Using Digital Tools to Transform and Scale the Investment Offering in Asia’s Wealth Markets

Jun 17, 2022

On Thursday June 2nd, Hubbis hosted a virtual discussion on the application of the latest digital solutions to the world of Asian wealth management as technology revolutionises the offerings and efficiencies of private wealth managers and the broader wealth management community across the region. The key topic of the day was how to transform and scale the investment offering as the wealth management community looks ahead to the continued growth of private wealth in the region, and as incumbents face up to the threats of big brand institutions that are at the forefront of digital transformation and new entrants who are agile and targeting many wealth management market niches in the region. Wealth managers and private banks are also increasingly striving to ‘democratise’ their service and product offerings to a wider audience of affluent clients to compete and grow in the new hyper-digital world, and tech-driven hyper-personalisation is at the core of fulfilling this concept. In Asia’s dynamic wealth management markets, this drive to hyper-personalisation has a relatively young, tech-savvy and rapidly expanding mass affluent market that are increasingly drawn to the world of investments, but who wants a seamless, interactive, and tailored offering that is highly relevant to their lifestyles, their needs and their aspirations for the decades ahead, and importantly, deliverable online or mobile.

The Panel:

- Jitendra Tekchandani, Executive Director, Customer Science & Segment, Wealth Management, DBS Bank

- Lawrence Yin, Head of Greater China, InvestCloud

- Rosemary Gilchrist, Managing Director, SS&C Technologies

- Alex Sim, Managing Director, Chief Operating Officer, UOB Private Bank

Setting the Scene

Delivery of a relevant, personalised and realistic investment product suite and investment advisory offering is essential for success in tomorrow’s world of wealth management. Our panel of experts analysed where technology solutions can help the banks and other players improve their investment offerings, not only in terms of the product suite and platform but also the delivery of RM-led communication, advisory and DPM. They helped identify what the next suite of solutions might be. They also discussed how the wealth management organisations competing in the Asia region can best adopt, and also assimilate these new technologies to enhance their investment propositions.

The reality is that much time and money can be wasted by not taking the right approach. The panel, therefore, looked at the significant advantages and opportunities for those who get this right and the risks for those who fail to take the right steps or who misdirect their technology investments.

The Discussion

Client centricity, personalisation and omni-channel

A leading digital transformation expert explained that his mission centres on boosting the platform for the frontline, using the data and AI to make a personalised journey for the RMs and advisors, and of course the clients. The platform serves all the segments starting from retail customers to the wealthiest private bank clients.

“We have seen an immense effort and huge investment from the banks in the last 15 years to enhance the frontline tools, whether mobile banking, internet banking, personalisation, data, AI, all these being used for boosting the customer-facing channels,” he reported. “In the world of wealth management, specifically in the HNW and UHNW segments, they are adopting more and more hybrid banking, which means that we are also transforming our offline banking as well, as this needs to be in sync with the online banking. Moreover, whatever problems are being faced by our frontline teams, we need to solve those problems.

He explained that his mission centres on a transformation project with the core objective to simplify the employee journey, specifically for wealth management. “If our teams are happy, our customers will be happy,” he said. “We need to make our bankers and others smarter so that we can give a consistent service and advice to our customers.”

Transforming and scaling the investment offering

A guest explained that the bank had been bringing everyone to digital, so that everything would be done in a digital way. “But we appreciate digital is not everything; hybrid banking is the way forward, and we need to deliver a high tech, smart touch offering across all digital channels, because we know that nowadays the customers want to have the choice, and they like to do on their own whatever they can do,” he told delegates. “At the same time, some areas cannot be handled digitally, for example for HNW clients their estate and wealth planning, their more complex investment needs, and so forth. So, we sync the digital and the human, the online and offline, into one cohesive approach.”

Secondly, he explained they are boosting the ease of information flows to and access for the RMs and advisors so they can have a meaningful conversation with clients. “They also need help on prioritising different clients, knowing when to contact them, and how,” he reported. “Much is based around the RM skills, but with the use of data and AI, we are truly boosting their capabilities and helping them see clearly. That of course helps the clients and their approach to investments and other advice we can provide.”

