Publications & Thought Leadership

Thematic Investing and the Asian Private Client – Why, What and How?

Jul 28, 2022

On July 14, Hubbis hosted a virtual discussion on the current demand for thematic investments in Asia’s private wealth markets. The world today is a very different place from the one we all inhabited a year or so ago. Then, the pandemic was still raging, and the virus was far more worrisome, but inflation was still a distant prospect and rate rises, while widely anticipated, were predicted to be very gradual. The threat of a Russian invasion of Ukraine was far from anyone’s main concern. But now, faced with some serious headline inflation numbers coming through in the US and Europe, in particular, with the Federal Reserve and other central banks pushing through rate rises both far higher and faster than anticipated, and with all the uncertainties over Putin’s aggressions and ambitions, investors have been redefining their portfolios and adapting them for the current and anticipated situations. It is against that backcloth that Hubbis assembled a panel of four experts to deliver their views on the why, what, and how of thematic investing for Asia’s wealthy private clients, as they reshape portfolios for the world ahead.

Panel Members

- Mitchell Lam, Senior Vice President, CSOP Asset Management

- Hock Kiat Ting, Vice President, Fund Specialist, DBS Private Banking

- Wendy Chen, Senior Investment Analyst, GAM Investments

- Isaac Poole, Global Chief Investment Officer Portfolio Manager, Oreana Financial Services

Setting the Scene – in a world of uncertainty and volatility, take the big picture and longer-term view

Thematic investment strategies are considered of great value for the curation of key elements of robust portfolios, as they help take into account many of the world’s more immediate and predicted financial, economic and geopolitical uncertainties. A past Fidelity Viewpoint paper highlighted how thematic investing strategies take into account long-term trends, ideas, beliefs, and values when choosing stocks, bonds, mutual funds, ETFs, and other investments, noting that among the most popular types of thematic strategies are those focused on disruption, megatrends, and ESG, adding that thematic mutual funds or ETFs can provide opportunities to invest in themes as well as offering the benefits of professional investment research and management.

And MSCI literature defines thematic investing as a top-down investment approach, designed to capitalise on opportunities created by macroeconomic, geopolitical, and technological trends that are both structural and transformative in nature. In short, this investment approach therefore offers investors a fascinating way to capture powerful global trends that may drive future stock or asset performance.

Our chosen experts on the July 14 panel looked at thematic investing from this big picture perspective, then offering their views on how thematics can reshape, solidify and future-focus the private portfolios of wealthy clients in Asia. They considered how thematic investing can apply to the Asian wealth management market, to discretionary and advisory mandates, and to private clients across the younger and emerging generations.

They reviewed what the private banks and the independent wealth firm and family offices, as well as the fund management creators are doing to tailor and deliver more thematic products and better solutions to meet the very clearly growing demand for this type of investment. And they put their ideas forward as to which thematic investment strategies are more relevant for wealthy private clients today, and the timeframes that these investors should be looking at in order to extract the right value from these major trends.

The very different world of today (compared to only this time last year) should be driving rigorous analysis of portfolios and their relevance for the world we face ahead

