Digital Assets and Tokenisation – Educating & Working with Asia’s Private Clients

Sep 19, 2022

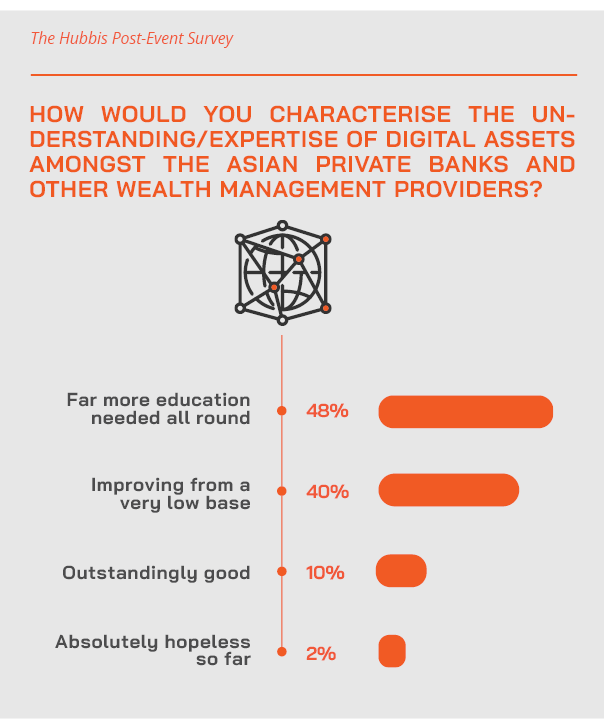

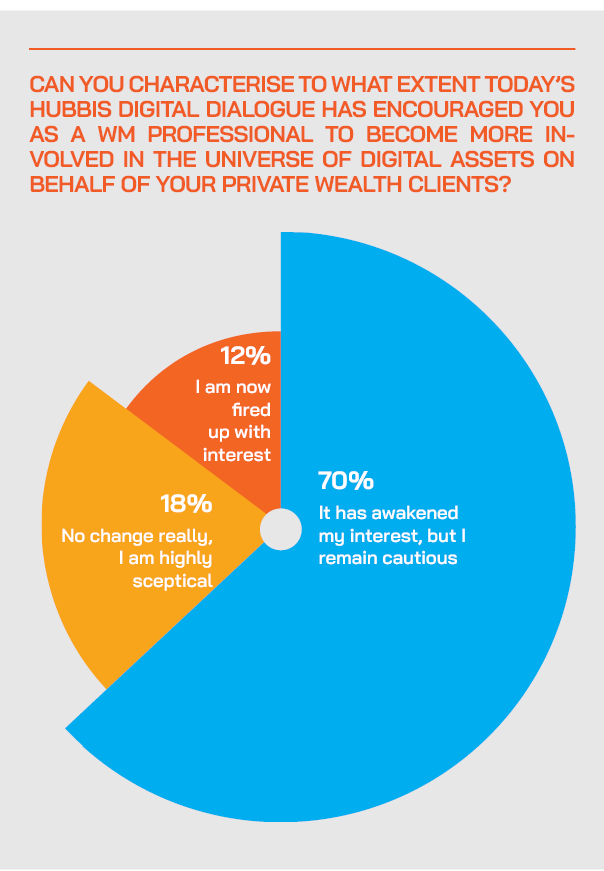

There are still plenty of sceptics amongst the private banks and EAMs, but for what is perhaps the majority today, digital assets are part of our collective futures. These banks and firms increasingly consider that their private clients should not only understand more about digital assets, but they should to some extent at least actively participate by building some exposures in order to understand more about buying, storing, custody, and, of course, the vicissitudes of market pricing and volatility. Why? Because there is more than a sporting chance that the future is populated by more and more digital assets. On September 8, Hubbis hosted a Digital Dialogue event looking at the evolution of cryptocurrencies and digital assets/tokenisation, and in particular analysing how the wealth management community can help educate their advisors and their private clients on this evolving market, and then help deliver the right types of products and execution. The event focused on exactly what types of conversations the growing band of proponents of digital assets could have with the growing ranks of investors who are interested in such investments, whether dabbling their toes in the water or taking a bigger plunge. The experts on the panel reviewed how the growing army of specialists can help the wealth industry to enhance their own understanding of such assets and to convey how the digital asset industry is rapidly moving mainstream, with specialist trading, execution and digital asset