Publications & Thought Leadership

The Art & Science Behind Delivering Personalisation and Elevating Client Engagement

Jun 14, 2022

To imagine that the art of wealth management is all about delivering the best products and solutions to private clients is like assuming that the most technically gifted footballers will score the most goals and win the most silverware. It is simply not true. There are other vital skills and capabilities that make a client-facing relationship manager into a trusted advisor for their clients. Most importantly, successful wealth management players that want to be seen as trusted advisors for their private clients must strive to deliver both relevance and impact. The Hubbis Digital Dialogue of May 12 drilled down into how today’s essential and increasingly user-friendly digital tools and solutions can combine ideally with the ‘softer’ elements of wealth management to deliver genuinely positive, relevant impact to private clients. In doing so, the private banks and EAMs will be well on the path to differentiating themselves and further building their brands and their platforms for the years ahead.

The Panel:

- David Wilson, APAC Wealth Management Lead, Accenture

- Thomas Roth, CTO, CREALOGIX

- Sharon Chan, Team Head, Regional Segment, DBS Bank

- Rajashik Chatterjee, Director - Consulting, Financial Services, EY

- Damien Piper, Regional Director, Asia, InvestCloud

What is client engagement, and what do we mean by the digital experience?

A guest first offered some broad-brush strokes to paint a picture of client engagement from a digital perspective. “What is digital client engagement and the digital client experience?” he pondered. “The engagement and experience imply empathy, so you know the client, and you can anticipate what the client wants. The experience should be pain-free, it should reduce friction, require fewer steps, and be as smooth as possible. Then digitally, the channels you need must all be available, and need to perform at the required level and have all the functionalities incorporated.”

Surveying the Asian wealth management market – three key trends and themes emerge

A guest opened his commentary by pointing to a recent survey of 2100 plus clients across 21 countries. He explained that there were three very important themes that emerged across the mass affluent segment, HNWIs, UHHNWIs, and family offices.

First, the service clients are expecting is at a much higher level of tailored advice, and they are expecting tailored offerings that are driven by personalisation. “Interestingly, younger clients are more open to sharing their data, but in return, they want a much more personalised service, personalised offerings,” he told delegates. “Moreover, what is needed is not just personalisation, but hyper-personalisation, so that supported with the right data and analytics, the end clients are offered the right ideas and very much at the right times.”

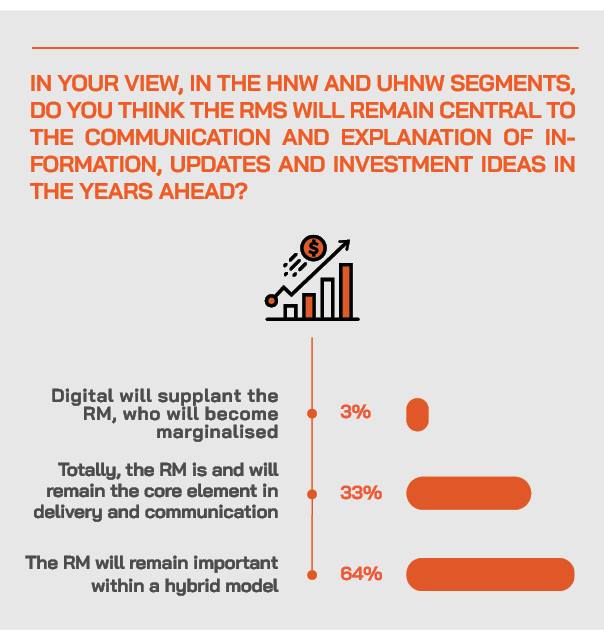

The second key theme was around engagement. “Is this going to be truly purely digital in the future?” he pondered. “Probably not. Is it going to remain as face to face as today? Also, probably not. So, and this is not new, the hybrid engagement model is the code for any financial institutions if they are to retain their clientele.”

The third key element centres on purpose, whereby the goals and hopes of these clients are aligned with the offerings their financial institutions can deliver them, whether around retirement, or education planning for children, or legacy planning, perhaps also the topical area of sustainability. “Everyone is different,” he stated. “It is vital to understand the purposes the client have for themselves.”

