Publications & Thought Leadership

Independent Wealth Management in Asia – State of the Market & Growth Strategies

Mar 9, 2022

The independent wealth management (IWM) segment has grown apace in Asia, but it remains far less established than, for example, in Europe or the US, with an estimated 30% of assets managed by boutique firms in Switzerland against estimates of 5% to perhaps (very optimistically) 10% in Asia. The growth is significant, but to date, it has therefore been from a low base. Moreover, set against the truly dramatic (and continuing) expansion of HNW and UHNW private wealth in the region, the IWM sector has much more potential, and there is plenty of room for growth from existing players and from new entrants. But what are the strategies, products, investment, technologies, talent and approaches required to seize the many opportunities ahead? The answer to this and many other questions were offered by our panel of experts at the Hubbis Digital Dialogue of March 3.

The Panel:

- Donald Klip, Co-Founder, Global Mortgage Group

- Urs Brutsch, Managing Partner & Founder, HP Wealth Management

- Harmen Overdijk, Chief Investment Officer, Leo Wealth

- Luke Moore, Chief Executive Officer, Oreana Financial Services

- Rafael Weber, Head Institutional Clients, Swissquote

The Agenda:

- What are the key developments that have been driving the evolution of the independent wealth management sector in recent years?

- Where is the growth going to come from in the foreseeable years ahead?

- Can Asia’s independent wealth sector really grab a much larger share of the AUM, as has been happening for example in Switzerland as the leading IWM market?

- Can the independents entice more HNW and UHNW clients in Asia to migrate away from the big brand names such as the global, boutique or regional banks, and further towards the independent model, and if so, how?

- What do the existing competitors need to do to adapt their strategies, product offering, services, team and operations to seize the growth opportunities ahead?

- And what about the new entrants? What potential is there for them and where do they see the growth potential?

- Can the independents win a larger share of DPM from their existing clients and if so how?

- How can the existing competitors win over the growing ranks of Asia’s younger wealthy, who are both inheriting trillions in the coming decade or more, and who are also making or controlling Asia’s next wave of vast private wealth?

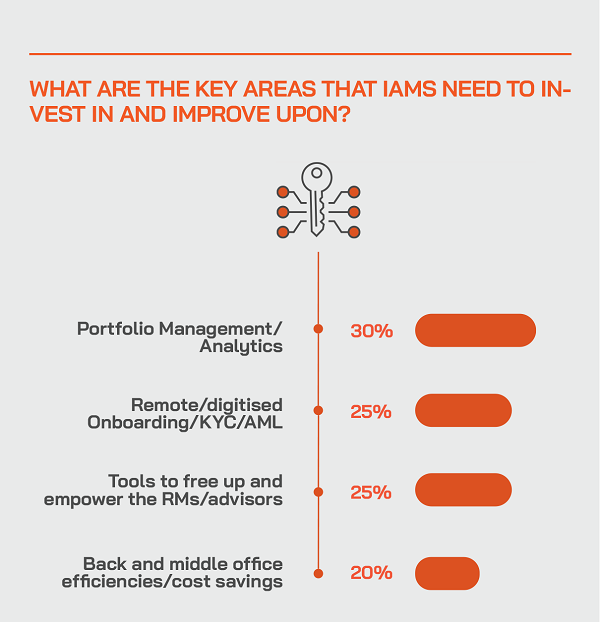

- What are the vital factors to consider when upgrading the technology of an independent wealth firm? And where is the investment required today?