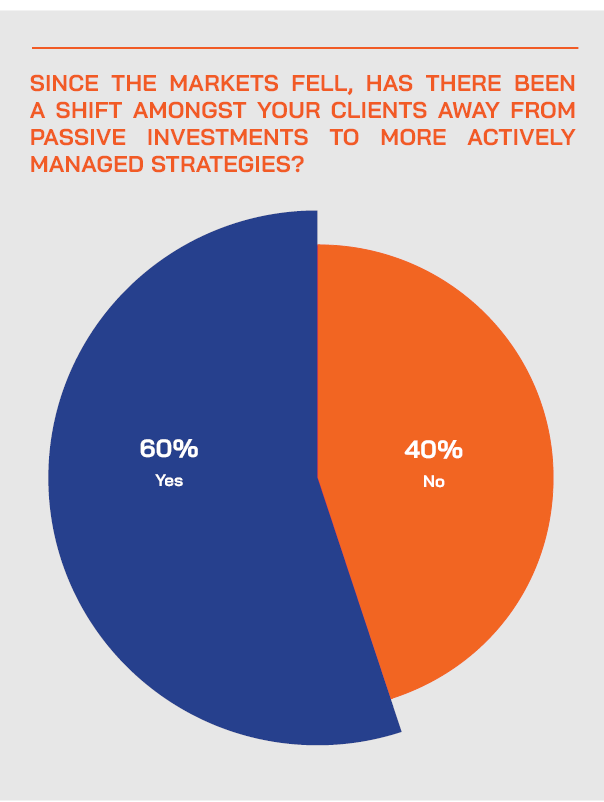

An expert opened his commentary by reporting that the dramatically different world investors face this year should have led to a rigorous and highly analytical review of current holdings, to see if they stand up to current and anticipated conditions. He highlighted surging inflation, sharply rising rates, falling indices, worsening sentiment, concerns over stagflation, and global geopolitical anxieties, all of which had been conspiring to put huge pressure on equities and on fixed income, and challenging even broadly diversified approaches to portfolio formation.

But he also observed that if the advisors, managers, and investors all see eye to eye on the trends and the timeframes, there are some very interesting themes for investors to buy into for the medium to long-term.

Testing times

“However, the problem right now is the great difficulty in identifying either turning points for the market, or the right timing and opportunities to reinvest,” he added. “The challenge is therefore to be more granular about asset classes, and for investors to think about whether some of the prevailing themes or strategies that they have focused on in recent years are still valid. They need to start thinking about entry points more broadly and start rebalancing portfolios to take the best opportunities right now.”

He said fixed income, for example, might be evolving into an opportunity, he added. “It's been a long time since government bonds have looked interesting,” he observed. “Over the last five to 10 years they have not offered a lot of downside protection, or income or yield, or a great deal of diversification, but that is changing.”

Challenging valuation metrics

Another expert agreed, noting that the environment we all face today had resulted in great difficulties in valuation modelling for investments and for analysts. “We are retreating to more of a top-down approach to guess and assess trends,” they said. “As to what has changed in the world that makes thematic investing more relevant today, I would point to all of the financial and geopolitical concerns we face in the world, all of which have led to a sharp downturn in alpha generation, especially often amongst many high-quality names that have been disproportionately punished.”

This specialist said that is why times like these require top-down approaches to uncover structural investment opportunities and stay ahead of curve. “For example,” they explained, “I am a China specialist, and strongly believe that in that market, thematic investing to capture the right trends often matters more now than selecting the right company.”

Active? Passive? Both? Public or private markets? Experts believe passive and active strategies, as well as public and private assets can all work well together to drive robust thematic exposures

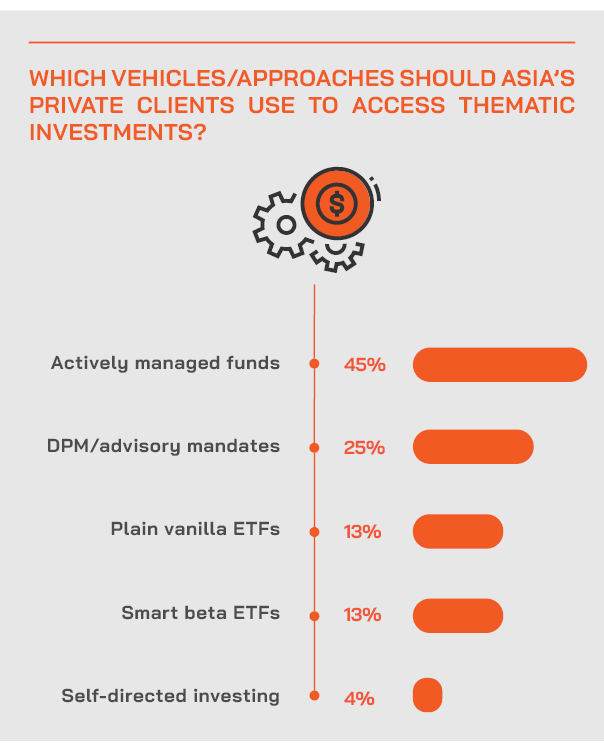

Another guest reported how their firm had been delivering a stream of thematic ETFs in recent years, all designed to be easily incorporated into private client portfolios with what he called ‘plug-and-play’ ease.

