Publications & Thought Leadership

Singapore Stays Ahead of the Pack as a Regional & Global Centre for UHNW Wealth

Sep 29, 2022

Asia’s growing ranks of UHNW and HNW individuals have in recent years increasingly been selecting Singapore as the jurisdiction of choice for their single-family offices and at the same time, more and more multi-family offices are also making use of the remarkably advanced infrastructure to establish and/or expand their client base in the region and indeed across the globe. Many of these ultra-wealthy investors are moving themselves to Singapore as well, often bringing some or all of their key family members with them to consolidate their family units in a safe jurisdiction that offers a remarkable lifestyle and outstanding facilities and infrastructure. In our Digital Dialogue event of September 1, Hubbis assembled a group of wealth and asset management, tax, trust, and other experts to analyse the development of Singapore, which has become increasingly compelling as a destination for the upper tiers of global wealth management. Singapore is today almost ideally formulated for family offices, due to the friendly ‘13’ suite of government incentives, the programmes developed by the Economic Development Board, smart structures such as the Variable Capital Company and its culture of encouraging innovation and agility alongside transparency and regulatory oversight and foresight.

The Panel:

- Lee Woon Shiu, Managing Director & Group Head of Wealth Planning, Family Office & Insurance Solutions, DBS Private Banking

- Edmund Leow, Senior Partner, Dentons

- Dominic Volek, Group Head of Private Clients, Henley & Partners

- Vincent Magnenat, Limited Partner, Global Head of Strategic Alliances, Asia Regional Head, Lombard Odier

- Tan Woon Hum, Partner, Head of Trust, Asset & Wealth Management Practice, Shook Lin & Bok

- Marilyn See, Director – Business Development, Trident Trust

Singapore’s skilful adaptation to key trends emerging across the world of wealth management

A lawyer opened is comments by reporting on the many advantages of Singapore, adding that a major attraction was the credibility of the jurisdiction compared with many offshore centres.

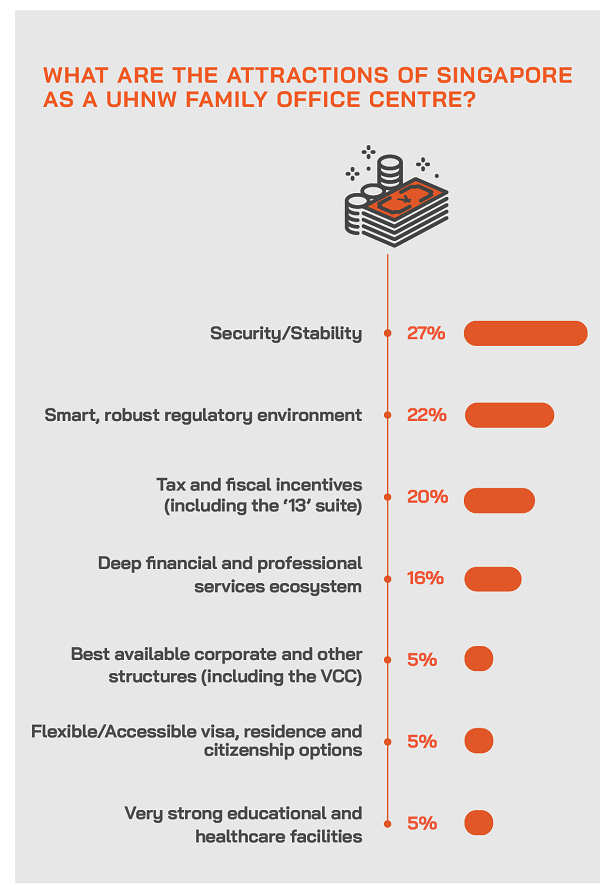

“It is a great place to do business, there is excellent security, a strong financial and professional services ecosystem, and there are many interesting vehicles and many all-around advantages for HNW and UHNW clients to run their structures there. “Importantly,” he explained, “there is nothing artificial about it. No one can accuse wealthy individuals and families of setting up in Singapore simply to avoid tax, or to hide assets or to ‘pretend’ to have substance. It offers these wealthy and super-rich clients clear rules and great transparency, and they are then associated with Singapore’s strong regulatory reputation.”

