Publications & Thought Leadership

Asia’s Wealth Managers – Rising to the Challenges of Discussing Digital Assets with Private Clients

Oct 6, 2021

For some of the leading private banks and traditionalists, cryptocurrencies and other digital assets are entirely off-limits as far as their official position is concerned and decline to advise on them. Indeed, quite a number of them actively caution clients against taking such exposures. And the same is true also of many of the independent wealth managers, who espouse conservatism and wealth preservation above all else. But there are other private banks – and some of these include the oldest brands in the business – and other EAMs that believe that digital assets are part of our collective futures. These banks and firms believe that their private clients should not only understand more about digital assets, but they should actively participate by building some exposures in order to understand more about buying, storing, custody, and, of course, the vicissitudes of market pricing and volatility. Hubbis, in association with our exclusive partner for the event, Q9 Capital, hosted a virtual discussion on September 23rd that focused on exactly what types of conversations the growing band of proponents of digital assets could have with the growing ranks of investors who are interested in such investments, whether dabbling their toes in the water or taking a bigger plunge.

Panel Members:

- Evrard Bordier, CEO and Managing Partner, Bordier & Cie

- Mark Wightman, Asia-Pacific Wealth & Asset Management Consulting Leader, EY

- Harmen Overdijk, Chief Investment Officer, Leo Wealth

- James Quinn, Managing Partner, Q9 Capital

It is increasingly important for the leading private banks and wealth management firms to understand the digital assets market, which today is worth an estimated USD2 trillion in annual activity. They need to enhance their own understanding of such assets and to appreciate and then convey to investors how the digital asset industry is rapidly moving mainstream, with specialist trading, execution and digital asset custody firms rising up and as this new sector of the global financial markets is also becoming more recognised and regulated by leading authorities in many key jurisdictions, thereby lending the industry an ever more visible air of authority and legitimacy.

Indeed, the proponents of this rapidly growing space will be reporting to their clients how the diversification of the digital assets universe is moving in line with the rapid development of a more professional market infrastructure and ecosystem. And it goes without saying that all these elements have of course been turbocharged by investors seeing the incredible performance of Bitcoin – yes, and volatility - in the past year, even as China and some other jurisdictions battle against the rise of cryptocurrencies.

An expert opened his commentary by remarking that it is roughly since 2016 that his firm had been helping clients navigate the emerging cryptocurrency universe, first perhaps helping hedge funds and others such as family offices create digital wallets.

A rising tide of questions

“And today, I would say that most of our wealth clients either provide exposure in some shape or form or are looking at it,” he reported. “There are many questions they want to address. Should we go beyond Bitcoin into a wider range of cryptocurrencies? Look at stable coins? What is the world of DeFi? What are non-fungibles? So, first of all, it is all about the ‘what’, and then you get into what services can be provided around all this, for example partners, the fastest way to market, building capability in-house or in collaboration, custody, staking, and so forth.”

But as yet, there are, in reality, more questions than definitive answers, such is the early stage of the development of the universe of digital assets.

A guest remarked that one of the core questions that comes up time and again is the vital matter of trust. “There is the trust from an AML perspective, but as we see crypto native firms coming into the fold, clients increasingly ask for our help to come in and validate controls, governance, cyber-security, and even getting into areas such as the SOC 1 and SOC 2 compliance, as for traditional financial service providers,” he explained.

A multi-trillion-dollar marketplace

“This is already a USD2 trillion-plus market, there is incredible excitement around it, and it is growing at a phenomenal rate,” an expert remarked. “However, the issues around how wealth management providers and investors venture into it compliantly, securely and confidently are key concerns on which we have been spending a lot of time with clients over the years. And this is very important as more and more players come into the market or want to enter the market. Some years ago, it was largely the hedge funds who we worked with, but now a lot of the private banks are providing services in this area, or looking at entering this space, and we also have a number of our institutional investors clients now looking at this universe as well.”