He commented that passives such as ETFs and active funds can coexist comfortably in private portfolios of all types and in DPM mandates. “They are certainly not mutually exclusive,” he said. “As a fellow panellist mentioned, ETFs can provide that broad thematics base, with active strategies layering on niche products and ideas. They can combine effectively.”

The rise of ETFs

But the major point he wanted to emphasise is the importance of thematics and the role of ETFs in delivering those to the mass market. “As everyone knows, thematic ETFs have very quickly become mainstream,” he explained. “Actually, prior to the pandemic, the market cap of thematic ETFs was in the tens of billions of US Dollars, but today it is over USD400 billion. That shows the immense traction these ETFs have gained in a relatively short time.”

He observed that ETFs also offer great transparency, and are actively traded in the US, or major markets, and in Hong Kong, allowing investors easy access to prices and to constantly monitor the constituents within each ETF, whereas active funds are much more opaque, and need to be re-priced each day.

Allocate to thematics

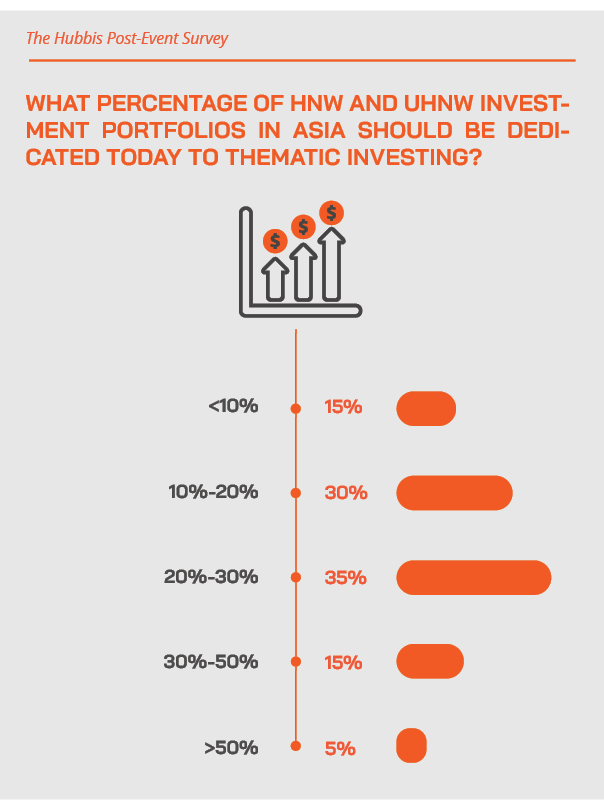

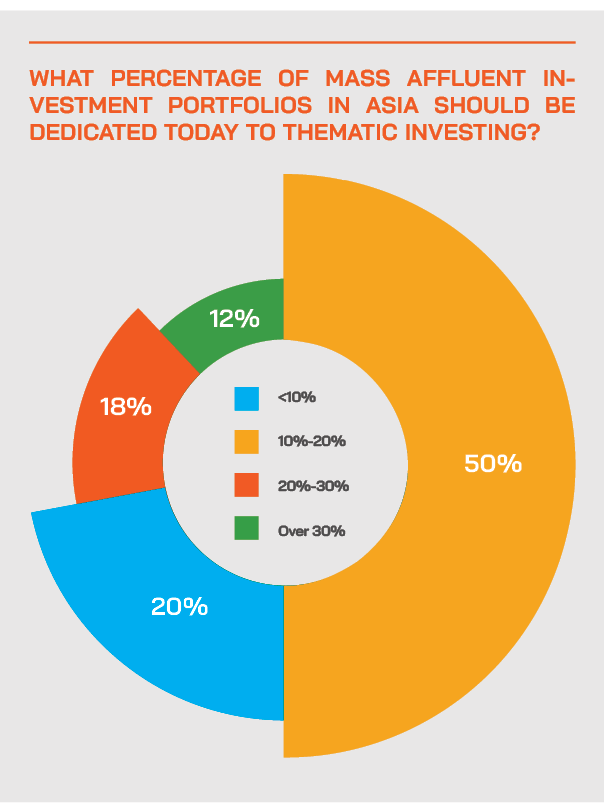

“We believe that, despite the current market volatilities and economic cycles, investors should allocate a decent portion to thematics,” he said. “Obviously, we don’t want all the eggs in one basket, but a portion of their asset allocation into thematics because undoubtedly, they're medium to long term investments that could provide a little bit of cushion and thereby help investors weather economic cycles and short-term market volatilities like the ones we're experiencing today. And so, for the medium to long term, we do ask our investors to allocate at least a portion of their assets into thematic ETFs or thematic investments.”

Another guest commented on active and passive strategies, as well as public and private markets can combine effectively to curate a smart approach to thematic investing. He said that advisors and investors can seek out pooled access to the less accessible private assets to gain exposure to some interesting thematics.

“For most investors, I agree that a combination of perhaps broad ETFs, and then some more specific active funds can be a good way to go about things, particularly in a DPM mandate, but it is useful just to highlight that those private options also exist,” he explained.

Champions of ‘active’

A different perspective came from a guest who conceded that while the use of ETFs is a valid approach for the more rudimentary types of portfolio formation, especially for those investors that have little time or inclination to study each specific target company, for many of the longer-term themes, like renewables, the bottom-up, more active approach is far better. “ETFs,” they observed, “might often include only the top or biggest stocks and miss some of the more start-up trends or market gainers that actually can grow in a much faster pace. In short, I am a firm believer in the value of active management and rigorous analysis of both the trends and the target companies in which to invest.”

