Thailand’s Wealth Management Market: Fresh Impetus & Greater Collaboration Drive Positive Developments

May 24, 2021

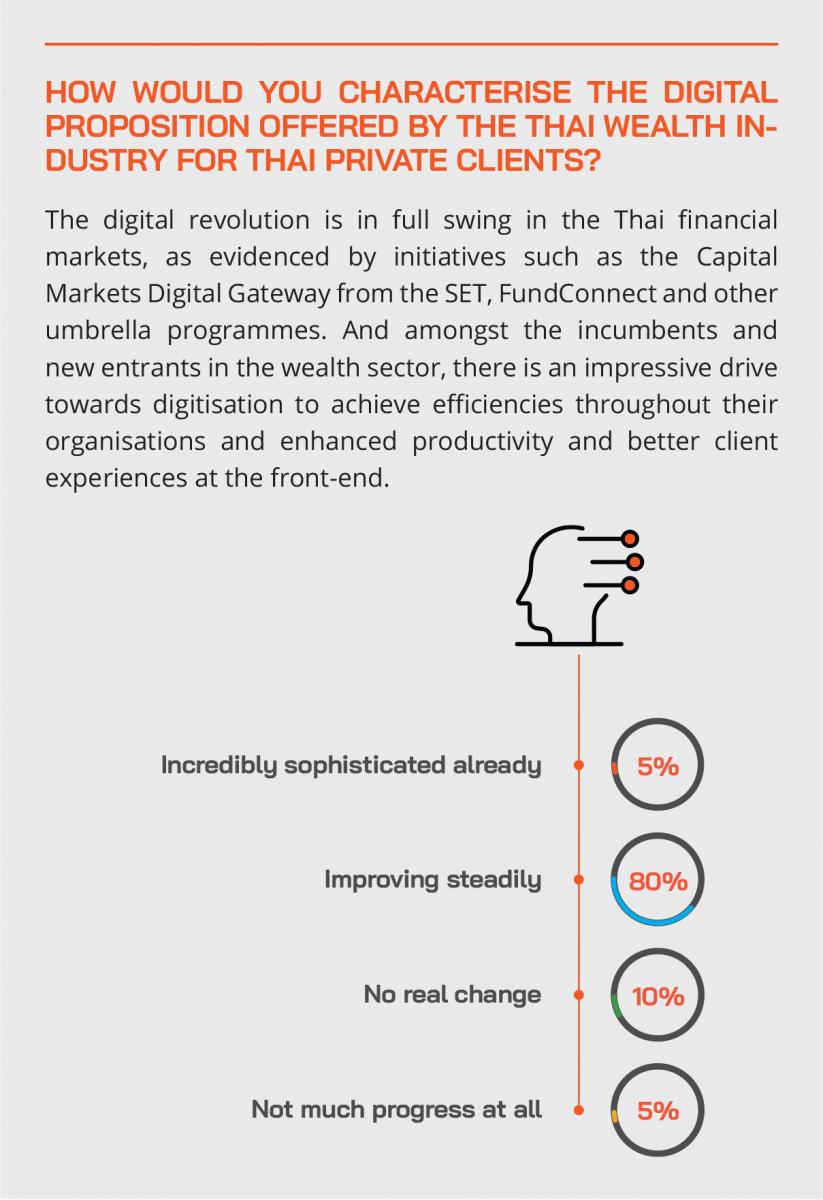

Thailand has seen tremendous growth and many exciting developments within the wealth management sector in the past decade. With local and international players upgrading and enhancing their platforms and propositions as they compete for market share, these moves have largely been supported by a robust and consistent effort from the regulators and from the government itself. The pandemic has somewhat hindered the progress, of course, but experts believe it has also offered a moment to incumbents and to newer competitors to hone their business plans, their models and their digital strategies to help them compete more effectively in the future. The institutions, the regulators and the industry have certainly been collaborating more effectively in recent years to help develop the market infrastructure, digitise more operational elements, broaden the range of products and encourage greater professionalism. Developments such as the Stock Exchange of Thailand’s Capital Markets Digital Gateway and FundConnect have helped considerably, and moves are afoot to expand the latter protocol to the bond market. Hubbis, in collaboration with our exclusive partner for the discussion, Robowealth, assembled a remarkably high-level and also a very thoughtful and engaging panel for what was an outstanding analysis of the state of the market and the challenges and opportunities that lie ahead.

PANEL MEMBERS

- Robert Penaloza, Chief Executive Officer, Thailand, Aberdeen Standard Investments

- Dr. Win Udomrachtavanich, Chairman of the Board, KTB Securities

- Vincent Magnenat, Chief Executive Officer, Asia, Lombard Odier

- Pote Harinasuta, Director & Chief Executive Officer, One Asset Management

- Chonladet Khemarattana, Chief Executive Officer and Co-founder, Robowealth

- Kitti Sutthiatthasil, Executive Vice President, Strategic Initiatives & Industry Utility Division, SET

Although large swathes of Thailand’s economy have been shut down by the government due to the pandemic – the worst hit being the vital travel, tourism and hospitality sector – Thailand’s currency has remained relatively robust, and the government seemingly on top of the national finances, at least for now.

Setting the Scene – Overcoming the Headwinds, Looking to the Future

There is accordingly considerable optimism that the private sector, the regulators and the government will pull together to help the country’s economy burst back into life once the worst effects of the pandemic have been brought under control, either by nature or by the global vaccination rollout.

When this takes place, the private wealth creation phenomenon that Thailand has been enjoying for multiple decades should resume robustly. The Thai private wealth management industry will be more ready than perhaps ever before to help spread products and services across the nation and across all segments of wealth, offering a more dynamic and diverse proposition to either draw money home from offshore amongst the nation’s UHNW and HNW clients or to keep it in Thailand.

Strategic visions, enhanced collaboration, positive competition

And the rapid expansion of digitisation is increasingly placing the WM industry in a good position to offer a far more exciting proposition to the country’s mass affluent investors. The hiatus caused by the pandemic has also have allowed some of the partnerships between international and domestic private banks and financial groups to have settled in, and there are already positive signs they will be increasingly competitive in the future. And Thailand’s entrepreneurial dynamism has also seen the arrival on the scene of new entrants, generally powered by the latest digital solutions and targeting the mass affluent and, to some extent, the lower HNW segments.