A banker observed that there is rising demand for wealth planning services in Asia, including for advice around family offices. “This region is going through a lot of transformations in the coming years, with literally trillions of dollars of wealth transfer taking place in the coming decade, and demand rising across the board for advice on all aspects of investments as well as wealth and legacy planning and structuring, including family and business governance,” he told delegates. And Singapore, he said, is remarkably well positioned to benefit from all of these trends, and many besides.

Key areas of progress

Another expert opened his observations by highlighting two key areas where he maintains Singapore is really pulling ahead of the curve.

First up is what he called the ventures and business enterprise value added. “The Economic Development Board and other associated agencies have really successfully shaped Singapore to become the leading destination in Southeast Asia for ventures and enterprises, thereby leveraging Singapore's vibrant ecosystem to really capture growth opportunities,” he explained. “For families coming to a centre for wealth management find a jurisdiction that can offer something else for them to go even further.”

He said there are now what he termed a somewhat “mind-boggling” 55,000 start-ups in Singapore, and in the first nine months of 2021, tech start-ups raised USD11.2 billion. He noted that Singapore is also consistently topping the Forbes Asia Top 100 list to watch.

“And I think also an estimated 300 private equity and venture capital fund managers now call Singapore home,” he added. “All these elements make Singapore not just a good place for clients to manage what we have already made in wealth, but looking forward, it gives them a major platform to grow their wealth and do much more in the future. So, that's one angle.”

Singapore the disruptor and innovator par excellence

He told delegates that the other angle is Singapore’s consistently drive to become what he calls the “disruptor/innovator par excellence.” He said Singapore is now the largest sustainable financial market in Southeast Asia, accounting for close to 50% of cumulative green and sustainability-linked bonds and loan insurance in the region. From 2018 to 2021, over USD39.8 billion of green bonds have been issued in Singapore and growth volumes of such loans have also quadrupled since 2019, he reported.

“This really does a lot to support the needs of family offices today, who increasingly apply a sustainability lens to their investments, and especially now, with the ascent of the next gen, these narratives can only become more important, more pressing, and more compelling,” he observed. “All this spells a very positive current and evolving environment for family offices.”

Singapore dances to the right tunes

A banker told delegates that important Singapore is a very important booking centre for their bank. He cited key reasons such as the increasingly robust wealth management ecosystem, strong government incentives to encourage HNW and UHNW wealth and families to its shores, the very strong regulatory environment framework, the stability and security, the deep financial and professional services ecosystems, as well as the quality of life, infrastructure and facilities in general. And of course, Singapore’s strategic position within the fastest growing economic region of the world.

Non-investment services such as wealth and estate planning and structuring, he explained, are a greater priority for the bank than ever before.

“We are in a region that will go through many important transformations in the coming years, including literally trillions of dollars of wealth that will pass to the next generations, driving the need for expert advice in these areas,” he told delegates. “We have produced a number of studies, including one soon to be released, that show how the market will need not only more investment advice in the future, but much more professional guidance in terms of wealth planning, governance, family governance, business governance, and succession planning.”

The great wealth transfer, ESG, onshore appeals and the need for professional advice

He offered delegates further insights into some major trends in the HNW and UNW client market in Asia, the first of which he had already mentioned, namely the Great Wealth Transfer across Asia that is now starting to take place. Singapore, he said, offers the right ecosystem to address these issues, with a deep financial system, a wide spread of local, regional and international law firms, accounting expertise, a vibrant trust and fiduciary services sector and so forth.

Second is sustainability, encouraged by four key drivers – regulatory/political, market forces, technology, and the individuals as they plan for the futures of their families. “Sustainability is a USD5.5 trillion investment opportunity, and what we see from our new study is that very wealthy investors in the region now realise that it will generate superior returns, or at least it will mitigate the risks within the portfolios.”

Singapore benefitting from the ‘onshorisation’ of wealth

Another trend he highlighted is the shift to onshore wealth management. “The region has strong international and offshore centres, but we also have emerging financial centres that offer increasing depth, so markets such as Thailand, Indonesia, the Philippines, and are seeing more what I can call ‘onshorisation’ of client assets. Offshore centres are quite expensive now, and if you can access the global markets through your local bank, onshore and get a similar quality of service, you will reconsider offshore.”

