Publications & Thought Leadership

Maximising the Opportunity – Estate & Succession Planning and Asia’s Next Generations

Sep 16, 2020

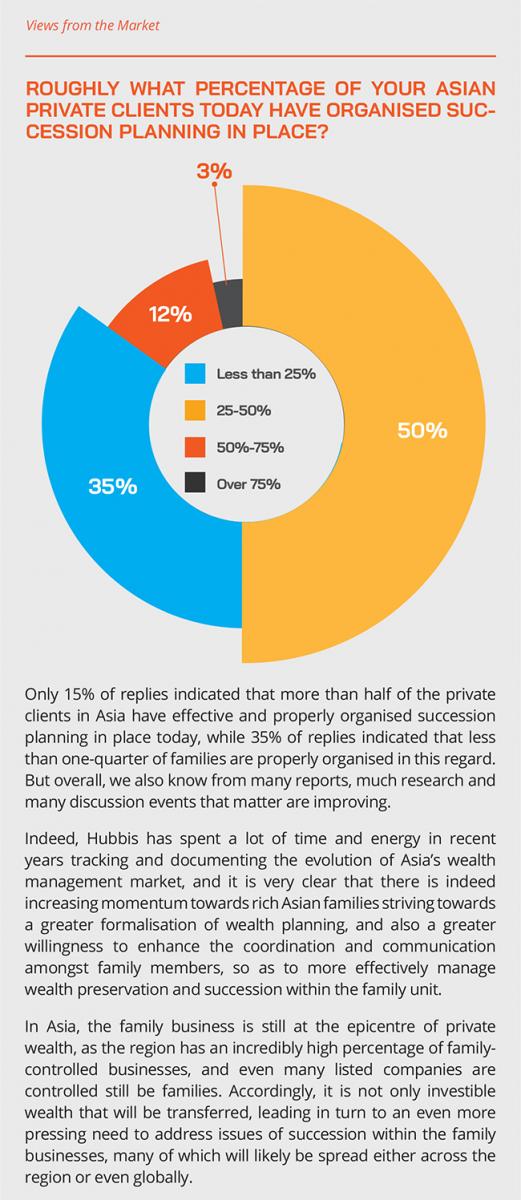

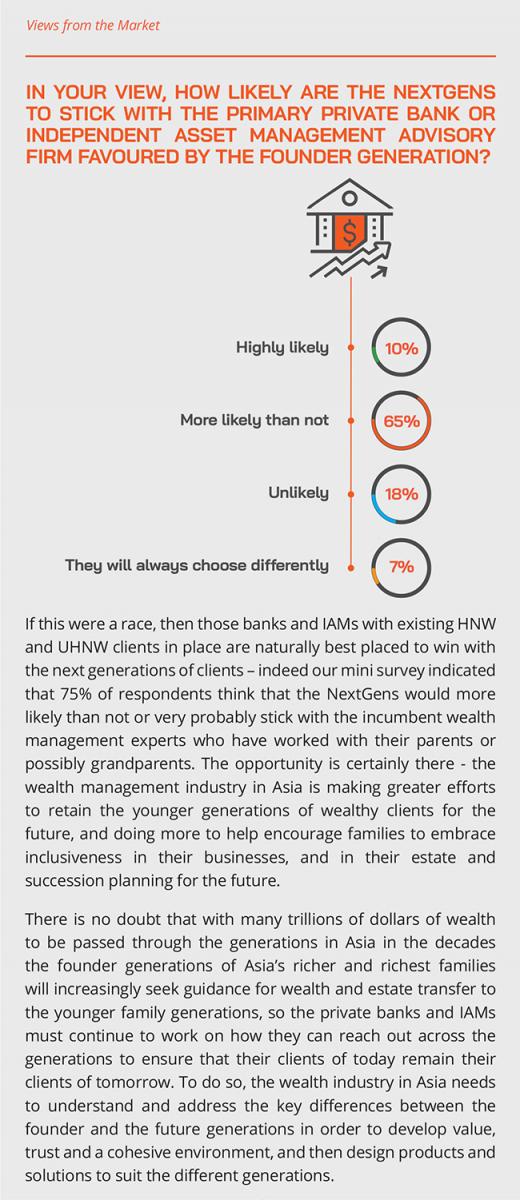

As the founder generations of Asia’s wealthy and uber-wealthy families and family dynasties increasingly seek guidance for wealth and estate transfer to the younger family generations, it is important for the private banks and other advisory firms in Asia to understand how to deal with their older clients in relation to the extremely sensitive and highly personal matters of legacy and estate planning, while at the same time nurture inclusiveness amongst the next generations that will, they hope, become their clients in the years and decades ahead. How are Asian families dealing with the next generation and business succession? How prepared are next-generation family business members for wealth transfer? Are today’s wealth managers building meaningful conversations with families about wealth and family business succession issues? How do you steer family wealth planning towards a multi-generational vision? What role should robust family and family business governance play, and why? Is enough being done to mitigate or avoid family disputes? Are there more opportunities to offer diversified advice to the younger generations? How does the industry offer the client better ideas and greater value? How can the Next Generation engage in a dialogue with their families about their own aspirations? In our Digital Dialogue of September 10, Hubbis assembled a group of erudite wealth management experts specialising in the field of estate planning and transitioning to discuss these issues, with the overriding objective of helping the industry elevate its vision, its approach and its skills in order to maximise the opportunities ahead, at the same time as helping clients avoid the many pitfalls of poorly conceived, poorly executed estate and legacy planning.

It is broadly acknowledged that the patriarchs and matriarchs of Asia’s wealthy and uber-wealthy families can be highly controlling, often not wanting to relinquish control of the reins or the assets, or not seeing the need to until it is too late. This can be difficult to manage for advisors and tough to handle for family members, leading to poorly constructed legacy planning and impaired succession planning, with the younger generations not feeling involved in the family businesses until they might suddenly be thrust into the limelight.

With literally trillions of dollars of wealth due to change hands in the coming few decades, it is vital for Asia’s wealth management industry incumbents to carefully navigate these potentially treacherous waters. Some families bury their heads in the sand, ignoring the need for clearly defined decisions and roles, while others are keen to embrace the process and to put in place the right governance, structures, and direction for the next generations.

