Publications & Thought Leadership

The Growing Opportunity for ETFs and Thematic ETFs in Portfolio Allocation

Apr 2, 2021

On March 25, Hubbis hosted a virtual Digital Dialogue panel discussion on Exchange Traded Funds (ETFs) and their rising prominence for the wealth management community in Asia. For this discussion, there was also a particular angle of refraction on the expanding universe of thematic ETFs, as the panel of experts cast their eye on how smart beta can be expressed through ETFs that adapt the asset composition to fit certain key investment trends and themes that their creators have identified, and which they believe will find strong investor demand. This growth of thematic ETF investing has already found strong appeal in the region, building on the already rising tide of interest in Asia and the discussion was of course framed in the wider context of the global rise of the ETF phenomenon, their increasing diversity, the rise of so-called ‘active’ ETFs, their effectiveness in sophisticated and robust portfolios, their value for self-directed investors and their growing usage by the discretionary managers and wealth advisors of Asia. It was not just equity ETFs that were in focus during the discussion, as fixed-income ETFs have also proven themselves to offer investors both liquidity and performance and gained more admirers during the periods of the worst market stresses of 2020. And the panel discussed where else ETFs might lead, including, for example, leveraged and yield-enhanced ETFs, fixed maturity ETFs, cryptocurrency ETFs, and others.

Panel Members

- Tariq Dennison, Wealth Manager, US-Asia, GFM Asset Management

- Alex Yang, Vice President, Institutional Solutions, Samsung Asset Management

- Gary Dugan, Chief Executive Officer, The Global CIO Office

- Adam Cowperthwaite, Managing Director, Head of Capital Markets – Asia Pacific, Citi Private Bank

- Tony Wong, Head of Intermediary Sales, CSOP Asset Management

The discussion was framed naturally towards the Asian wealth management community, as the moderator asked the panel to debate where such ETFs fit into private client portfolios in the region, and how and why they should build a greater allocation towards ETFs, including the smart beta ETFs that allow for greater thematic expression in the portfolios. The panel were tasked with addressing a number of questions, as well as tackling other issues as they emerged.

A speaker opened the event by observing that the growth in ETF adoption in Asia had been dramatic in the past five to 10 years, but that Asia differs from the rest of the investment world in some areas. He explained that his preferred approach of focusing on sectors and segments in global markets was to some extent mirrored in Asia which is why thematic ETFs have drawn relatively more demand in the region than the broader index type tracker ETFs used more widely in the rest of the world. “We have seen people more in greater conviction investments, such as technology ETFs, or those playing demographics such as aging populations, and it is a lot easier to talk to thematics and sectors than it is to those broad countries,” he reported.

ETFs trump actives in thematic plays

He explained that investor have gone the ETF route for this because there are very few actively managed funds that have worked well in the thematic area. “Active managers have actually struggled in these thematic areas,” he stated, “and thematic ETFs have grown well in Asia, also driven by the absolute return mentality here.”

Another expert remarked that the wealth industry worldwide and more so in Asia had somewhat resisted ETFs due to lower fees and difficulty in loading additional fees within the funds and other solutions. “Here in Hong Kong, I still see a lot of loaded mutual funds and other expensive products there,” he observed, “but the transition to ETFs largely comes quite simply from a recognition of better, faster, cheaper.”

Expert Opinion - Tariq Dennison, Wealth Manager, US-Asia, GFM Asset Management: “ETF buyers mostly buy ETFs for one of two reasons: access or bundling. ETFs providing access to what these buyers can’t easily buy directly are so far a tiny fraction of the size of those that simply package stocks end clients could just as easily buy directly. The paradox is that the least necessary ETFs tend to be the most popular.”

Better, faster, cheaper

Cheaper because there is no manager involved, the S&P 500 ETF is exactly that, 500 stocks. Faster because ETFs are so easy to buy and the global market is open 24 hours a day and there is no market to market at the end of the day as with mutual funds. Better, he observed, because there is such a diversity and now more and more ‘actively’ managed ETFs. “The ETFs that I think I'm very interested in tend to be the ones that provide very niche access to otherwise very difficult markets.”

Another expert agreed that there is a shift taking place within Asia to more focused ETFs, for example his clients often nowadays ask if his firm has an ESG ETF in Hong Kong about China or focused on Asia.

“We see more family offices in Asia using a lot of the ETFs to access certain areas, for example, like the China STAR board, which historically is a bit tricky to access. Lots of family offices are using ETFs today as building blocks, and we have seen growing of interest from the DPM or the portfolio management guys for the leveraged and inverse products using those as a hedging tool for portfolios with a really extremely short term view. And we see a shift to fixed income ETFs as well.”