For some, the drive to achieve client engagement starts with a genuine ‘obsession’ with the customer

“The customer is at the heart of everything we do,” a guest told delegates. “That has been the case for over a decade, but we are taking it to the next level, we are actually advocating internally to be customer-obsessed and trying to create a culture around that.”

As to what this customer ‘obsession’ means, this expert explained that the bank starts by trying to discover and understand their everyday needs and pain points and only then devise the solutions. “We put ourselves in their shoes,” she said. “As a leading bank, we see this relationship as an end-to-end journey with them.”

And the key to effective customer engagement is relevance, she reported, and that there are three elements involved. What do you want to engage them on? When do you do it? And how do you continue to do it? “The content must be right, the timing accurate, and we need to be providing outcomes constantly, not just one-off solutions, however good those are,” she elaborated.

Accordingly, she reiterated how the bank was spending a lot of time trying to understand more about the customers, their needs, and their motivations. “And we are doing it a lot through data, and digital and technology,” she added.

And she said data must be relevant and timely; there is no point promoting children’s insurance to an aunt with no children, even though that person has been seen online regularly finding children’s presents and so forth for their nephews and nieces.

Looking well beyond finance & investment for leads that can be applied to the world of wealth management

An expert observed that a lot of the cutting-edge progress is being made away from the financial sector and can be applied to the world of wealth management, at least where regulation permits. The hospitality sector, for example, is achieving a lot around transparency of pricing and product discovery. The purchasing journey is very easy and triggers the experience element, for example, automated emails to thank the client for choosing that hotel or institution. The triggering then might ask for more information that will be applied to making the experience of the actual hotel more impactful on arrival.

A heavily regulated industry is the medical sector, where the pandemic has greatly accelerated e-diagnosis, e-consultation, appointment making, and so forth. “And we see in the US that there is more machine learning, where they can actually automate through data and analytics, the diagnosis, and the doctor then has more time to focus on the key issues,” he observed. “Many of these advances can be applied to private banking.”

In an increasingly fast-moving world, the wealth industry is constantly vying for the attention of clients

Picking up on this theme of competing for the client’s attention, a guest remarked that banks and other providers must realise they need to elevate their game, or risk being marginalised.

“First,” he said, “in the waking hours of any client, wealth management providers are competing for their attention with a host of alternatives, from work and family to Netflix and so forth. Time is limited, so the engagement must be on point and pleasant.”

Secondly, customers have numerous points of access, from smartphones to smartwatches, to mobile, online, and within those a wide variety of applications; hence if the wealth industry can offer an enhanced USX, they can gain an increased share of the time of the customer.

“This, in turn, means you get a better chance to engage, to showcase what you can offer, and this improves share of wallet and also boost the likelihood of being able to cross-sell and up-sell within your organisation,” he elaborated.

The third point is to overcome some of the ‘pain’ of compliance and other administrative tasks that are a necessary burden for the wealth industry.

“You have to make the drudgery elements as engaging as possible,” he said. “You can send the clients an investor profile questionnaire to fill in to help gauge suitability and preferences around investments, or perhaps you can achieve the same outcome, or better, through an engaging client discussion and advisory talk, whereby you are helping to create mutual trust, you learn about the client, and you can then convert those findings to something more valuable.”

Tailoring the channels and delivery to the end-clients, and retaining the human connectivity and support

As to the precise digital journey offered to customers, that will depend significantly on the types of clients, whether mass affluent or extremely wealthy, a panellist reported.

“For example,” he said, “if you want to attract young, affluent or future-affluent customers, you can offer digital-only for digital natives in the young demographics of Southeast Asia, to start those customers on their wealth management journey. But you do not need to throw out the RM assisted journey; that will still be there in parallel, but that can be more for wealthier clients, or those we already know will pay more for a higher-touch model. The RMs are thereby somewhat freed up to serve the more complex needs. And you stitch all this together in the famous omni-channel and then personalise accordingly to the particular clients.”

