How to Boost Engagement with Clients and also Build Business in Today’s Still Uncertain Times

Apr 21, 2021

To imagine that the art of wealth management is all about delivering the best products and solutions to private clients is like assuming that the most technically gifted footballers will score the most goals and have the most impressive careers. It is simply not true. There are other vital skills and capabilities that make a client-facing relationship manager or into a trusted advisor for their clients. The Hubbis Digital Dialogue of April 15 mined down into the vital elements of the wealth management institutions and of their key players that differentiate them with their clients, that set them on the right path to building on their brands and their platforms for the years ahead, thereby effectively future-proofing their businesses and their individual careers.

The Panel

- Richard Straus, Senior Managing Director, Head of Private Banking - Hong Kong, EFG Bank

- David MacDonald, Consultant, Hubbis

- Noor Quek, Founder, Chief Executive Director, NQ International

- Damien Ryan, CEO, Asia-Pacific Strategy & Communications Advisory, Teneo

- Karen Tan, Head of Private Banking, Asia, VP Bank

Overview & Mission

To imagine that the art of wealth management is all about delivering the best products and solutions to private clients is like assuming that the most technically gifted footballers will score the most goals and have the most impressive careers. It is simply not true. There are other vital skills and capabilities that make a client-facing relationship manager or into a trusted advisor for their clients. The Hubbis Digital Dialogue of April 15 mined down into the vital elements of the wealth management institutions and of their key players that differentiate them with their clients, that set them on the right path to building on their brands and their platforms for the years ahead, thereby effectively future-proofing their businesses and their individual careers.

The ability to communicate effectively must be first and foremost on the list of must-haves, and it is not simply the right digital tools, but understanding when to speak up and being able to tackle complex subjects and potentially awkward topics with sensitivity. To do so, the vital skill of empathy is required. But to what extent is this innate to the individual and to what extent can the institution help imbue this in their key client bankers? How then can you therefore balance off EQ and IQ in your relationships with your clients, to ensure that they are delivered the right combination of information and detail, along with relevance and personalisation, and thereby avoid delivering solutions that simply do not fit the profile or character of the client?

How do the best bankers time their delivery of concepts, ideas, advice and even warnings to make sure that the clients have an open mind and ear to them? In the world of WFH and remote connectivity, how are the best advisors actually delivering and timing their recommendations and key information to their clients to ensure they are seen, heard and understood? How do the best client advisors influence their clients to take the right decisions and adopt the right investment and wealth planning strategies? What are the key skills required to bring a new client on board and to negotiate the right package with them? How can this best be done in a remote communication environment so that a fair deal is struck at the outset and so that needs and expectations are aligned?

What is critical thinking, and again is that innate, or can it be improved with training? How important is agility and flexibility in handling clients effectively, and where are the lines in the sand? How can you improve your resilience to survive adversity and possible rejection, and what can the institutions do to help train professionals in these matters? Are you collaborative internally and with external partners and therefore capable of delivering your clients the best range of expertise available, or do you want to hold onto the client at all costs? And are you dedicated to the mission at hand, in other words delivering the best and most relevant solutions and practices for your clients, not only for your firm’s revenues and your paycheque? Ultimately, considering so many of these different facets, is the bank or EAM/IAM delivering trusted advisors, and building sustainable, long-term relationships?

In what was a fascinating and thought-provoking discussion, our team of wealth management experts and consultants debated these issues in detail on April 15. We have summarised their many insights and observations below.

The Key Insights & Observations

Engagement with the private clients since the pandemic hit is certainly not a walk in the park

It seems that everyone is now a publisher on LinkedIn or other platforms, and it seems that everyone is producing thought leadership content and offering different views and content but tailoring such information and ideas to be truly relevant is not so easy.

Tailored and personal

Accordingly, it is even more the case than before that a banker or advisor wants to make an impact with an individual, it must be tailored, personalised, and relevant. The clients need something they actually care about and are likely to adopt as an idea or acquire as a product or service.

Understand the client

In order to even imagine being relevant, the RMs and advisors need to understand their clients, their businesses, their financial and family situations, their hopes and aspirations, their pain points, as well as the pitfalls and challenges they face. They need to see who they are as individuals, what life stage they are at and what they face ahead. Then there is somewhat of a leap of faith as an RM or advisor, as you are then aiming to put something in front of them that is truly relevant and that they could or perhaps should act upon.”

On the client’s team

Client-facing bankers and advisors need to demonstrate that they are on the ‘team’ of their clients.