The professionals are crowding in

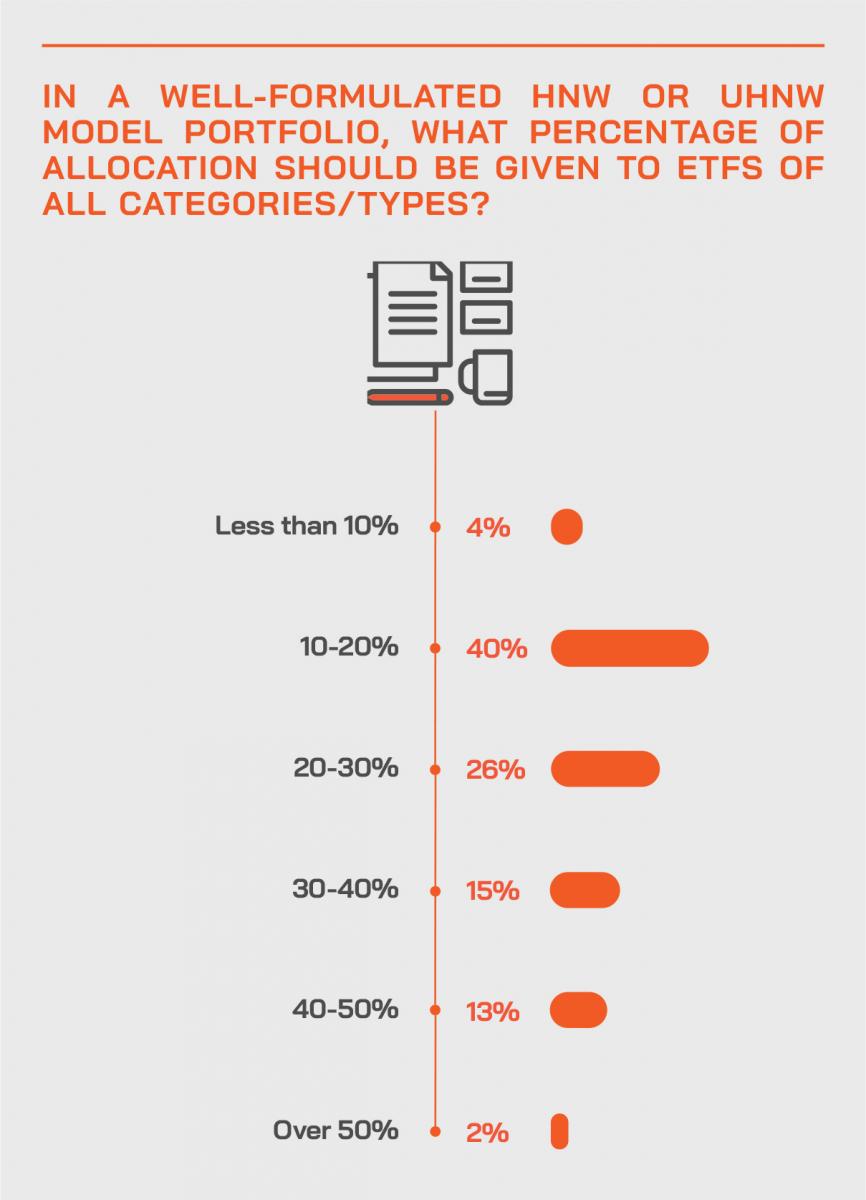

A panellist agreed, adding that he also sees rising demand for ETFs based on portfolio allocation principles and increasing adoption by wealth managers implementing a core-satellite strategy. “That approach has been very popular among the advisory and DPM segments in the west for many years but is also increasingly being adopted in Asia as well these days,” he reported.

He explained that what the wealth managers would typically do is to use more broad-based equity ETFs, such as a single market benchmark ETF, or broad-based equity ETF, as the core of their portfolio, the bedrock that underpins the key characteristics or risk return profile of their portfolio, and then add sector or thematic ETFs as the satellite to either increase the weight towards a particular sector such as a high growth tech sector or a value sector in recent months, and just to achieve more nimble tactical allocation.

Strategic moves

“For example,” he said, “I can refer to our Samsung S&P High Dividend APAC Ex-New Zealand REITs ETF that we launched in October last year. In recent months, we see that with the sector rotation and a move towards a supercycle, we see that some wealth managers are increasingly recognising this ETF as a tool, like a yield enhancer to help them enhance the overall yield of their portfolios, thanks to the high dividend features and the quarterly payout that this ETF offers.”

He added that ETFs are also being employed to access certain markets without the need for numerous regulatory hurdles in individual markets to be overcome, including different settlement and tax treatments.

Diversification without the hassle

“Previously,” he noted, “without ETFs, if they wanted to access a particular sector, and achieve true diversification with individual stocks, chances are they would need to go beyond their local market and invest in multiple markets, meaning different trading hours, different settlement cycles and different taxation policies of different markets, which could be quite a hassle even for wealth managers and for professional investors.”

However, he said that with an ETF, you can access multiple markets in one basket. “All those complexities that I just mentioned are eliminated, and there are additional benefits, for example to potentially significantly reduce the trading cost of your portfolio, or in Hong Kong achieve a stamp duty waiver. In short, we are seeing more wealth managers actually using ETFs across Asia.”

Still a case for active managers

Another guest offered a rebuttal on the views being expressed that active managers had been failing. “There's a common theme, which is that there isn't much value in active management, and I think that's completely wrong,” he argued. “It’s wrong particularly in sectors or themes that are very technical because I think that many of the managers employ individuals who have deep expertise within those sectors, they've worked in those sectors, they know a lot about those sectors and they have a much better idea of where the opportunities are within those sectors to where the growth is coming from. I think it's especially true in fast-changing sectors with rapidly-evolving technologies. You can think back over the last 10 or 15 years of a whole range or a whole number of companies that you could have invested in and they might not have done that well, because their technology basically became obsolete after a relatively short period of time.”