The connectivity between major trends and time - investors need to avoid being fickle, they must be realistic in the timeframes they adopt in their approach to thematics

A guest opined on the connectivity between themes and time, cautioning that private clients who expect too much alpha in too short a time are pursuing the wrong approach. “They should be looking for cumulative alpha over a long period of time,” he advised. “At times, there can be a complete mismatch between the theme, the process and philosophy of the fund managers and the expectations of the clients, and that results in the sort of churn that is not great for the fund managers.”

Aligning expectations

In short, the key message is that advisor, fund manager and client timelines and expectations match, otherwise there will be disappointments all round. “It is truly essential for advisors to have the right discussions with clients upfront, to ensure these timeframes are agreed and properly understood and to make sure that return expectations are realistic. Without that, you are likely to be having have some very uncomfortable conversations with clients later on. These types of frank and realistic conversations are the right entry points for working on thematics with your clients.”

Open communication

A fellow panellist agreed, noting that investment expectations and timelines must be carefully and transparently aligned between the clients, the advisors, and the managers. They cautioned that private clients need to gain access to interesting opportunities with the right degrees of patience, so that they can participate over time in the more interesting and dynamic growth potential ahead. “Yes, it is very important for clients to actually understand when they're investing and what they're expecting,” this expert stated.

And they added, for example, that if investors are trying to buy into disruptive technology, investors must realise that sometimes the whole process can be much longer than expected, and the markets can make some wrong in terms of share prices during that waiting phase.

The analytical approach

“Accordingly, remember not to chase or whatever buzzwords are out there, and to be analytical,” they advised. “And we understand the importance of handholding of the clients to help them understand these issues and to remain patient and objective. For example, for some of the Chinese clients have been hit very hard, so we need to be upfront and talk to clients proactively to help them see and seize the opportunities in some sectors as things turn around. We are the ones who are responsible to stay ahead of the curve, and tell clients when there is new potential ahead, and hopefully before it actually becomes known to the entire market.”