The need to understand the ‘contact contract’

The wealthier the individual and the more successful, very often the more limited their time, even during lockdowns. It is not advisable practice to simply call the client whenever it suits the advisors; both parties instead need to connect and understand when it might be convenient to speak on a regular basis.

Curate your content with greater precision

There seems to be an increasing disconnect taking place between content and the target recipients, with too many webinars and too much content engagement delivered to what are too often rather generic audiences. You need to select out ideas and products that are truly relevant to your clients.

The Hubbis Post-Event Survey

The Hubbis Post-Event Survey

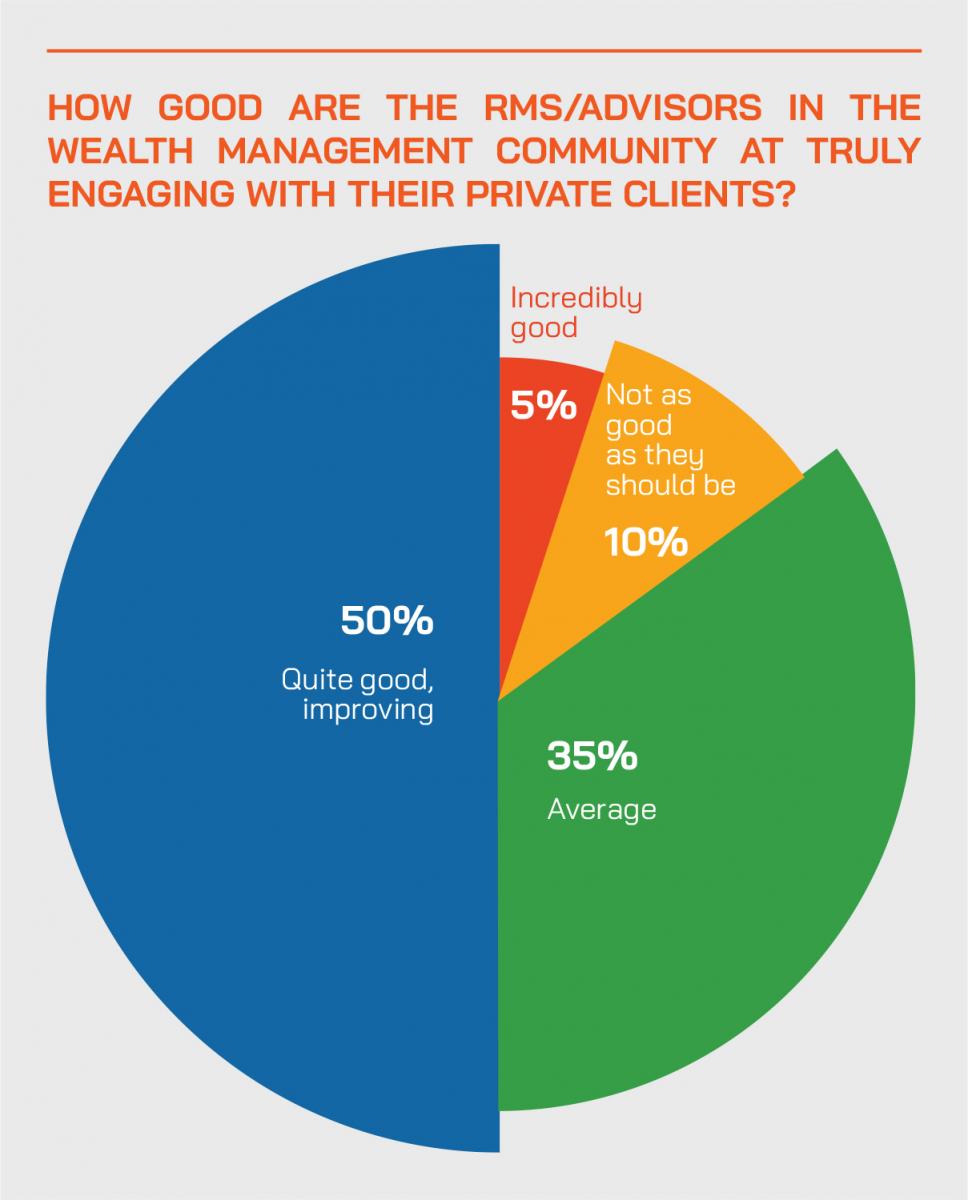

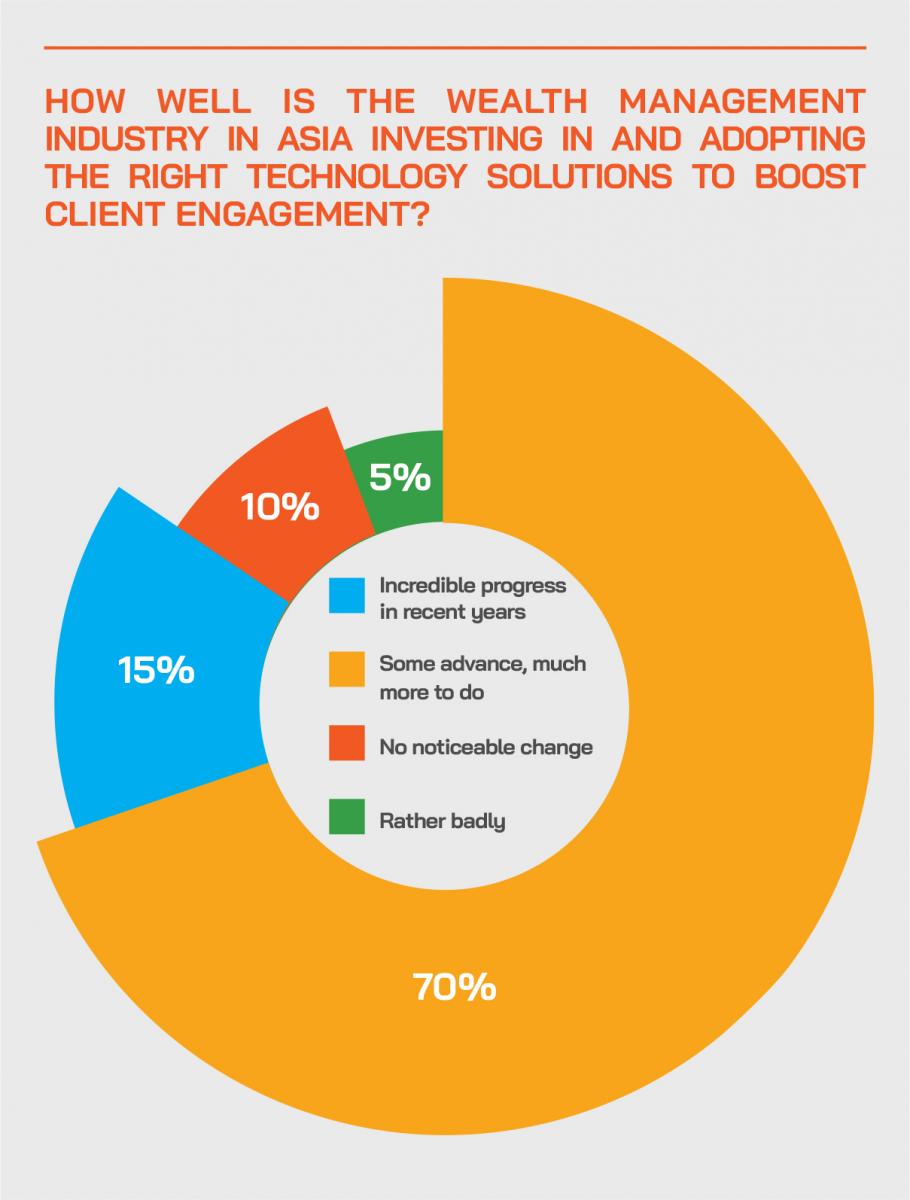

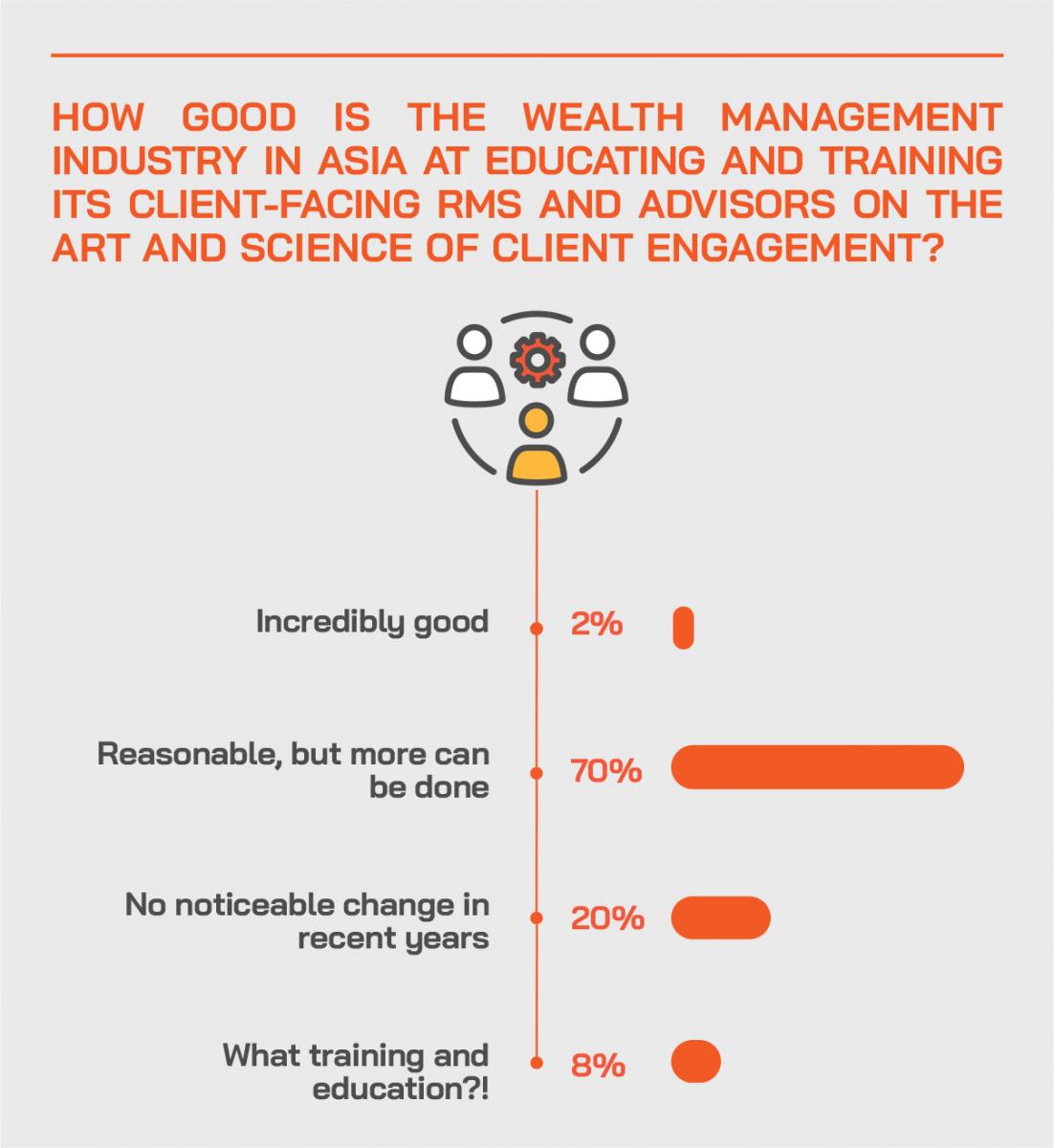