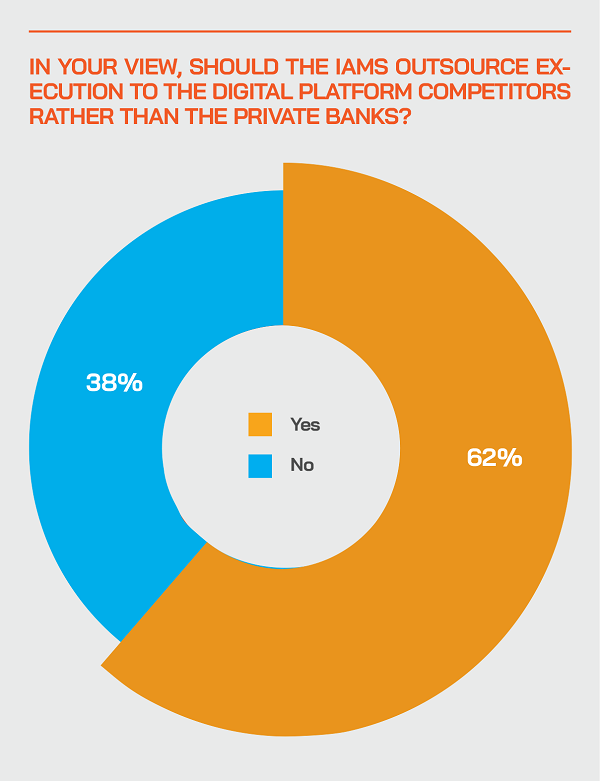

- Should the independents outsource to digital platforms and other partners to offer a truly global product, advisory, execution and administration suite to clients?

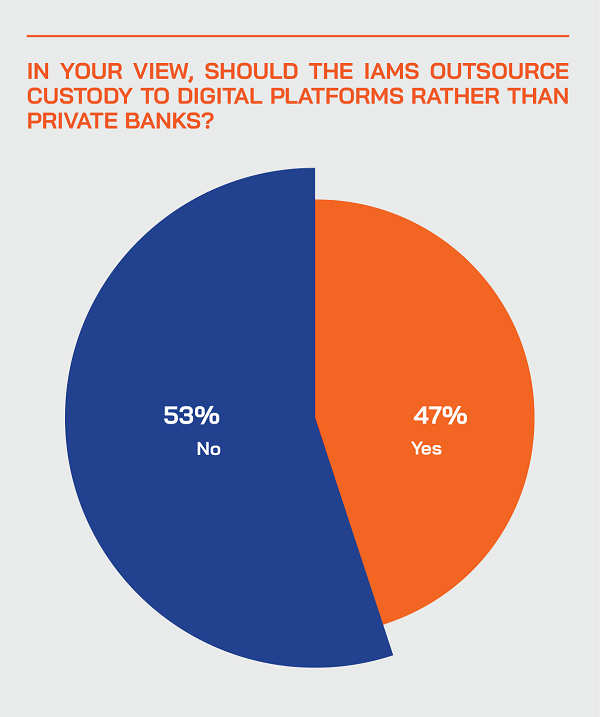

- What will the IWM community need from custodians in the future? A wider range of products? Better execution? More efficient and lower cost custody?

- What are the right fee models, and are retrocessions still part of the overall picture?

- To seize the growth potential, how do you attract and retain talent to expand in the future?

- What is the ‘secret sauce’ for the independents to seize the growth opportunities ahead?

Setting the scene: significant progress, but plenty more can be achieved

The pandemic has not derailed Asia’s growth trajectory. Private wealth is being minted at incredible speed, and more and more people are joining the ranks of Asia’s HNW and UHNW community, while literally millions are moving to the growing legions of mass affluent. To cater to the rapidly expanding needs, expectations and diversity of investments and structures of Asia’s HNW and UHNW clients, the region’s independent wealth management (IWM) firms – both the incumbents and the new entrants – need to continuously hone and refine their strategies in order to seize those opportunities.

