Publications & Thought Leadership

Expanding Allocation to Private Assets. Why? How? And What’s Next

Apr 29, 2022

There is a seismic global shift towards private markets amongst leading investment institutions – from sovereigns to pension funds - and also increasingly in the private wealth sector. More and more private clients in Asia have been gradually diversifying their portfolios by including longer-term private asset investment strategies of all types, from plain vanilla early and later-stage private equity, to private debt of all types, private commercial real estate deals, hedge fund strategies, and so forth. These assets can offer investors strong long-term performance potential, while their historical downside resilience and lower volatility compared to public market securities also help make this asset class attractive for portfolio diversification and, to some extent, for peace of mind. But Asian private clients remain under-allocated to private markets, opening up a world of potential for them and for the advisory community.

The Panel:

- Gary Leung, Head of Managed Investments and Private Equity, Hong Kong, Bank of Singapore

- Maximilian Hoenigsmann, Managing Partner, Corecam Capital Partners

- Frank Yu, Managing Director, Head of Securities, Hywin International

- Harmen Overdijk, Chief Investment Officer, Leo Wealth

- Kevin Moss, President & Portfolio Manager, Liberty Street Advisors

- Conor Smyth, Founder & CEO, TritonLake

For our Digital Dialogue of April 7, Hubbis assembled a top-flight panel of experts to look in-depth at the evolution of the private markets, looking from a 360-degree perspective at the pluses and minuses and analysing where the market is heading and how the Asian wealth management community is positioning itself for what will surely be the ongoing and rapid expansion of these markets in the years ahead.

