Publications & Thought Leadership

Vietnam’s Dynamic and Growing Wealth Management Market – The Journey has Just Begun

Aug 4, 2021

Albeit from a modest base, Vietnam looks set to eventually become a rising wealth management market star in Southeast Asia. It will take time and patience on behalf of the incumbents and the newer players who will be attracted to compete there, but with years of robust economic growth already and an incredibly industrious population of over 100 million, it will happen. Indeed, Vietnam’s wealth management market is growing, encouraged by regulatory changes, the increasing expertise and drive of local professionals, rising private wealth across all segments, retail banks and securities firms upgrading and enhancing their platforms and propositions, and the fledgling asset management industry slowly developing new investment options. All these developments are bringing diversity and opportunity as Vietnam’s private clients – from mass affluent to UHNWIs - demand more variety and more sophisticated solutions. But where exactly is the market today, where has it come from, and where is it heading and at what pace?

PANEL MEMBERS

- Hanh Luong Thi My, Head of Domestic Asset Mangement, Dragon Capital

- Thomas Tse, Presales Consultant, InvestCloud

- Hang Le Thi Le, Chief Executive Officer, SSI Asset Management

- Gauraw Srivastava, Head of Affluent Banking & Wealth Management, VPBank

- Eric Levinson, Deputy Managing Director, Head of Business Development, VinaCapital

The consensus amongst the experts was one of measured optimism, aligned with realism that Vietnam’s wealth market still has many years of catching up to nearby countries such as Thailand. Building a sustainable wealth management business in any country, especially one that is today considered a frontier market on its way to becoming an emerging market, is challenging. It means drawing together the optimal range of products and services, building teams and expertise, defining and executing strategies that work for the market, then achieving outstanding delivery and enhancing the user experience. These challenges, and numerous others, are never easy to overcome. But in a country of nearly 100 million people and with investors numbering just around 3% of those people, the upside is truly colossal.

Key Observations from the Panel of Experts

Vietnam’s wealth market is very young, but with immense potential and an accelerating pace of development

Where is Vietnam today? Four decades, perhaps more behind Malaysia in terms of its financial markets, perhaps more. Three decades behind Thailand. But as we all know, the pace of development accelerates, year on year, so it will not take the country those decades to catch up. Look at China, which in the past two decades has caught up with the rest of Asia and steamed ahead.

The pandemic has quickened the pace of digitisation of wealth management

Far from stopping the market’s evolution dead in its tracks, the pandemic has in some ways been speeding up the adoption of wealth management as providers have accelerated the digital delivery of wealth management. Conventionally, wealth management is, of course, a person-to-person business but as one banker explained, the industry has adapted well and managed to encourage rapid internal and client adoption of the new rules of engagement. Moreover, the providers are able to act more rapidly, with roadblocks therefore becoming more facilitators for the business.