Embracing inclusiveness

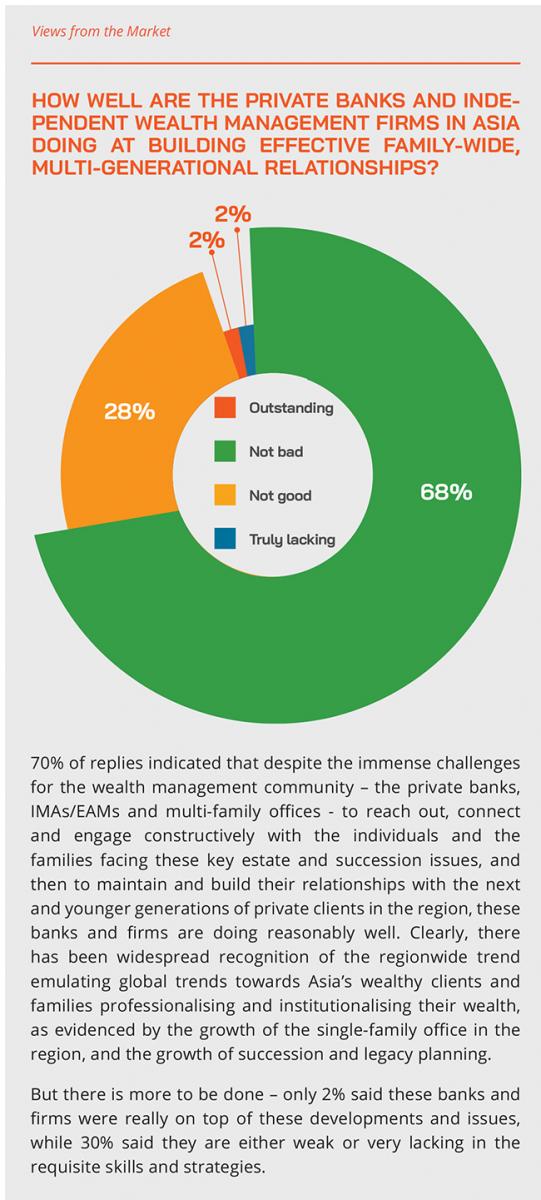

If the wealth management industry wants to best serve its clients, and also to retain the younger generations of wealthy for the future, they should help encourage families to embrace inclusiveness in their business and estate and succession planning for the future.

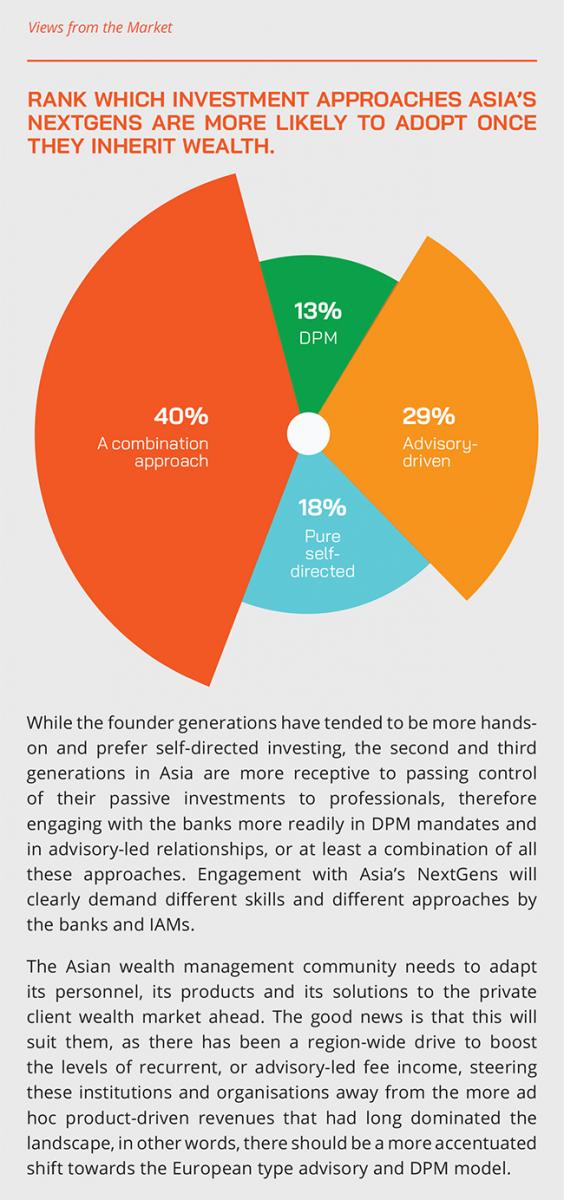

The next generations are usually highly educated, often in long-established Western institutions, which leads to a better understanding of worldly matters, of wealth management issues, and often serves to boost their entrepreneurial hunger as well as enhancing their focus on governance generally, and on sustainability in the family business and indeed in financial investments. The wealth industry in Asia needs to understand and address the key differences between the generations to develop value, trust and a pull-together attitude, and then design products and solutions to suit the different generations.

Embracing the opportunities

“There are many opportunities out there,” one expert commented. “Many financial institutions of all shapes and sizes are homing in on what they perceive to be significant revenue-generating opportunities in the family office space. That’s all good and well, but anybody who's operated in that environment, pretty reasonable length of time, will have an understanding of just how challenging it can be to get business from family offices. Family businesses, at least in Asia, remain quite patriarchal. They tend to be run by powerful figures from the oldest generation, and often these figures are able or unwilling to let go. So, this makes it quite difficult for second or third generations to bring in new advisors or change things around.”

Same but with a difference…

He conceded that this was of course a generalisation and that not every part of Asia is the same, and there are different leadership models, and transition strategies amongst the family-owned companies around the region.