We also asked delegates for their opinions on client engagement, what is needed and what is lacking, and what can be done to improve matters. We have distilled their comments into the briefing below.

What are the key qualities that RMs and advisors in Asia should demonstrate to become trusted advisors to private clients?

- Keeping up to date with knowledge, markets, rapidly accommodating to client's requirements by adopting the right strategy while following guidelines laid by regulators and compliance.

- Listen, learn and fully understand what the client wants, and then follow up diligently.

- Keep close contact with them on a regular basis, send birthday cards and gifts when appropriate.

- Do not be a product pusher.

- Professional knowledge and effort to understand client needs and can come up with solutions in line with clients’ interests.

- Honest and open conversations with clients. Be well informed of financial markets and products. Be aware of ever-changing client needs.

- Empathy.

- Honesty.

- Be proactive.

- Gain and keep trust.

- Be knowledgeable and passionate about the subject.

- Focus intently on solving customer needs.

- Build rapport and trust whilst being professional, knowledgeable and able to communicate advice well.

- Be smart and know your markets and products, so you do not have to pass the clients on all the time to the investment advisors; otherwise, the RMs are no better than advertisers for the products and solutions.

- Be proactive and react rapidly; clients need rapid replies nowadays, much more so than ever before.

- At the very least, the qualities should include ubiquity, promptness, and a basic understanding of the various investment products being introduced and sold.

- A pleasant and professional personality and demeanour.

- Tailored solutions and ideas that are relevant to the clients.

- The key ingredients are privacy and trustworthiness and understanding what the client needs.