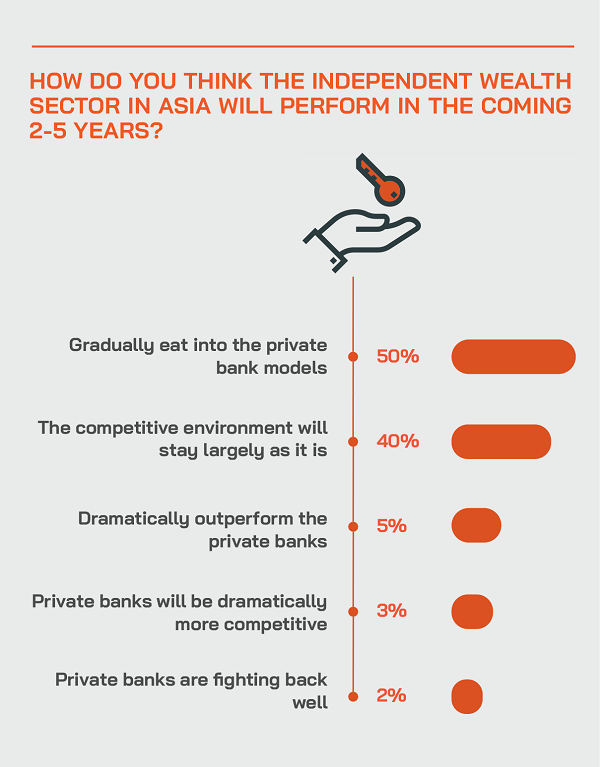

As they do so, the IWM sector can gradually emulate the great success of their peers in the more mature markets, the shining example of which is Switzerland in terms of the penetration of the independent wealth providers.

There is little doubt that the IWM community in Asia is in the right place at the right time as to market demand, but can they adopt the right model to win more market share of the rising private clients AUM in the region? Can they extend their relationships beyond their founder/creator type clients to the younger generations who are either making or inheriting literally trillions of dollars of wealth? How can the independents scale up sufficiently through technology, for example not only adding cost-saving solutions and RM-boosting technology, but also by embracing external investment and custody platforms and bringing in new talent and even new offerings to compete in the markets of tomorrow?

The IWM sector in Asia is still not fully punching its potential weight class; more talent and differentiation required

A leader with some 13 years of experience in building an EAM in Asia reported that the IWM sector could be growing faster. Hindrances centre around the shortage of talent, as RMs willing to become more entrepreneurial risk-takers, rather than sticking to the relative safety of the private banks’ well-furnished halls. Another shortfall is lack of differentiation, the absence of the critical edge. “If RMs are what they were in the banks, then they are not extending the reach of the independents or themselves,” he said. “We all have to differentiate ourselves, in one way or another. Competition is pretty stiff.”

He said his secret sauce was their consistency of approach and strategy. “We have focused on our core expertise of managing money and sticking to a strategic asset location in a highly disciplined way and not trying to be too tactical, not trying to pretend that we know how to time the market, because obviously we don't, just like everyone else, if they are being honest.”

Another element is transparency, he reported. “We never worked with retrocessions with our partner banks,” he reported. “That was tough at the outset, but it's paid off, because we have recurring income and so we don't really have to trade to pay for the bills at the end of the month. Honest advice to the client is to pay appropriate fees in order to make sure all recommendations are transparent.”

He explained that growth is incremental, adding space, adding the right people and enjoying the business and staying the right sort of size, not too big and not too small. “We think our sweet spot will be 40 to 50 people in total,” he stated.

Expert Opinion - Donald Klip, Co-Founder, Global Mortgage Group: “As Asia’s young and wealthy are set to inherit trillions of dollars in the coming decade or more. Having client advisors that can speak to this new type of client - Web3.0, crypto, NFTs, early-stage investments and so forth are obviously what we know now, but even liquidity events will be different from the IPO and M&A options that we know. The role of passive managers and ETFs will also evolve in the new tokenised, decentralised world.”

Being transparent, objective, and client-centric are all vital qualities for EAMs

Another guest agreed with the comments on transparency and the need to avoid conflicts arising through taking retrocessions. He explained that the wealth industry in Australia had transitioned from commission-based or retrocession-based advice into the fee for service model, driven by regulators being proactive.