“However,” he said, “if we look at the members of the new generation who ultimately will become responsible for all the decision makings and time on wealth management, they come armed with their overseas business degrees and have got quite a difficult juggling act on their hands, they often see an urgent need to document the knowledge that's hidden inside the founders’ heads, then use that across the organisation. But, at the same time, they want to speak out about reconciling what they learned in business school with the older generation’s expectations of appropriateness, courtesy and good timing.”

Looking far ahead

He added that a trend he has been seeing is some of the more prescient and creative Asian families, making a very conscious decision in some cases to put the family before the business.

“If you look at some of the more successful families who have reached third and fourth generations, often they're very clear on what their family values are and that that is often the driving force in terms of how they do business. The evolving environment here and the rapid pace of change and technological change means a very different way of doing things of operating for businesses ahead, leading in turn to many opportunities for wealth advisors to help these families. But it's not going to be the old model – these family businesses are going to be managed by younger people in due course who have a very different mindset in terms of how they want to operate, and indeed how they want to live their lives. In short, enormous opportunities ahead, but a very different game going forward to what we have had in the past.”

Empathy and sensitivity required

Another guest highlighted how difficult it often is to engage in very personal planning discussions with individuals and families.

“There can of course be a real reluctance for people to share their thoughts,” she said, “and part of that is often because people haven't perhaps formulated them themselves, and even if they have, they would not necessarily even go about sharing them with someone whom they don't yet have a particularly close relationship with. So, if you are even having a conversation with someone, that means by that time, or by the time they get to talking to a trustee, or somebody else who's helping with the intergenerational wealth transfer at least they are already willing to engage in the process. For me, I usually start by telling people stories and sharing stories of families that I've worked with, and then asking them if they have thought about doing things themselves.”

Expert Perspectives

Hubbis: How prepared are next-generation family business members for wealth transfer?

Expert Opinion - Joanna Caen, Managing Director, PraxisIFM: “I think that preparation is improving. The positive and negative examples seen in the media and privately among wealthy Asian’s peers are, I think, encouraging all high net worth families to look at their planning. I also think that families are beginning to see that proper planning for wealth transfer helps preserve family wealth through helping the family stay focused on growing the family business, secondly preventing costly disputes and importantly, preventing disorderly breakups of family companies, thereby also demonstrating to potential outside investors that the family business is well run and therefore a safe investment opportunity.”

Expert Opinion - John Shoemaker, Registered Foreign Lawyer, Butler Snow Singapore LLP: “Banking secrecy may have been dealt a death blow, but attorney-client privilege still survives. Licensed legal practitioners are particularly well-situated to fill the current client need for frank advice which isn't complicated by potential conflict or fear of inappropriate disclosure.”

Hubbis: How can the Next Generation engage in a dialogue with their families about their own aspirations?

Expert Opinion - Joanna Caen, Managing Director, PraxisIFM: “I often hear that in Asia patriarchs are less willing than patriarchs in other parts of the world to communicate their longer-term plans to their children, and to discuss those plans with them. However, this is not my experience – it really varies family to family. For example, in one family I worked with from New Zealand, which may be seen as a haven for liberally minded children, the father told me his son was going to read law and business at university. During the same meeting, the son told me his intention was to read English literature and film studies. Clearly, they needed to talk.”

With this in mind, the first point I think is to make sure families create a “safe space” for the next generation to share their thoughts and ideas. In the case of this family, the father and son before long realised they needed to speak. They compromised on the son studying business and film studies. Once the son graduated, he was given an allowance for a number of years to help establish himself as a filmmaker. At the same time, the father expected him to engage on a part-time basis with the family business. Once the allowance ran out, the son got to choose – continue as a filmmaker and support himself, or join the family business and be paid accordingly.”

Expert Opinion - John MM Williamson, Chairman & Managing Partner, Generations: “With wealth, one considers competing desires; to grow wealth, to preserve it and to fulfil personal aspirations. People put different weightings on these desires, and these change with time. The right balance creates the possibility for satisfaction with what wealth can accomplish. What drives you should drive the next generations.”