He said that ETFs are very good for giving an initial core exposure within a theme or a sector but that there is still a lot of value of having an active manager or an active advisor. “An active advisor would be managing the single stock portfolio that one might build around a platform of ETF holdings,” he maintained.

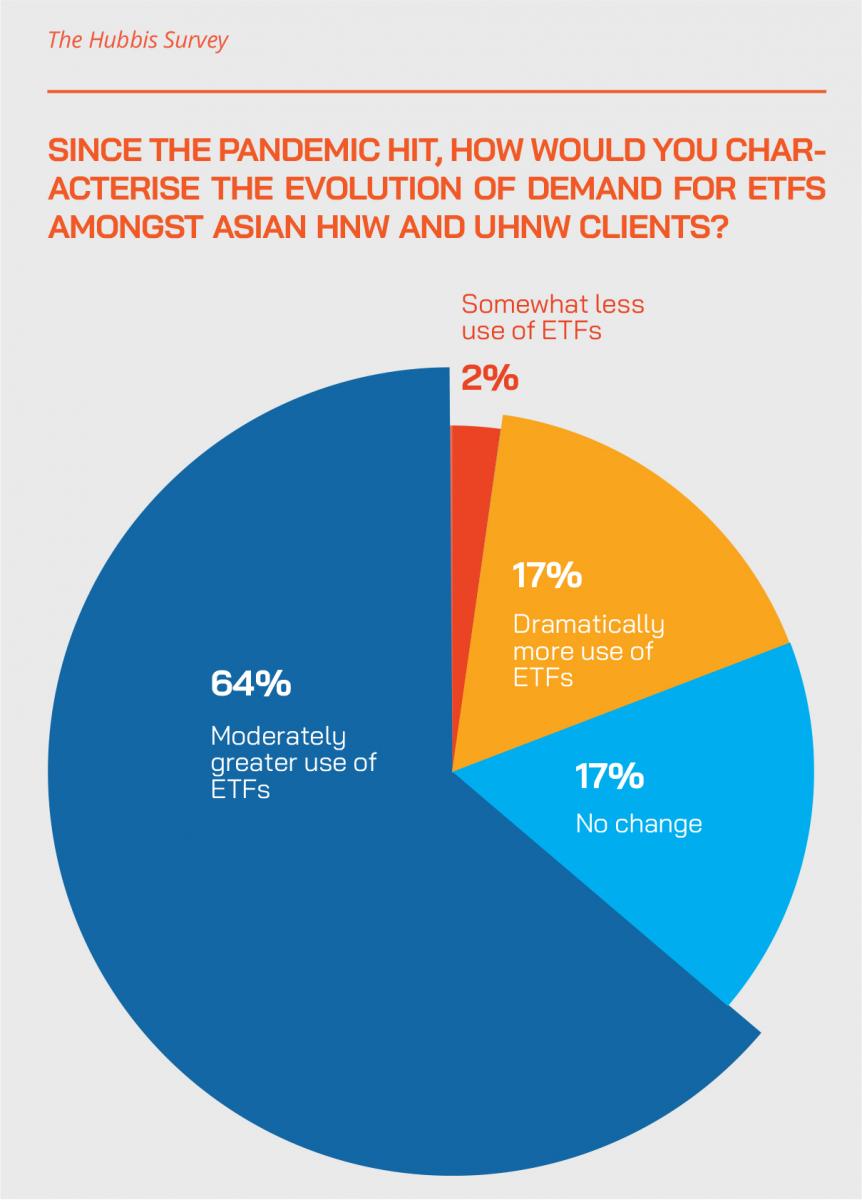

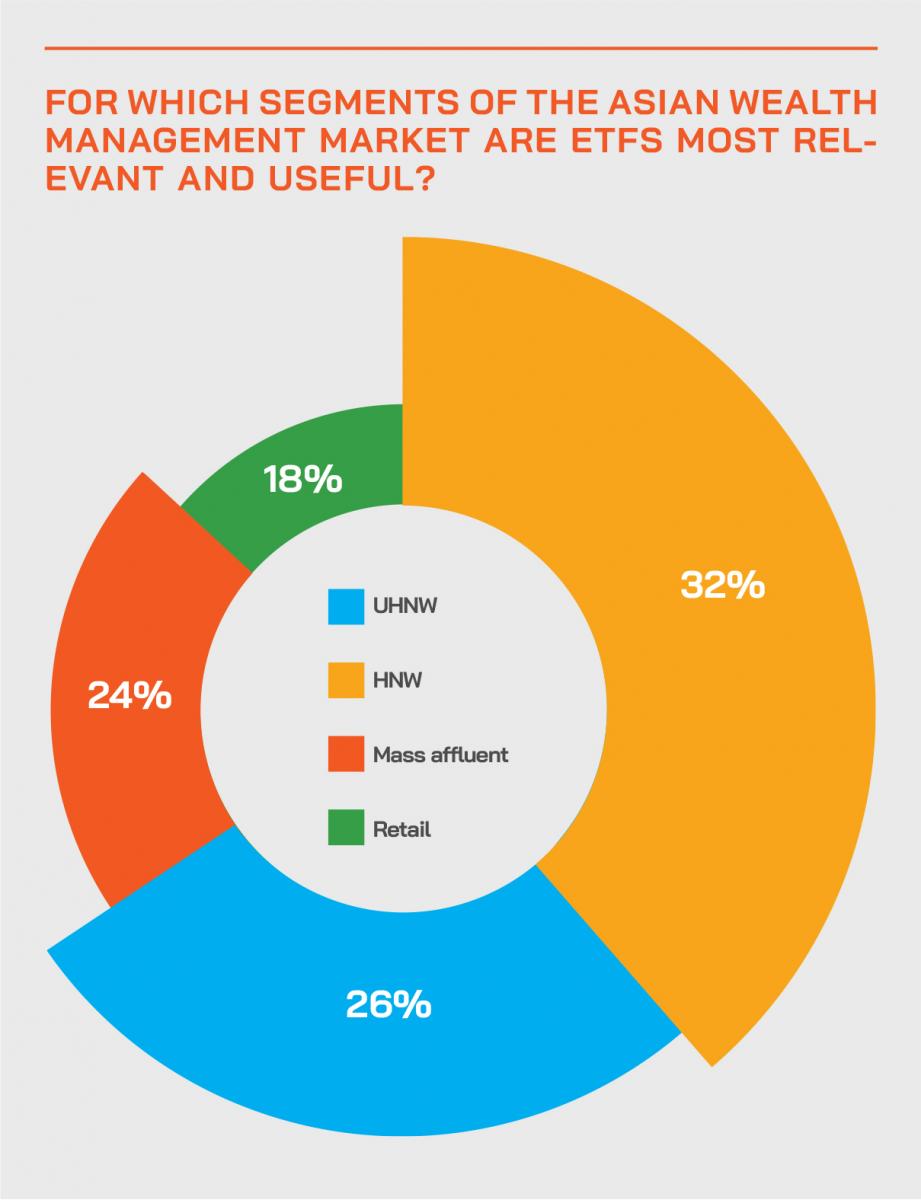

The Hubbis Post-event Survey

Are you seeing increasing demand for ETFs in the Asia wealth management community and if so why, or perhaps why not?

- Yes, to access markets in Asia Pacific while the mainland China ETF market is growing fast.

- Yes, they are a cost-efficient way to get broad-based thematic/sector exposures.

- Yes, cheaper, more convenient, for example a good way to buy into gold instead of physical gold, which is cumbersome.

- Low cost, easy for asset allocation, well-diversified.

- Efficient and liquid.

- More cost effective and more liquid if compared to mutual funds.

- Yes, especially leveraged ETFs, which are getting more popular, providing leverage and they are still relatively safe.

- Yes, but actually that is because there is an increase in demand and interest for investment in equities.

- Yes. Individual security picking is increasingly difficult these days.

- Yes. ETFs pay out dividends quarterly by holding all of the dividends paid by the underlying

- stocks during the quarter and then paying them on a pro-rata basis.

- Yes, with quick and easy access of ETF through various digital wealth management platforms.

- They are transparent and that along with the lower fees make them appealing to millennial HNWIs.

- We have seen increasing demand as they are cost-effective, building blocks to portfolios and can provided access to some unique markets that are tough to buy into unless for registered institutional investors.

- Yes, in the past decade-plus, the shift mainly due to clients were unable to redeem their funds at that time, and the NAVs dropped dramatically.

- Yes, due to cheap fee charges in comparison to the traditional mutual funds, easy access into the market, and a widening variety of product types offered for portfolio construction and diversification. Yes, but clients in Asia still need some time to learn about ETFs.