But for Asia, he explained they are in Hong Kong and Singapore expansion thinking about what model is right, indeed whether there is a half-way house model that works best. He said the key is transparency, giving clients the option to choose how they pay for the service that they receive; that could be purely advisory fees, or commission based, or a mix of the two.

“As long as the client is properly informed and understand how they are paying us, that is the right approach. In my career – and we were bought out some years ago from a major bank - we've always been a fee for service business, but especially here in Hong Kong, we might need to adapt and deliver in ways the clients like, understand better or are more familiar with.”

Another expert leading a firm of roughly USD4.5 billion in AUM, roughly 50 people and, following mergers and partnerships with offices in Asia reported that they now manage the business on a global scale.

“We have a similar business model across the group, focusing more on discretionary than advisory, more on recurrent income,” he reported. He explained that they are benefitting from the US experience as in that vast market, the IWM sector had moved from 5% to 30% of the wealth market in the past two decades.

“The focus there has been in transparency, and offering full picture advice,” he commented. “And that is how we approach it, offering tax planning services, proper estate planning, and other key services for the families. The private banks are not really doing that anymore.”

He explained that in order to grow, they believe they need to expand more globally, with a three-year to five-year strategic plan aiming to have a presence in Singapore, a base in Tokyo, and also a base in Tokyo, and we would like to have a base in the EU in order to be within that market and their regulation.

Another panel member observed: “The issue to be aware of is that client expectations are changing just as rapidly as the market and technology. Large banks with incumbent and legacy technology and compliance procedures won’t be able to move as fast as new players. Additionally, the need for a brand name may not be as valuable going forward, and trust will be put into the regulatory framework and technology.”

Fee for advice is taking root in Asia, but selectively as some clients prefer choice or a mix of options

The same guest agreed that the fee-for-advice approach was gaining ground, but in the past decade, much slower than he might have hoped for. He indicated that the Asian families they work with, including their younger generations as the older generation takes a step back, have a more receptive approach.

Some in the IWM community are diversifying their models towards digital delivery while retaining the personal connectivity

An expert reported that they do not believe in the digital model for wealth management, but the hybrid approach does work, while there must be great care to ensure the personal touch. “For the real advice, to think about what their family strategy should be, perhaps discuss concerns about markets, they still like to talk to people,” he reported.

The right types of products, digitised execution and even custody away from the banks are immensely valuable options for boosting the IWM proposition

An expert explained how they support the IWM community in Asia by focusing on seamless, digitally-delivered execution and also offering custody away from the private banks.

“Many clients today and many in the independent space these days do not place as much importance on being a client of a private bank. What they really care about is what kind of offerings they get, and not so much to get invited to some kind of golf event. We deliver custody and execution expertise seamlessly for almost any bankable asset out there. And we are pure service providers; we do not ever cross lines in the sand to advisory or in any way compete with the clients. A digitised platform such as ours offers a wide range of advantages, and those became especially clear during the pandemic, enabling a higher level of service and full transparency on when orders are executed.”

For the EAMs, he observed, in helping to really scale their businesses, it is very important to have at the backend a very strong custody and execution partner. “The EAM can thereby focus their efforts on the human touch, on the actual advisory and don’t need to allocate too many resources and time to just make sure that the operational issues are sorted properly.”

He added that in Asia, the platform focuses only on external asset managers and multi-family offices and accredited investors. “We have been here a little bit more than two years in Asia and have onboarded quite a large number of those clients who truly seem to appreciate the breadth of our product offering and our approach and service,” he reported. “We are expanding, and with additional licenses, we will be able to offer more. We are a semi-institutional platform, and I think more and more external asset managers appreciate what we offer; they trust us, and we are building genuinely long-term relationships with our clients and our partners in the region.”