But many remain cautious

A guest conceded that many banks still prefer not to get involved in cryptocurrencies, citing a variety of reasons, including the difficulty in the valuation of these assets and issues around AML. “But we are seeing more and more come into this space, and ultimately, as an industry, we're all here to provide services to the clients, and as more of them demand more and better coverage we expect more institutions to follow in,” he reported. “Clearly, private clients are not going to be throwing lots of money from their portfolios at this segment, but they are increasingly taking some exposures.”

He expanded on these comments, remarking that the world of private banking is highly competitive, and there is a significant risk in not competing in selected areas, especially those growing so rapidly.

Will the tide turn for the highly conservative?

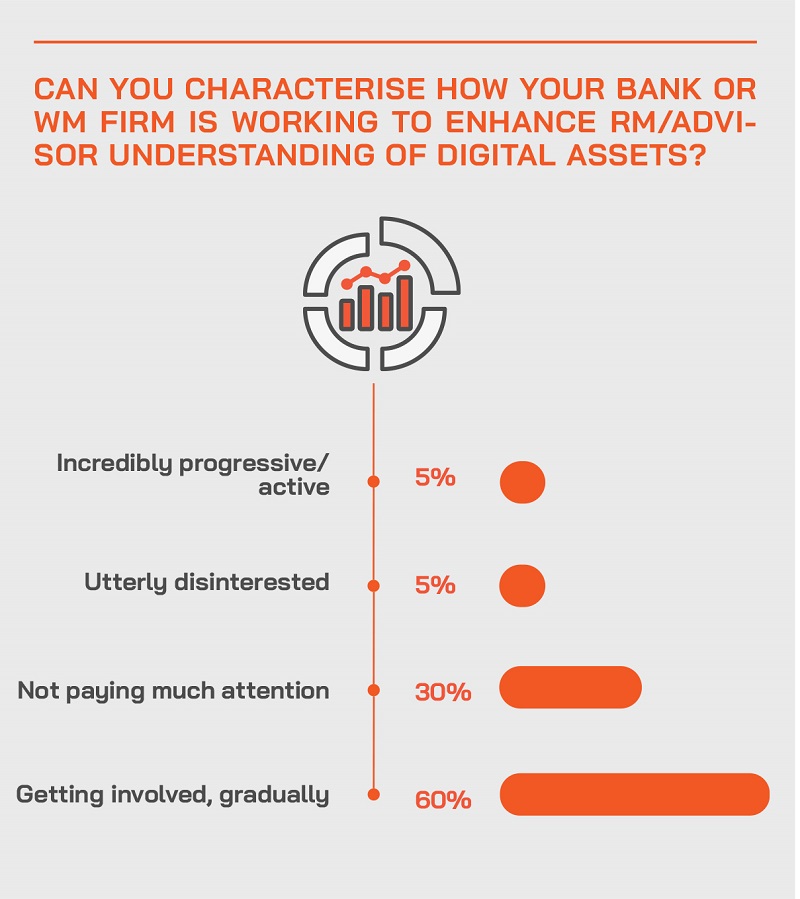

“Yes, we certainly see that some private banks and wealth managers prefer to remain extremely conservative, they want to do things in absolutely the right way, but whereas historically, they may have said ‘no’, now more of them are saying ‘maybe’ because clients are demanding it,” he observed. “But it is a different world, a different operating model, so they need to become comfortable with all the practicalities and nuances before they enter the fray. In short, I would say that the majority of wealth managers that we talk to now are seriously looking at providing access in some shape or form, that is, if they don't do so already.”

A banker explained that they had begun to get more deeply involved in digital assets first out of Switzerland, and in partnership with a leading digital bank in Switzerland licensed by FINMA. At the current stage of evolution, they do not proffer advice, only access to trade on the digital bank platform and client reporting on their statements. “We are sometimes seeing volumes higher in the cryptos space than in the mainstream assets,” he reported, “and normally people hardly sell nowadays, they just acquire more.”