Personalisation is at the epicentre of ‘modern’ wealth management, and engagement drives activity

Expanding on the topic of personalisation, a guest said in his view, there are two key elements to this. There is the personalisation of the conversation and the personalisation of actions or recommendations.

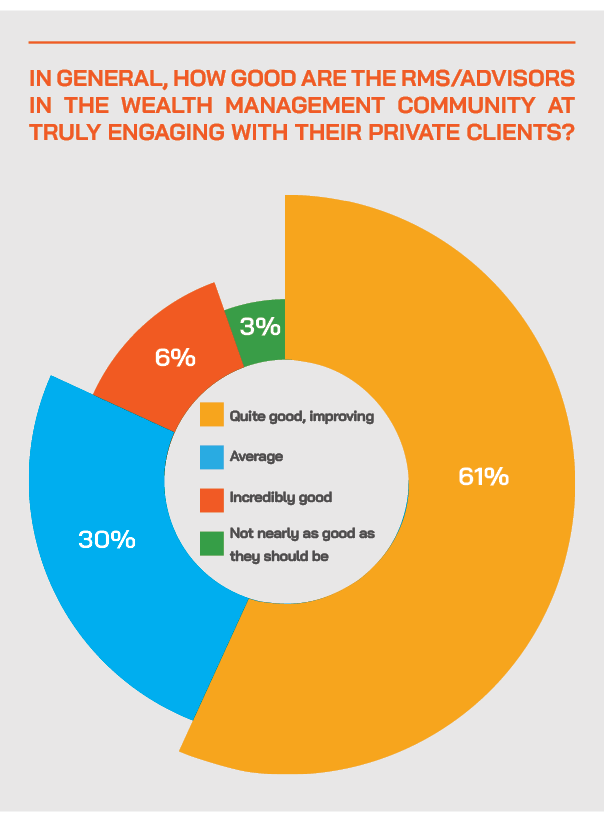

“The conversation centres on understanding the clients, their expectations, their timings, their frequency, their preferred channels, so you become more than advisor; you've suddenly got more mindshare,” he explained. “This is important as clients in Asia are multi-banked, especially in private banking at the higher levels, so you want to be considered the primary wealth manager where we know you get hold of a lot more of the AUM. So, personalising the conversation is key.”

Then for the actions and recommendations, he explained that you are acting on anticipating of what a customer may be interested in or perhaps needs to do. For example, they might want to take a new investment route or perhaps they urgently need some portfolio rebalancing. They might be looking like they want to leave the bank, so you can react by perhaps changing the RM, adapting fees, and so forth. “

You can also pull out all the different levers within the bank, so the client gets a more 360-degree offering from all areas,” he elucidated.

Responding to comments on key trends from fellow panellists, another guest said he would try to focus on how these trends have been put into action from a digital experience perspective and also on the evolution of the delivery of personalisation in the Asian wealth markets.

“We are finally seeing some technologies, like machine learning, being put into practical use to help drive towards the ultimate goal of hyper-personalisation,” he told delegates. “This means the right content, the right offer to the right customer. The tools are now both available and sufficiently proven, or mature, to be really effective. And as we have discussed, this all starts with understanding the clients and individual preferences across investments, including in areas such as sustainability, and appreciating the rationale for certain decisions.”

CRM/CLM is an integral part of the mission to achieve enhanced personalisation and better engagement

A panellist observed that smart CRM is immensely valuable but explained that banks should not apply CRM just for the sake of CRM. They need to make it entirely relevant to the RMs and advisors as they try to solve advisory, execution and to help the management, client servicing, and improve all of the internal practice management around sales planning and so forth.

“If you have gone down the CRM route,” he elaborated, “you've got to make that work with all your internal systems and processes and strategies and teams to make sure that the life of an RM is not 80% admin. The RMs and advisors need to be delivering added value, delivering on their relationships, and further building trust. When the RMs see the opportunity of some major activity with their clients, they must actually have the time to focus and deliver.”

Another expert said we have come from a situation where CRM was very basic to one in which there is far more focus on behaviour.