custody firms rising up. As this new and incredibly dynamic sector of the global financial markets is also becoming more recognised and regulated by leading authorities in many key jurisdictions, the industry needs to acquire an ever more visible air of professionalism, authority, and legitimacy.

The Panel:

- Henrik Andersson, Chief Investment Officer and Co-Founder, Apollo Capital

- Nirbhay Handa, Group Head of Business Development, Henley & Partners

- Frank Yu, Head of Private Markets, Hywin International

- Changwhan Yea, Co-founder & CEO, Kasa Corp

- Harmen Overdijk, Chief Investment Officer, Leo Wealth

These are some of the questions the panel addressed:

- Why should Asia’s private clients even be considering investment in digital assets?

- Should Asia’s private banks and EAMs be promoting digital assets to their wealthier clients?

- How do banks and other intermediaries help educate investors on cryptocurrencies and on tokenisation and what will this achieve?

- What assets can be tokenised and what does this mean to investors?

- How are these developments being empowered by the blockchain and why is the blockchain considered such a core element of the future of financial transactions of all types?

- How are digital asset brokerages evolving, and are they being properly regulated, are they secure, and are they achieving the growth they expected?

- How do you safely and efficiently buy and then organise custody digital assets?

- What is coming up next for digitised assets?

In 2022, the world of digital assets has collided with and collapsed alongside the world of mainstream assets, but for many advocates, the game is far from over…