He said the third key area is personalisation and hyper-personalisation. One size does not fit all, he said, and personalisation is not only about the product and investment offerings, but also all about the location, it's all about the timing. “It's all about whether these matching with their events, the customer lifecycle,” he elucidated. “So, all these dots need to be connected and this is how we produce the personalised banking for our wealth management customers. In short, to achieve the personalisation and hyper-personalisation journeys we need the context of the customer, and we need the relevant conversations that naturally ensue and that engender genuine trust.”

Encouraging and promoting the right conversations at the right times

“One of my fellow panellists mentioned next best action,” a guest commented. “And this is where we're using the data and AI to define what is the next best conversation for the RMs. We call it next best conversation because we think the action follows these conversations. To define this, we look closely at the clients’ online behaviour, their life events, their demographics, their relationship with money, and their preferences in general,” he explained. “We understand that clients might look similar in many ways, but their relationship with money is so often different; some might take bigger risks, some might go big into cryptos, while others that appear similar avoid those assets at all costs.”

Making the RMs and advisors more customer-centric in their investment offerings

A guest said that whenever the RM is preparing for a meeting with the customer, it takes a lot of their time because, first, they have to gather the information about the customer, then they have to think about the trends, the CIO insights and so forth. And for the conversations, from RM perspective, he or she needs to understand the context, and this is where when we are thinking about the employee journeys, how to make it all simpler and better.

Moreover, all interactions and actions need to be logged, so the bank and the teams all learn as they go ahead. “We cannot expect RMs to write up all these engagements, so this is where leveraging and managing unstructured data into useful structured data is so important,” he said. “Furthermore, we might have great engagement, but if it falls down due to lack of operational excellency, it means your fulfilment is taking too much time and is too difficult. In the world of digital, most of the companies they always try to make their frontline beautiful, but we can tend to forget about the whole operations piece, which also needs to be seamless and excellent.

A technology expert agreed, noting that nowadays the RMs need to have all the data filtered and focused to then deliver the clients concise and relevant information and ideas, and at the same time with the aim of providing their clients with a valid and worthwhile experience.

“The RMs want to be able to see and control the data on a holistic view,” they said. “If they have perhaps 15 clients invested in one fund or one manager, they want to be able to look at it on a per client basis. But the RM also wants to see their firm’s exposure to that one manager, or to that one security. Accordingly, the ability to look at everything on a manager level, but then be able to go down another level to the securities those managers hold and to be able to pull that information together on a holistic basis, which is in essence what our clients are asking for.”

Elaborating on these observations, they noted that a major pitfall she and colleagues find as they liaise with RMs, family offices and other is that they often have several systems pulling information from different places. Information on the equity portfolio, the fixed income portfolio, the private assets may be dotted here and there, but to arrive at a more holistic view, you need an automated solution that traverse the asset classes with one system.

Solving technological and cultural issues around RM and client engagement and connectivity

A technology expert reported how their mission was to solve two problems. One is how to help clients to communicate and engage with their end customers to achieve client growth and client retention. And then the other side of it, is to tools for the RMs to help them to sell more efficiently and more effectively.

“An example,” he said, “is a client in this region who informed me they have about 100,000 unique visits to their websites, and five times that, more than 500,000 unique log-ons to their apps. But the problem that they had is that these digital touchpoints are not meaningful digital engagements. We understand that a meaningful digital engagement is an interaction that facilitates an exchange of information, so we need to encourage clients to give the banks information around their preferences, their hopes, fears and dreams. And then in exchange for that information, you can encourage your clients to consume personalised news, research, for example your CIO house view that's specifically relevant for that client’s portfolio.”

He said that other areas to be explored include, for example, helping deliver relevant short educational courses, or tips that help them to build confidence. “Clients buy when they are confident and it's through these types of interactions that we're helping our clients and giving them tools to build what we call a digital engagement funnel,” he explained. “The ultimate goal is to help them to move their clients on their digital engagement funnel to a better financial future or outcome.”

To achieve all this, he said the RMs also need a lot of tools because they have to balance their clients’ portfolios between their CIO team's view and their clients’ preferences. “Accordingly, they need a lot of tools around portfolio construction, portfolio monitoring, and portfolio rebalancing.”