Another banker wholeheartedly concurred with these views. He opened his comments by observing that there has been excessive fickleness in the approach of investors to their thematic exposures.

Do not be fickle

“We see too many looking at thematics as a trading opportunity, buying in and selling out again as different flavours of the month come and go,” he said. “This results in money flowing in very quickly, but also then out again,” he explained. “We really prefer clients take up some of those themes that are broader, that are more diversified, so that there is a really broad investable universe for these themes to be surviving over the long term. We prefer not to look at small, restricted thematic funds.”

And a fellow panellist added: “We advise against the more niche funds, sticking instead to a more conservative and defensive approach with some of the larger, more diversified technology sector funds that have broad exposures to a wide range of companies and segments. We know that Asian clients are very risk averse as well as they are very return centric, and at the end of the day, when we recommend a certain theme to the client, be it healthcare, or renewables, for example, we just want them to see the long view and hold in there. We really want our clients to be looking to take advantage of the long-term growth opportunity and to adopt a three to five year holding period, at least.”

ESG and thematics not only combine neatly, but ESG is really a central element within thematics, according to some experts

A guest highlighted what they consider the key difference between thematic investing and ESG investing. “I personally see ESG as an important - even central - element in thematic investing, as social and environmental shifts tend to boost demand for transformative technology. For instance, while green energy adoption has been on government agendas for long, the rallying energy price since the Russian invasion is pushing technology innovation and adoption on renewables across the world. So, ESG and thematics work well together.”

As to some of the more interesting thematic investment opportunities today, this guest advised investors to distinguish between real viable themes and more speculation, as investors’ spotlights on flavour of the month type themes often leads to ‘story-telling’ from companies that are eager for a boost, but where the narratives are not so sustainable.

Another expert agreed with this view, adding that their firm is very proactive in pushing ESG-centric investing approaches. “We see this in two forms, ESG integration as well as ESG thematics,” he explained. “We take exposure to selected funds labelling as SFDR Article 8, which basically means that they integrate certain ESG considerations within the investment processes, and to ESG thematic funds, mainly those classified as SFDR Article 9 funds, which are investing into certain companies that have revenues coming from sustainable agenda.”

With the right degree of patience and the right selection of themes, investors can curate more robust portfolios and position themselves for a broader recovery ahead

An expert also opined on the timeframes required to extract the best results from such investments. “Thematics generally require a more medium- to long-term holding power, which helps overcome nearer-term volatilities and weakness short-term is good for the current market volatility environment. So, I think in terms of thematics, it's more of a macro question that you got to ask, so for example, this might be overly simplified, but it could be as simple as questions like, is climate change still going to be around in the next decade or a few decades or so, and if so what technologies are sitting at the forefront of this growth?

He cited, for example, some of his firm’s thematic strategies, such as a China solar power ETF that addresses the whole supply chain, whether via upstream, midstream, or downstream companies that are all at the heart of the solar movement. He explained this theme plays very tidily into the efforts of numerous government and multi-lateral bodies to tackle climate change and to drive towards carbon neutrality.

A shining example

“Solar, as you all know, in terms of conversion of solar to electricity is getting cheaper and cheaper, so this is more and more feasible, and meanwhile net income growth for Chinese solar companies has increased quite significantly on a year-on-year basis as well, especially with China taking up a large market share in solar, whether domestically supplying to themselves or whether exporting it to other countries that are in need of solar panels. This has of course been accelerated by rising fossil fuel and other prices. Accordingly, this is a good theme for the longer term. Despite falls in the US overnight, for example, the solar ETF I referred to earlier was up about 4% in trading earlier today.”

Enjoying strong structural support

“We like these sorts of themes that have this broad-based global structural support,” he told delegates. “Other themes include global electric vehicles and China-focused healthcare, with the latter benefitting from major domestic structural support from the government and strong drivers in terms of the rapidly aging population in China and rising disposable income as well. Those two factors really play into the creation of more innovative healthcare, from sophisticated medical devices and technology to online healthcare clinics.”