Hubbis: How do you steer family wealth planning towards a multi-generational vision?

Expert Opinion - John MM Williamson, Chairman & Managing Partner, Generations: “On the matter of how to steer family wealth planning towards a multi-generational vision, we consider that bringing in advisors does indeed benefit families because a third-party, non-family member with the right experience and understanding can see and offer a different perspective and put things into context. These advisors can help facilitate the examination of succession issues, help create harmony and identify ways to include the next generation in the process as the family evolves.”

Expert Opinion - Joanna Caen, Managing Director, PraxisIFM: “I recognise that most of the families I work with are, at least initially, reluctant to share their multi-generational plans with me. This is even though I’m helping them structure their wealth for generations to come. For this reason, I tend to start by telling them anonymous anecdotes about other families I’m working with, to see if that prompts their thinking. For example, one family I know has started transferring relatively small, but actually quite large, sums into trust structures and appointing the next generation as the financial advisors to the structures. This gives them some control and helps them learn and develop their money management skills on behalf of the whole family. Another family started by getting children involved in running small projects or teams within the company to develop their business skills.”

Hubbis: How are Asian families dealing with the next generation and business succession?

Expert Opinion - John Shoemaker, Registered Foreign Lawyer, Butler Snow Singapore LLP: “I see that high net-worth and UHNW families in Asia are just starting to grapple with the complexities of business and personal succession, with old structures and plans/intentions in place being second-guessed in light of rapid legal and tax changes globally as well as a second-generation mind shift in regard to wealth inequality, private wealth advising and advisors play in integral role in helping shape those new conversations.”

Expert Opinion - John MM Williamson, Chairman & Managing Partner, Generations: “The NextGen has a balancing act on its hands. There is the need to document and disseminate knowledge ‘inside the founder’s head’. Simultaneously, they must balance reconciling what they learned in business school with the older generation’s expectations. Key concerns are similar around the globe, but differ depending on the life cycle of a family.”

Expert Opinion - Joanna Caen, Managing Director, PraxisIFM: “I have been in Asia for five years now, and I would say that slowly but surely families in this region are getting better at having conversations with the next generation about business succession. This is helped by some high-profile examples of families who undertake the planning well, and have clear, public, succession plans as well as those who do not and who generate negative press because of this. There have been some high-profile situations involving very prominent families, where the patriarch passed away and litigation began only days later.”

Hubbis: What role should robust family and family business governance play, and why?

Expert Opinion - Joanna Caen, Managing Director, PraxisIFM: “In my view, robust family and family business governance is key to avoiding disputes within the family, to enable wealth preservation, etc. However, there’s a distinction between merely having governance plans in place (no matter how comprehensive) and actually having plans that everyone in the family has engaged with and accepts. My experience is that if the patriarch merely dictates what the governance plans are, the rest of the family (especially the next generation) will be less likely to accept them than if there is real communication about the plans when they are being prepared. Although this necessarily means the plans will take longer to prepare, and can make the process itself more contentious, it certainly helps. Different people, even within a family, can often have different views of what seemingly simple words and phrases mean. Christian Stewart, a family governance guru, gave a recent example on LinkedIn. He was talking about the word “harmony” and how he helped a patriarch define what that word meant to him. Once that definition was set, the family could then plan how to accommodate the patriarch’s views on harmony.”

Hubbis: Is enough being done to mitigate or avoid family disputes?

Expert Opinion - Joanna Caen, Managing Director, PraxisIFM: “There is an increasing number of specialists who can help families avoid disputes through proper planning. Some of these are independent family planning and governance experts, some of them are employed by trustees, corporate service providers, banks, and the like. However, it doesn’t matter how much expertise is available unless families know about them and are willing to engage with them. It’s up to us, as those who work with high net worth families, to make them aware of the assistance available to them and to help steer them to the right people for them at the right time.