- Yes. Most clients are moving from managed funds to ETFs. Active managers and portfolio managers have not really delivered on promises of outperformance and have been laggards. They have largely not been able to justify their fees, either in outperforming the good markets or preventing underperformance in falling markets. As we see it, 95% of the fund management industry has failed in delivering on promises. ETFs are an easy alternative due to liquidity, low TER and accessibility.

What role do you think ETFs should play in well-structured private client portfolios and why?

- Building blocks for both the core portfolio (beta) and the satellite portfolio (alpha.)

- A way to fill in the portfolio gaps to obtain exposure into niche markets and sectors.

- Not sure, I think private clients are still more interested in investment advisory service from their private bankers or their investment specialists.

- Easy to access, relatively low admin costs, no cross-border restrictions.

- For exposure to certain topics/themes efficiently.

- Low cost, easy for asset allocation, well-diversified.

- Both as a hedge and as part of portfolio allocation.

- For thematic investment strategies and also solutions which diversify portfolio risks.

- As we ss them, they should represent less than 20 % of the client's total net worth, the other portion should be allocated to other actively managed products.

- Clients can start to invest a small portion and gradually increase based on their needs and preferences.

- They play an important role for our clients in stable dividend pay outs.

- Tax-efficient wrappers of allocations that are harder to hold directly.

- It can be part of a core portfolio in asset allocation, which can have both satellite strategic and tactical plays as well.

- ETFs could replace the mutual fund allocation that those clients used to have. The reason we see is due to the fees and liquidity; ETFs are efficient and better than traditional mutual funds, which have tended to perform less well than expected.

- ETFs are considered to be low-risk investments because they are low-cost and hold a basket

- of stocks or other securities, increasing diversification.

- I advise clients to use ETFs as their core holdings to represent equity allocation. Fixed income is better traded direct because credit is highly personalised. That said, there is great value in going in for HY or EM debt ETFs due to high diversification.