The roles for data and personalisation in boosting engagement and delivering the best investment and advisory offering possible

An expert observed that everybody has data, but technology helps the industry to connect all this data to have the meaningful insights about the customer. “That results in the context I talked about earlier,” he said. “Once you have the context of the client, and whatever offerings or whatever you have, that context can match with all the products and all then we can have a meaningful or very relevant offering for the customer, either the digital or non-digital. And that helps us to build trust. Once you have that trust, it's a long-lasting engagement on the relationship with the customer.2

He said they must also then measure the performance and the culture of the business. Traditionally, the measurement of the business is the revenue and profitability, he elaborated, but the bank also strives to understand the drivers of the outcomes, to then understand and then adapt to achieve better business, which will centre on better outcomes for the customers, and better outcomes for the RMs and advisors.

Striving to manage and organise structured and unstructured data

A technology expert reported that their mission is to manage and coordinate and re-present structured data obtained from the major banks and other clients, which they said is relatively simple to handle. But it is across all the unstructured data that there are more challenges, and that data is coming in from all types of players and in all forms. “However, we have developed technology specifically for the wealth management arena, to digitalise all that unstructured data,” they reported, adding that this all becomes increasingly important as clients start investing in non-mainstream assets such as in private markets and as new investors enter the fray, for example different generations of family office members, each with different activities and preferences.

Each of those investors might be buying different funds, and every underlying fund they invest in might have lots of unstructured data, she explained. “So, if you can imagine a portfolio of perhaps 30-40 funds in that allocation, that data becomes very difficult to manage, they elucidated, noting that their technology nevertheless overcomes a lot of these issues.

Leveraging AI and ML to achieve optimal results with existing technologies

A guest reported how their technology uses artificial intelligence to read all types of underlying documents, and then the AI starts to teach the bots to log on to the portals and pull that information down. The result is that the wealth managers can then really concentrate on managing the portfolios, and not waste time gathering all that information, extracting the financial information, and categorising all of those documents.

“We have really put a lot of effort in the past decade plus at developing that technology to give investors and especially wealth managers, the ability to look at their portfolios in totality,” they reported. “So, you're not just looking at your custodian or brokerage statement, you're pulling that data in and marrying it with the private investment you have as well. But while AI has advanced remarkably in the past 10 years, it is not perfect and there is still some human intervention required.”

The investment proposition is also adjusting to new trends and themes, such as ESG or private markets

A guest highlighted the different attitudes towards investing amongst the generations, and the concomitant rise of ESG-driven investment. “This creates needs among the RMs and advisors and of course the investors,” they said. “This means the systems and technology need to adapt all the time. We need to deliver a truly systematic approach to cover all assets, all different investment approaches and developments.”

They added that in terms of digital assets, these represent a whole new challenge. “In this new segment, we take a careful approach, reviewing how we can administer those assets, and how indeed we can be sure that these assets do in fact exist. We have taken a more conservative approach than some administrators, adopting more of a wait and see strategy.”

The same expert also said that timeliness is essential, which is a particular challenge for private assets.

“Clients do not want to wait for the traditional model of statements at the end of each quarter, this expert opined. “They want to know what they own on a daily basis across asset classes to see a total picture. Accordingly, being able to get that information to the ultimate user, the ultimate stakeholder frequently and accurately is essential. To achieve that, we need a combination of automated technology, and human technology to validate those results. To overcome these issues, we are converting vast amounts of unstructured data into structured data all the time, so that the wealth manager can work on the investment decisions, without being worried about whether or not that data is accurate.”

Multi-channel? Omni-channel? Take your pick on nomenclature, but there is no optionality on seamless, tailored delivery

An expert reported that whatever one calls the delivery of wealth management through many channels, the mission is to encourage the client to be able to engage with the banks or providers as and when he or she prefers, and in the mode that they prefer at any one point in time.

“We want to give the client the choice,” he reported, adding that as client AUM increases, so too their preference for RM connectivity rather than digital, but with digital as a constant support. “As well as digital delivery, we certainly need to equip the bankers so that they know when to engage the client, how to respond, and most importantly, how to look knowledgeable in front of the clients in the midst of all the information curation for the best possible advisory and investment offering.”