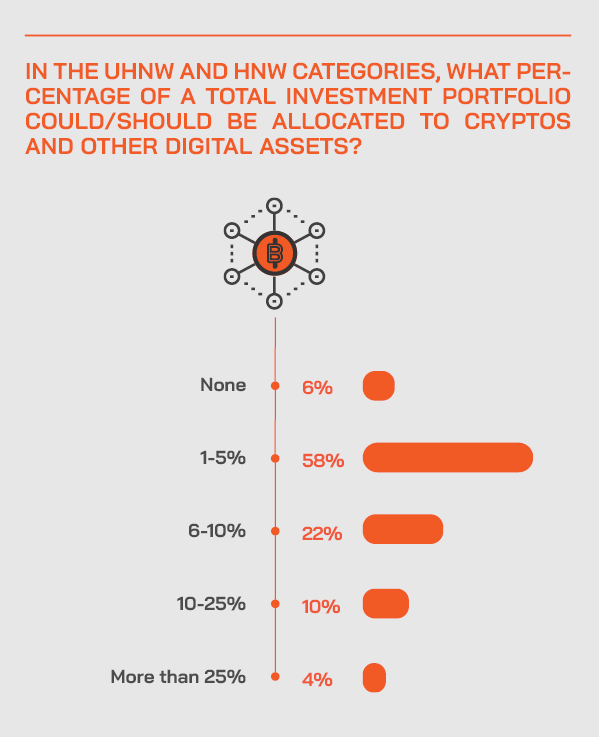

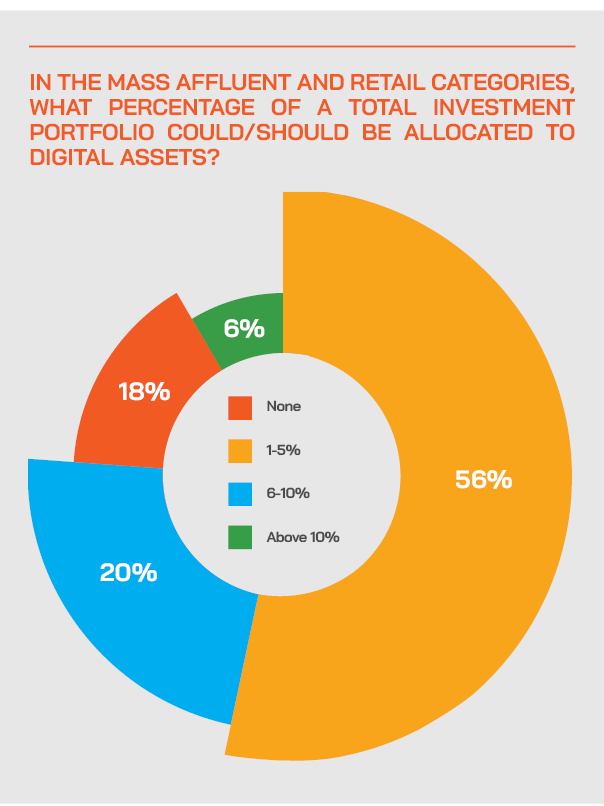

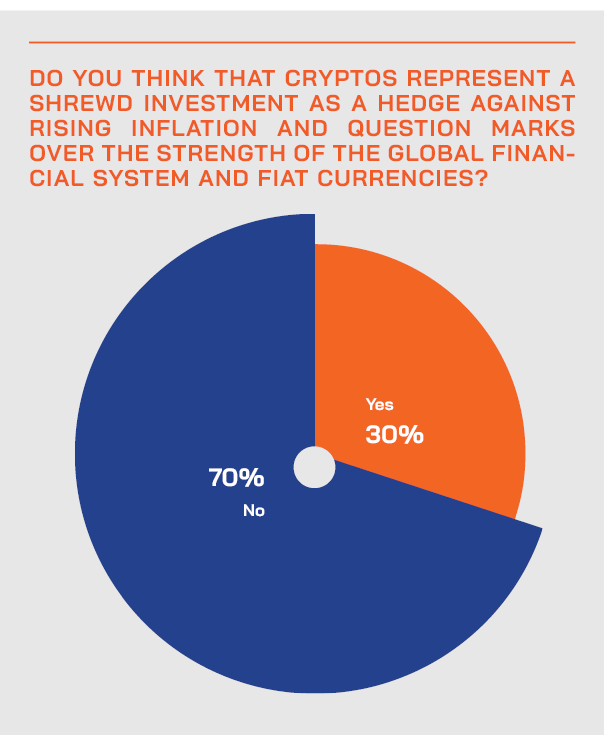

Disconnected from the real world? An ideal non-correlated diversification that is immune from the same pressures as in mainstream markets? Not so, as proven by the collapse in cryptos prices this year. “We have seen that cryptocurrencies are not escaping the sort of the macro factors that are affecting other asset classes like equities, fixed income and commodities,” said one banker. “However, we believe that it is an investment category, and it is big enough not to ignore and that investors should have at least a small portion of their portfolio allocated to digital assets.”

He added that his firm was never a believer that digital assets are independent of mainstream markets. “We see that people still run back to the US Dollar, and we believe that will be the case for many, years and decades to come. And yes, cryptocurrency sold off 60% to 70% since April, but so too have certain growth stocks. And that is how we sort of view it, as somewhat of a hybrid between commodities and high growth technology. Is this the end of digital assets? No, it isn't. We don't think this materially changes anything. We still advise clients to allocate for the long term. Look for example at active managers that are able to develop a proper investment strategy can actually profit from a market that is still pretty inefficient and highly volatile.”