- I think ETFs should be part of an overall portfolio of investments, where a client wants to access particular themes, sectors, or countries without active management. The active management part will come from the Wealth Advisor, who will be managing the client's overall investment portfolio.

- I believe ETFs should be a portion of passive income within a client’s portfolio diversification. When the markets are volatile and there is significant uncertainty, clients can usually rely on ETFs to remain a participant in the markets and enjoy continued growth.

Demand for thematic ETFs increased sharply, so what types of thematic ETFs are enjoying the most demand in Asia and why?

- Megatrends (such as digital transformation, 5G, renewable energies, etc.), and are better than stock picking in terms of risk-adjusted returns.

- Healthcare and biotechnology.

- Bond/Fixed Income ETF.

- Green and impact theme ETFs.

- Environment-driven ETFs.

- As a means of accessioning specific countries, for example China and Vietnam, as well as more regionally dispersed themes, for example SE Asia, or even regional and new age economy combined.

- We forecast huge demand for actively managed ETFs in Asia and believe the market needs this type of product.

- Actually, I think thematic ETFs are a bit of a scam. It is a wall of money chasing poorly performing companies. Looking at thematic ETFs in isolation is not only dangerous but also bad investing. Most thematic ETFs are so new that they have not seen a down market and are full of companies that do not even produce an operating profit. An example of an asset class performing but the thematic ETF delivering poor results is a junior gold miner ETF that is down around 80% since 2012. I think some thematic ETFs, which are effectively all the frothy bubble stocks in one basket, will meet their reckoning shortly. Valuations are crazy yet still retail buyers pour in.

- Any ETF products to do with sustainability, limiting impact on the environment and technology are seeing most demand. These are universal issues that concern most people and will have profound effects on the world in which we live in the future.

- I believe that ETFs consisting of products from less-popular sectors or products that are difficult for clients to participate in directly will experience a significant increase in demand for further portfolio diversification. Despite the apparent risks, crypto ETFs will likely garner a lot of attention.

- China, ESG, crypto-currencies, and blockchain-related ETFs.

- Electric vehicles, clean energy, biotech and robotics.

Leveraging talent and judgment

He explained that his bank’s approach on the managed portfolio side is to employ its highly talented people to select a large number of active managers, and specifically active managers within things like themes across the various aspects of the managed investments. Those are then wrapped into the clients’ portfolios, to assist the clients to achieve whatever they are trying to achieve in terms of exposure, in terms of weightings, in terms of yield, or performance.

“Then on the active advisory side,” he explained, “we have advisors in each of the asset classes, and those advisors assist clients to position themselves, not just with respect to sectors and themes. We do use ETFs, but also with respect to those single stock holdings, those overweight positions being in areas where we see specific value.”

What does active mean and represent?

“I disagree,” said another guest. “Firstly, just because something is an ETF doesn't mean that it's passive, doesn't mean that it's not active, an ETF is a wrapper. In the US market right now, one out of every 10 ETFs there is today ‘actively’ managed, it's just a way to wrap it so it is easier to access and quite importantly, you're unbundling the distribution side of it from whatever the active management service is that you're overlaying on to it.”

He said ETFs are ideal for buying access. “If I'm buying a Hang Seng tracker, I'm just saving myself the effort of having to go buy those 52 stocks myself. It is like buying a ready-made sandwich, I could assemble all the ingredients myself and do it, but that packaging just saves me the effort.”

The active funds ‘supporter’ rebutted again, arguing that he would prefer a sandwich put together by a chef – the active manager as the expert - rather than a sandwich put together by a machine or someone who doesn't specialise in making outstanding sandwiches. “I believe that there is a value to active management particularly for certain sectors as it becomes more technical, and as it becomes more and more fast-moving,” he stated.

A gun to the knife fight

Bringing a gun to a knife fight, another guest said that the data shows clearly that active managers had not performed well enough for too long a time. “I typically go back, look over the last five years, and ask ‘have active managers added value persistently?’ If yes, okay use active management. If they haven't, then your clients are going to ask why you are not buying into ETFs as the cheaper version.” And the strong implication was that he does not believe active managers have proven their worth sufficiently consistently, although of course there are plenty of exceptions.

Another expert then delved slightly deeper into the discussion around adding value. “A problem with increased industrialisation, the increased number of layers between the client and the investment is that is adding value only a question of basis points of performance on a quarter-to-quarter basis,” he observed. “I've spoken with clients for whom adding value can mean knowing what they own, having a better understanding of what's in their portfolio. I think where active managers have fallen behind is in actually describing what their value is beyond just quarter-to-quarter basis points.”