The panel of experts took a deep look at the market environment and outlook, and at the range of products and advice available across the different segments of wealth in Thailand, as the regulators gradually liberalise the market, and help facilitate the diversification of products and the development of talent in the local market, as well as at the evolution of the delivery of the wealth management offering to different segments, from UHNW to mass affluent.

Diversification of product range, improving advice, expanding the talent pool

The panel analysed the evolution of the onshore WM offering compared with the offshore proposition, it mined down into the regulatory environment and anticipated future developments there, and the experts reviewed the evolution of the customer base and their expectations amidst the new world of ultra-low rates and continuing economic uncertainties, as well as the competitive situation in the market. And the panel anticipated some of the key challenges ahead for incumbent players and new arrivals.

Expert Opinion – Vincent Magnenat, Chief Executive Officer, Asia, Lombard Odier: “Today, the range of offerings for Thai clients has increased. But what we shouldn’t forget is that we need the talent, and we need to grow and develop this talent pool of wealth advisors and bankers in Thailand. It is one thing to have the products and offerings, but it is also important to remain holistic in our approach, and ensure our advisors and bankers are able to provide quality service to clients. We are also in a country where we are in the first, and maybe second generation of family businesses and entrepreneurs, and being able to take the right approach, to provide good advice in terms of wealth planning, is as key as having the right products.”

The SET’s Capital Markets Digital Gateway – driving cooperation and efficiency

The event opened with Kitti Sutthiatthasil, Executive Vice President, Strategic Initiatives & Industry Utility Division, at the Stock Exchange of Thailand (SET), offering his overview of the SET’s drive to create its Capital Markets Digital Gateway.

He explained that the SET in recent years had expanded its services to include a utility function. Besides the typical stock exchange journey of trading, clearing, settlement, depository, the SET keeps aiming to build innovation for the stakeholders in the Thai capital markets. He reported that the SET several years ago saw that at the backend, all the financial intermediaries needed to invest in the same thing, and that this was very costly. Accordingly, the SET aimed to promote the concept of backend collaboration, and targeted improved efficiency and standards around digitalisation.

Accordingly, he told delegates that the SET had devised the Capital Markets Digital Gateway, where financial intermediaries could connect to one stop service centre, the Digital Gateway, to connect to the banks, and to connect to the authorities, allowing the financial intermediaries to focus attention on front-end innovation. He explained that this means faster time to market, more accessibility, wider choice and a more inclusive investment community.

Armed with two excellent and detailed slides, he reported that the digitised utility service enable back-end collaboration or back-office collaboration between the various parties and includes a payments system connecting to roughly 12 banks by which the financial intermediaries would use just only one standard format to send into the payment instructions.

The SET’s FundConnect - advancing the market infrastructure

And for wealth management, specifically, the SET has introduced its system called FundConnect, which allows the selling agents or investor services for the mutual funds to buy into many, many thousands of funds in Thailand, thereby creating an open architecture platform for the wealth management industry.

In the near future, Khun Kitti explained that the system would also connect to telecom operators and the national digital ID platform to help financial sector parties onboard their customers electronically, and in a standardised format.

He explained that regarding mutual fund connectivity, the SET system went live around three years ago and that today the infrastructure works very well indeed and is now processing almost a million transactions per day.

Greater partnership results in greater opportunity

He also said this was down to the positive collaboration with the financial sector incumbents and newer players too, including important firms on the panel such as Aberdeen Standard Investments, KTB Securities, Robowealth and others, as key pioneers coming together to help build this infrastructure with the SET, and he even thanked those representatives on the Hubbis panel personally for their support, adding that without their positive involvement this would not have been possible in such a short period of time.

Expert Opinion - Dr. Win Udomrachtavanich, Chairman of the Board, KTBST Securities: “Extreme market volatility, regardless of COVID, inflation or central banks activity remind us that we need to be constantly adjusting our portfolios. Being able to access diversified products along with advice from a skilled and trusted wealth manager are both essential to help mitigate risk in this environment."

Expert Opinion - Kitti Sutthiatthasil, Executive Vice President, Strategic Initiatives & Industry Utility Division, SET: “The SET has been building various market infrastructures to help promote back-office collaboration so that our participants can focus on front-end innovation. Innovative platforms recently introduced include mutual fund distribution, payments and digital identity. The SET is spearheading the country towards an end-to-end digital journey.”

Expert Opinion – Vincent Magnenat, Chief Executive Officer, Asia, Lombard Odier: “The disruptions and impact of the Covid-19 pandemic are manifold, and have forced leading families and entrepreneurs in the region to rethink everything. One thing is clear – UHNWIs have reflected a strong desire for a trusted local adviser that helps them navigate and access markets they can no longer travel to easily, and for banking relationships with banks that are aligned with their principles and convictions. Banks that have values that they feel connected with – our strategic alliance with KBank Private Banking encapsulates this. Through KBank Private Banking, Thai UHNWIs are able to access local, regional and global opportunities via Lombard Odier and its network of strategic alliances in the region.”

Boosting the proposition and democratising the world of investments

A guest agreed, noting that the FundConnect infrastructure allowed his robo-advisory platform to bypass the need to connect with each and every asset management company in non-standardised file format, as was the case before, and that the infrastructures had helped them more rapidly and successfully penetrate the mass market and the under-served segments, helping them also connect to more key parties with their robo platform. He remarked that they had been delivering more success with e-KYC, and the advances ahead in relation to digital national identity would add further impetus in the future.

“Our focus right now is to build a core system as an open API to connect with FundConnect and to connect with any other systems, such as settlement systems or E-wallets to onboard new financial institutions, if they would like to do robo-advisory,” he reported. “And we plan to partner up with more international firms, especially in Singapore.”