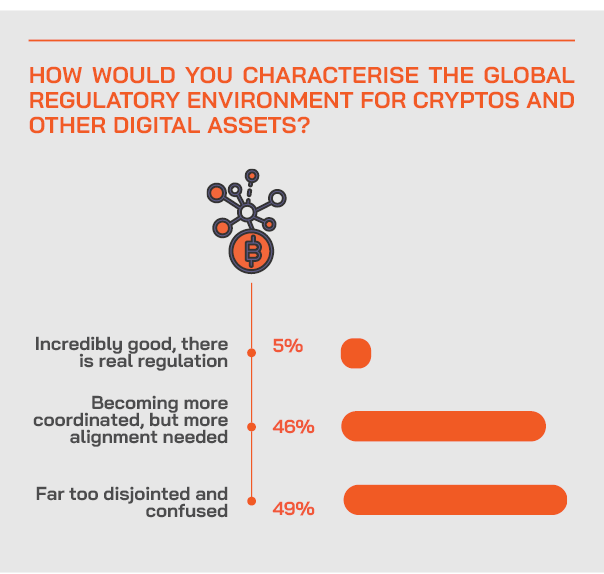

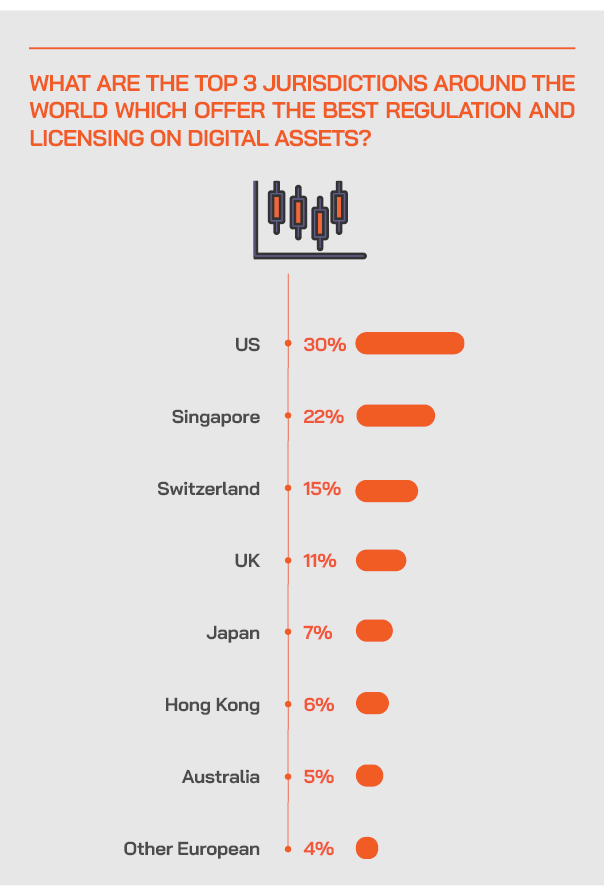

He added that regulation still needs to improve significantly, but that some of the right steps are being taken, for example in Singapore, where the regulators have tightened their prescriptions and oversight this year.