Rates down, equity and other risk assets up

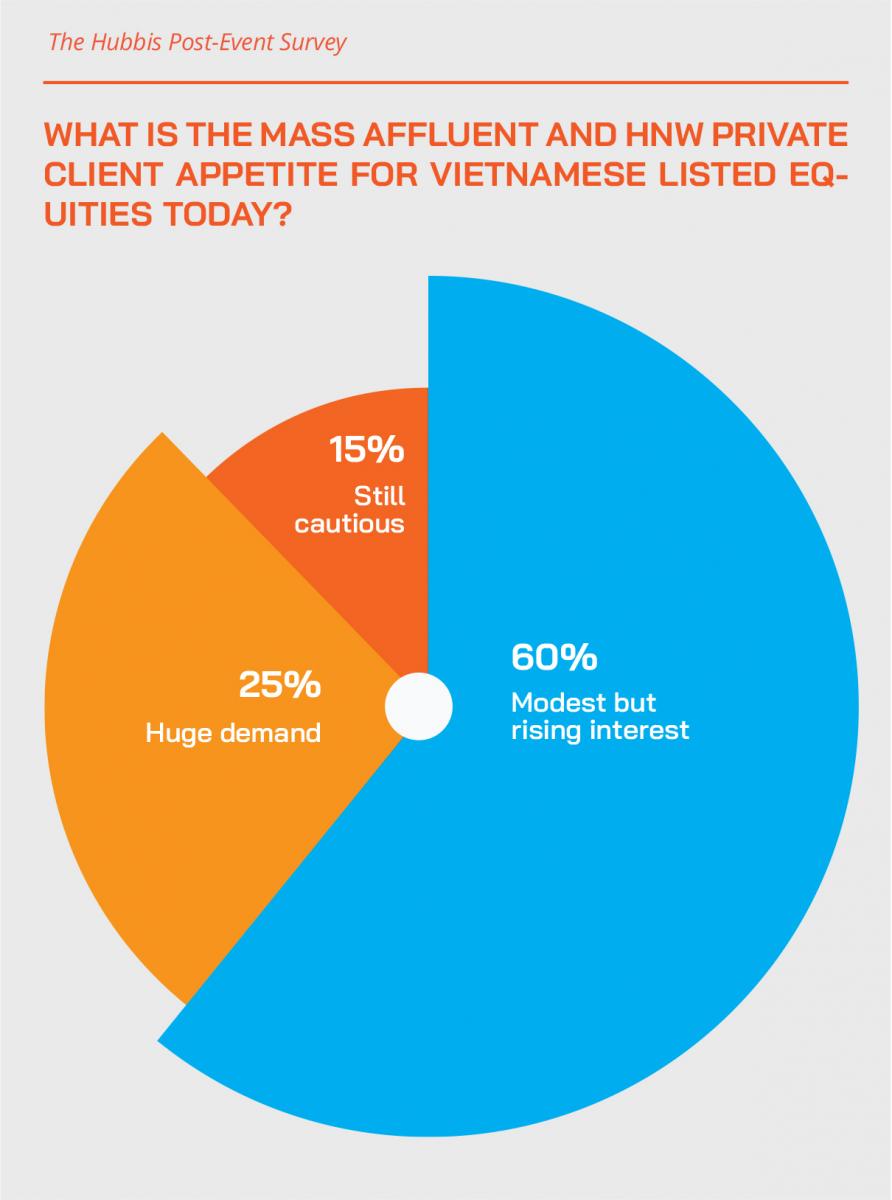

Declining interest rates, albeit coming down from a healthy level compared to global norms these days, have been a catalyst for increased investment activity in equities and also to some extent fixed income, although opportunities are limited in both, especially debt. Falling rates have been a good door opener to conversations with clients, with clients considerably more willing to look at options to enhance their portfolio yield.

Another guest offered delegates her views on investment and financial market trends, remarking that with the local interest rate and bank deposit rates heading downwards since 2020, the capital markets have naturally become a much more attractive alternative investment for most Vietnamese investors. They explained that Vietnamese investors had long placed surplus funds in deposits as bank rates have been appealing, but with the draw of the performance as well in the stock and bond markets, demand for both equities and fixed income is on the rise, with much of the buying through funds.

“That is why we saw some 500000 new accounts opened in the first six months, bring the total to nearer 3.5 million trading accounts today,” she noted. “However, with a population of nearly 100 million, that is still a rather low penetration rate, so the potential is still very great.” Trading volumes, she noted, are driven by retail buyers, who account for almost 85% of daily activity.

To meet client demands and expectations, deliver new ideas and personalisation

A banker explained that for the wealthier clients – and there are many more year on year – they are international in perspective already, but the mission remains to help them become more comfortable with a portfolio approach to their investments. The other types of customers in Vietnam reflect the demographics of Vietnam, an extremely young country with an average age 32 years, with rising wealth and increasing ambition in the Millennial segment. This banker explained that for this customer, they tend to start smaller and build their wealth and investment planning and activities over time. But this second category will be truly significant customers in the future.