And he said that in this regard, Singapore has positioned itself extremely well, with many key incentives to attract UNW wealth, while more of the HNW clients shift their wealth back onshore or at least keep it locally managed and onshore. “And I think many here are aware that at our bank we have been building its onshore reach and capabilities through strategic alliances that we have built, of which we now have six in the region, all of them already successful and developing well. It is a strategy that we will build upon further.”

The shift to advisory and discretionary – both suit Singapore’s business model and capabilities

The fourth key trend he identified is the shifting investment environment to a more challenging world in which discretionary and advisory wealth services are more in demand. “The world of investments is no longer benign as it had been for so many years, and as we all face up to that we are seeing a huge increase in demand for more advice and for DPM mandates amongst our clients. Singapore is very well positioned for that market evolution.”

High costs must be matched with high value-added, and Singapore can cope with that

A guest addressed the issue of rising costs in Singapore. “It is really all about cost relative to value,” he commented. “The Singapore government is still delivering a lot of advantages, including the VCC that came in approaching two years ago and incentives around that to help defray costs for fund founders. And likewise, in terms of other areas, like philanthropy, which is an area the government is keen to promote, there are also some tax benefits and grants to be enjoyed. Actually, there are efforts being made constantly to help control costs and help develop activity.”

Talent is a key area that needs addressing, he also observed, noting that the government is developing the mid to upper senior levels, encouraging home-grown expertise and training so that it is not always necessary to hire in overseas talent. “Such initiatives aim to keep a lid on costs all round, and this benefits the family office sector as well, or course,” he said.

13 is a very good number in Singapore

A guest briefly reviewed some of the ‘13’ suite of Monetary Authority of Singapore incentive schemes to appeal to UHNW families looking to centre some or all of their investments out of Singapore and open the door wider to key professionals and investment experts to manage those assets. And for the larger family offices, he explained that the EDB Global Investor Programme is open for SGD200 million in assets to be deployed within five years, and the hiring of at least 10 people locally.

He said this was ideal also for client keen on Singapore as the new base for their Asian headquarters, such as some major ‘unicorns’ from China looking for an operational HQ for Asia ex-China. “So, we see strong interest and demand from a variety of different UHNW clients and their families,” he said, “sometimes starting with a family office and then expanding to bring in other family members and businesses as well, sometimes also pivoting to becoming a licensed multi-family office and expanding their remit and their activities. In short, Singapore provides a very fluid and agile platform for evolving the platform for these families and investors.”

He explained that Greater China continues to be one of the most promising segments for inward investment, but that Southeast Asia, and notably Indonesia, as well as India are also bringing more of their large pool of VCs and start-ups to Singapore’s shores.

Singapore offers excellent fund and structuring vehicles, and the VCC wins many plaudits