Setting the Scene

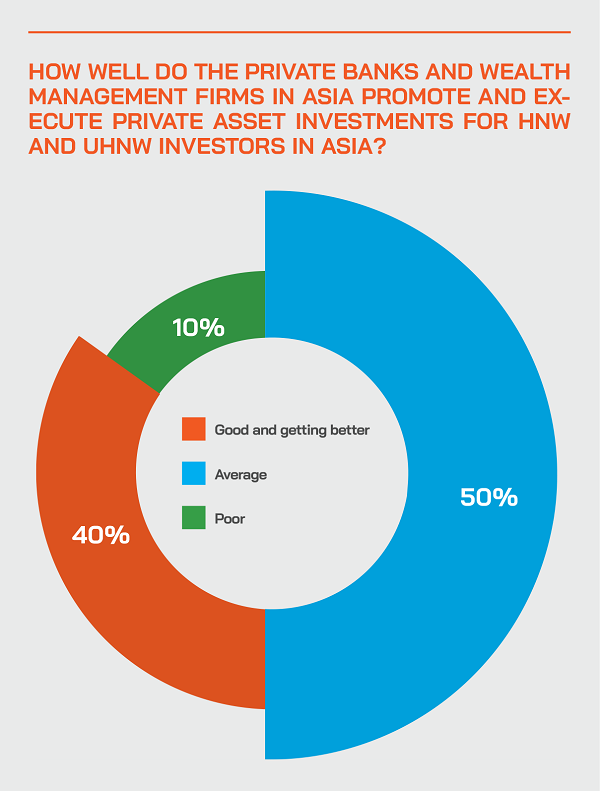

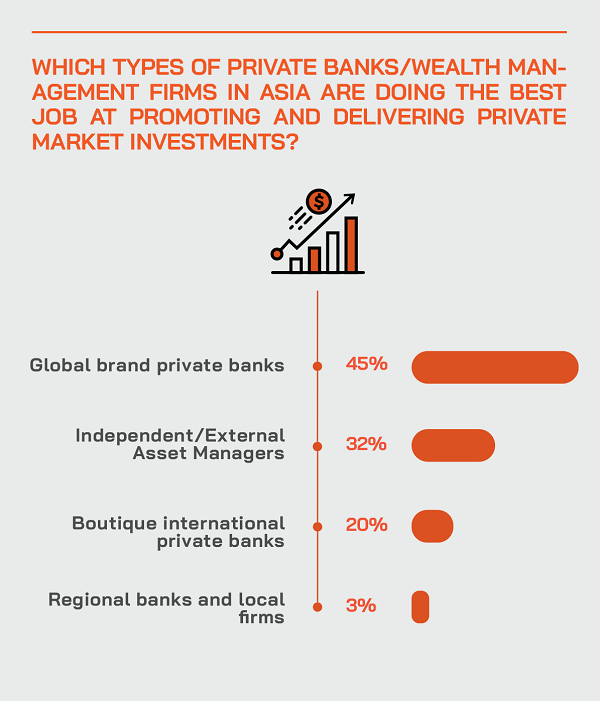

The Asian HNW and UHNW clients that are taking up more of such opportunities need a highly professional point of access via private banks, the independent wealth community and other key specialists. They need experts who can filter, package, promote and then monitor these investments, thereby opening the door to what are considerably more complex and longer-term holdings. For the wealth management community investing in building and delivering this expertise, the carrot is significantly higher fees than in the public markets.

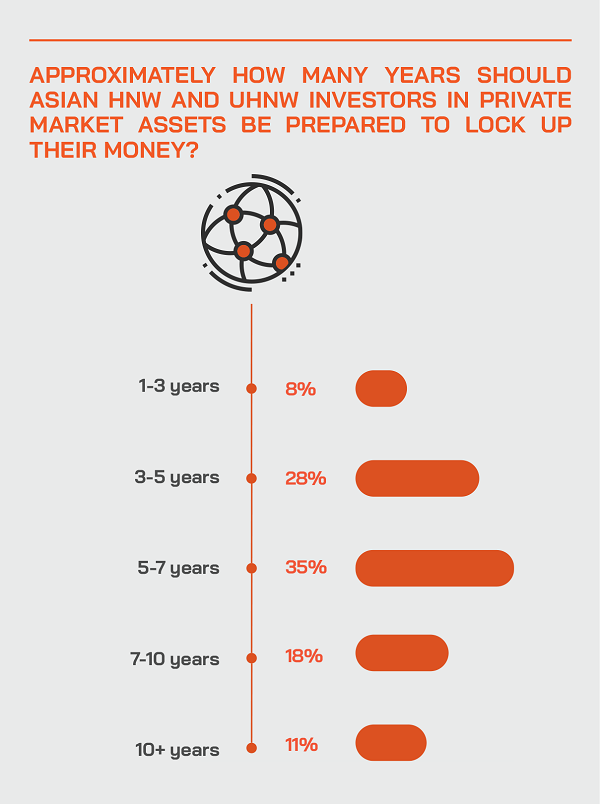

Diversification to private assets offers investors the chance to get into longer-term income and capital gain opportunities, albeit requiring a considerably longer time horizon due to the minimal liquidity available, although more and more deals are being structured to offer some modest liquidity throughout the general 3-10 year holding periods. Naturally, due to the lower liquidity and longer holding times required, these deals more suit the upper HNW and UHNW segments, although access to private markets is also being democratised by slicing and dicing, sometimes even for mass affluent investors via digital assets/tokenisation.

Our panel of experts, all highly experienced in either curating or managing private asset investments, offered the benefit of their perspectives to our virtual delegates. We have summarised some of their insights below.

The Experts’ Key Observations & Insights

Asian investors are in general under-invested in alternatives, hence there is great opportunity ahead for the advisory community and the clients

A guest reported that Asian clients are generally quite under-allocated to alternatives, presenting great upside potential for him and his team. “And as private assets increasingly feature some degree of liquidity, and as public markets are more volatile and as geopolitics remain troubled, we are at a prime time for investors to be allocating to private markets.”

He explained that the private wealth market is far from homogeneous, ranging from UHNW clients, perhaps with family offices, to the middle tier HNW client market with perhaps USD5 million or more to invest, and then there is the mass affluent market with investible funds of perhaps up to USD5 million. “We target all these segments, but of course it is vital to address them correctly,” he told delegates. “In the UHNW segment, they have an immense array of choices of all the big-name brands and players, so we need to offer them something that is more of a bespoke, direct investment or a specialist product that will really add value for them. In the HNW space in Asia, the clients value manager brand names and track records and are seeking diversification from public market assets and their associated volatility.”