Thematic trends

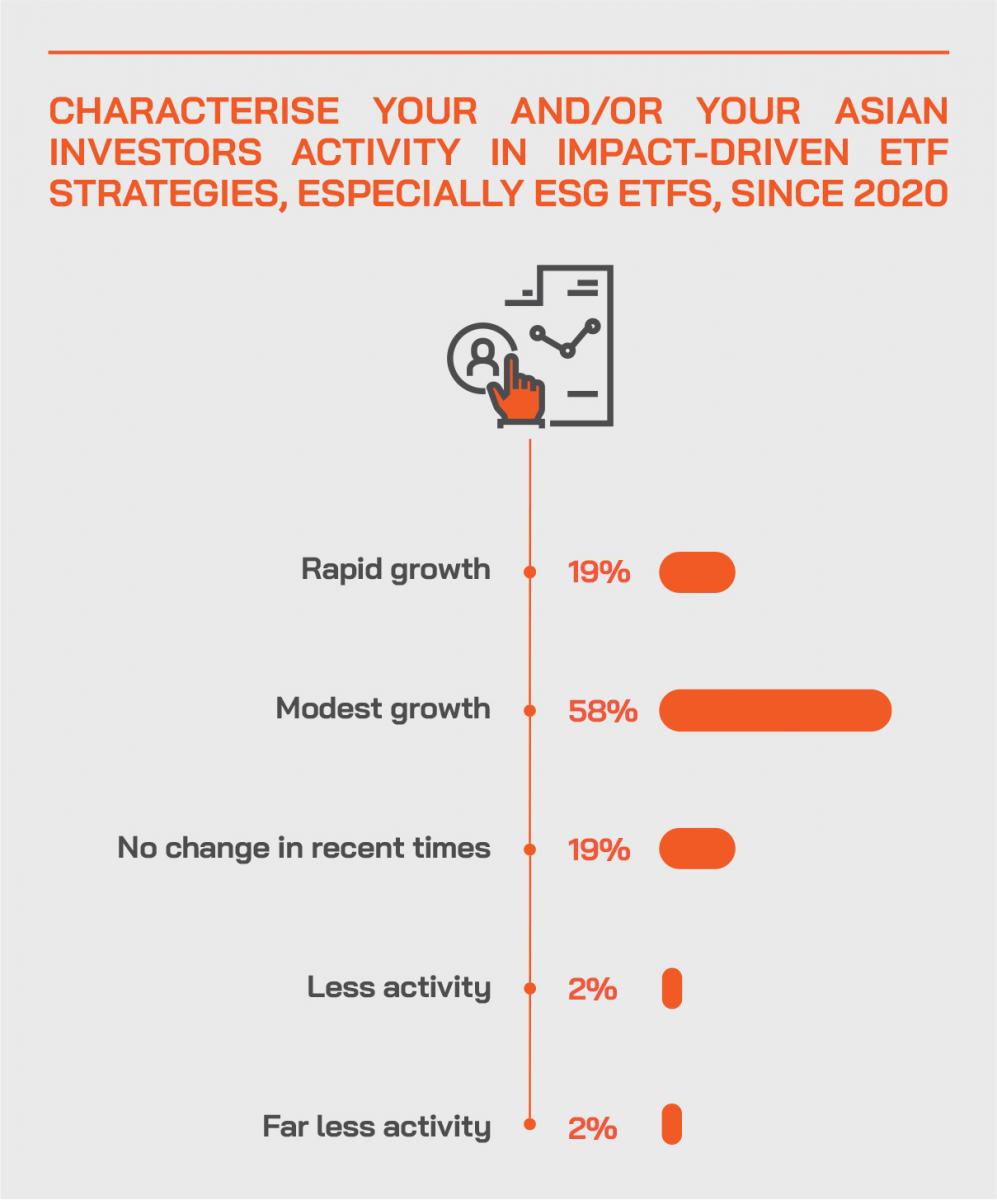

As to thematic ETFs, there are many trends that can be captured, such as for example China’s technology sector, global medical and healthcare, or perhaps country-specific ETFs such as Vietnam, or perhaps carefully assembled ETFs that aim to selectively capture the towards sustainability and social impact via ESG-centric ETFs. The panel looked closely at how these smart beta ETFs are assembled and discussed the rationale for the broad expansion of thematic ETFs.

A guest reported how remarkably active their firm had been in thematic ETFs this year. He said his firm launches ETF products in Asia, not only in Hong Kong, but also in Singapore as well, and themes such ESG and China, ESG and Asia are resonating, electronic vehicles globally, or cloud computing globally. He reported in Singapore that they have yield-enhanced products suitable for the appetites of local investors in Southeast Asia. He said the firm is looking into the concept of digital currency ETFs, leveraged and inverse ETFs, and commodity ETFs, having already launched a successful gold ETF.

Another expert explained that ETF creation is naturally also driven by feedback from family offices, private wealth managers, discretionary portfolio managers, IAMs/EAMs and others, with the aim to fill the gaps those investors feel they are missing. “We also look at Hong Kong and Singapore where we launch our products, and we try to analyse where the product gaps lie between the two exchanges and then we try to plug those gaps.”

Expert Opinion - Tariq Dennison, Wealth Manager, US-Asia, GFM Asset Management: “Done right, ESG presents myriad opportunities for smaller, specialised ETF managers to shine a light on impacts larger funds tend to overlook. Done traditionally, ESG looks like another layer of box-ticking bureaucracy where we pay higher fees for executives to fly around in private jets to tell the rest of us why we shouldn’t own oil stocks.”

Opening new doors

A fellow panellist explained that his firm tries to find ideas for ETFs that have a clear investment focus on a particular theme or a particular sector, but meanwhile provide broad coverage over several markets. “This is because we position ourselves as a regional ETF provider; hence we believe that ETFs that cover multiple markets will complement the local product selection, whereas currently in markets such as Hong Kong, single market ETFs still dominate the total AUM, and there is a lack of regional focus ETFs in the market. And this is also aligned with the product strategy that we have been pursuing for many years, with strong demand from investors for this type of clear investment focus.”