A tiny step could make a big difference

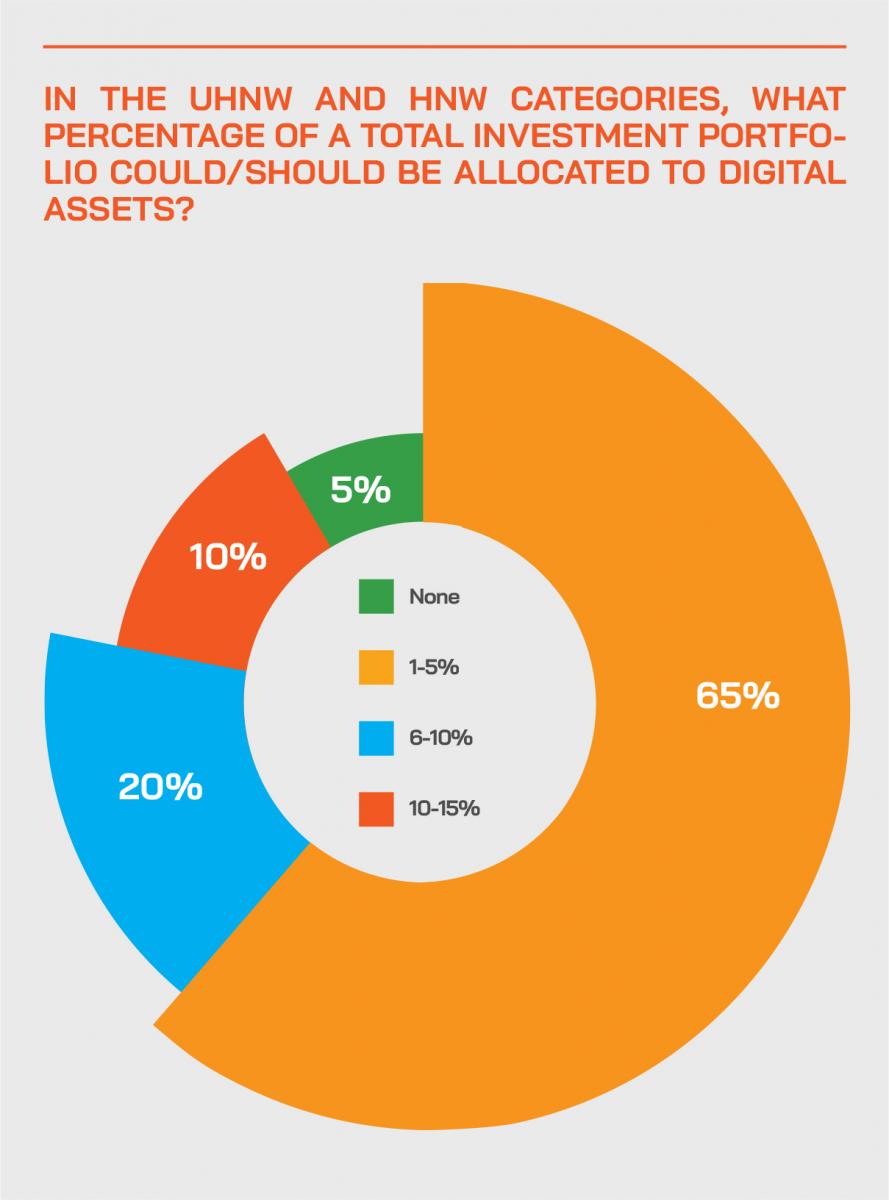

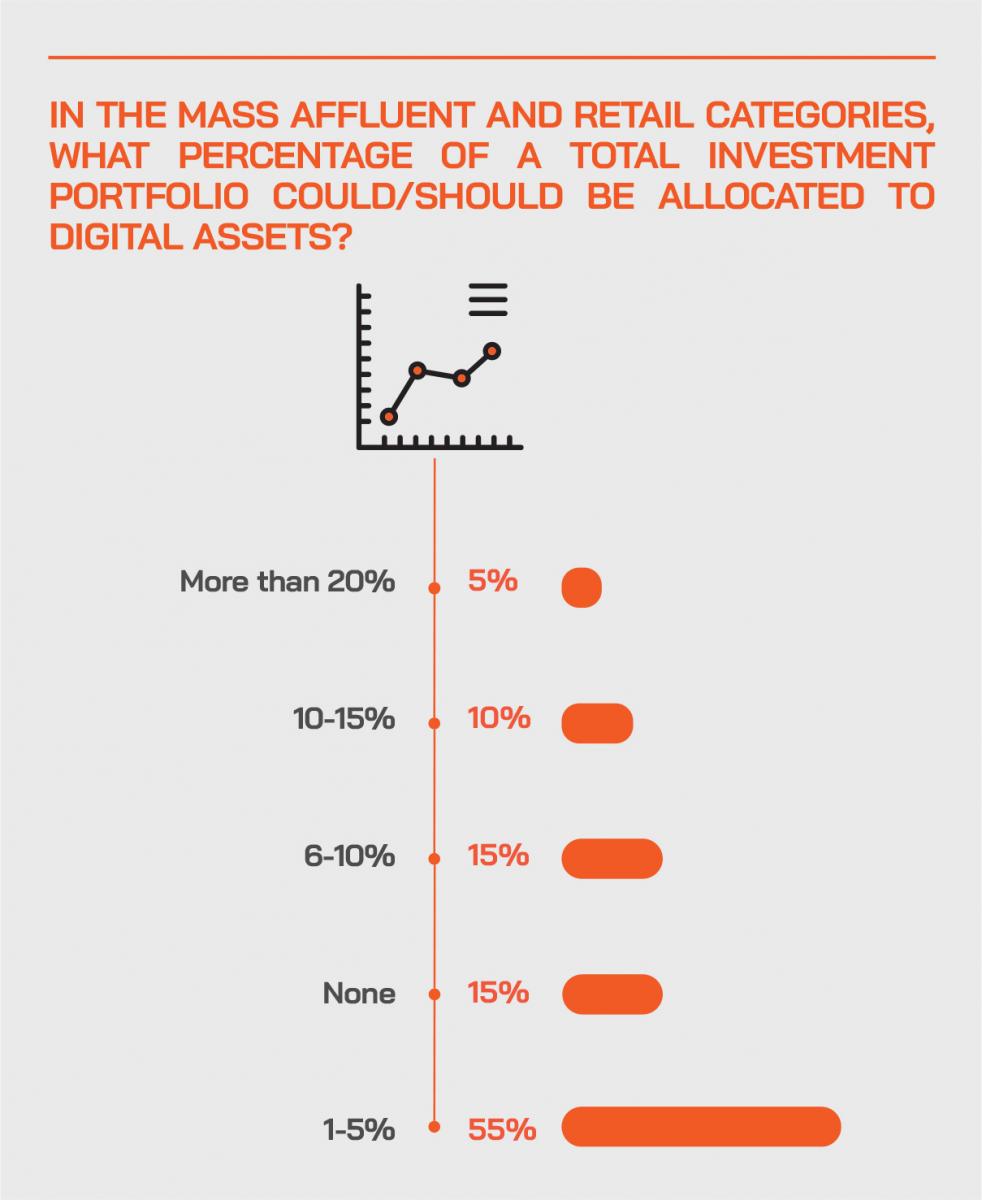

This expert told delegates that research had indicated that shifting 1% or 2% of portfolios to crypto assets – sticking at first to Bitcoin and Ethereum - could enhance returns significantly, whereas if clients lost all of those investments, they would lose only marginally.

And he explained that although the bank’s RMs are continually becoming more knowledgeable, the bank does not yet offer advice, preferring at this stage of the market’s evolution only to offer the platform for access rather than elevating the proposition further.

Another expert commented: “We see lots of interesting developments taking place in the decade ahead, but not only in cryptocurrencies, as there will be much more interest in digital coins as well. However, we are not believers that this will be all about cryptos – we believe that other tokens such as Decentralised Finance, represented by DeFi tokens, and other security tokens are potentially going to form a much bigger part of the digital asset space in the future.”

The Hubbis Post-Event Survey

Should the private banks and EAMs/IAMs be actively promoting digital assets to their private clients? Why, or why not?

- We think there should not be active promotion of digital assets, only open discussion with interested and knowledgeable clients.