There are many advantages and appeals of going independent, but you must at heart be bold and patient

A guest offered his views on the journey to go independent and the advantages. “You won’t be waking up to find the head office of the bank has made major decisions that affect your role and future,” he said. “You develop different and deeper relationships with your clients, as you are truly working for them; it is a very different relationship if you work for someone rather than with someone, and if that person pays you, you do your utmost to deliver added value. And if you do that, it then further strengthens your relationship. You have less compliance burden; you can, if all goes well, make more money, but if you are the same person as in the bank, then think again. If you go independent, you need to change your mindset, to really work for the client.”

However, he cautioned not to underestimate the hurdles of building the right infrastructure, or creating the network and extending the relationships. He advised considerable patience, as it will take time for the business to gain traction and then build momentum. “This is a long-term business, and if you build the relationships and deliver on your promises, there's no reason why you cannot be successful.”

For his own business, he told delegates that the near-term priorities today include expanding the private market capability, especially as public markets are likely to be challenging over the next few years.

Another core area for growth is the multi-family office space they inhabit in Singapore, helped by schemes that are available like the 13X and the 13R and so on.

“Singapore,” he reported, “is the best place for our business today, and we feel that we do not want to dilute our attention with other offices around the world, except perhaps in the future Dubai and possibly Switzerland. We do not want to grow too big or to have too many clients for each RM, we want to stick to our core values and qualities. For us, the RM is core to the business and the service we provide to clients, and digital solutions are tools that help them, not bypass them. Our mission is to preserve client wealth first and foremost, to understand them and to offer careful, studied advice.”

Expert Opinion - Donald Klip, Co-Founder, Global Mortgage Group: “Given the well-known impact technology has on all areas of wealth management, from robo advisors to increasingly-sophisticated ETFs, the value added of a client advisor will have to evolve just as fast. We feel that ‘independent solution providers’ like ourselves that are unbiased and offer more specific solutions will be more important going forward as interests are more aligned with the requirements of the investors.”

Some EAMs take a different approach and prefer to expand globally to scale up and extend their offerings

A somewhat different view came from another expert who said that being able to offer international offices and a truly global service helps greatly with their thrust deeper into estate planning and tax planning.

“That is why we like to be present in different locations,” he reported. “Because of the pandemic, because of all the things that are happening in the world right now, in Hong Kong, obviously, Russia, Ukraine, and so forth, people are reconsidering where they and their families want to be and moving and structuring accordingly. And we are better placed also to offer advice to the younger generations. Additionally, we are better placed to help with digital assets, which in some jurisdictions are far more ‘legalised’ and where more and more clients need help and good advice. In short, we get more and more clients from these angles, looking at the total picture, hence our strategic plan is to be in different locations in the world, with the different regulatory regimes, able to service our global client base.”

Build your advisory and services partnership ecosystem in order to deliver best-of-breed advice and solutions

He also advised working carefully with a set of experts and partners outside the firms and the different offices, to ensure the best advice and the right compliance approach for different objectives and requirements.

“We do not share fees with anyone, in either direction,” he reported. “When we refer clients to a lawyer or a tax accountant, we don't pay them, they don't pay us. It's a professional working relationship, and we refer clients to each other. In that way, we are fully transparent. We earn our fees from fixed advisory fees on their portfolios. Clients are aware of all this from the outset, and know that in all our actions, we are out to deliver the best solutions for them.”

New opportunities for high-wealth clients include specialist real estate lending alternatives to the banks

A guest highlighted the interest in the independent wealth market for bespoke international mortgages. Based in Singapore and with offices and partnerships across the globe, he explained that his firm connects its international high net worth clients to the firm’s network of lenders around the world, offering real estate financing solutions in the US, UK, Europe, Canada, Australia, Japan, Thailand, Hong Kong, and Singapore.

The typical clients include wealthy expats, HNWIs, UHNWIs, family offices, developers, investment funds, client advisors, as well as private banks. They have a network of over 300 direct lenders globally and work to devise solutions that ideally fit the needs and expectations of the clients.