Another guest agreed, observing that private markets are obviously not exposed to the price shifts and volatility of the public arena. As they also offer an interesting risk and reward profile, as well as significant diversification for private client portfolios, there are many reasons for the wealth community to promote deals to their clients.

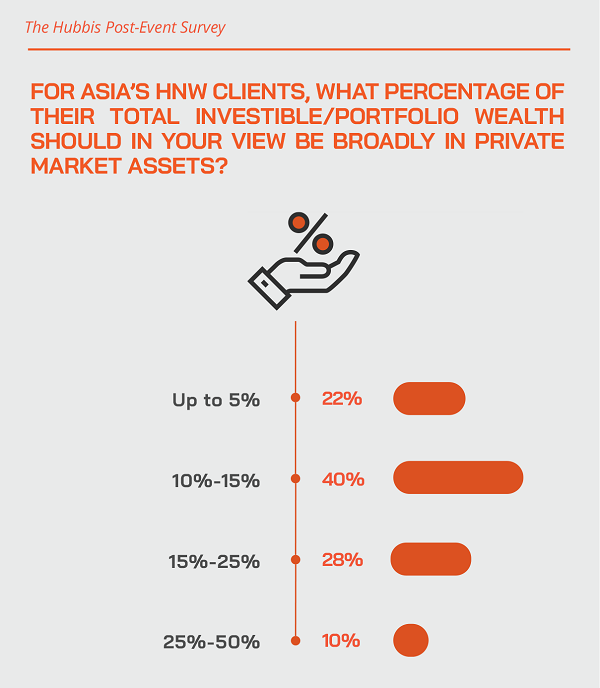

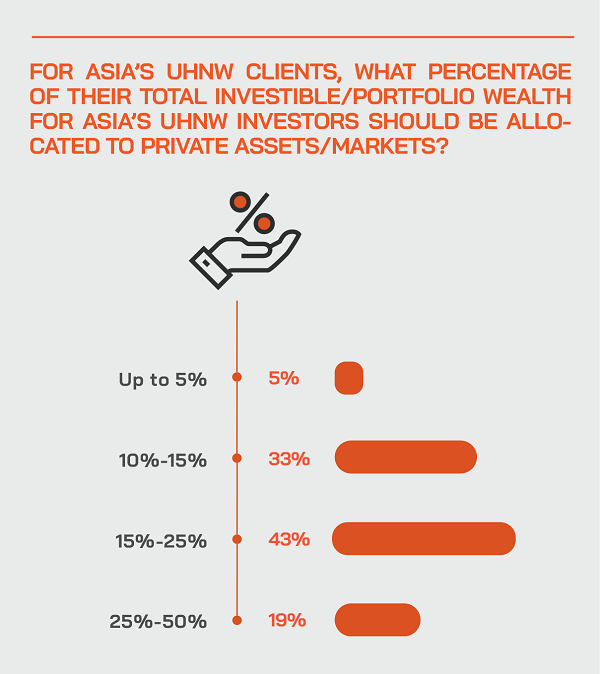

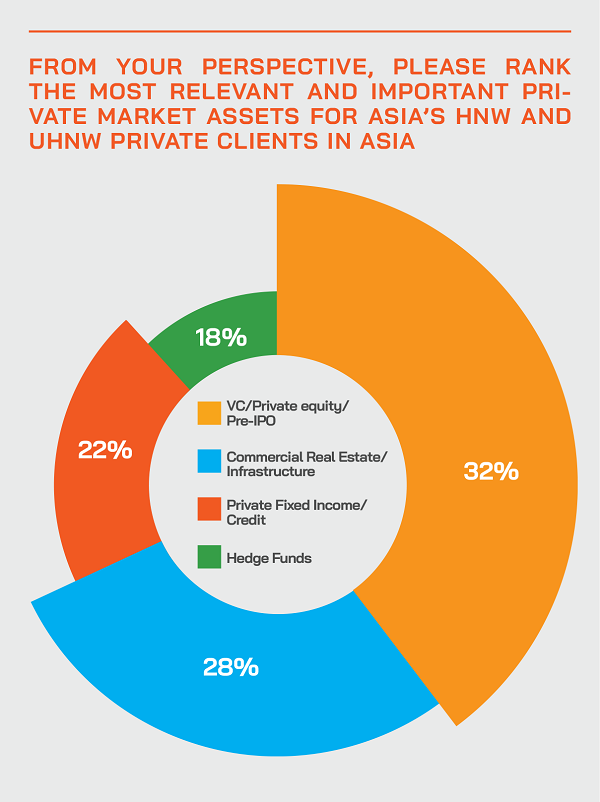

The Hubbis Post-Event Survey

We asked delegates to offer their own insights into private equity investing. We have summarised the many views we received in this short synopsis:

Hubbis: In your view, what has been driving the growing global demand for private market investments, and will the demand continue/grow?

- Diversification, search for income, return expectations and public market volatility. There is long term growth potential in Asia.

- The high-net-worth clients are looking for capital preservation and leaving their legacy to future generations. This demand will continue, and there are many great growth opportunities ahead.

- Access to cheap capital, and yes, the demand will continue grow.

- Clients demand more bespoke investment ideas instead of the usual, plainer vanilla investment ideas pedalled by most private banks.

- Alternative investments with potential greater gains.

- More growth is taking place in private companies that are staying private much longer before they go public

- Public market volatility, rising rates.

- The driving force in the private market space in recent years is that private market investments offer a variety of assets selected for investors to allow them sectoral diversification and a shift away from the public market.

- The demand will continue to grow in particular when the public markets are facing geopolitical risk, inflation risk, and rising interest rates, which all tend to drag down prices.

- The diminishing appeal of investment options in the publicly traded markets where equity market valuations are really stretched and where publicly traded debt has been prone to defaults (at least in Asia) while investment-grade fixed income hardly offers any spreads.

- Private markets seem more appealing, although there might be a false sense of security that private fund managers know what they are doing and will be in a better position to manage the risks.

- Seeking long term returns to avoid short term volatility; greater awareness of the asset class; and more brand names staying private and only accessible via private markets.

- Private market investments have continued to proliferate as companies are staying private longer, and in the debt arena, tradable fixed income isn't yielding the same returns as it used to. The demand will continue to grow as long as there is an abundance of liquidity in the private markets.

Companies stay private longer, so more value creation is taking place away from the public markets arena, but some investors want some liquidity and yield due to long holding periods

An expert told delegates how a lot more value is derived from the private market these days, as companies tend to stay private for longer, with many unicorns not going public until they reach many billions in valuation. “That means to some extent returns that are less correlated to the public markets and that are less susceptible to market volatility,” he said.

Another guest confirmed this view. “Apple went public after they were five years old, and they had to do so because they had to continue to raise capital to finance their growth,” he explained. “Today, companies stay private for many more years and can access private capital for further growth while still unlisted. So private investors have access to that growth phase that used to be in the public domain. Many of our typical investors are those who in the past might have faced headwinds getting access to traditional PE or traditional real assets, so they have come to us as we offer new and innovative ways of getting exposure to these asset classes and as we offer some liquidity features. Now, they can enjoy much more robust growth through these investments, as some of the most dynamic value creation remains in the private markets space rather than in the public markets.”