- I don't think so as regulatory and volatility concerns.

- No. Too many unquantifiable risks surrounding digital assets.

- The understanding of the way these assets move is still difficult to comprehend and hence putting these on an advisory platform will be challenging.

- Possibly, but with great caution given the capricious and uncertain regulations. Digital assets are an interesting asset class.

- Yes, for diversification purposes.

- The clients need to understand what these assets are and how they work.

- Yes, there is huge interest and to be able to gain access early is important to their portfolios.

- No. Crypto as an asset class remains highly volatile and the regulations are as yet unclear and ill defined.

- No, there still too many non-clarified issues regarding the status of crypto as securities or not, for example see the US SEC’s latest position. Still, PBs could and perhaps should enable trading and custody either directly or via partnerships.

- Not really, it’s still a very “wild” asset class.

- Maybe not actively promoting at this stage but be able to explain pros and cons to clients requesting that support. This asset class is growing and cannot simple be ignored any more.

- Given the volatility and high risk of many digital assets it is probably not something that should be actively promoted but handled on a reactive/instruction only basis.

- I think it's early times yet to ‘promote’ these investments, but it is never too early to engage clients in discussions. A watch over the development in the legal, regulatory and operational aspects, compliance perspectives vis a vis the aforementioned will give us a better idea as we move along.

- No, as there are still too many uncertainties regarding the management of digital assets.

- Perhaps, but only if they have the expertise to monitor and advise on them.

- We think promoting actively is not yet very appropriate as digital currencies are not yet mature or well regulated. It is a good vehicle for responsible professional investors.

- For the time being, they should not be promoted actively, because the current rules and regulations of digital asset trading are not yet formulated, widely agreed or in place. As an advisor, if we are not able to fully understand the industry it makes it inappropriate to actively promote this segment.

Evolving – from medium of exchange to investment asset

Crypto coins, a guest noted, were originally created as a potential means of exchange but had evolved into a viable and interesting investment class in their own right.

“We began investing in cryptos for our clients last year,” he said. “We can say it is rather similar to investing in gold or silver, which were historically also mediums of exchange, currencies effectively. We offer cryptos to clients in discretionary portfolios as they had since the pandemic hit been asking for a much higher percentage of gold in their portfolios. We agreed but we said that they should look a little bit broader than that and see where the global flows are going; that's clearly into the crypto space. We do not expect clients to take large exposures; this is purely for diversification, as we see it.”

Bitcoin and Ethereum lead the charge

A panellist explained that their firm prefers not to look beyond Bitcoin and Ethereum and are not believers in the proliferation of numerous cryptocurrencies. “We are a licensed firm here in Hong Kong and in the US, and a central concern, of course, is investing safely for clients, so we started investing through recently ETFs, or securitised versions of Ethereum, and Bitcoin. In the US, for example, Fidelity offers index products for qualified investors and we're now looking whether we can offer that in a regulated way in Hong Kong, through the only regulated digital assets exchange in Hong Kong at the moment, which is OSL. In short, we invest actively with modest and careful allocations to Bitcoin and Ethereum in the thematic portions of our portfolios.”

He explained that clients have the choice if they do not want such exposures, noting that while there are some who decline, most will take a very small allocation, seldom going beyond 1% of their total portfolios. He reiterated that this is for diversification; it is not because they believe investors should load up on cryptocurrencies.

Building solid but modest exposure

“We see this as a segment of the asset markets to which investors should have some exposure,” an expert said. “And we recognise how volatile the markets are. However, we are not traders; we are ‘buy and hold’ in our approach, seizing the opportunities to also rebalance if Bitcoin or Ethereum fall very sharply. That is a good time to also potentially convince more clients that they should add it to their portfolio.”

Another guest highlighted three core pillars of the evolving cryptos market – high liquidity, wariness around offering advice, and rising confidence in the future of digital assets.