“This goes way beyond simple addresses and socio-demographic data and assumptions and moves towards hyper-personalisation,” he observed. “This is far more than ticking boxes on preferences and past activity, and far more about predicting behaviour and preferences and then making suggestions. You anticipate behaviour based on psycho demographics; this is really the next step.”

To achieve this, he said the banks need to enrich the CRM system, but also what goes beyond the CRM system, the systems that are fed by the CRM, the interaction system, the omni-channel delivery, and so forth. “CRM today is a piece in the puzzle, a piece which is within the chain of knowledge of the customer, and a facilitator for being able to serve those customers with solutions delivered in an omni-channel ecosystem,” he reported.

Another guest concurred, explaining that his firm had been working for some years on the application of behavioural science. “That is another really critical ingredient and facilitates more differentiation amongst the financial institutions,” he commented. “There are many customers out there who are multi banked, so we believe developments such as behavioural science really can differentiate the brand of the bank and the elevate the client experience.”

The hybrid model can align digital and human connectivity for optimal client USX and outcomes

And the panel agreed that the future of wealth management is the hybrid model, at least for the foreseeable future and for the wealthier clients where scale is less important.

“We all still value this face-to-face interaction, whether in private banking or elsewhere,” a guest claimed. “We prefer that human interaction; many of us can't wait to go back to the office to have that water cooler chitchat. The reality is today there is a combination and a balance needed between digital and human, and the right balance depends on the individual, so we need to understand our customers as well, to really know what they want. And that comes back to the customer obsession I have highlighted earlier.”

She said that hybrid engagement and personalisation span all segments of wealth management. “We all want the same thing, namely, to feel special, to feel approached as an individual, so the content must be right,” she said. “And knowing the customers helps us know when they should be approached, even down to their preferred times of the day. We are nowadays not just competing for customers’ attention with other banks or other financial institutions; we are vying with Spotify, Netflix, MySpace, so how do we catch their attention? We need to achieve that attention and also continue to stay relevant.”

A fellow panellist also offered his perspectives on the hybrid protocol in wealth management, remarking that personalisation can be very efficiently and successfully delivered if the digital and the human interface can be well combined.

“Clients want and need the digital options to interact with the bank because they have less wait time, because it's at any convenient time for them, because they can browse, and so forth,” he said. “And then combining the automated approach with the human who steps in where it's really relevant and valuable, where there is more of the emotional side of the client interaction to address. This is really the key piece in solving this hybrid puzzle.”

The RM cockpit and the 360-degree perspective on clients and their activities

An expert explained that all the points discussed on the panel supported the rationale for the major momentum in the industry around trying to give RMs the cockpits and the tools so that they can be empowered and enabled, so they have a 360-degree client perspective, and so they can forge ahead easily with next best actions, next best conversations, portfolio rebalancing, and so forth. He observed that this results in a far more personalised, relevant and trust-engendering relationship and activity between the bank and the client.