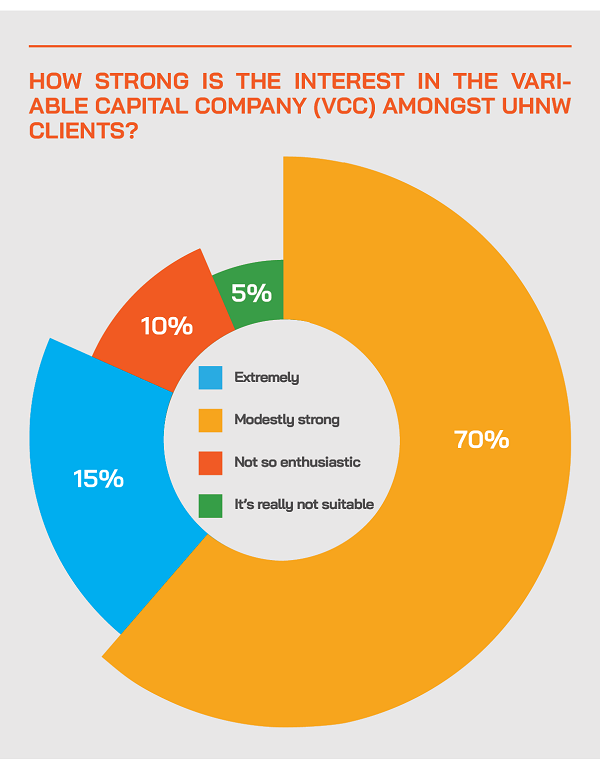

A panellist commented on the Singapore Variable Capital Company, noting that this was originally targeted at the multifamily office type structure, as the VCC must be managed by a licensed fund manager and is ideal for different sub-funds, for example a tailored fund for each of the families involved. This expert noted that when the VCC was first introduced in Singapore, it was not targeted at single family offices at all, it was targeted more at the fund industry.

“They thought that the VCC will be attractive for people setting up PE funds, hedge funds, VC funds, that's what they intended the VCC for,” he observed. “But of course, nowadays, many single-family offices have tried to make use of the VCC as well, and we have been involved in advising them on how to structure themselves to fit within the various conditions. The VCC may not be suitable for everyone. It's obviously very fashionable but it may not be the best option for everyone. And that's the reason why people need to get professional advice.”

Evolving demand for the VCC

Responding to comments on the VCC and its origins and objectives, a lawyer explained that his firm had worked with all kinds of fund managers and family offices and EAMs.

“We see the VCC used effectively for hedge funds, for private equity funds, credit funds and real estate funds, and we also have multifamily offices and single-family offices that partner up with licensed managers to do private label funds using the VCC structure,” he said. “Yes, as a fellow panellist said, the VCC was initially meant perhaps for multi-family offices and those who wanted to create funds and sub-funds, where more than one investor is involved. But we see increasingly that single family offices might want to have different funds for the founders, the children, the younger generations, and therefore need a variety of sub-funds to reflect that diversity. You might also see family enterprises with cash management strategies and treasury functions under various sub-funds. If structured properly and approached professionally, the MAS can approve these types of arrangements.”

Many strategic and real world advantages on offer

He added that the VCC is therefore useful and has a variety of advantages that provide such clients with significant flexibility, as well as fiscal and other advantages built in. “There is the confidentiality, the flexible structure, the variable capital, where you have different waterfalls and the ability to pay cash dividends, even if there's no accounting profit,” he remarked. “These are all additional benefits that other funds may not have.”

Another expert added that the VCC is also useful for clients that want to leverage. He said that some family members do not want to commingle assets with other brothers, sisters or others, and they might have different approaches to the use of leverage. “The VCC again gives a client a new dimension to explore and to really magnify the importance of asset protection or ring-fencing vis-à-vis different branches of the same family,” he said. “That all dovetails again into what ultra high net worth families and family offices really want in terms of wealth management solutions from a trusted jurisdiction.”

Diversified and diversifying international demand for Singapore as a core wealth and structuring jurisdiction

A lawyer said that with all these many appeals that the panel had highlighted in the discussion, his firm was, like other professional service providers there, finding great demand from Greater China, Indonesia, and India, as well as healthy and rising interest from Europe, and some interest from Vietnam.

He explained there are different approaches, ranging from a step-by-step approach to building a presence in Singapore to more of the ‘Big Bang’ type strategy of setting up a major family office from day one, potentially a multi-family office to handle other families’ wealth as well. He explained that often the older or founder generation – perhaps the patriarch and his spouse from Mainland China - remain in their home country, while they set up the second and younger generations to operate out of Singapore, with full immigration status built in from the outset.

He also noted Singapore’s rising and diversifying strengths as a regional and increasingly global hub for wealth management, especially for very wealthy clients. He noted that his firm had been seeing strong and rising demand from greater China, followed by Indonesia and India.

“We are also seeing some healthy traction from Europe, and a little bit from Vietnam as well,” he told delegates. “Clients are considering the mid-level type of family office, or sometimes the very large clients, the ultra HNWIs look at either starting off with a single-family office, or perhaps go straight into multifamily office, including taking up the MAS’s Capital Market Services license for fund management. The ‘Big Bang’ approach as I might call it is to go straight for a multifamily office that has a large part of the core AUM form that single family, but also has a mandate to handle the wealth of perhaps two to five other large families in one substantial operation.”