“There is huge volume of these assets relative to their market capitalisation,” he reported. “But there are not many great investment programmes to help investors. The clients just want to be invested, not to miss out at this stage, sticking to the major names, but not really seeming to want to become real experts yet. “For the majority of investors out in the world, at this stage they just want an allocation into this space, with our clients generally seeking more than 1% allocation, in fact more like 2%, 3% even 5% of portfolios if they are a little bit more aggressive. They tend to start off with Bitcoin and Ethereum, but they often want to expand into other assets.”

The Hubbis Post-Event Survey

Are your private client investors in Asia only speculating in cryptocurrencies, or are they actually taking a

more serious and studied approach to them? Why or why not?

The replies indicated that most of the active is pure speculation. The respondents made these comments to put flesh on those bones:

- Most of the investors we see are young entrepreneurs with high risk appetites and cryptocurrencies suit them well. They understand the upside potential compared with the significant risks.

- Currently its more speculation due to the questions around valuations, what is driving the prices, and the practical use as a medium of exchange outside the financial system, which is after all the original premise.

- Gains are switched quickly to mainstream currencies.

- FOMO is one of the key reasons.

- Some are buying in more carefully through ETFs, in a semi-professional approach, especially for those who are not really convinced about these assets.

- It is difficult not to see this as speculation, when there are no real valuation parameters. Unlike gold, you cannot even wear or display these assets, so although prices have risen dramatically in recent years, it is all driven by supply and demand, not by any fundamentals.

- People are also dipping their toes in the waters in order to learn more about them and how the market works.

- Half and half, some clients are very optimistic about the future of cryptocurrencies, while others are very sceptical and even think it's more of a scam. I think it's mainly due to the relatively short history of cryptocurrencies and the lack of recognition of their legitimacy by major jurisdictions.

A seamless USX is vital

He explained that his firm offers wealth managers a digital end to end solution for cryptocurrencies and digital assets, with a user experience that is very clean and straightforward.

“I don't think the advice part is actually the crucial part yet,” he commented. “We're just not that far along. First, it is about getting involved.” He said he agreed with another comment on the panel that there will not be thousands of winners, but on the other hand, there will probably be more than two or very few winners.

Another guest agreed, remarking that some clients are going much more aggressively into the market. “The volatility makes it difficult,” he said, “but people are buying into the dips and tend to be really looking at the long-term returns.”

Cryptos, recognition and taxation

A guest observed that more governments around the world are recognising crypto as an asset class – with the most notable exception being China - and that what comes with recognition and regulation are taxes, as night follow day.

“The original investors in crypto were people who often wanted to be outside or be in a decentralised financial system, but that's not how governments around the world look at it,” he said. “You have to figure out how to properly account that for from a tax perspective. In Hong Kong or Singapore, this is not an issue as there is no capital gains tax, or wealth tax, but elsewhere it is totally different. The US authorities have made some really specific rules about how to deal with crypto from both gains and estate duties perspectives.”

He commented that this of course means that investors’ estate and legacy planning must take into account your crypto assets. In Europe, where there are wealth taxes in some countries, they take the value on one day of the year and they tax you on that, despite the incredible volatility of prices, he said. And given that crypto are on the blockchain, they can if they want possibly track back to see if the investor really declared that properly. “In short, we see a lot of interest in this – structuring properly and accounting properly is essential,” he cautioned. “This is even important in case of a divorce or splits between spouses and partners.”