As to advice on portfolios and risks, the same expert noted that clients also have preferences, they have likes, they have dislikes and their likes and dislikes do not always tally with the portfolio theory, the approach and asset allocation promoted by the bank. “The challenge we face in trying to curate this into what I call a one-stop shop for the RM is to achieve the right sort of balance,” he explained. “We also need to make sure we observe the right regulatory approaches, especially to new or exotic asset classes, and that we focus on fulfilling obligations around investor protection.”

Balancing the needs and expectations with the wider regulatory responsibilities

A technology expert picked up on this last point around balancing client preference with a fiduciary duty and a bank's view and obligations. He explained that they have tools to break down hefty reports and information into bite-sized chunks, so that the clients can understand and absorb those in snippets centred on the asset class level or at the product level.

“Then,” he reported, “based on data or client preference, you can do an either AI based matching or a tagging-based, rule-based matching to see, okay, based on the client preference on the most likely snippets that they are going to be interested in. But, of course, you overlay that with another set of rules, either from the bank's compliance or either from the bank's investment office, for example if a bank prefers not to provide advice or execution around digital assets. The result is you can produce something that's curated for the client based on their preference, but also, something that's compliant to the bank's views, both in terms of investment views as well as fiduciary obligations.”

He added that the snippet type approach also allows the clients to properly consumer the material across any channel “Give them something relevant, something easy to digest and read, and if they want more information, they can ask for that later,” he said. “In this way you are fulfilling your obligations, offering interesting and good ideas and advice, but also making it easier for the clients.”

Digital advances ahead that will further enhance the wealth management proposition

A guest proffered that there are several areas in which the wealth industry can progress.

“We need to continue to improve our self-directed digital channels. And when I say continue to improve, this does not mean that we need to keep adding the new and new functionalities, but to make those functionalities more personalised and more meaningful,” he reported. “Today, every bank, even every app has these push notifications to talk to customer, but whether those communications are meaningful for them, whether it's timely or not, we will see. And we will see if it's not only a one nudge, or one notification which works for them, and see how our communication is connected with the previous communications.”

Secondly, he remarked that technology will come and go. “That means I personally prefer not to focus on what is coming next in terms of technology, but on what we need,” he told delegates. “One area is to improve self-directed activity, another is to sync online and offline journeys, the third is to make the RM tools world class and make the employee journey more meaningful.”

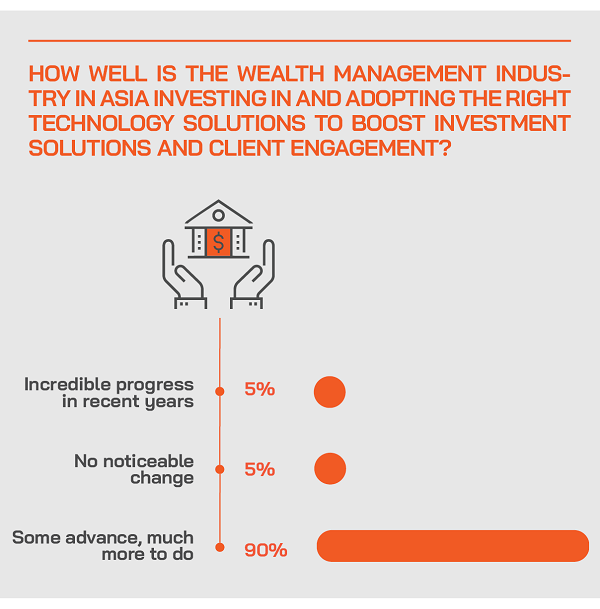

Great advances, significant progress, but far more to achieve

“The end-customer experience, that ultimate stakeholder experience, is really what we are trying to deliver accurately, rapidly and in a format that engages them,” a guest reported, closing the conversation. “We have moved on a lot in the past 10 years, for example with much better data coming in from the managers, and still improving. But while all this is very encouraging and provides optimal outcomes at this time, there is further to go, more advances needed, and we and the wider wealth industry need to be smart and adaptable to achieve further progress ahead. As I said earlier all this is improving in leaps and bounds, but we continue to strive towards better technology and better outcomes.”