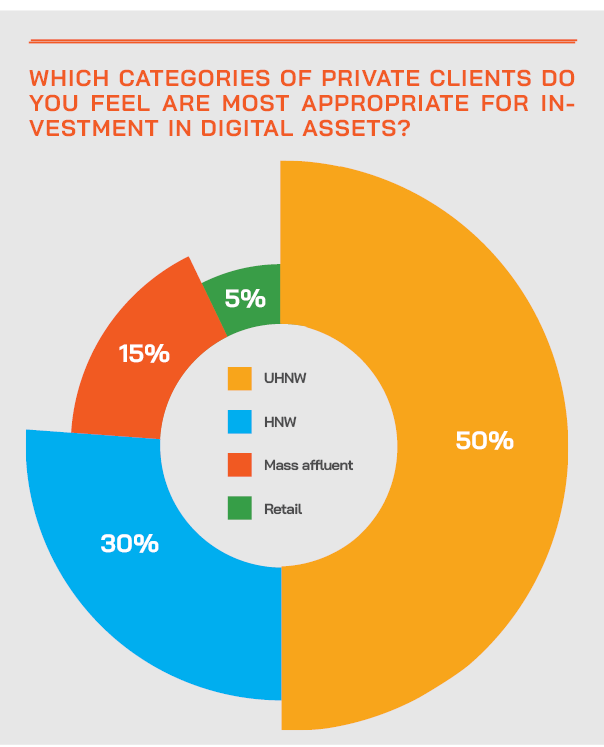

For the moment, he said it is a question of dipping toes into the waters. “We talk to clients about a mere 0.5% to maximum 1% of their portfolios, it's really just to have a foothold or dip their toes in the water and watch the developments and of the blockchain technology. Like the tech sector back at the turn of 2000, we cannot be sure which cryptos or other digital assets will survive. Will it be Bitcoin, or Ethereum, or others? Which one will be the next Amazon or Apple?”

However, some argue that it is too early to be advising private wealth to buy into an untried market with no valuation parameters, although even the sceptics often keep a close eye on developments

Another guest said they remain inactive and do not yet advise their clients to buy into these instruments, albeit they are keeping a close watch on developments and especially Non-fungible Tokens (NFTs) representing perhaps underlying real assets such as property or art or other collectables.

“We have seen traditional giants such as Coca-Cola or LV entering this field, and names such as Stephen Curry, and we remain interested and we are getting closer to participating and advising our clients on these ideas,” he said, adding that compliance risks are the biggest concern. “We think that actually as regulation tightens, [cryptos] prices will drop, so we want to old off for the time being.”

Active digital asset management is, for some, the only realistic way forward for average investors

There are some individuals and operators who are genuine experts in digital assets, but the average private investors cannot possibly comprehend what is going on and ow and when to participate, and in what digital assets. Hence, one expert on the panel argued that assertive management is the right choice for investors. “There are all kinds of issues around accounting, around security, not the least picking the assets because there are tens of thousands of digital assets out there today,” he explained. As active managers, we can keep track with the developments, we run long strategies and we have market neutral strategies as well, and we are investing across the space from early stage investing, what some people call liquid VC.”

He explained that his firm has a very clear investment thesis around the use cases for crypto. E said Bitcoin, still the biggest asset in this space, is becoming like digital gold. Meanwhile he said the decentralised financial (DeFi) market is creating a new financial infrastructure that is both fairer and transparent than the traditional financial system. “We have done very well from being an early investor in that space, and we continue to be very active in that space,” he reported.

And NFTs have broken through, with brands such as Tiffany & Co entering the fray, and Ticketmaster announcing very recently that they will sell tickets as NFTs on the blockchain, joining FIFA, which also recently announced the launch of their NFT platform. “We are seeing this huge consumer adoption of the NFT space.” He added that they are active in all these areas, with their funds structured in Australia as unit trusts and also accessible through our offshore vehicles in the BVI and in Cayman.

If you want to participate in the digital assets universe, what skills and attributes should intermediaries or investors be looking for?