Choose your jurisdiction wisely

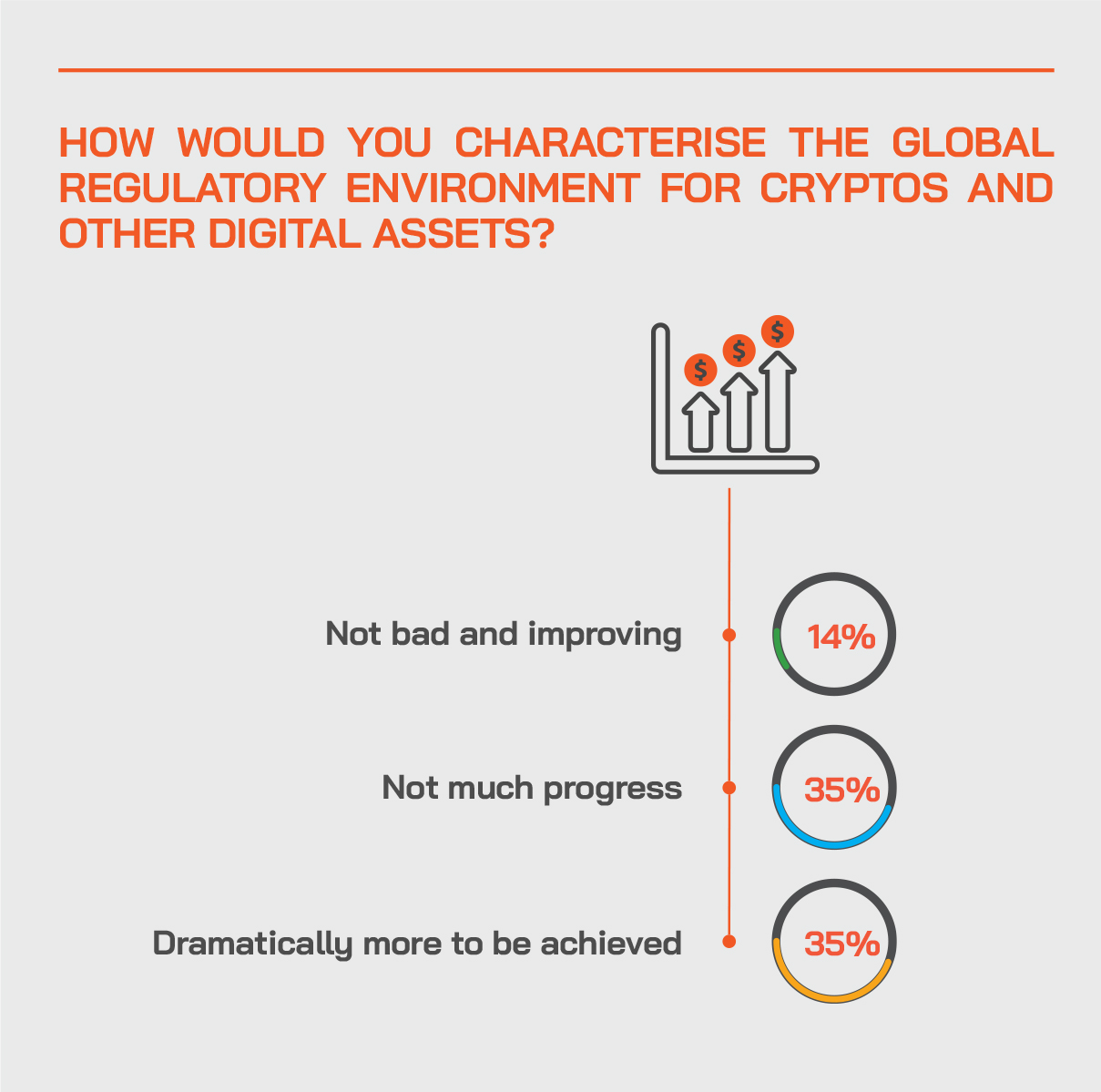

A panellist observed that in the handling of digital assets, the chosen jurisdiction is particularly important. “Certain jurisdictions have been very clear on the regulatory guidelines, the licenses, and the protocols to follow. From our perspective, we have many conversations centred on Switzerland, the US, and here in Singapore. Some jurisdictions are less accommodating to digital assets, so that is naturally driving the hubs where we see things coming together.”

He added that certain jurisdictions are successfully building their digital assets ecosystem, whether wealth providers offering these services, whether FinTech firms are in the mix, or specialists providing institutional level digital custody and other services, such as staking and yield enhancement.

He returned to the regulatory environment, noting that some of the private banks see this as a major hindrance to their participation. And he observed that unlike the world of mainstream financial assets, there are significant differences between the approaches of different jurisdictions, for example, Singapore and Hong Kong.