Vietnam presents an excellent investment opportunity for foreign investors

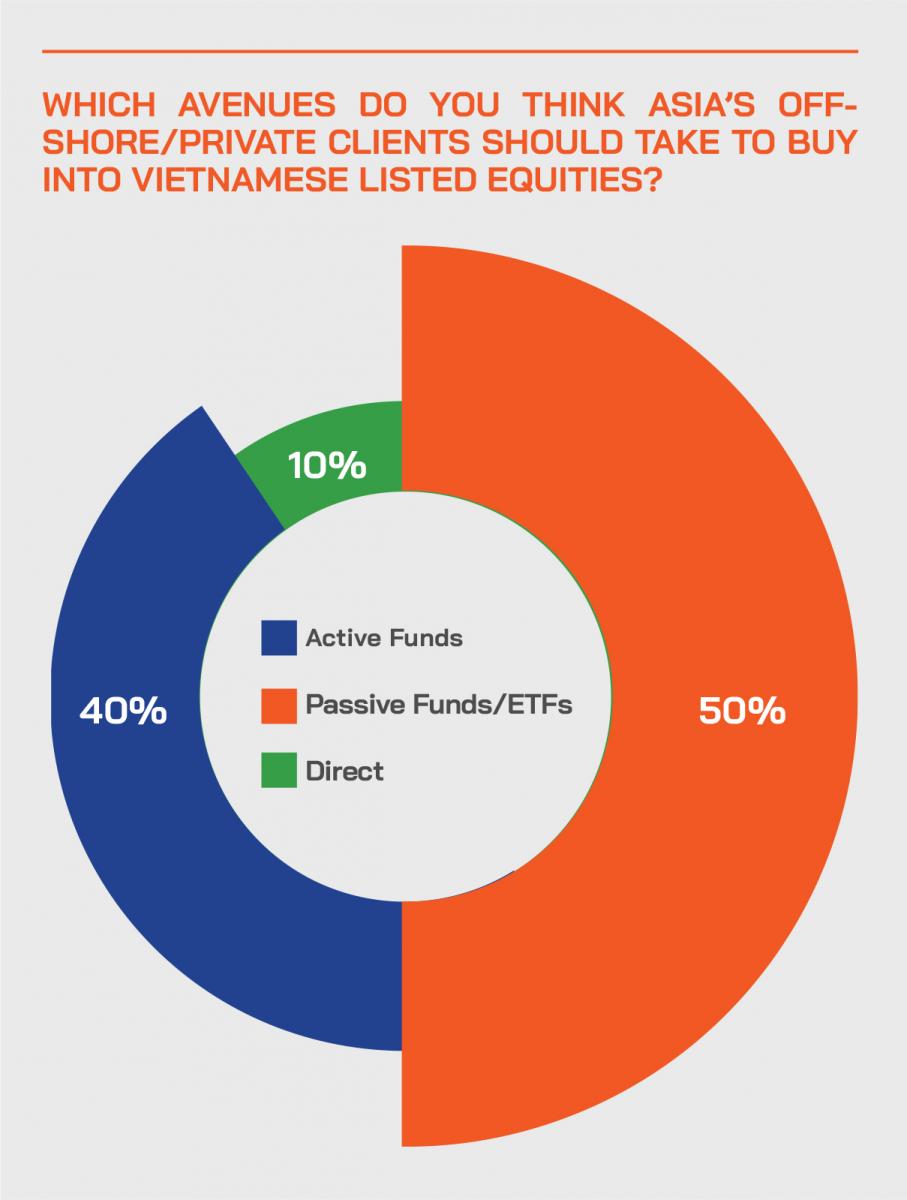

A panellist pointed to the growing array of active and passive funds through which foreign investors can – and he thinks should – access Vietnam’s expanding financial markets, which have performed especially well since the nadir of 2020. Although Vietnam has been hit hard by the 4th wave of the virus in June/July, he believes the government retains robust control of the pandemic and the economy will rebound. In fact, the economy has performed surprisingly well throughout the pandemic, he noted. As to the markets, those had retraced modestly in July, but have performed especially well in 2021 and he advised against trying to time entry and exit, but instead focus on the underlying companies and sectors and look medium to long-term.