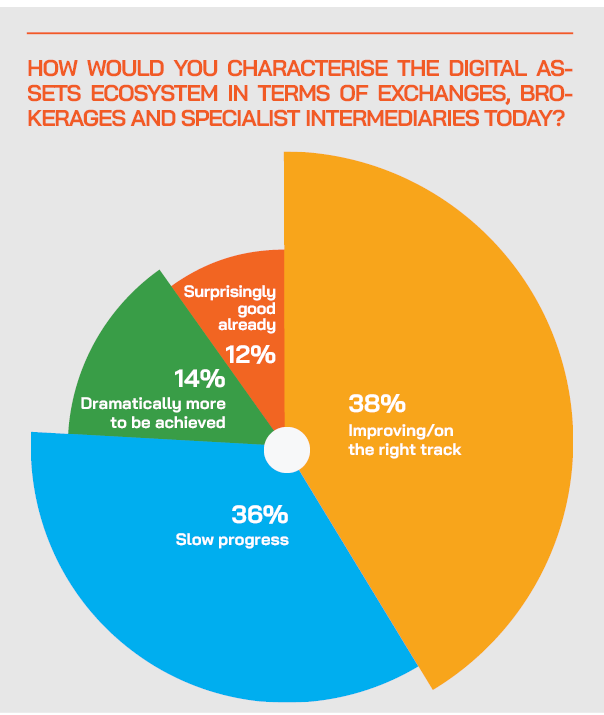

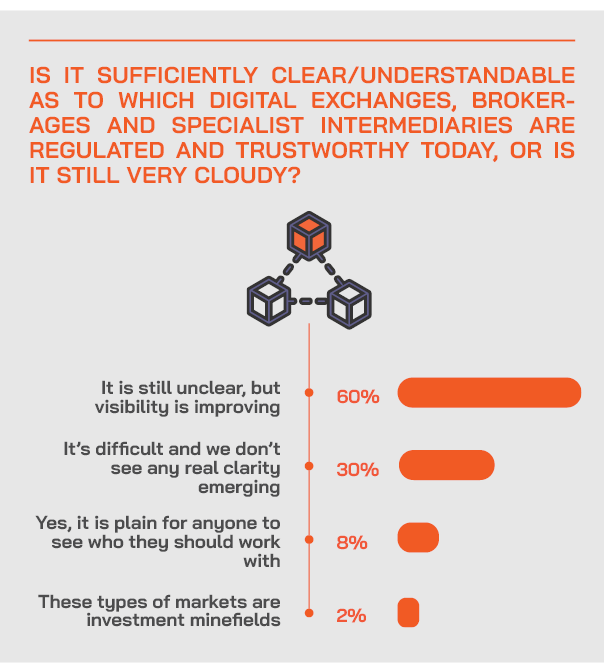

Another guest observed that in such a young market, it is difficult to understand who does what and how, and which organisations are credible, or not. He explained that his firm looks closely at all elements of the intermediaries and their partners, counterparties, execution, jurisdiction, custody and reporting, and so forth, just as they would for any mainstream financial markets operator they might work with. “Custody is especially vital, and if you end up staking your coins, the lessons of recent months are that you need to be involved only with creditworthy counterparties.”

“When we do the due diligence exercises,” a guest added, “it looks very similar to a very traditional process, I think, for any fund or hedge fund out there with addition, as well there was mentioned like custody, which is obviously quite different in the digital asset space. Custody is really critical. There is a significantly better infrastructure available today, versus say five years ago for custody of digital assets, but it is still improving. In the last few years, more custodians also have insurance. You have also seen kind of more traditional institutions entering the space, names such as Fidelity, for example, offering custody of Bitcoin and other assets in the space. I think that's really important as well for obviously, institutional investors that already have comfort with those kinds of firms that are entering the space. This is also important for the rapidly growing area of staking.”

Expert Opinion - Henrik Andersson, Chief Investment Officer and Co-Founder, Apollo Capital: “Despite the recent market turmoil, the fundamentals of crypto assets haven’t changed. The use cases are clearer now than any other time in the past. For long-term investors, this could be a good time to get deeper involved and start making investments into this new asset class.”

Digital assets are entirely separate and disconnected from the mainstream? No, they can be grounded in the real world and can often now be valued with more traditional metrics

Top-flight commercial buildings might cost a small or large fortune in major cities across Asia but access to investing in them can be trough tiny tradeable digital slices of these prestigious properties. An expert explained that they can sell such Korean properties to investors through digitised, or tokenised, slices, and the platform is aiming to do the same in Singapore. The first target market is accredited and institutional investors, but later on the aim is to sell these fractionalised property assets to individuals.

“We are essentially a digital exchange for assets that are actually in the real world, we're dealing with real estate,” he told delegates. “Regulation and compliance are central to our evolution, and we are now licensed in Korea and Singapore. In Singapore, we have been MAS approved with the CMS and RMO licenses. In Korea, we received a sandbox approval to run basically an exchange for real estate. We take real assets and fractionalise and had worked with about 250,000 investors in Korea in the past two years, and we are going to be launching in Singapore next month.”