He added that around Asia, there are some restricted markets where investment from foreign investors is subject to caps – for example Vietnam – so adopting their firm’s strategy for these types of multiple market ETFs adds an additional layer of liquidity for foreign investors, thereby improving access.

Targeted but with plenty of overlap

He offered the example of their China Dragon Internet ETF, which launched in 2018 with a clear focus on the Chinese internet sector and comprises 30 Chinese internet leaders that are listed globally. “Meanwhile, we also provide diversification in the sense that we not only cover a single market, but also all the major markets in which Chinese internet leaders are currently listed, so we include US ADR, Hong Kong equity as well as A-Shares,” he reported. “From time to time, these three markets will move in different directions, so with this portfolio, we are able to provide diversification in terms of market risks. The product thereby provides diversification as well as precision.”

Room for improvement

A banker offered his views on where the ETF market could develop, remarking that the fixed income ETF market had perhaps been less utilised, certainly amongst his client set.

“In an environment where yields are low, there is a very good opportunity for clients to improve their yield by playing on the inexpensiveness of ETFs,” he said. “The only aspect they do need to understand is the way that an ETF performs through different interest rate cycles, and that is potentially slightly more difficult to get to grips with because effectively as interest rates rise, and therefore, the price of the ETF will decline; clients basically need to understand that they are through the longer- term going to be compensated for that eventually through higher yields. Over a longer period of time, the investment in the ETF should provide them with a good investment. Clients find it a little bit more complicated, but I think that if we can get over that, I think that that is one area where I would like to see much more participation.”

Expert Opinion - Tariq Dennison, Wealth Manager, US-Asia, GFM Asset Management: “Most smart beta ETFs seem very watered down, with only slight tilts overweighting assets that are cheaper, smaller, or higher-scoring on some other well-researched factor. This seems to be because many ETF buyers are afraid to deviate too far from the benchmark, but that deviating deep exposure is exactly what would make smart beta more valuable.”

Fixing the gaps in the offerings

Another guest opined that in terms of the missing pieces, he pointed to the lack of fixed maturity ETFs. “We heard about fixed income ETFs,” he remarked, “and the fact is, many of us wealth advisors use bonds by holding to maturity. The problem with fixed income ETFs is they keep rebalancing, so I can't buy an ETF and hold it to maturity, so if I want a client to buy a diversified portfolio of high yield bonds, all maturing in the second half of 2022, and hold that to maturity right now, I don't have that in Asia.”

He added that he would like to see more specific country-related ETFs that access emerging or more likely rare, frontier markets, for example Nigeria, or in Asia, Bangladesh. “When we talk about like China technology, I can trade those shares directly,” he remarked. However, to access certain markets where is might be foreign investor limits, or complexity in terms of regulatory matter, or limited liquidity and information, it would be useful to have more dedicated cross-border vehicles.

China in the spotlight

A guest commented that the giant opportunity today is China, and that there are many opportunities in those domestic markets that foreign investors cannot yet access, or only with great difficulty. He said that, for example, data is lacking in the vast domestic bond markets, liquidity poor in places that people might want to buy. “If someone can solve that for us, that would be very helpful,” he said.

He added that there are opportunities in the broad risk management space. “People do use structured products for certain payoffs in order to kind of mitigate some risks that they've got in their portfolio., so for example, if inflation is likely to head up, can someone put something smart together, where I can benefit from inflation rising. It can be more sophisticated with perhaps a more quantitative approach to some of the risk management that we need in portfolios, delivered through an ETF. And I totally agree that it would be ideal to have a low cost fixed income ETF with a fixed life.”

A banker agreed, adding that many of his clients like to buy bonds to maturity, with some leverage and therefore the concept of fixed maturity ETFs would be appealing as an alternative to achieve those goals. “As long as they're happy with the credit, they can continue to hold, but they are looking for something with a defined maturity.”

A window on China’s vast debt market

A speaker highlighted how their firm had in 2020 launched a fixed income ETF, in Singapore, raising USD1.2 billion in three months, a remarkable achievement, he said. “A very simple product,” he reported, “as it is a Chinese government bond ETF straightforward with low fees and really low fees. We are still focusing a lot on China bond ETFs and an actively managed China bond fund as well. Investors keep looking into these two areas regarding a China focus, not only on equities, but also from the fixed income perspective, as it is difficult to access that market.

He added that the firm is now planning some type of yield-enhanced product this year in Hong Kong, and that they would certainly be looking further into fixed maturity ETFs.

Another expert reported that their focus remains on equities and commodities, but that his firm is constantly looking at new ideas, and through conversations with clients, they are seeing more ways for them to use fixed-income ETFs.

“For example, on the institutional side, we see that insurance companies are increasingly using fixed-income ETFs for asset-liability management,” he explained, “because different fixed-income ETFs can provide exposure to different ratings, yields and duration characteristics. For wealth management and family office investors, we also see that some of them are using a bond ETF, particularly short duration bond ETF, money market ETF for short term liquidity management, and quite interestingly in China, we also see that some asset owners and corporate bondholders are using bond ETFs as a way to diversify their portfolio risk through income creation. As we see each of those different use cases, it gives us more inspiration for new product launches.”