One guest reported that as a major ETF provider in Vietnam, they have been seeing the most demand for equity ETFs from foreign institutional buyers, who are choosing ETFs as an ideal conduit into markets such as Vietnam in which they are short of the necessary information to make their own direct investments.

Moreover, she reported that as local ETFs are considered local investors, foreign investors do not come up against foreign investor limits.

In nascent markets, education of the client base and nurturing their confidence are essential

An expert noted that as the stock market is roughly two decades plus young, and investors need a lot more education and handholding to encourage them to invest in more risk assets, take a longer-term view and build portfolios rather than invest in an ad hoc fashion. It is not only education of the clients, but also of the wealth ecosystem’s partners, enhancing the skills of the RMs, building out broader knowledge and trying to encourage a buy and hold and re-allocation approach, rather than seeing investors trying to time their entries and exits, which as we all know is generally a poor approach.

“I'm very optimistic that with the partners we have on this call,” this expert commented, “and the more banks that are becoming part of the wealth management space, our business will grow significantly less in the next couple of years, and education will really be key to driving it forward.”

He added that, for now, growth in AUM for many leading players from such a low base is dramatic in the industry – in the 100s of percentage growth annual, but the industry needs to ensure it is a steady and quality ship that can weather the different seas in the future. Another expert reported that the AUM of mutual funds had risen from USD2 billion equivalent to more than USD5 billion in the past year.

Another expert agreed, remarking that training is absolutely critical to the market’s development. “We offer training to our partners, to the RMs, we offer the training to our clients, so they could understand more about the pension funds, for example, or mutual funds or ETFs, we also partner with some media, we focus on financial literacy, financial planning to help people to understand about spending, savings, investments, and so forth. In Vietnam, 70% of people have savings, but only 30% understand anything about financial planning. That's the reason why we put most of our focus on investor education, through different channels and different partners.”