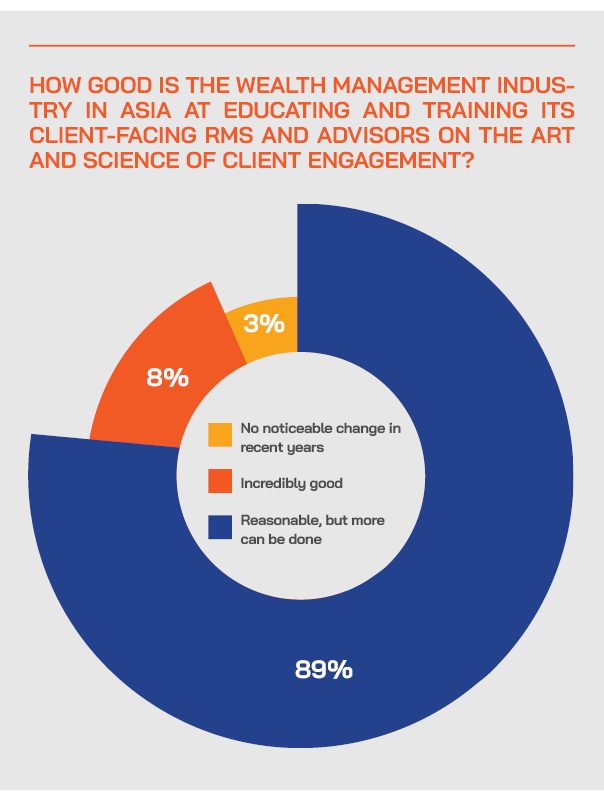

Focusing on the higher echelons of customers, another guest observed that the RM needs to be empowered with technology, not marginalised by it, and that to do so, the RMs also need to learn how to master the tools that are available. “They cannot take advantage of what they might be offered without knowing how it works, just as there is little point in having a Ferrari if you can't drive properly.”

Another expert agreed, adding that the role of the RM, so vital in wealth management in the past, was most certainly central in the hybrid wealth management model of the future that he had referred to earlier.

A guest agreed that this is all well and good, but to achieve the required results, the RMs and advisors must also engage with the technologies available and really understand how to make the best of them. “My way of explaining this is to describe this as the ‘adoption component’ whereby we are encouraging the RMs to enjoy using the technologies, to make it as simple to use as possible and as enjoyable as we can,” he said.

He concluded that there are three key components that need to align. First the bank’s technology and its use of data must be exemplary. Second, the RM or advisor engagement with technologies and tools must be positive and progressive. If these two elements come together, then the user experience will be significantly enhanced, and that will, in turn, result in greater trust, better outcomes for the clients and ultimately better business.

Content-based advisory and the advisory lifecycle

How can you make your RM stand out from the competition?” an expert asked, rhetorically. “Well, it is about empowering them with the tools for them to focus, to prioritise and then deliver. They need bite-sized information to help them focus, prioritise, and then to deliver a genuinely relevant client offering and experience.”

“We are seeing a number of more advanced wealth managers working with us on the concept of content-based advisory,” the same guest told delegates. “They are thereby breaking away from the classic idea of having hefty great reports – that, incidentally, almost nobody reads - to more bite-size content that is shared with clients in a much more natural way, in a conversational manner between advisor and customer.”

Content-based advisory, he said, impacts the entire advisory lifecycle. “I spoke to one of our customers who said they had spent tens of million dollars creating the best reports they possibly could, but the customer seldom or never reads them because they’re usually 20-pages plus, and nobody has the time,” he reported. “The right snippets at the right time delivered through the right channels achieve far more these days.”

Keep experimenting, keep testing the waters, keep learning from mistakes

A guest observed that nobody will get things right all the time. “We have to experiment to get things right,” she said, “so we are not afraid to make some mistakes as we go through this journey. Secondly, we keep trying to learn from everyone across the board, and I mean all types of businesses, from Sephora to Amazon and many others besides. We try to see how we can distil elements and make our wealth management offering better for everybody. The clients’ needs are never static, so we strive to continuously evolve. And to achieve that, we are also deeply into the behavioural science of it all, and how can we make sense of the data.”

Bringing it all together is easier said than done

A panellist’s final observation was that in banking, the customer’s life and the banking services were separated, but that now, increasingly, with digital tools, technology, data, analytics and so forth, it is all more inter-twined. “The challenge now is to be completely integrated,” she said. “We need to master all the data and information and understanding and elevate the proposition, the engagement and the offering. And that is what we are doing.”

Another expert closed by commenting that the banks and other wealth management firms first have to figure out where they are on their journeys, where they are heading and then figure out how to get to those objectives.

“We see a lot of banks or financial institutions getting many parts of the journeys right, but we have yet to see people figuring it all out,” he explained. “For example, many banks continue to struggle with source of wealth, or source of funds, and nobody seems to have yet forged the silver bullet to put this beast down once and for all. These digitisation journeys are evidently largely heading in the right directions, and [as consultants] we are there to help refine their visions and recalibrate their compasses so that their clients achieve their stated objectives and perhaps even more.”