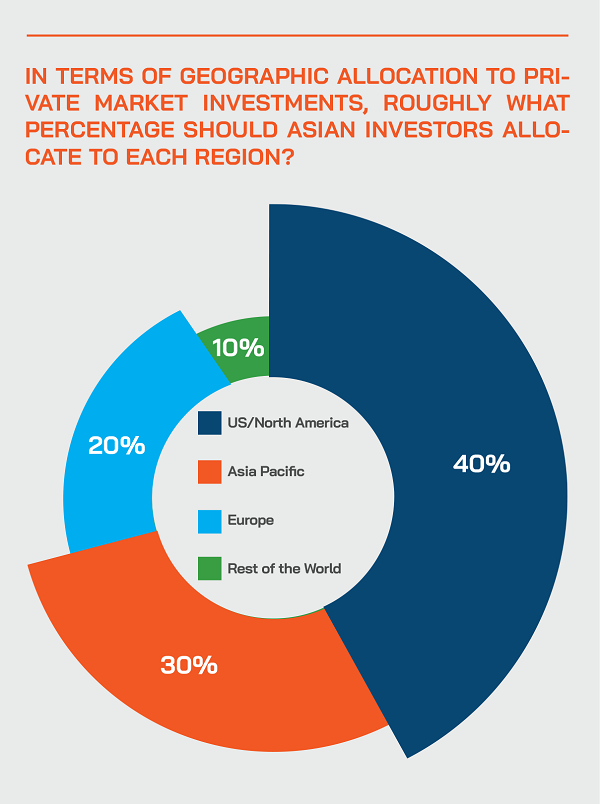

Another banker reported that Asian investors, who are historically very invested in hard assets in their countries, possibly in the region, are increasingly interested in exposures to markets they are less familiar with, such as the US or Europe, so if we bring them the right deals with the right managers, they are very interested.

He said Asian buyers are seeking more exposure to real assets, and they seek some liquidity, even in their allocations to private assets. “These segments, especially the mass affluent investors, need more liquidity than the UHNW market, so we need to bring them the right sort of products that address their needs and personal situations,” he explained.

And he added that investors are also seeking income as well as long-term gains; hence his team concentrate also on opportunities that offer some running yield during the relatively lengthy holding periods required for private assets. “Core real estate and infrastructure are interesting as you have running yields through rents and other income, while at the same time inflation, are driving asset prices higher,” he explained. “In short, there are some really compelling reasons for investors to shift allocations to private markets and, armed with the right opportunities that we help curate from around the world, our clients are seeing the benefits of this trend and already reaping some of the rewards. And there is plenty more to come.”

Expert Opinion - Conor Smyth, CEO & Founder, TritonLake: “One of the challenges the wealth management community faces is the sheer volume of opportunities that is available in private markets today – TritonLake is a marketplace that leverages behavioural science in order to intelligently help sophisticated investors to cut through the noise, and efficiently get to differentiated and relevant opportunities.”

A fellow panellist concurred, adding that his firm manages a fund in the US and had also recently partnered with a European fund manager to run a new and similar strategy. “We focus primarily on late-stage venture capital,” he reported. “When we set out to access this asset class back in 2012, we immediately noticed a real trend of companies staying private much longer. There is a real shift of capital taking place between public markets and private markets, so actually the public markets are shrinking while the private markets are expanding. That means there is an enormous amount of capital being raised in the private markets.”

He also agreed that private clients would so often want at least some liquidity. “From the outset, we have been trying to really evolve the private equity offering, offering innovation so that investors can really access this in an appealing and new way. Some of the things that we tried to do were changed the fee structure. We wanted to get rid of the performance fee, and just charge a management fee. We added a liquidity feature, which in the world of private equity with funds locking up capital for up to 10 years, sometimes longer, was important to our clients for flexibility and rebalancing. And all this was to offer access to as many investors as possible, so they can participate in the growth taking place in the private market. We now have our eyes firmly on the Asia private client market, where there is growing demand and where we want to build our activity.”

The Hubbis Post-Event Survey

We asked delegates to offer their own insights into private equity investing. We have summarised the many views we received in this short synopsis:

Hubbis: What key skills and qualities are investors in Asia seeking from the banks/firms they will work with for private market investments?

- Access and understanding ahead of the crowd.

- Solid track records.

- In-depth company analysis and ongoing monitoring.

- Risk-takers with proactive knowledge of economic & industry development.

- Ability to identify good investments as there is less research available.

- Good deal sourcing and execution.

- Product and market knowledge.

- Asian investors are looking for brand-name and track record from the banks/firms when considering private market investments, as the private market investment is less transparency. Asian investors will then rely on the banks/firms to select the right product for them.

- Clients in the region are generally looking for quick turnaround in investments. The time horizon is down from 7 years to around 3 years. Clients in Asia have no patience for European style funds as they do not have long term views. That is the reason for emergence of club deals and secondary investment funds.

- The inherent lack of skills in private banks in evaluating such investments and sometimes the lack of access to proper data rooms limits the quality of advice, so the key is for clients to work with external experts who really understand the space.

- The key is good connections with the best managers and experts and a deep ecosystem of expertise.

- You need to work with the banks that work with top tier private market managers and deal sourcing firms.