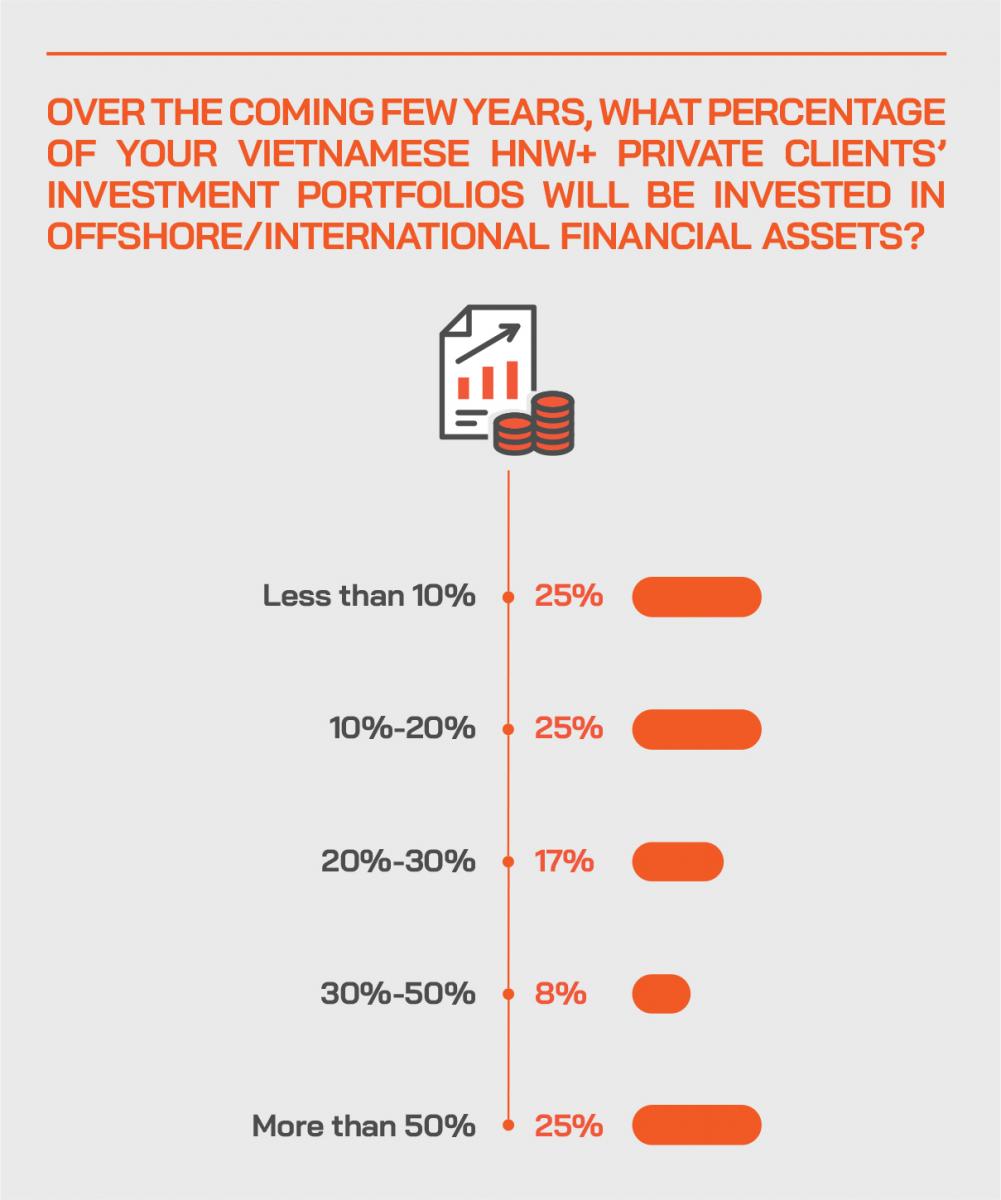

Regulation does not yet permit foreign investment, but there are gradual shifts

Vietnam is a captive market for domestic investors and the regulators are very gradually helping increase the range of domestic investment options, with more equity funds or bond funds, more balanced funds, more access to direct investing, and so forth. But easy direct onshore to offshore access to global capital markets is not a prospect on the horizon as yet. However, in 2020 the regulator permitted 20% of mutual fund assets to be allocated to offshore investments for the first time. “Demand for international investments is high, especially amongst HNW and UHNW clients,” an expert remarked, “so this is a positive step.”

Private pensions – very early days but great prospects ahead

A guest reported that their firm is the first to obtain a pension fund license in the country and was actively promoting them to corporate clients for their staff. There is a desperate need for private pensions and rising wages, and with a rapidly expanding corporate sector, the potential is immense. The first moves by the government are modest to date – tax exemption is only USD200 per month and allocations to fixed income (government bonds) and equity are conservative by international standards, understandably. “Things will change gradually,” this expert observed, “but not yet. Later, the government will open the door wider and loosen the regulation for more players in the market and to offer a broader proposition for the Vietnamese people.”

The nascent ETF market offers exciting growth ahead

ETFs are ideal vehicles for domestic investors and of course for foreign buyers, and there are more such funds each year, with most of the demand coming from offshore, using ETFs as conduits into the country.

“We have actually seen a huge movement into fixed income by retail investors, especially the older clients, as yields on fixed-income funds are superior to deposits,” one expert reported. “This trend has been continuing since last year, with some of the money flowing into fixed income ETFs.” But she explained that most of the buying into their own ETFs were from foreign institutional buyers, with far less demand from local investors.