Expert Opinion - John Shoemaker, Registered Foreign Lawyer, Butler Snow Singapore LLP: “We in the wealth management industry need to become better at learning to deliver bad news, make ancillary specialist introductions as needed and find ways to soften our clients' natural privacy concerns with regard to involving the next generation in discussions surrounding problem resolution immediately.”

Suggest, but don’t push

She added that it is also useful to suggest to them in terms of what models they might take, for example, if the family's out of the business and has sold out, it really now often has a large amount of cash to manage and invest.

“Talking to them about putting some of that money into a structure where one of the children can manage it for you, where they can then take the lead on that management and achieve some control is valuable,” she commented, “as for those NextGens it helps give them some skills that they can learn to develop themselves. And if the family still own the businesses, then I might suggest the older generation gives the NextGens a team or an operation to look after first.”

Encourage dialogue and openness

Another specialist commented that dialogue is the essential first step, hopefully with the NextGen(s) included. “If the generations excluded,” he cautioned, “it's a recipe for future disputes once that first generation is gone, no longer the glue holding family harmony together.”

He said it is a tricky juggling act to ensure that the siblings are accommodated, including those more and those less willing to take control of the family businesses and affairs. “You can structure periodic family meetings, but how do you run them? And how then do you sort of balance everyone's interests including the ones who are not as involved, and who are perceived to be troublemakers because if you don't deal with that now, we're just inviting more disputes, which are really becoming increasingly prevalent, and we need to somehow help prevent them.”

With age come challenges

He added that his firm was also seeing more issues around capacity as the clients get older, with longer lives often culminating on Alzheimer’s, dementia, Parkinson's, and other impediments. “We sometimes need to bring in psychiatric experts from the outset just in case people challenge later; these are difficult challenges all round.”

Building true trust

An expert said in his view that are some key vital ingredients to help in the whole wealth transfer process – integrity, trust and communication. “We must realise that just because you might be called a trustee or an advisor or a legal or other expert, that doesn't necessarily mean that you'll get the trust of the various parties involved in any family discussions. In my experience, trust takes a lot of time. There are realistically many key challenges around all this; it really is not easy.”

A panellist agreed, adding that many family companies are not structured and organised as businesses with external shareholders and possibly public market status. “You can spend a lot of time with any given client trying to get them on the right track, and often that effort, that work can unravel very quickly at a significant change in the family power base,” he warned.

Soft skills are vital

A lawyer commented that, although it was challenging for him to admit, soft skills are vital in the whole process, as well as particular areas of formal expertise. “I've come to appreciate and understand that soft skills and having conversations with clients and listening to the emotional side of things, not simply the bottom-line, legal or tax outcome is absolutely necessary,” he said, “and today it's what sets great practitioners apart from just the average Joe trying to get a client's business nowadays.”

“One of the first things we have to realise as advisors is people disagree and it's okay that people disagree,” came another view. “But what I like to say to people is let's work out where the areas of common ground are and put to one side those areas that you do disagree on, and then come back to try to find a compromise and try to find a way through all that. Having that kind of ability to mediate and understand both people's perspectives and try to encourage them to not be positional, but come to some kind of compromise that works between them, I think can be very helpful.”

Anticipating change

They added that advisors need to be inclusive, as there is a real danger that when there's a change in control or power within the family, there can suddenly be a change of advisors. “The risk is that if you align yourself with any one particular person in the family, then you get seen as that person's advisor and seen as being on that person’s side,” she said, “so trying to be very neutral and stay in the middle as much as possible, listen to everybody, keep everybody's confidences back to, that all helps with the image of integrity and trust.”

A guest highlighted how, despite immense wealth, most of these rich and uber-wealthy families have issues.

“I think we have these enormous expectations of families of wealth that they should operate in this terribly perfect manner with great advice available so that the wealth can be transferred on seamlessly,” he said. “Sadly, my experience has never been as simple as that.”

What’s around the corner?