He explained that they work with asset management companies whereby those holders of property investments are prepared to collaborate with their platform to achieve digital imprints of those assets, which are the digital asset-backed securities on their platform. “And then anyone can trade on the platform as they might assets on any mainstream exchange,” he explained.

He said that although they are a digital asset platform, they are also dealing with very traditional, very conservative building owners, property managers. “One of the most rewarding things about our journey specifically was really kind of making it familiar for both sides,” he said.

Differentiation, he reported, comes in the form of careful curation of custodians and robust compliance, working also with licensed entities of proven credibility. “In Korea, all of the accounts have to go through Hana Bank, which is the number two bank in Korea, and that will be similar to ow we operate in Singapore when we launch,” he explained.”

Expert Opinion - Henrik Andersson, Chief Investment Officer and Co-Founder, Apollo Capital: “Actively managed crypto funds potentially represent a superior way to get exposure to crypto assets. Through these funds you are able to get diversified exposure and a vehicle that is regulatory compliant. In addition, it solves the headaches around custody, security and accounting that are otherwise present when investing in this market.”

In an increasingly digital world, the work and life jurisdiction of choice is also an increasingly important consideration for wealthy investors

Another panellist explained that the digital world is creating a lot of new wealth, much or most of which is geographically flexible as to their location in the future. The jurisdictions themselves can serve as hedges against events or potential events in their home countries or regions, much as digital assets can serve as alternatives to mainstream assets.

“You may not relate to the values or ideologies or the laws of the country that you may be in right now, but for participation in digital assets in the future, you might see more and more crypto entrepreneurs, or digital asset entrepreneurs moving to more friendly jurisdictions,” he said. “If you look at places like Dubai and Malta, you see they've really become the epicentre for a lot of blockchain activity, and we see people naturally being attracted to these two places, because they want to conduct their business there, where there is better digital asset regulation, and there is a culture of encouraging innovation in these fields.”

He added that governments are now increasingly looking at the blockchain and Metaverse to help drive E-governance. He pointed to Binance founder Tim Draper as the brand ambassador for the island of Palau, which has come up with an identity verification system based on NFT and blockchain. “You have a digital identity, let's say you're opening a bank account, then you don't have to go through this obsolete process of lots of documentation, because they already have everything required for identity verification. If you look at immigration in general, I think we're really caught up in the past, not much has changed. I believe blockchain will help create these identity verification systems.”

Finally, when individuals select a country to move to for residence or citizenship, the investment platforms in the future might be increasingly digital, for example through tokenised participation in government or private sector assets.

The blockchain is starting to realise some of its potential to revolutionise the global financial ecosystem

Can the blockchain achieve what many hope and revolutionise transactions across the planet, from residential or commercial real estate to mainstream equity or fixed income or structured finance transactions? Yes, many believe, and it is gradually happening,

“Breaking up real estate into tradable tokens is getting closer to how,” a guest reported. “For example, the Swiss Stock Exchange is actively using its ETP programme to securitise investments that are otherwise tough to make liquid. I think the traditional security markets and the traditional exchanges, the New York Stock Exchanges, the NASDAQs of this world, they'll eventually all run on blockchain technology, because to be honest, the current ways are outmoded. And yes, we have bad actors in the crypto space, but you'll see that law enforcement is actually already starting to find out how they can use blockchain technology against these bad actors.”

The final word – the digital assets market is a work in progress, volatility has been endemic, but leading crypto prices have actually risen for many years, and quite often, dramatically

The final word went to a keen and active exponent of digital assets, explaining that most of the clients they work with might allocate between 1% to 3% into this space. “Cryptos outperformed for many years, despite being incredibly volatile,” he noted, “and we are now in a bear market and historically, the down phases were good times to buy in. Obviously, we don't know where asset prices will go over the next six months, but if you have a long-term horizon, maybe this time, kind of during a bear market is probably not a bad time to kind of get involved in this space if you don't already have exposure to digital assets.”