Different strategies for each UHNW family

He noted that some clients also choose to put a second team in Singapore to complement their core team, perhaps in Europe or Greater China region. “They are looking for diversification, a Plan B in Singapore, perhaps not seeking migration to Singapore initially, but planning for the medium to longer-term,” he observed. “This might be for themselves, the founder generation, or for their second and third generations. Oftentimes, the patriarchs or matriarchs do not like to leave their home base but want to groom the younger generation with the help of professional advisors, so they set up a team in Singapore to run a parallel structure here, while the founders continue to look after the businesses in their home country.”

Singapore’s ability to provide true stability and the long-term perspective and genuine future-focused planning

As to the ongoing evolution of wealth management, another guest said Singapore is probably one of the few countries where you would see a 50-year masterplan that is actually executed with clinical precision. “These developments started back in the 1980s, as the government sought to build the financial infrastructure with consolidation of the local banks, and then in the 2000s we saw more focus on private wealth management, and then on asset management, and then on family offices,” they reported. “Clients like certainty and predictability, and Singapore offers that assurance about its direction of travel, which is very important.”

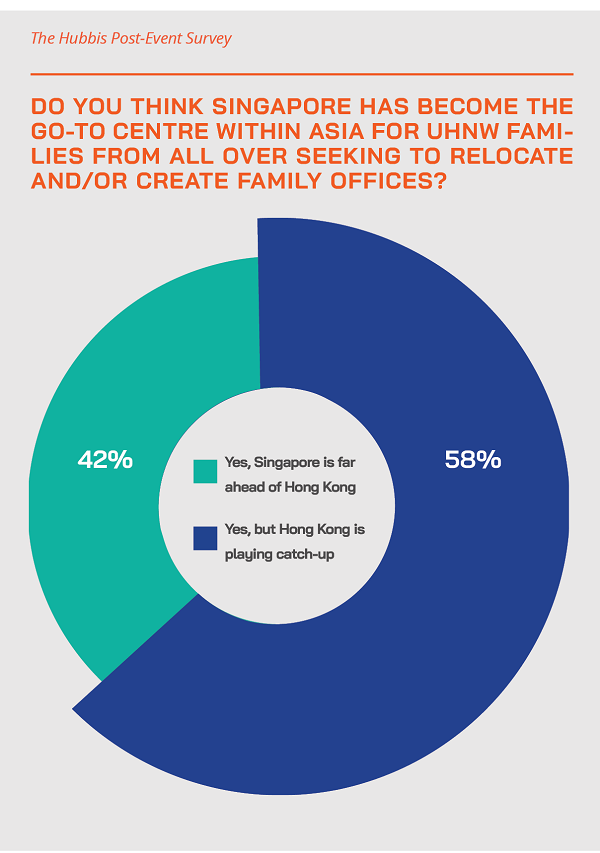

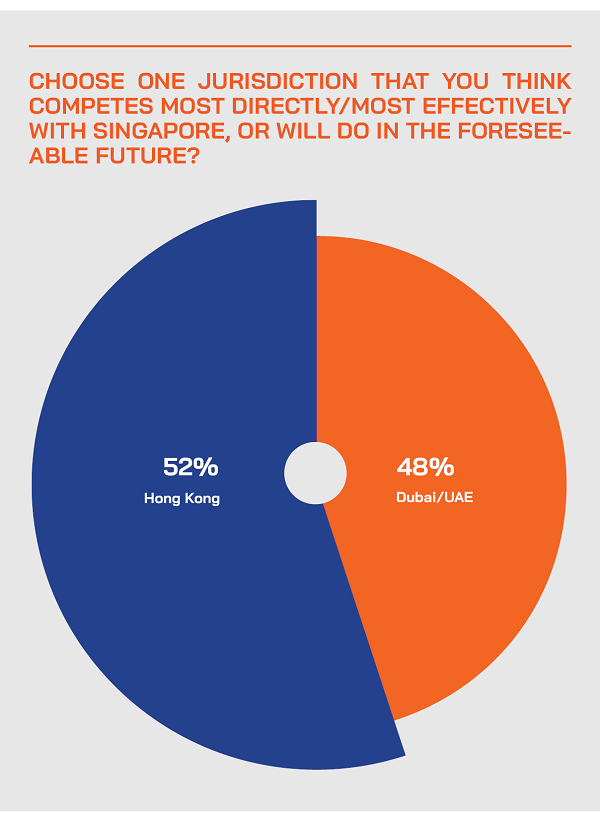

A fellow panellist highlighted the magnetism of Singapore for the wealthiest families around the globe. Although competition from Dubai and increasingly Hong Kong once again is more intense than before, Singapore remains ahead of the game in many areas.