- Don’t be driven excessively by commission and incentives.

- Be current on what next wave trends are, be aware of client's concerns and needs. Forward looking, anticipate potential generational changes that affects the client's business and family structure. Don't come across as a product pusher but offer solutions and help position client's strategically in terms of investments, business trends, familial developments that the banker detects.

The need to demonstrate empathy and to be multi-faceted and multi-skilled

RMs and advisors need to focus on the outcomes, and to achieve their goals, they need to be multi-skilled, multi-faceted; they need to demonstrate empathy and reassure and remind the clients that they are on their teams.

To be more connected, be more personal

An expert advised that advisors should aim to really connect to their clients and to be open to engagement at all times that might suit those clients, and also to remember their birthdays, information on their families, perhaps even send them some of their favourite foods, wines or whiskies. An idea can even be to combine virtual events with wine tastings, the wines having already been delivered to the clients in advance, in other words, to make the whole connectivity more personal and more aligned.

Take a holistic approach to the clients

It is not only about selling products to the private clients; the bankers need to look more broadly at their actual and anticipated needs, including their businesses, business succession, legacy planning, estate transition and multi-generational engagement.

Be ready for more personal engagement ahead, but also aware the remote will endure

While the wealth industry will naturally revert to direct personal engagement as a preference for all parties – the personal connection is core to the business – remote working practices might be here for longer than we all expect.

Expert Opinion - David MacDonald, Consultant, Hubbis: “Blanket, generic, non-personal marketing messages are less effective now than ever. In a virtual world especially, we have to be more relevant, more targeted, and absolutely personal in our approach to attracting new clients.”

Be truly professional, the best representation of yourself

In the good old days, private bankers were really just relationship managers, often spending much of their time entertaining clients, but the private banker and RM of today must be so much more informed, so much more on top of products, markets, concepts, they must be armed with a world view and local knowledge, they need to stand on their own feet, not always need to bring in other product experts or investment counsellors. They must be able to discuss ideas, markets, events, products, plans, strategies in depth and with real knowledge.

Don’t keep deferring to other experts; it wastes time and erodes confidence

Clients don't want to hear that the RM needs to consult with all his or her other experts; they want rapid responses and well-informed guidance. They do not want to wait for insights and replies. To be able to be competitive, the private bankers have to arm themselves with a lot of product knowledge, market knowledge, and the RM should be able to deliver that at speed and seamlessly.

Discipline is essential, especially in a remote world

RMs need to be very sensitive to their clients in that sense that they are not just bombarding them from all directions, that they are disciplined, that they can schedule remote engagements, and that we are very concise, well prepared, and that they are focused and relevant.

Spot the opportunities to up the ante, don’t be afraid, if successful, to really build the business

Don’t ask, don’t get. RMs and advisors that are working well and successful with their clients should not be fearful of asking for additional share of wallet, to up the AUM allocated to the bank or wealth firm. But timing is everything, so spot the opportunities to begin those conversations.

Leverage internal resources and open new doors

To help boost the AUM and client satisfaction, it is often helpful for the banker to invite a team head or a business head, or even a senior product person along on a call, or a meeting, as sometimes it might be easier for that senior colleague to ask the clients these questions about expanding the share of wallet. Oftentimes, the client will express support of their banker, perhaps even sing the praises of the banker, and that can open the door to posing these questions about expanding the business relationship.

Seek a balance between being a trusted advisor and fulfilling sales potential

An RM can be both a salesperson and a trusted advisor at the same time, providing he or she truly appreciates the client’s personal situation and needs and expectations, and devises the right concepts and solutions that are genuinely relevant to that client. Those clients are commercially minded, they have owned and operated the businesses that brought them their wealth, they understand and appreciate that they are engaging a bank, a wealth firm and their experts to help them, that there is a two-way flow involved of business and personal engagement, all wrapped up in a trust relationship.

Expert Opinion - David MacDonald, Consultant, Hubbis: “Tens of thousands of years of human evolution, which have led to us developing instincts that help us to recognise when and how we can trust another person, haven’t been eroded over a year of Zoom meetings.”

Only promote what is right, don’t be pressured to ‘push’ unsuitable ideas

There is no mileage in any RM promoting products or solutions that might be a bank’s flavour of the week, or month, unless those are relevant to and suitable for the clients. The more ideas delivered that are wide of the target, the less likely the clients will be to pick up the phone or listen to the next ideas. Relevance and suitability maintain trust and keep the door open to positive client engagement. At all costs, avoid bombarding every client with every idea that comes out.

