong and Abu Dhabi, where we need to build further but have been present for five plus years,” he reports. “And we want to expand our business into Saudi Arabia, where we see lots of encouraging and interesting developments.”

Wind in the UAE’s sails

Looking to the future, Yann explains that although there is a new corporate tax coming through, due to pressure from major jurisdictions, this is only for those businesses that actually operate there, whereas businesses that operate through the UAE but for international assets and business can apply for exemptions. “You will still have the ability to claim to be working and operating in a fully legitimate manner but out of a zero-tax centre, and nobody can then imply you are operating in a non-regulated jurisdiction. This is actually a high-regulation jurisdiction that has a tax regime that allows for exemptions.”

He says the whole trust regime and ecosystem has advanced markedly, and he also anticipates continued growth in demand for foundations, which were introduced from 2017 onwards, and which have caught the attention of local and international UHNW families.

He reports that close to 700 private foundations are now in place in the UAE alone, and another 250 are likely to be created in 2023 across the DIFC, the ADGM and in the RAK International Corporate Centre.

“The foundation is a very important element as part of the expanding wealth, legacy and succession planning activity here,” he reports. “The foundation is so popular as it is a registered vehicle, remarkably close in spirit to a trust, but technically looking more like a company. Foundations have many advantages for estate and legacy planning for wealthy families in the region and those UHHNW families setting up offices or residence here. Moreover, they have also proved efficient for both Muslims and non-Muslims.”

Yann says he is also looking forward to more flexible family holding company regime, including an anticipated revamp of the DIFC single-family office offering. “And as I mentioned, the next frontier is domestic custody, to rival other tier 1 centre in quality,” he predicts. “If more assets can be held in custody in the region, which will be a positive step, even if it takes time to build a sufficiently deep range of institutions leading the way. It is one of the priorities of the government in terms of bulking up the financial sector here.”

Riding the wave

His final word is that the independent wealth management ecosystem has been expanding for some years and that it is already fairly diverse and increasingly high-quality offering.

“Today, you see established firms that have a presence in Switzerland, or Singapore all of a sudden coming here because they realise that some of their clients are moving here, and they see the growth taking place,” he says. “There is great momentum in the EAM market. Operating a sister firm - Re/think - focused on entry to market for and ongoing support to regulated entities and EAMs in particular, we are ideally placed to work both in support of, or alongside the banks and major institutions and the increasingly diverse range of EAMs.”

Managing Partner at M/HQ

More from Yann Mrazek, M/HQ

Latest Articles