“Singapore offers an incredibly long list of benefits that would attract not only the capital, but also talents,” he explained. “I saw a report this week about sort of a global talent type visa that Singapore will look to implement, something that Australia has done very successfully. The UK has a global talent visa as well. So, Singapore now looks to bring this in for very high achievers, those earning at least SGD350000 a year such as very experienced people from the world over. And Singapore is very successful at drawing in more and more UHNW individuals and their families.”

Expert Opinion - Dominic Volek, Group Head of Private Clients, Henley & Partners: “Ranking 5th globally, Singapore is Asia’s second-biggest millionaire oasis after Tokyo. Home to 249,800 millionaires, including 336 centi-millionaires and 26 billionaires, the city-state is widely regarded as the world’s most business-friendly city and is one of the top destinations for migrating millionaires. A net inflow of approximately 2,800 high-net-worth individuals is projected for 2022 alone according to the latest Henley Private Wealth Migration Dashboard.”

Take the best advice, you can afford it

A guest explained that in many cases working with large and complex clients with businesses and assets all over the region or the world, there are numerous issues to address and many professionals with different areas of expertise required to deliver holistic advice and solutions. “These are big projects,” he said, you need the best lawyers, bankers, accountants, trustees, fund administrators, wealth planners, and others. Minimally, you really need three or four professionals, and you need to pull in the right people along the way.”

He explained that if, for example, a client is looking at Singapore’s Global Investor Programme they need to liaise with the Economic Development Board early on and then take all the right steps along the way. If they are looking at a family office and the ‘13’ suite of incentives, they will need distinct and tailored advice around that route.

Expert Opinion – Edmund Leow, Senior Partner, Dentons: “Singapore offers a combination of attractions, including political stability and the rule of law. In addition, it is a regional financial and business hub that many Asian patriarchs like to locate their families. Accordingly, there is nothing artificial when they choose to locate their trusts and family offices here. In today’s transparent world, they don’t want to go to a jurisdiction which raises suspicion that they have something to hide or something to evade.”

Drawing on the deep pool of expertise and the broad financial and services ecosystem

A guest said that although they are remarkably busy, bandwidth at his law firm is not an issue for his practice group but opening bank accounts for clients is a major bottleneck, according to reports from his clients.

“Another key issue is finding the right trustees and other professional services experts,” he reported. “Many of our clients, especially the second and third generations speak fluent English, but many from Greater China also want Chinese speaking professionals to work with, whether it's banker, lawyers, tax advisor, or fund administrators and trustees. And finding really experienced professionals that can speak Mandarin language efficiently, effectively and understanding them as well as the culture, know how to handle the clients, is actually very important, and is still somewhat of a challenge today.”

Yes, Singapore has serious competitors, but is determined and highly focused

A lawyer expanded on the preferences amongst Greater China clients, noting that many of them remark that Singapore is extremely ‘comfortable’ for them as effectively a Chinese city overseas, where they can speak their own language, enjoy Chinese food, albeit not the same as at home, but certainly Asian Chinese food.

“Very simply, they feel at home, they feel the closeness, and it is easy to fly to within only a few hours, and they can send their children and grandchildren to school or university here. It is easy for them.”