- Reputable bankers with good networks can assess and examine the validity and viability of each individual private market investment so that investor can be confident.

- They need to show transparency, education, analysis, good judgement, objectivity, technology and liquidity.

Asian private clients are very often pre-disposed to private equity and backing founders and management teams

A panellist explained that typical Asian private clients have often founded and listed or sold or retained their own businesses and have a natural affinity to invest in private. “And what we've seen in the last two years especially is a huge increase in interest in private credit, which makes a lot of sense to us, as you can gain access to credit risk without much duration risk,” he told delegates. “And we have seen increasing appetite for other parts of private markets such as real estate, which remains a coveted asset for many clients and especially in the inflationary environment.”

Another expert agreed, stating that many of their typical private client investors have considerable personal experience as entrepreneurs themselves who have had exits and transactions and who can easily understand the premise of a private equity strategy. “If you bring them a black box hedge fund idea, they’re really seldom interested in even trying to understand it,” he reported. “So, we are offering them something they understand and really want, and we help cut through the noise out there to really offer them opportunities that add value and that they can relate to.”

The Hubbis Post-Event Survey

We asked delegates to offer their own insights into private equity investing. We have summarised the many views we received in this short synopsis:

Hubbis: In the private equity market – spanning from VC to pre-IPO funding, what are the key criteria investors need to consider before they invest?

- The true risk profile of the company, the management and the business sector.

- The business sector and outlook.

- Local and international factors.

- The exit strategy.

- Management team and capability.

- Liquidity, as they might need to release some funds during the lifetime of the deals, unless, for example, they are UHNW investors who need not even look until the exits.

- Possibility of future capital calls to fuel future growth.

- Patience.

- Robust oversight and top-quality reporting.

- Running yield if these businesses generate surplus cash.

- Relative valuations at entry and projected exit valuations.

- Geopolitical risks.

- Investment allocation relative to the client’s overall portfolio – do not put too many eggs in any one basket.

- The ‘real’ investment time horizons.

Careful curation of deals is essential, and transparency about both due diligence and outlook are vital

A panel member observed that there are many ways to access different private assets, but the key challenge is to select the right opportunities and make the right assessments based on different information than is available in the public sphere. “Some private assets offer considerably less transparency as well as less information per se, so the analysis and selection of the right deals is critical,” he said. “While we see there is considerable room for additional private assets in almost every client's portfolio, where suitable, especially in specific areas, the challenge for us, for other intermediaries and for the clients is to determine which types of products to select and then which opportunities to invest in.”

He acknowledged that no private bank or wealth firm can cover all the bases, so they must devise a menu consisting of what they can really serve up professionally. “Selection of these deals involves a lot of due diligence,” he said, “and we cannot cover every possibility, so for us, we focus on what we believe is of most of interest to our clients and try to find the best solutions within those areas. It is hard enough in the well-researched public markets, but in the private arena it is even more challenging.”

Expert Opinion - Conor Smyth, CEO & Founder, TritonLake: “There is investor interest across private markets – but in particular now in later-stage growth equity and small market buyout – especially where there is a sector focus and operational aspect. We continue to see a growing appetite for impact and climate strategies – as long as the returns are also attractive.”

Chinese investors are shifting attention to private assets, but they remain significantly under-allocated

A guest reported that they had conducted a study targeting China Mainland private clients, finding that investors from Mainland China and Hong Kong have a significant and increasing interest in private markets. He explained that more companies are staying private in the pre-IPO stages far, far longer, citing an average of 4.5 years two decades ago to up to 10-20 years today. “With so much value creation remaining in the private space, it is natural to want to grow exposures in this phase,” he reported.

Nevertheless, he conceded that the allocation by Chinese clients to private assets remains modest at 10% or less of their portfolios. “My clients are ready to put considerably more into this space, and some indicate up to 30% or even more in the future,” he reported. “They are targeting private equity from the VC stage onwards, as well as real estate.”