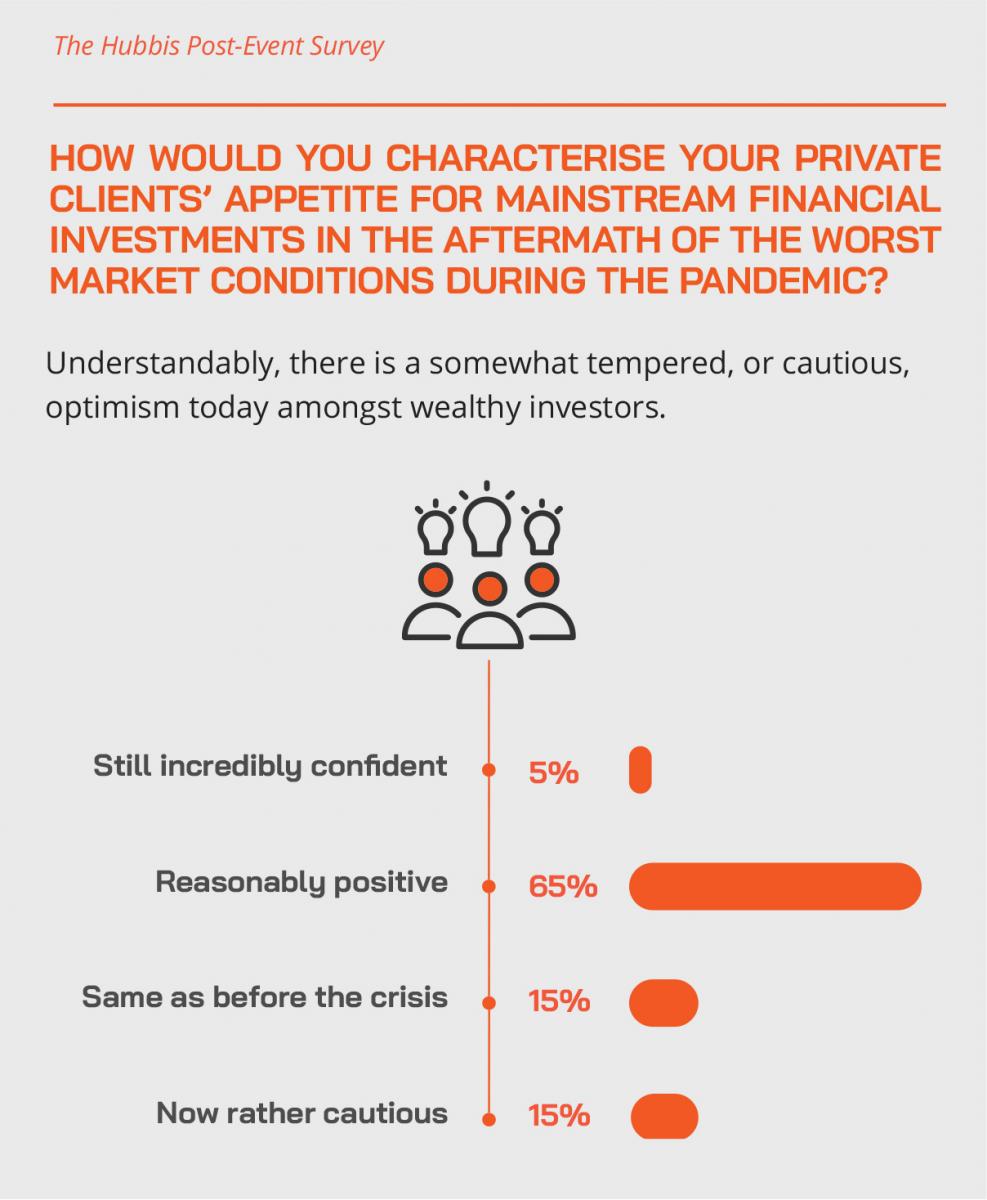

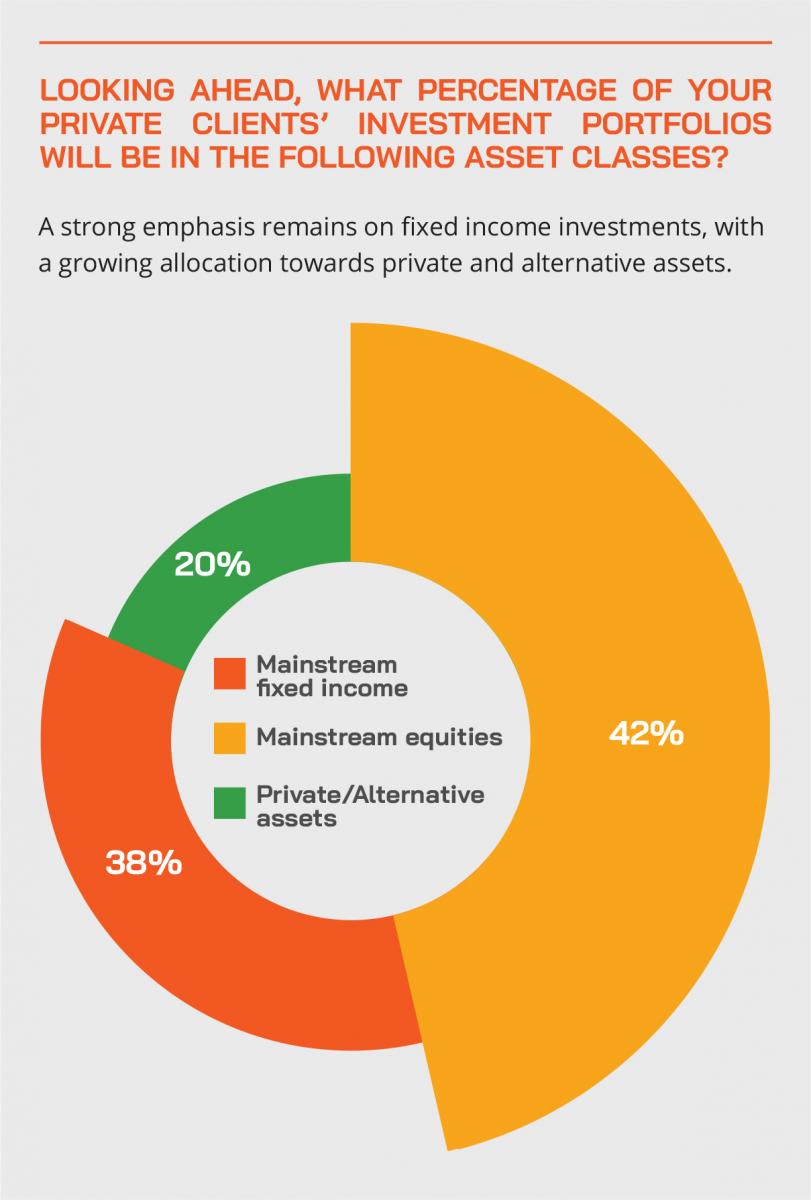

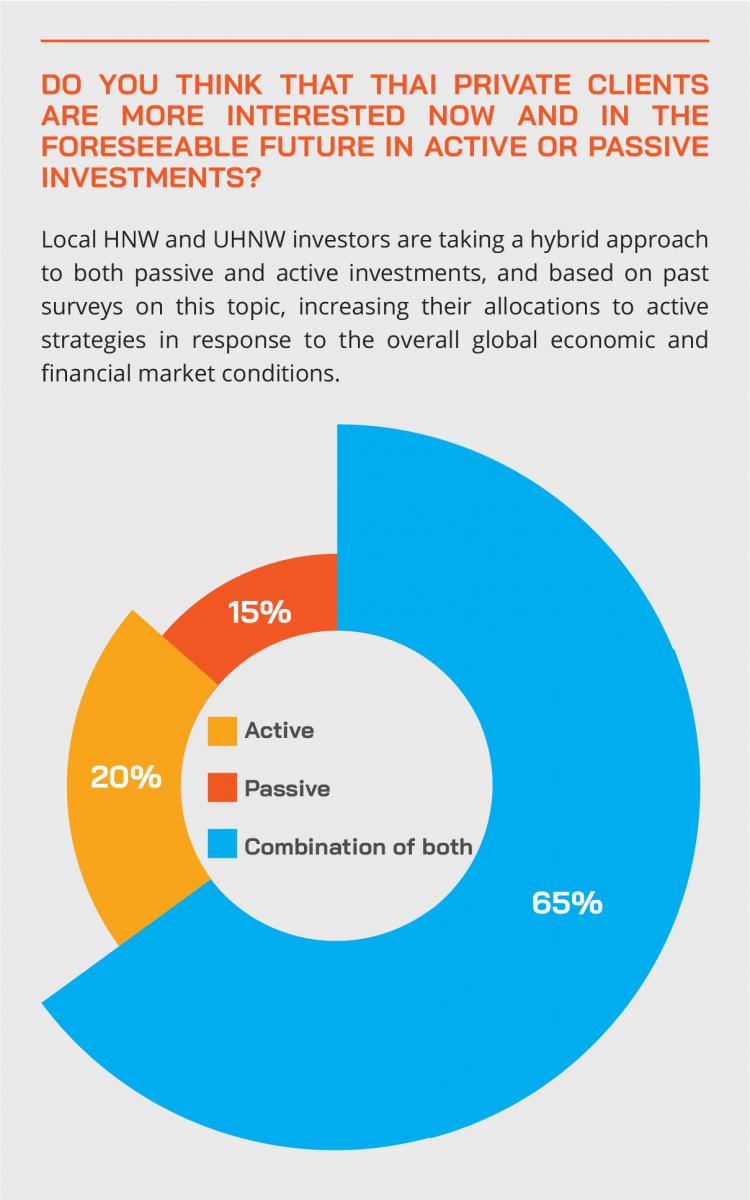

The Hubbis Post-Event Survey

Hubbis: Amongst the mass affluent and HNW private clients, what are the main investment themes and products (including public and private market assets) that are resonating with clients today?

Comment: Looking at the many replies, the strategies and themes currently in favour are all the usual suspects. International diversification, sustainability and the environment, ESG-compliant, biotechnology/pharma/healthcare, technology, AI, alternatives (hedge funds, private equity and debt, precious metals), cryptocurrencies, insurance-linked products, China and Greater China, multi-asset portfolios, real estate and others all featured in delegates lists.

Hubbis: Are wealthy Thai investors focusing more of their portfolio allocations on offshore/global assets, and if so, why?

Comment: There was no doubt at all among delegates that wealthy local investors have been diversifying their holdings offshore and continue to do so. There were some interesting views as to the reasons. Most replies indicated the trend was diversification to a far greater universe of opportunity. But one reply said that global assets are protected from frivolous lawsuits and unjustified claims, you enjoy privacy and personal security, and of course there are many possibilities to legally reduce taxes. Another said they had little confidence in domestic assets. Some replies indicated that the trend was more the second and Millennial generations, who are savvier and more sophisticated, who understand the products well and who believe more in diversification in the world ahead.

Hubbis: Are HNW and UHNW Thai investors buying into more private/alternative assets and if so, why and what is in favour?