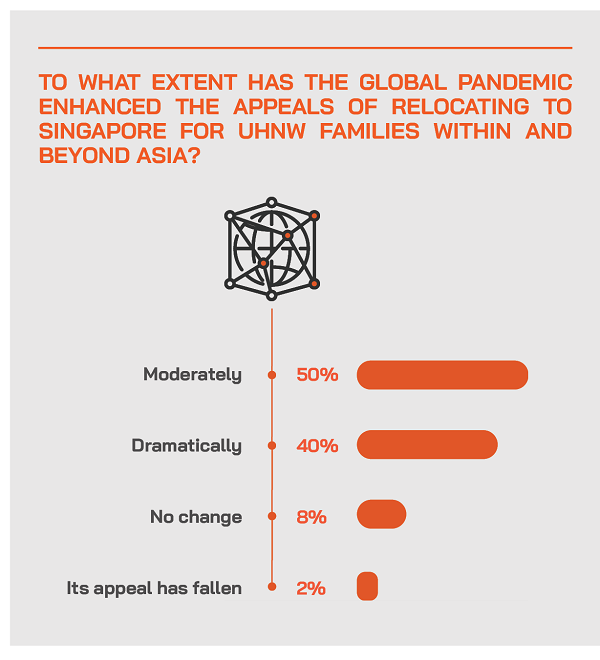

And Singapore at the same time is a very international and indeed global city and jurisdiction. “They see the appeals of Hong Kong, of Dubai, of Switzerland, but there is no doubt that Singapore is the sweet spot for most of them,” he said. “The only issue really was around the pandemic and restrictions here, which sent some people over to Dubai, which managed things more liberally. And now that Singapore is reopening properly, we hear many clients stating that was a short-term fix for them, and that Singapore is much more on their radars again.”

He said he believes that Singapore offers a remarkably attractive overall proposition and range of services, products and expertise for UHNW clients from the world over. However, he says it is important not to have blinkers on when advising clients and to offer clients a whole suite of solutions and bankers and others must advise them properly on different optionalities.

Objectivity is central to the proposition for wealthy and uber-wealthy clients who literally have a world of choice

Accordingly, he explained that when a client says they are looking at establishing a family office, he likes to run them through the options available in Singapore compared with Hong Kong and Dubai, the latter offering family offices in three free zones, the DMCC, the DIFC, and the DWTC. “They might of course opt for Singapore once they understand all the options, but first and foremost, I think one needs to explain these options clearly and objectively,” he told delegates. “Once they then make their decisions, they are more likely to come to us as their trusted advisor.”

He added that nobody should count out Hong Kong’s resilience and creativity. “Hong Kong advisors are remarkably resilient, and there is strong and growing support for the jurisdiction from Invest Hong Kong and its Family Office Hong Kong, which is now starting to deploy teams onshore based in Europe, Brussels, and also in China, so there is intensifying competition from there,” he reported. “They have an increasingly comprehensive and organised battle plan, and I do believe once the pandemic restrictions are fully out of the way, Hong Kong will come roaring back. And we as trusted and unbiased advisors must offer our clients this complete picture, to help them make the best possible decisions.”

Tax pressures all around, but again Singapore is remarkably well insulated and well prepared

The discussion turned inevitably to tax and pressure on government finances all around the globe. “Singapore has always offered a very favourable tax system, and attracted investment from all over the world,” said one of the lawyers.

He explained that the family office incentives provide for tax exemptions on wealth managed here, mitigating mounting tax pressures for many HNW and UHNW clients at their home jurisdictions, many of them high tax economies. Many have decided as a result to shift not only their assets but themselves and their families. And to do so effectively and without collateral damage at home, they avail themselves of the right structures and the right compliance to establish themselves with legitimacy and transparency.

Singapore as the ideal base for consolidation and control of wealth

He added: “They might say, yes, if I stay in my home country, I'm going to be paying high tax rates on my worldwide income, worldwide capital gains, I'm going to pay estate tax when I pass away, I'm going to pay gift tax when I make gifts. But in Singapore those are not applicable, and the family office and other structures offer additional incentives as well. Nowadays transparency is the norm, and secrecy is gone. Aside from incentives, Singapore also has many double tax treaties to help families invest in other countries as well. That is another huge advantage that Singapore offers.

He also remarked that Singapore has very substantial government reserves, and instead of worrying about how to pay interest on debt it is a major recipient of income from hundreds of billions of dollars of investments. “We see most countries becoming more and more aggressive in terms of taxation, and we see the global minimum tax rate and more tax disputes arising, something we certainly see in lur legal practice between different tax authorities. But Singapore is well organised and well-placed in these issues.