Other themes he mentioned include general and mainstream trends such as cloud computing, and Metaverse. “For Metaverse, we are shifting into the Web 3.0 obviously, and whether you believe in the concept of the Metaverse or not, a lot of these companies are sitting at the very centre of the development story into Web 3.0,” he explained. “And in terms of cloud computing, as everyone knows, data is the new oil, so obviously that is something in the next decade and beyond will be a powerful theme and one that cannot be ignored.”

A great IDEA

Another guest said their bank had produced a new strategy to help clients access companies that are innovators, disruptors, enablers, as well as adopters across the world, and across different sectors. This helps the bank and clients to curate their portfolios driven by the best ideas and across sectors and geographies and thereby to capture long-term secular growth trends in which they invest for the medium to long-term, instead of the quick inflow and outflow type approach.

This is the IDEA fund, standing of course, for those innovators, disruptors, enablers, and adopters. “And the big picture story is we are driving clients towards allocating up to 30% of their holdings in these types of thematics,” he explained. “And we follow the same sort of guidance and initiative with our DPM mandates, where we work closely with our discretionary team.”

He explained that this approach helps remove the shorter-term favour of the month type approach and instead replace it with a more enduring, ‘sticky’ type mentality towards such investments.

“This is why, to drive more of a longer-term mentality amongst investors, we innovated a strategy that invests into high quality companies, either profitable or breakeven companies, best in class across different sectors, but with a longer-term view,” he reported. “This will help clients ride the secular growth trends, and not jump in and out on short-term volatilities or concerns or enthusiasm. Hence the IDEA Fund.”

Demographics play out over time

Another expert drilled down into some of the themes he considers valid today, such as healthcare. “Thematics such as healthcare need to be seen through the prism of time and to generate sustainable alpha over the medium to longer term and sometimes a very long term,” he said. “For healthcare I would see it from the perspective of aging demographics in the West, younger demographics in the East, these are themes and megatrends that have been in place for some time and exist independent of the pandemic. Such trends will be there in 10 years’ time.”

He said these trends will also impact inflation. “It is interesting that despite this surging inflationary environment, there's been very little discussion about demographics, as there are now some cyclical issues pushing inflation higher, but as a trend that will persist for some years to come,” he reported. “Accordingly, healthcare as a thematic is interesting, especially to gain exposure to these longer-term demographic trends.”

He said other themes of interest are in areas such as digitisation and artificial intelligence, both of which he said are critical for combating inflation through productivity enhancement.

Plenty of opportunities

A panel member explained that their firm currently considers a number of areas of interest. These include technologies in the form of disruptive innovation, such as AI, IoT, Web3, Metaverse, Cybersecurity, and others, but only if they have proven foreseeable cashflows rather than simply a nice narrative. And this guest highlighted social themes such as retail and travel evolution in a post-Covid world are also interesting, as there are profound changes taking place. Energy also in terms of accelerating clean energy adoption amid ‘greenflation’, which requires innovative solutions, such as smart grid and energy storage, new EV battery technology and so forth, she added.

And they observed that what had actually resulted from the past three years of lockdowns was the emergence of many new social trends and new business approaches that are probably still somewhat under the radar, although already receiving more attention from the secondary megatrend players.

“For example,” they said, “for the younger generations, they are shifting to multi earning sources, they do not really have to rely on the old single salary job, they see they can actually create income through either create content, or innovative selling, or other ways. In short, I see significant social structural changes taking place, especially for the next generations.”

Thematics centred on the world ahead and adopted with the right approach by advisors and investors can future-focus private client portfolios and mitigate some of the nearer-term risks

A guest closed the conversation by concluding that thematics are ideal for private client portfolios, but their adoption must be based on sound analysis of and belief in key trends that will play out over a good number of years ahead.