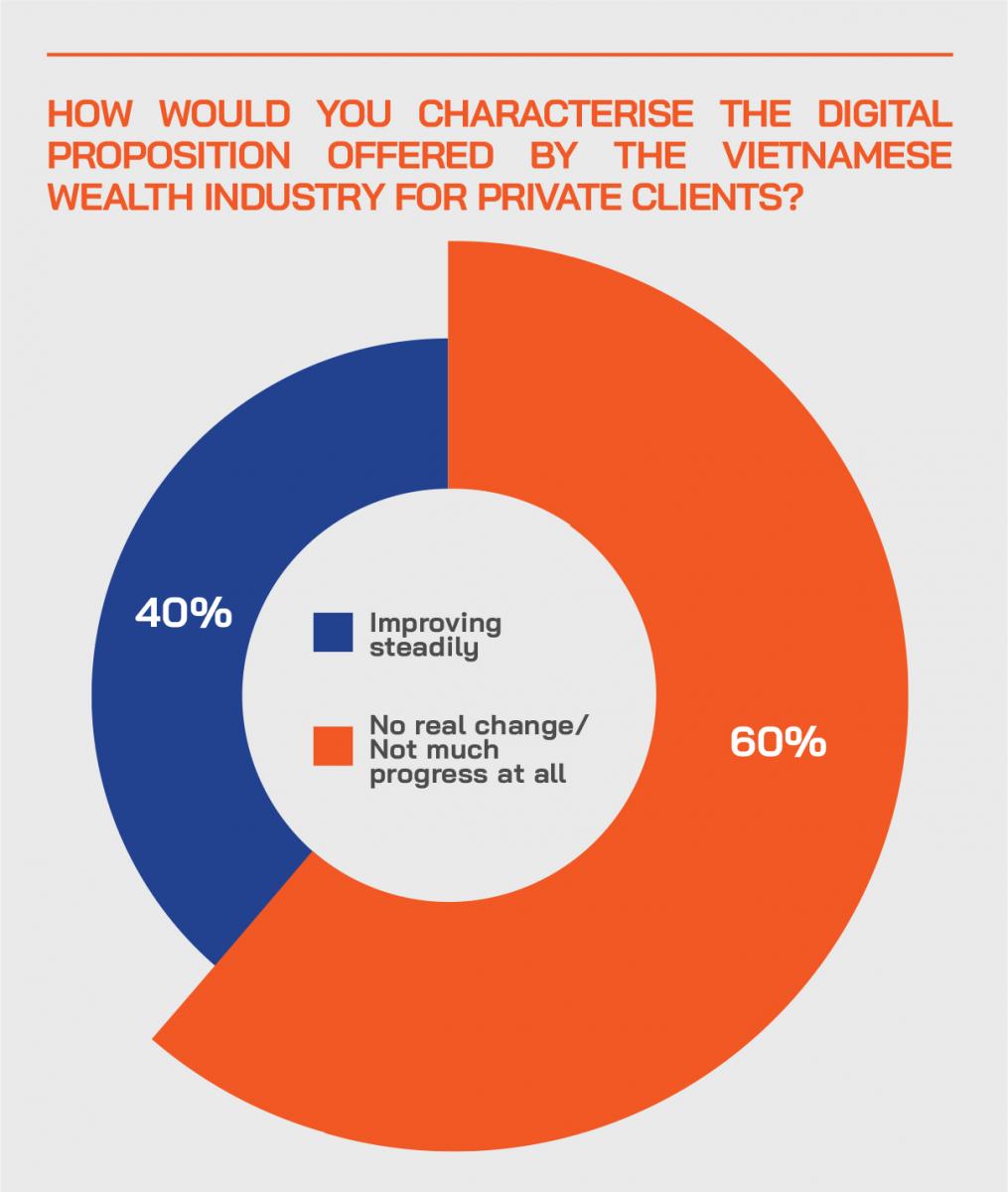

Digital days ahead as Vietnam’s financial sector and wealth market enhances capabilities

An expert explained how valuable it is to create true digital front to back wealth management platforms for providers to boost their capabilities and for clients to enjoy a dramatically enhanced experience. He explained that Vietnam is very early in the evolution of its wealth market, but that their firm likes to work with local partners and others to build out the understanding of the opportunities and solutions. He explained that they work extensively across the region, and North Asia helping RMs and advisors become more efficient and productive, to improve the marketing to clients and to boost the customer experience. He remarked on data and data personalisation, on tailored and more relevant advice and recommendations, real-time alerts and information dissemination, and boosting appreciation of goals-based planning, financial and portfolio formation.