Plentiful opportunity in the real estate space and affordable housing

A guest highlighted some of the types of opportunities his firm offers clients in the real estate space, including asset-backed lending, with gaps opening up all the time where the regulators are pushing the banks out of that lending market. He also pointed to the growth in the US affordable housing sector. He added that in some of the deals, liquidity is a risk, but the underlying asset can still be high quality and actually decrease overall risk exposure and still offer good yields, as other investors are not so keen on taking this type of exposure. Nevertheless, he observed that in Asia, there is a gradual shift in understanding, with more private clients acknowledging that yields on typical tradable fixed income and debt might be more tempered than in the recent years.

Sometimes the best (private asset) offerings come in smaller packages

A guest observed that as an intermediary focusing solely on curating private deals, his firm tends to work mostly with funds that are at the relatively lower end of the fund-raising drive. “We do not focus much on the huge funds run by the global brand names, but more the sort of USD500 million funds, which then tend to focus more on key industry and business sectors that they have particular expertise to bring to bear. There's often an operational aspect as well, where they can come in, and they can help some of these companies.”

This, he elucidated, means that the firm is curating somewhat less competitive and potentially somewhat more complex situations and offering investors lower valuation entry points than generally available in the larger situations.

“The overall scenarios result in less demanding valuations that then, in turn, make it easier for the companies to deliver on their forecast returns without having to perform heroics,” he explained. “In baseball terms, they are not pressured to knock the ball out of the park to achieve their base level numbers. They can prove themselves and perform over time and with stability.”

He said that as they are generally fishing in a smaller pool in a less competitive environment, the valuations are not driven to excess by the big-name sponsors. “It is easier then to deliver believable forecasts that can be achieved,” he said. “Investors who go into the deals clearly have to sacrifice liquidity, but they are entering more realistic situations and have a much better likelihood of achieving their target returns.”

Expert Opinion - Conor Smyth, CEO & Founder, TritonLake: “In terms of ESG, sustainability, and indeed diversity and inclusion – we continue to see an increase in the appetite for strategies incorporating these elements. ESG is almost table stakes from a corporate perspective, and more and more investment mandates now incorporate a diversity and inclusion element.”

Timing is everything, but only by pure chance can you get it exactly right, so think long-term and invest with your eyes open; and as these are private markets, you are somewhat sheltered from public market anxieties

“There is never an ideal time to invest in these private assets,” a guest stated. “But from our viewpoint, investors should always be making a consistent allocation to private assets. To time these things is extremely difficult, for example nobody could have foreseen a pandemic, no one can predict the timing or arrival of geopolitical events or other crises. Nobody would have known coming into this year that the tech-heavy markets would have been down 15% to 20% or you would have seen the type of rotation going on in the high growth companies. But allocation to private assets can, at least in part, shield your capital from a number of these exposures and protect from the worst volatility.”

He explained that in periods of uncertainty, when you see significant drawdowns in public markets, and you have market trading, short selling, analysts producing research, and all these forces can drive prices one way or another, so these are all forces well beyond a private investor’s control.

“The stability of holding private assets to some extent insulates you from the concerns of the often-worrisome day-to-day movements you see in public securities,” he said. “Many of our investors really like that lack of correlation to public markets, and the stability that they find when they're holding these types of assets.

Having said all that, he acknowledged that in periods of real financial distress there are perhaps opportunities related to price dislocations, which if one has a capital to deploy, can be beneficial.

“For example,” he said, “there are some companies that we looked at last year that we really liked but we could not get our arms around their valuations, but today, six months later, the world has changed, prices have weakened, and we are deploying capital more actively for those opportunities,” he reported. “In short, it's a very interesting time right now. What this should also mean is that private assets will further outperform over time.”

The Final Word – A World of Opportunity

There is no doubt whatsoever that Asian private clients will be presented with more and more opportunities to invest in private assets of all types in the years ahead. The wealth management advisory players have both a great growth market ahead and also a huge opportunity to differentiate themselves by providing clients the best offerings and the right advice. This is not a segment in which to jump in at the deep end; investors need to realise that these are long-term and significant commitments and that, although isolated from public market volatility, there are, of course, many risks involved.

Looking historically, the right deals over the years prove that the returns can far outweigh the risks, but only for the better-quality deals. With the stock of listed companies shrinking in the most developed markets – the US in particular – acquiring expertise in private assets is more than a diversification luxury and instead is becoming an allocation imperative.