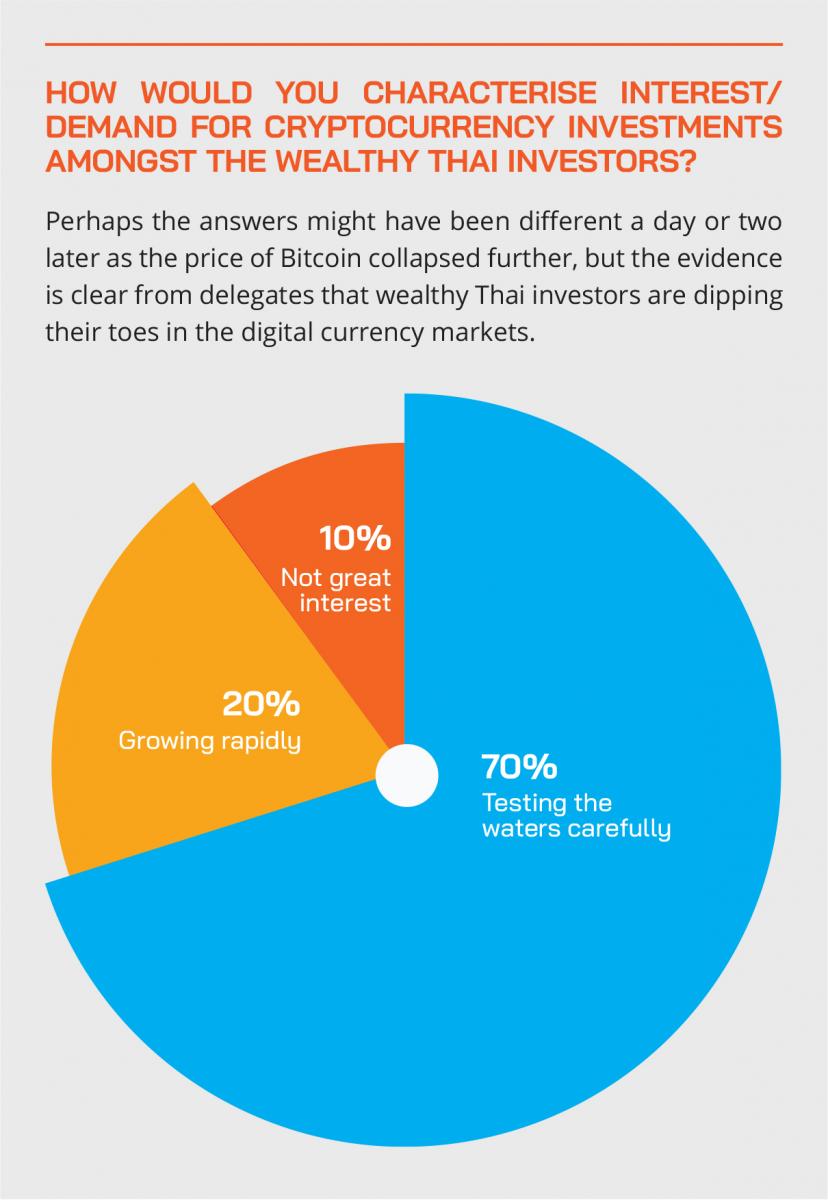

Comment: Private equity, debt and hedge fund strategies are in favour, along with private debt and Hedge fund strategies, along with offshore real estate, partly some said because of family members being educated overseas. Precious metals, oil, and even cryptocurrencies are on the lists currently.

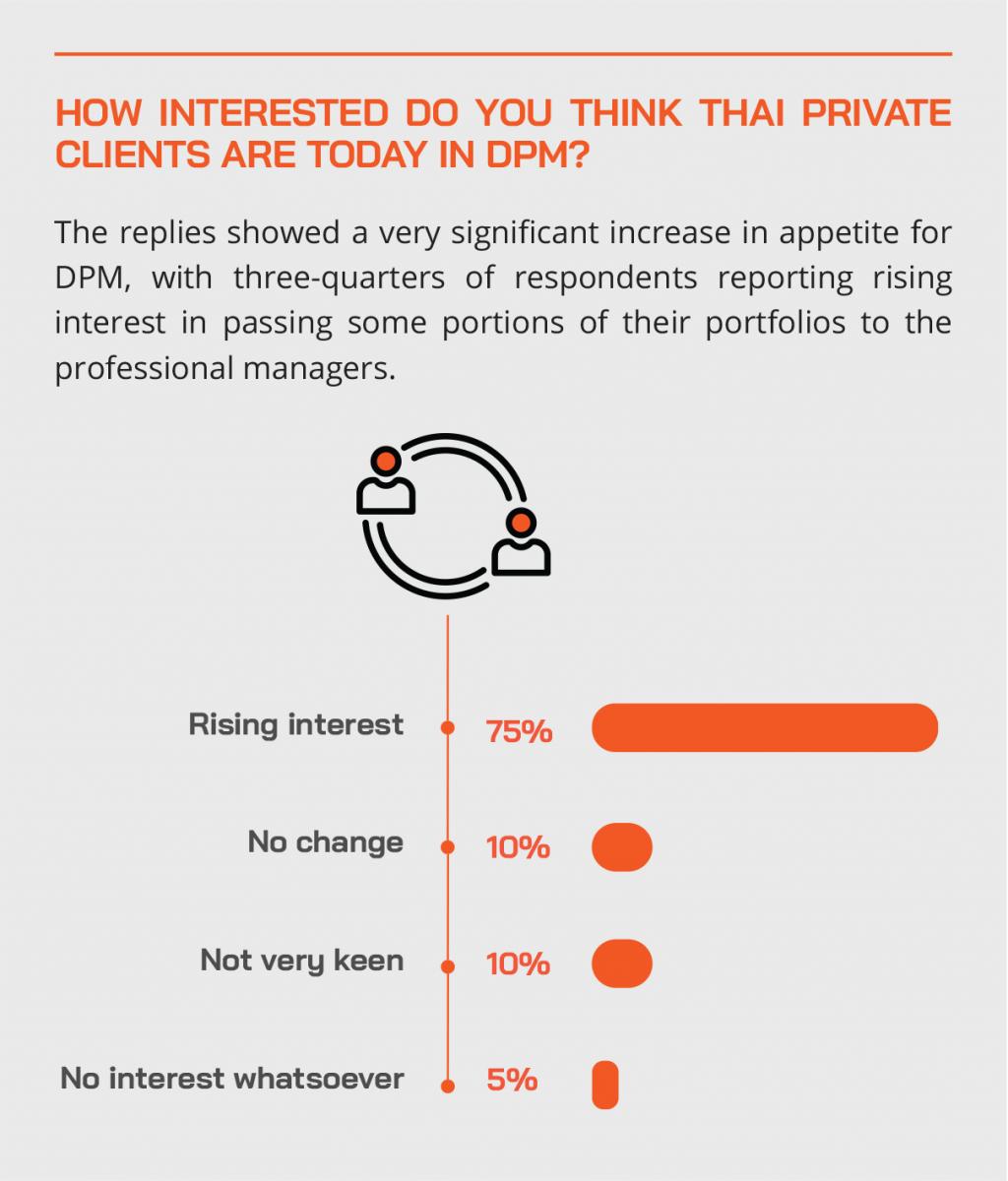

Hubbis: Is the Thai wealth management industry succeeding in converting more clients to Advisory and Discretionary Portfolio Management? Why? Or why not?