“There will often be disputes about the will,” he continued, “as perhaps some of the clauses may be ambiguous and open to challenge. Sometimes, other parties will come along, perhaps some business or life partner that was not known about by the wider family. In my view, the time that's invested in the next generations during their earlier years, that often has a significant impact on how they behave when it comes to the wealth transfer, whether they want to get into the business, or whether they want to go and use their time sensibly on some other pursuit.”

A lawyer commented that tax continues to be a major topic due to, or despite of, global transparency and reporting. “Tax and other issues are driving clients to seek more professional advice,” he said, “so, for example, the announcement in China around rules on global income and reporting that have been there some time but that are now going to be enforced. These sorts of changes often scare clients into seeking advice and taking action.”

Expert Perspectives

Hubbis: Are today’s wealth managers building meaningful conversations with families about wealth and family business succession issues?

Expert Opinion - Joanna Caen, Managing Director, PraxisIFM: “From what I see, I think this is improving. Wealth managers are often highly trusted by the family and may have insight into the patriarch’s thinking, which helps them assist the family with their planning. I also believe it’s in the wealth manager’s interests to make sure they are seen as the family’s advisor, rather than merely the father’s advisor. This may stop the next generation developing their own relationships with other wealth managers to whom they transfer the wealth on the father’s passing.

Hubbis: Are there more opportunities to offer diversified advice to the younger generations?

Expert Opinion - Joanna Caen, Managing Director, PraxisIFM: “Absolutely – especially during these Covid times, the next generation is happy to meet advisors remotely. This creates opportunities to reach out to and engage with members of families outside of the jurisdiction in which the advisor is based. The next generation is not a homogenous group, any more than their parents’ generation. This means that some will be interested in different topics, such as asset diversification, philanthropy, impact investing, etc. Once you know what they’re interested in, you can help them learn more and make decisions accordingly.

Hubbis: How does the wealth management industry offer the client better ideas and greater value?

Expert Opinion - Joanna Caen, Managing Director, PraxisIFM: “By really listening to clients and finding out what it is they’re interested in. if a family wants to maintain a manufacturing presence in a particular location to support local jobs, then they will be more interested in learning about how to create efficiencies in the manufacturing process or even change the manufactured item. However, if they want to remain within a particular industry, and could manufacture the product more cost-efficiently in another jurisdiction, then they will want to know how to do that. Once you know what the family wants, you can then advise them in a way that is specifically tailored to them.”

A guest highlighted that track record and word of mouth recommendation are both very valuable for business expansion. “The best endorsement you can have is from an existing client,” she said, noting that helping families with governance is a vital step in helping to achieve the trust between generations and avoidance of conflicts and disputes.

A specialist then commented that consolidation of assets in certain jurisdictions and the relevant use of trusts and structures is highly valuable in helping to simply all sorts of estate and legacy planning issues. “These are matters that can and should be dealt with professionally,” he said, “but the key point here is that they need sorting out good and early if they are to be effective. Yes, there is a trend simplification, and quite rightly so because overcomplicating it means it's difficult to administer, it's expensive to administer, but getting on with all this in a timely manner is essential.”

Take ownership of the process

As the discussion drew to a close, an expert summarised the need for clients themselves to be careful about who they deal with, to make sure they do their research properly, to check credentials, to then hire advisors well, to fully understand what they are doing and why, and to take ownership of the process.

“Unfortunately,” she said, “a lot of people don't take the time to do that due diligence and live to regret it. Nothing really beats the detective work before you commit your privacy, your confidences or indeed your wealth to some third party.”

Another panellist concurred, adding that the two things he always tells every client at the beginning of an engagement is to make sure they get things in writing, and make sure they fully understand the advice and recommendations they receive.

Your wealth, your legacy

“My job is for them to understand even the most complex topic to bottom-line it for them so that they know precisely why they have certain structures, what the trusts do and how their relationships with those trusts must be conducted. The clients really do need to take ownership because, at the end of the day, it is their pocketbook, their reputation and unfortunately in some criminal cases, their liberty which is on the line, not the people around them that are whispering in their ear and giving them advice.”