As digitisation increases, there is a rapid expansion of account opening and activity

A guest remarked that digitisation is definitely on the rise, and that the competitors in the wealth industry must then convert the rising number of conversations to revenues. He said that digital adoption has been widespread across the age groups, with a digital penetration rate above 82% in the high value client segment. He explained that with the ability to open accounts electronically, buy insurance digitally, and transact digitally and via mobile, there had been a significant rise in the competitiveness of key players. In the capital markets, some one and a half million accounts had been opened since early 2020, and there are a record number of trading accounts being opened each month, with numbers doubling every quarter, with most accounts being opened entirely digitally.

Connecting to the Nextgens, the future of the markets in Vietnam

Today’s students are tomorrow’s entrepreneurs and many of the luckiest of them would normally currently be studying overseas but are stuck at home due to the pandemic. One guest reported how many of these well educated young people were turning their hands to investments, either emulating their well-to-do parents, or forging out on their own, perhaps investing through the new FinTechs that offer starting thresholds as low as USD20 or even below that.

“They have been trying out their skills at investing here,” this expert told delegates. “Buying into mutual funds and direct investing also through the FinTech companies here in Vietnam, which have opened access to younger investors with only modest sums to invest. This augurs well, as these young people are rapidly learning about the markets and even about financial planning and asset allocation from a very early stage. In the future, that will actually be one of the key drivers for the asset management market to grow in Vietnam.”

The wish-list of advances and changes that could and should take place

Regulatory evolution

High on the wishlist is that regulations will advance to better enable the expansion of the wealth industry.

Client and market education

This topic was well covered in the panel, and the experts reiterated the vital importance of constant improvements in the understanding by providers and clients alike.