Comment: The general consensus appeared to be ‘no’, partly because many private banks and other providers are selling products, first and foremost, and also because so many private clients are highly sensitive to fees. Others said that the RMs need to be better educated towards selling advisory and DPM, and that remuneration schemes need to change to encourage these developments. Nevertheless, some respondents see the gradual shift to advisory and DPM, elevating the industry slowly from more of a brokerage type environment to more of a full investment advisory platform, similar to the global wealth management environment. Nevertheless, it remains tough to get the message over that those portfolios managed by professional portfolio managers with requisite controls over risks and in anticipation of different cycles will provide more robust returns over the medium to longer-term.

Thailand’s wealth market is evolving fast and gaining dynamism

A fund management expert observed that on returning to Thailand following a lengthy ten-year plus stint in Australia, he was excited to be in the hot seat again when Thailand is going through what he observes is such a dynamic and innovative phase of change and development.

“If we look at before, when the market was very much domestic orientated, whether it was fixed deposits moving into fixed income, and then into equity, what we're seeing now is more open architecture,” he reported. “Investors are considering not just traditional assets, but even non-traditional asset classes, providers are thinking about how to access the clients using digital technology, the industry is thinking of the alternative type of investments, whether it's private equity, infrastructure, even cryptos, all have really taken off in a big way. Coming from Australia, where you are seeing a very mature developed market, Thailand is extremely progressive today.”

Progress through diversification and education

He observed that there would be more progress ahead as well. “Clients are still being sold on products based on past performance,” he said. “There is certainly a need for more investment education, perhaps better transparency with regards to fees and charges and more diversification beyond the top tier of holdings. But, again, this comes with time. However, in terms of the infrastructure, in terms of expanding the addressable market, accessing the clients, making it more convenient, what some of the firms and institutions on this panel are doing is extremely exciting.”

He added that as Thais are busy diversifying their holdings, so the providers are more accurately addressing the client needs and objectives and adapting the types of investments they are putting their clients into.

More products and greater awareness of the opportunities available

“There is a natural evolution in the education of investment consultants as well as clients,” he reported. “Awareness of different geographies, different asset classes, different strategies, compared to my first time here in Thailand, all these areas have really come on in leaps and bounds.”

Another expert agreed with these views, adding that the regulators and authorities had during the pandemic been working harder to liberalise the market and permit more access amongst general investors to buy more products off the shelf, including more REIT opportunities; there are discussions underway on distressed bonds and private equity opportunities, and so forth.

The lines of demarcation between players are increasingly blurred

As to the competitive environment, the banks, insurance firms, asset management companies and securities companies, and digital players are all intertwining and selling each other's products and now manufacturing each other's products. Accordingly, not only is competition intensifying, but there is greater competition for key staff and greater competition in terms of fees and charges. “So, it's a good market for buyers, and that's why we need to look outward to offshore,” he reported. He said the SET and others had helped significantly in the improvement of access to foreign intermediaries and investments and to expand the offering of offshore investments for the domestic market.

Advisory propositions are improving, but these are still early days

Another very senior panel member observed that the brokerage and securities industry onshore was in the process of transformation, with more of an advisory and asset allocation slant, more diversification to fixed income and other product areas, more foreign assets, and a greater range of sophistication and complexity. This is happening in response to investor demand.

However, the scale of domestic demand needs to increase significantly, as many of these developments are centred on the relatively small number of wealthier investors, less than 5% of the investment market. Nevertheless, the industry is gradually shifting and there should be many more developments ahead in the next three to five years, he predicted.

Technology, he said, was a key element driving and also demanding change. Without the right digital solutions and connectivity, he said, the incumbents would not be as competitive as they need to be.

Advisory skills and genuine expertise will become ever more important for success

Another expert commented that advisory is essentially free and that firms still need to sell products to survive. However, he predicted that from what he sees evolving, in the near future whichever provider can offer what better advisory services and expertise to clients will grow their businesses faster.

“So, I believe that in the near future, the key for us is to enhance our relationship managers, aside from being able to offer investments in mutual funds or securities and so forth as in the past,” he said. “They have to be able to advise on portfolio establishment and asset allocation, they have to be able to dig down more into the products, and it is their firm's job to help them on this transition, as well as helping them with more products as well.”

HNW and UHNW wealth continues to expand, creating demand for diversification

A banker reported that despite the pandemic, wealth amongst the very richest investors continues to grow and that estimates of growth over the next five years are between 15% and 20%, underlining the intensifying need to deliver more products and other solutions to them, either onshore, or offshore, or through the onshore-offshore partnerships in place.