In the US, through a wholly-owned subsidiary they have built a similar infrastructure, offering over 150 US bank and wholesale loan products directly to international clients. The firm is even applying for a wholesale banking license, which is expected to be completed mid-year. They have extensive reach, and capabilities with offices in Hong Kong, Singapore, Shanghai, Beijing, Manila, Bangkok, Seoul, and the US.

Their story goes back a few years when two founders, both from the US, met in Singapore, got on well, and co-founded the firm.

“We identified problems that existed for financing US real estate investments while living overseas and realised we needed to fix this,” he explained. “For example, despite some USD100 billion of US residential real estate being purchased annually by foreign nationals, only 20% used a mortgage, whereas, globally this percentage was more like 98%. The lack of financing options represented an opportunity for us to fix and ultimately help create a situation where securing an overseas mortgage was far easier and far more transparent. We are trying to democratise non-resident mortgages, making it far easier to borrow, bridging the significant gap in the market where banks are either unwilling to help or have qualifying requirements designed for its own citizens.

He explained how they act as real estate financing partners for their clients who are primarily external asset managers, some client advisors, and some of the smaller private banks who have clients seeking these requirements. A typical transaction for a client referred to by a private bank might, for example, be to finance a GBP10 million home they own in Knightsbridge, London, or perhaps a hotel in Hong Kong, or even to help them finance the building of a golf course in Australia.

“We started more with the digital delivery to democratise access, but as we progressed, we realised that there was a very large gap in the market with respect to high net worth, high value sophisticated real estate financing, which was a result of our initial journey,” he elucidated. “So, for example, say a USD20 million condo in New York, or a GBP30 million home in Knightsbridge UK, there were limited options outside of private banks.

“Nowadays,” he added, “we are there for a private client directly, or for an independent wealth manager to offer this type of solution to their clients. We have also evolved into other asset-backed financing, such as cryptos, shares, and so forth. As the banks become more regulated than ever before, it is increasingly tough to qualify for mortgages, or financing in general, so we stand available and ready in that significant gap in the market.”

And he added that as client wealth shifts to younger generations, there are significant opportunities to spread financing away from the dominance of hard assets and also towards cryptos and a variety of tokenised assets that blockchain and other technologies are opening up, for example, offering liquidity on a wide range of assets. “So, I think being one step ahead or being in the present, understanding the language, the players, the technology is going to be important,” he said.

Expert Opinion - Donald Klip, Co-Founder, Global Mortgage Group: “Technology and digitization will not only affect investment products and financing solutions, it will also improve the transparency and speed of how transactions and compliance will be conducted. This will be an area where non branded banks can gain an advantage. Good or bad – the world is headed this way. One recent example was how India digitized 98% of his population with the Aadhaar Act of 2016. Large banks with incumbent and legacy technology and compliance procedures won’t be able to move as fast and new players.”

Digital assets and cryptos are playing an ever-larger role

The same expert reported that at the group level, almost a third of their platform’s revenues are already coming from digital assets, and they expect that percentage to increase. He said there are two kinds of clients for the platform.

One is the traditional clients which want to tap into digital assets, and they want to have a safe counterparty, a regulated bank in Switzerland with a Tier 1 capital ratio of over 24%, and therefore an ideal counterparty rather than working on digital asset trades or custody with some of the newer companies.

And the second category comprises those who might have made their wealth in cryptos and now want to diversify into other asset classes. “So, we are definitely very bullish on digital assets,” he reported. “And I think it will be a very important growth driver for the group.”

“From my viewpoint,” he added, “as I am talking to many EAMs, I expect to see more focusing on this client group, as many of those whose wealth came from digital assets now need good financial advice and support. And there is not much competition for those clients as of now, because some might be wary of these clients. We can offer those clients the entire spectrum, from crypto assets to all bankable traditional and other assets, and we plan and hope to do the same out of Singapore as well.”