Allocations and new ideas

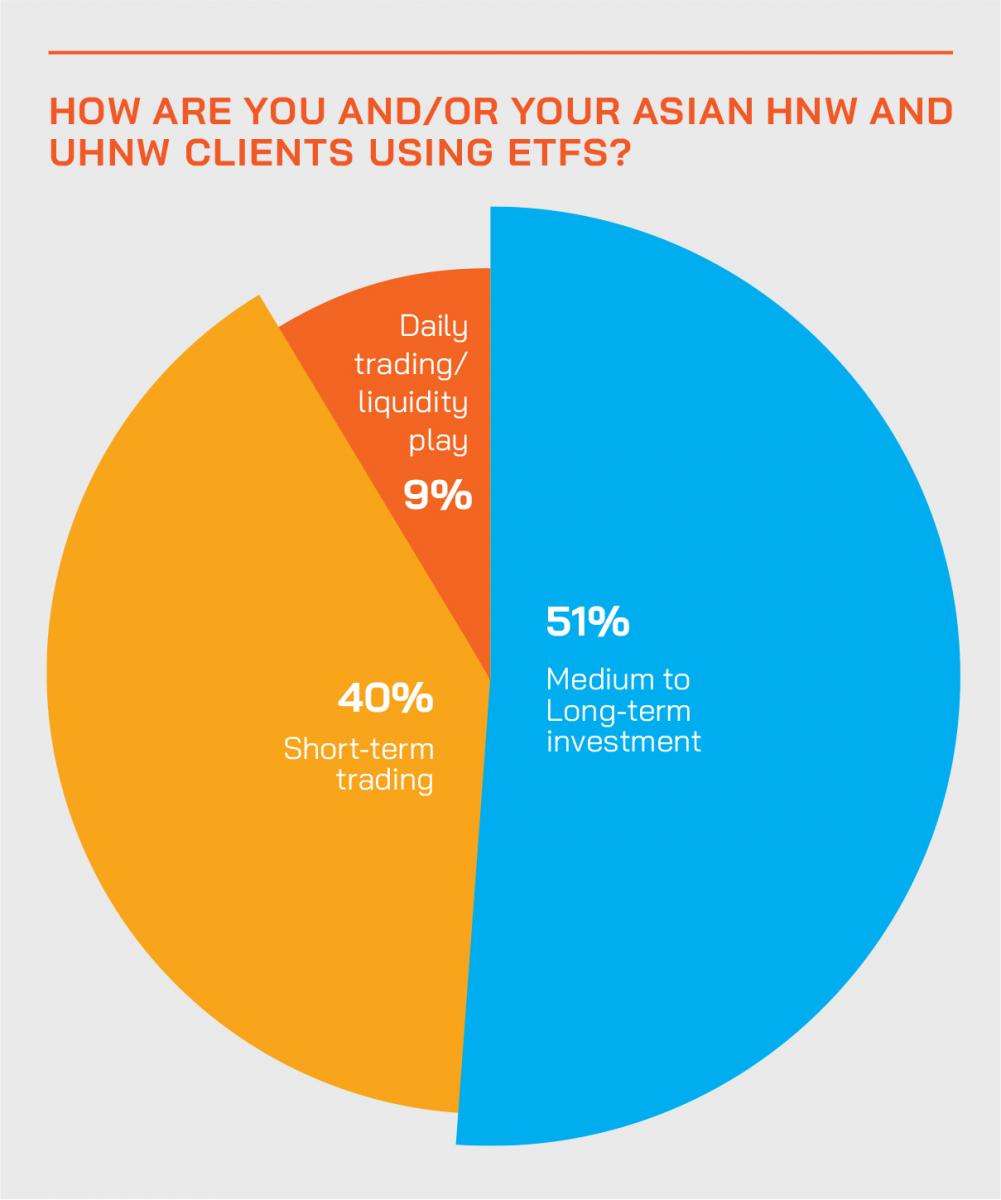

The panel closed the discussion by commenting on what types of allocations clients should make to ETFs. A guest said in some cases, clients are 100% invested via ETFs, and for others, it is more selectively based on specific opportunities. Another expert reported that ETF allocation had in his view roughly doubled in the recent past several years, partly due to cheap access and partly due to the surging availability of thematic ETFs.

“It varies,” came another voice. “We have seen obviously increasingly that clients will use ETFs for their core exposure, some of them do want core exposure in global markets across the global markets. Then, other clients want exposures to specific themes or areas/sectors. There is probably a place in every portfolio for a certain amount of ETFs, and I think that it depends to an extent on how much time and effort the investor wants to put in with their advisor, managing a portfolio.”

He said, for example, if an investor wants exposure to electric vehicles as a theme, the investor might initially buy an ETF to achieve that, and then the same investor might look in more depth into individual names, but of course to buy into an actively managed portfolio of EV names, that would take a lot of time and effort to manage on an ongoing basis. “Most of our clients are entrepreneurs, business owners, people who don't have an enormous amount of time to devote to managing an active or an actively rebalanced or an actively traded portfolio of single names,” he explained, “so, those clients will continue to probably maintain a fair amount of the exposure through something like an ETF whilst taking certain tactical positions from time to time in high conviction names.”

The final word went to a speaker who said that he wished investors would migrate completely to ETFs, but that of course it depends on the investor and their objectives. “There are certain areas that ETFs will work really well for, but there are certain areas that individual stocks will work better. As an ETF issuer, it's very important for us to really listen to our investors and understand what they need and provide the right solutions, and that is what we will continue to do.”