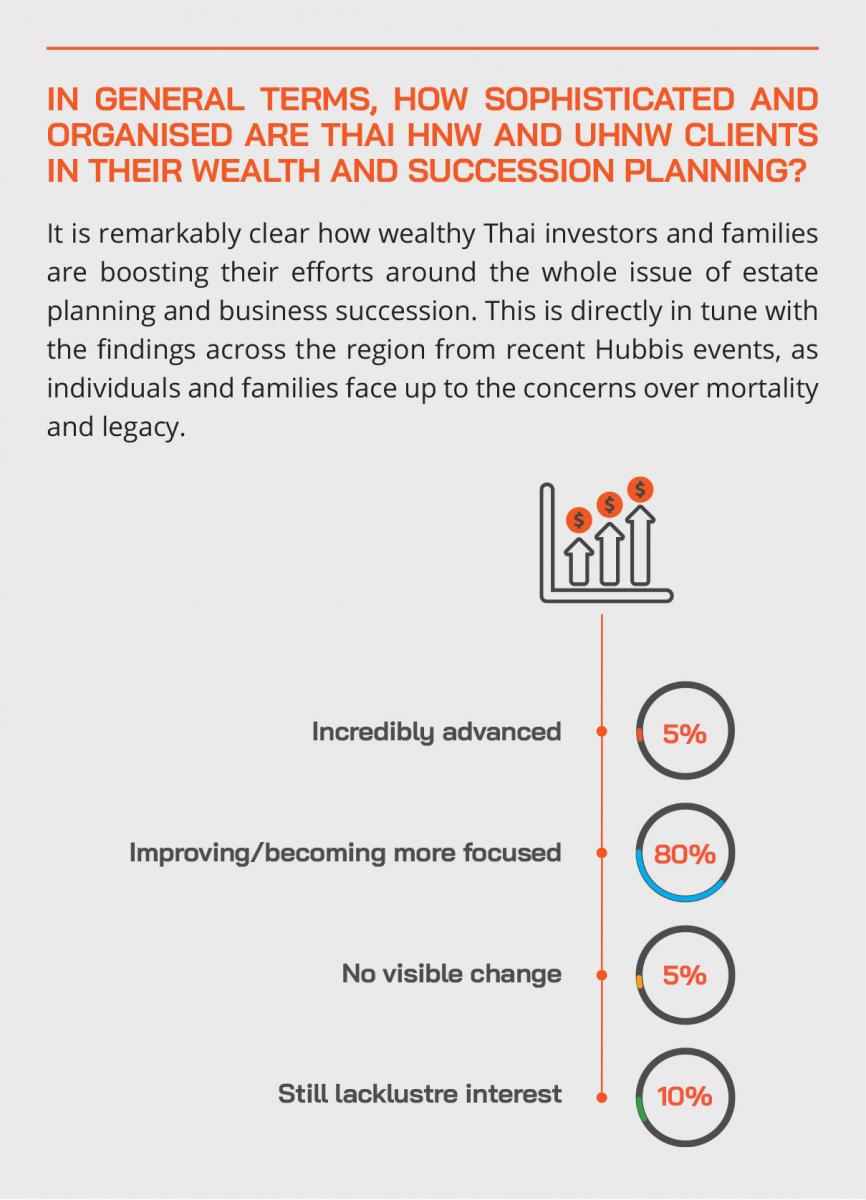

Talent, he reported, is a vital element in the growth potential for the market, and that it is essential to remain holistic in the approach, making sure that the advisors can provide the level of service and expertise, and also suitability, and not only the products. He remarked the market is well regulated. And he observed that there is increasing emphasis on wealth, business and estate planning and issues of succession.

Expert Opinion – Vincent Magnenat, Chief Executive Officer, Asia, Lombard Odier: “The potential for growth in Thailand is extremely high – reports have shown that the HNW population is set to grow approximately 16% from 2020 to 2025. Our strategy is clear, to continue building on our strategic alliance with KBank Private Banking, adding value to our end clients. Together with KBank, we will strive to develop the service offering for HNWIs and also UHNWIs in the market, one that provides both onshore and offshore solutions.”

Talent and knowledge transfer are vital

He reported that onshore-offshore partnerships could often be highly effective for knowledge transfer on both sides, for the offshore partner to better understand Thailand and to provide the offshore expertise and historical knowledge of global wealth management and asset management.

“For us,” he said, “our strategy is very clear, namely to continue our friendship, to continue to add the value that we want to bring to the end clients, with our partner here. And in terms of growing the offering for the UHNW and HNW sectors, and eventually also for the mass affluent locally. As I see it today, the quality of service that you can get onshore in Thailand is really very high now.”

He also referred to a study of UNHW investors and families conducted across the region and further afield and including Thailand. The findings uncovered that these investors are focusing on four key elements from their wealth management advisors, namely the technology they provide for connectivity and ease of information flows, the range of diversified investments they can professionally present, their expertise in family services which means essentially the realm of estate and business succession and advice, and finally how the providers approach sustainability in the products and solutions they can provide.

Needed for the future – digitisation, diversification, planning and sustainability

He elaborated on each of these. Technology was a key deciding factor for many of those surveyed, and is expected to be increasingly so for the future generations of clients, although the hybrid digital and human advisor approach will persist for these types of investors. In terms of investments, diversification of opportunities and assets is essential, but it must be well-judged diversification into the right sectors, products, themes, markets and so forth. Meanwhile investment advice must be forward-looking and evolved from traditional asset allocation theories that might not hold up in the future.

Family services is all about the need to plan for the future, for the family, for the business, and should include close attention to governance in all aspects, and that will help significantly with the structuring of the wealth, business and estate planning and structuring.

ESG and sustainability

And as to sustainability, more and more investors, especially those who have choice and perhaps the next generations of very wealthy clients, all of them are focusing more intently on what they invest in and why. Moreover, there is growing evidence that such an approach will reduce risks and boost returns in the future. “This will be really the major factor for the next generation in the choice of their partners they work with,” he concluded. “Technology is essential, but it is a given, whereas sustainability will make their choice for the future.”

Boosting market infrastructure – next stop, fixed income

ConnectingFrom equtThe conversation then delved deeper into some of the advances taking place in terms of digitisation. An expert highlighted how the SEC had initiated a strategic initiative call for better digital infrastructure for the capital market, and this will extend to the corporate bond market.

“Right now,” he reported, “most of the bonds are traded and controlled by all the major commercial banks with little participation from the securities firms. But the SET is building something very similar to FundConnect, but for the bond market. By the end of this year, you'll see a new digital infrastructure that is very meaningful and that underpins the next phase of growth of the Thai capital market. And after the corporate bonds, we will introduce government bonds onto the platform as well.”

He explained that these initiatives are a collaboration among three parties, which is the SET, the Association of Securities Companies and the Thai Bankers Association. “Two years ago,” he reported, “there was not such impetus and drive to digitisation, but the regulators and others see that this is now a must and that they must move very fast and must be very responsive to the needs of the stakeholders in the Thai capital market.”

Initiatives and collaboration - helping drive market activity

He added some noteworthy data. The volume for Thai equities trading had roughly doubled to USD3 billion a day, making Thailand one of the largest Asian exchanges nowadays. “And we have a very collaborative environment, in terms of infrastructure building, and the stakeholders will continue to innovate their front-end solutions, which is to the advantage of investors in Thailand. I also hope that with this innovation, we would be able to serve more, and we would like to capture the underserved segments.”