Know your subject and leverage internal resources

RMs and advisors need to be thoroughly professional, they need to know their products, markets and structures, but they should also leverage internal skills and resources, delivering those expert colleagues to the clients as and when they need to, or at the very least delivering information and relevant insights to help the clients reach certain decisions.

Delivering on DPM and advisory mandates

Client-facing bankers have real value to offer. Their clients have different skills and usually different backgrounds. Even the very top tennis players or golfers have coaches and experts to guide them, and usually a whole team to help them. So too wealthy clients should be encouraged to leverage the professional resources at hand, for example allocating a portion of their AUM to DPM or advisory mandates. They can also self-manage a portion of their investments. RMs should not be afraid of reasoning their clients towards such steps. So many private clients invest with emotion, whereas the DPM approach takes the emotion out of the equation, as it is the asset manager whose job it is to makes the decisions.

DPM does not mean exclusion

An expert highlighted how DPM mandates offer clients a far more involved role than might be imagined, as the objectives and parameters of the portfolio are set in advance, the clients will have regular updates with the asset managers, and adjustments to strategies and allocations can be made as time moves on. In short, the clients are not relinquishing complete control; they are passing responsibility to professionals with whom they will maintain an ongoing relationship and regular communication.

Expert Opinion - David MacDonald, Consultant, Hubbis: “The pitching of products and services was somewhat tired and ineffective before the pandemic. The need to dig deep into our reserves of behaviour aimed at building relationships of trust has been amplified by virtue of our now virtual connectivity with our clients.”

300 billion emails and counting!

A speaker highlighted some recent research that indicates there are more than 300 billion emails circulating the globe daily, aside from all the chat app and other messages, and wondered how then bankers can catch the attention of clients with so much ‘noise’ around. He said it is a real challenge to keep the attention of existing clients, let alone capture new clients, especially in a virtual world of work connectivity. He advised having a tacit agreement with clients to informally arrange the best types of regular contact times and schedules so that the clients are not surprised all the time or that they do not feel inundated. All too often, these arrangements are too ad hoc, too unstructured, too reactive.

Measuring success in referrals

A banker explained that the results can often show through in referrals and introductions from the clients to their friends, families and acquaintances and that the job of convincing those new contacts to come on board as clients is already more than half achieved in the process.

Knowing your client’s connections and taking the right opportunities

Another expert said he likes the word introductions rather than referrals. He said a smart banker would actually plan for introductions, even estimate or target how many such introductions he or she might achieve in a year or perhaps quarterly. He said they should understand who their clients connect to on a family level, friends, acquaintances, and so forth, and not be afraid of finding the right time and place to ask the clients for introductions or to gently prompt them to think about such. One introduction at a time is plenty, he advised, and said that if half of the clients introduce one such individual each year, that should make a significant contribution to building the RM’s book of clients.

Successful relationships with successful clients lead to successful introductions

The same expert advised an approach such as ‘If there is one person in your current personal or professional network, whom you know, and who is not receiving the kind of advice and input that you seem to value from our conversation today, who might that person be?’ And then be ready to follow that up with further questions as to how you could possibly then make contact with that individual jointly or individually. He said that these private clients are successful in business and life; they understand the value of relationships and connections, they appreciate good advice and judgement, so don’t be afraid to ask the question. But he also advised not to push too hard.

Education, organisation and opportunity

Another key comment came from an expert who observed that the banks and other organisations must work harder on the education of their key team members to ensure they are armed with the optimal technologies, the optimal approaches and the best knowledge. Meanwhile, the bankers and RMs must ensure they are highly aware of products, markets, trends, ideas, and must be highly organised, to make sure they capture the great opportunities out there. He concluded that when there is a crisis, as there has been, clients will turn to those who serve them best and are most caring and responsive to their needs.

Listen, listen, listen

The final comment was that many clients will have had difficulties in their lives or their financial world during the pandemic and that the bankers must listen and listen some more because the crisis will often have changed mindsets, changed family situations, changed businesses and colleagues and outlooks. He, therefore, advised listening carefully, probing with intelligent, sensitive questions. And making sure the clients are aware that the bankers and RMs are making a major effort to truly appreciate them and understand their situations. He advised working closely and in positive collaboration with the clients, with colleagues, with external partners, in order to deliver the best and most suitable outcomes. If they achieve those goals, they will have built and retained the trust, and that means they will have those clients for the future, through difficult times and hopefully the better times ahead.