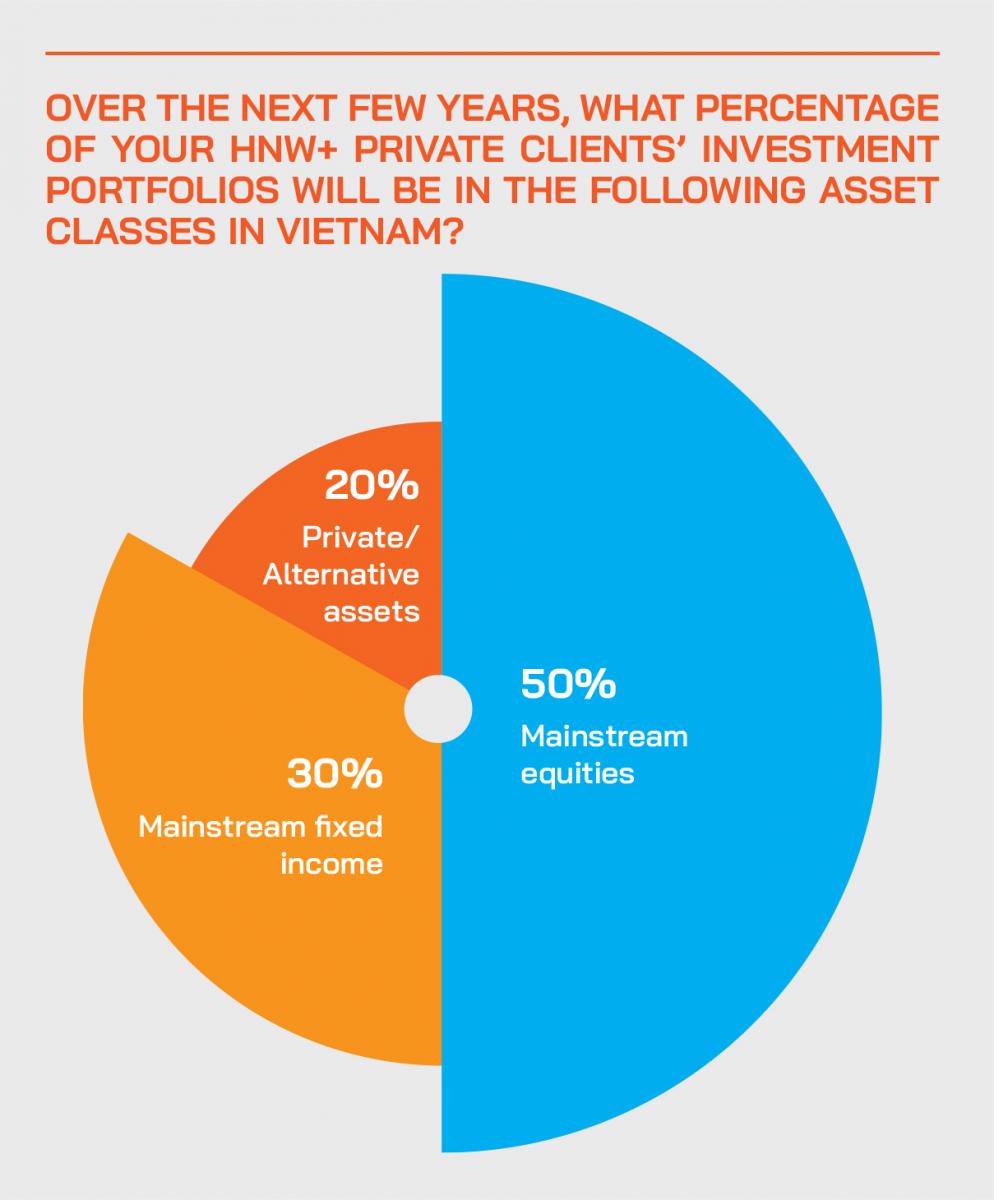

Product and investment diversification

An expert remarked that this has already improved, and that clients are embracing more diversity amongst the products already available in Vietnam, and that the robust performance of the domestic financial markets had established a positive platform for the future, with investors having expanded their portfolios and activities in the past year and having enjoyed very positive returns by doing so. He remarked that clients had gradually been moving from simple deposits to government bonds, corporate bonds, listed equity, and even private equity. “We now need to ensure that these products are very well understood both by the client and the advisors so that we can scale up,” he said.

A longer-term perspective and greater professionalism

Experts called for clients and RMs alike to adopt a more professional mindset and a longer-term view of investing.

A more encouraging tax environment

A guest called for a more conducive environment regarding transaction taxes, for example on mutual funds, better savings and pensions incentives, and other fiscal advantages beneficial for the wealth industry. They noted that this would also help encourage key products still missing, such as money market investments and REITs, both of which are hugely popular around the world.

The final comments – stay in front of the pack by steering a course ahead of the market trends

A guest commented on the competitive environment amongst asset managers, noting that being innovative and aiming to be a first mover has been a key advantage for their firm. “Knowing the market, anticipating the key trends in demand, both local and foreign, these are also key skills,” she explained. “The other element is performance because if we can help investors perform, they will stick with us. Finally, the quality of the services we offer and the breadth of our offering, comprising fixed income, equity, and real estate. In short, we need to offer the full range of asset allocation, strategy, financial planning and deliver with the right quality, and clients will then stick with us.”

And remember – Vietnam’s exciting wealth management journey has only just begun…

An expert rounded off the event by remarking that the priority now is to continue growing the firm’s AUM to capture a growing slice of the expanding market in Vietnam. “With about 99 million people and investors representing maybe 3% of that number, clearly the growth potential is enormous,” she said. “Asset management is only really at the beginning of its journey here in Vietnam, so if we can keep up this progress, if we can keep educating the growing middle class, if we can help them see longer-term and plan their financial futures, if we can connect to the younger generations, then there is a rosy future ahead.