Another expert hailed advances towards a more open architecture approach, from the major banks and incumbents, but also from the digital players such as robo-advisories. He indicated that to curate the optimal diversification of onshore and offshore opportunities, the robo-advisory will also collaborate with other robo-advisors, and will incorporate more integrated features, such as having banking products built into the investment platform, Lombard loans for the mass market, insurance products and so on, thereby broadening the platform and the ecosystem significantly. He added that there is the potential to bring more and more FinTech start-ups and incumbents to work together as well in the future, to create an even more collaborative environment.”

Industry players must be agile and adapt their models and approaches for the future

An expert then referred to the drive to what his group calls the democratisation of risk, which is all about the dramatic expansion of choice.

“Historically, we've always been managing money and servicing typically for an institutional client,” he reported, “but that clearly is changing, and we are evolving and transforming, and we need to, so we are adapting accordingly.”

He pointed to a new strategic approach to the world of asset management, to a new brand and logo, a more high-tech approach and the articulation of a proposition that is far more than just asset management, such as financial planning, which already exists in the group and needs rolling out in various strategic growth markets, including Thailand.

Expert Opinion – Vincent Magnenat, Chief Executive Officer, Asia, Lombard Odier: “We undertook a study on Asia’s ultra-wealthy together with our network of strategic alliances in the region, which include KBank in Thailand, to better understand the current environment and needs of these UHNWIs across four dimensions, namely technology, investments, family services and sustainability. Interestingly, some key highlights for the Thai market show that: 45% of Thai UHNWIs who do not have a family governance structures in place are now thinking of adopting one; 87% of Thai UHNWIs considered that the availability of extra financial services such as access to real asset opportunities and the ability to connect with other entrepreneurs influences the choice of their bank; and that 69% of Thais take sustainability into account when making investment decisions, and a larger proportion of them, compared to other Asian markets, chose sustainability as an important factor in starting a relationship with a private bank.”

Clarity of strategy and a clear focus on core skills are vital

He explained that the group defines its core capabilities around alpha creation, and when investors think about the firm, they should be thinking also of the different types of assets the group covers, the different geographies, the many different themes and strategies they offer across different asset classes and markets, including risk mitigation strategies, because people might be concerned about inflation, growth strategies, decumulation strategies for retirement solutions, or perhaps income strategies.

“We need to be clear about what we stand for and what can we credibly deliver,” he summarised.

He added that sustainability, an issue brought up by several fellow panellists, is no longer just a hygiene factor. He said that the firm had sustainability or ESG in-built in its funds and screening processes for a long time, but that now it's really about the outcomes, so the firm is intently focused on making sure that they have the right products that achieve the right outcomes or impact or ESG enhancements.

He said the firm has invested intellectual property around climate change and is able to develop strategies that can actually achieve better outcomes for clients based on how they predict climate change affecting industries and businesses. And that the firm does not offer simply investment capabilities around technology but offers technology solutions.

Expanding the proposition towards advisory by leveraging data and boosting talent

He added that as a global asset management house, the firm is making numerous investment decisions every day and therefore should be in a good position to give perspective and to be able to create models, asset allocation advice, and so forth. “We have platforms in our group, and we should be able to be more dynamic with our advice, given our future outlook for different situations for our clients.”

In brief, he said the firm was excited about the future and what it will in the months and years ahead deliver to its clients in the Thai market, which, he reiterated, is developing apace and in the right directions.

Picking up on the theme of advisory, a guest proffered the view that this encompasses several elements, all of which are enabled by technology or digitisation. More product diversification can be aided by good technology, good connectivity, good systems and networking.

Asset allocation – from theory to practice

With the broader products come better strategies, because the providers have more products to facilitate more advanced asset allocation. Then comes customisation to the client and delivery of individual strategies that best fit to that particular client. And then there is the trusted relationships, again with technology helping those RMs and bankers deliver better products, better advice, better service, better expertise, and better relevance and outcomes.

And he added that talent is essential for all these elements to come together. We cannot go ahead into the world of greater complexity, of more customisation, or more relevance, and at greater speed armed only with technology, he warned.

Talent is the lynchpin to success as the market upgrades its capabilities

“Eventually,” he stated, “we need to have and keep talent, however big or small the organisation is, and this is one of the biggest challenges for any participant in this industry. I don't know how to solve it. I believe that none of us know exactly how to solve it. Training is vital support, good support and the right strategies essential to make the talent happy, to keep them with us, as individual relationships are so important, perhaps more than the institution and the branding going forward.”

The same expert added that the country’s good financial markets infrastructure, the increasingly positive support from the regulators and from the infrastructure providers, such as the SET, all these factors are helping with the back office and efficiency.

“But then we need to think about how we can be more creative on the front office services so that our clients are really happy with us,” he said. “There is greater competition – healthy competition actually - out there, including the robo-advisories, so we need to face the world ahead and positively.”

Drawing the discussion towards a close, a guest pointed to the necessity of ensuring that, whatever happens ahead, their investors handle asset allocation in a more diversified and professional manner, suitable for their wealth and their goals and risk profiles.

He added that Thailand also has a relatively large pool of untapped clients, the middle class who live outside Bangkok and in their late 20s and early 30s and up, and who will be attracted to digital propositions and delivery, such as robo. He also said that the providers need to understand and separate their market segments.

Vital ingredients: Training, Upskilling, Discipline, Dedication, Professionalism

“But we must also upscale the sales skills and efforts,” he stated. “I think RMs in Thailand are generally rather shambolic. They don't really sell the right products, especially those working in bank branches. Right now, we have sales people across the country who are 80% soft skills and 20% hard skills. And we have investment counsellor teams and advisory teams who are on the reverse, so 20% soft skills and 80% hard skills. But we need to have super sales, super IC, and sell the right products.”

He said the industry in general had expanded in terms of the numbers of capital market players, perhaps doubled in the past five years. And it had done well in increasing the range of opportunities, for example greater retail access to IPOs, but that much more opportunity lies ahead in a wide variety of products and structures, including even democratisation of certain otherwise too large or too illiquid investments via tokenisations.