An evolving regulatory environment

“And the US is already quite developed, but still is taking a somewhat different approach from the Asian and the European markets,” he commented. “And then you see markets such as China, Thailand and India where they had effectively outlawed crypto to a large extent. Naturally, we comply with both the Hong Kong and US regulatory situations, as we operate out of both jurisdictions. The regulatory environment will clearly evolve significantly in coming years, and as the regulators catch up, that will certainly impact how these markets develop.”

Far from a token effort…

As to the evolution of other forms of digital assets, an expert said he was looking forward to an ecosystem where DeFi or security tokens become a much larger element.

“For the time being, they are more comparable to gold and other commodities,” he said. “We also actually included crypto in our inflation hedge commodity thematic strategy. They have some characteristics similar to precious metals, for example, in that supply is limited. It is not a fiat currency, has a different and potential intrinsic value, which nobody actually really knows yet. They are probably less affected by, for example, by the strength of the US dollar or a rise in real interest rates, but not totally uncorrelated. In short, we see this as an asset class that would fit in with where other commodities and precious metals in a way fit, and a diversification component for our global portfolios.”

A guest commented on how essential AML protocols are when dealing with clients involved in digital assets. He advised anyone coming to a reputable bank or firm and asking them to count their digital assets as part of their AUM to make sure they have a clean ‘wallet’ and not to transact excessively, otherwise it becomes more and more difficult to trace back to the origins of funds. “If I can offer advice as an institution that sometimes receives cryptos, if you have made money thanks to your cryptos, then prove it,” he warned. “Clarity is essential.”

DeFi in focus

A guest elaborated on DeFi, which he described as the next level up from cryptocurrency. “As I mentioned, Bitcoin was originally designed as a potential payment currency; the idea was to use is to help create a much more efficient payment system because even today transferring money from one country to the other and across fiat currencies is still relatively expensive. And credit card companies are still taking quite a big chunk out as transaction fees. Moreover, unlike fiat currencies, there is no government to simply issue as much additional currency as they want. So, the whole concept of cryptos as a medium of exchange is evolving and DeFi is sort of the next step from what the Ethereum network, the smart contract network was already doing. It allows you to use the blockchain technology in different ways and for different applications that make, for example, accounting easier or that simplify AML or compliance or tax filing.”

A tokenised world of investing

Security tokens, he observed, are somewhat different again. They could, he said, for example convert plan vanilla shares traded on mainstream stock exchanges into a digital format. “Why would that be useful?” he pondered. “Well, let’s say you want to sell Microsoft, which is traded in the US in dollars and buy Nintendo, which trades in Tokyo, well, you have to sell and settle in the US in dollars, buy Yen and then buy Nintendo in Tokyo. However, with security tokens, you could effectively trade them directly against each other without numerous intermediaries and steps. It would potentially make the markets a lot more efficient.”

An expert also offered his views on the expansion of tokenisation. “These are very early days still in what is really a new ecosystem, and within that the whole concept of tokenisation is emerging,” he observed. “Clearly, tokenisation allows us to create tokens and we can fractionalise anything, but for example, why do this for real estate when you can buy into REITs. So, it is really about the application of tokenisation, as areas such as collectables, art, fine wines, classic cars, and so forth become more relevant. Tokenisation effectively allows wealth management businesses to offer some unique or at least differentiated ideas to their clients.”

He also observed that there are many assets that are not available in manageable sizes for many investors beyond the very large institutions or UHNW type investors.

A new universe of exposures

“If we can leverage tokenisation to provide access to some of these private assets, and then allow them to be distributed through the wealth managers, the enlarged ecosystem is going to potentially provide wider and wider access to investors,” another expert commented. “The banks and wealth management firms can then participate in a variety of areas, from origination to trading, custody and so forth. This whole sphere of tokenisation is opening the doors to new assets, new exposures, and we certainly see growth in both the supply and demand sides ahead.”

A guest also projected that the lines between what will end up as bearer digital assets will become more blurred, causing regulators to focus more intently as they come to effectively represent or in many cases supplant equities, fixed income and commodities over the next decade or two.

Another expert commented that liquidity is key for tokenisation to really take off in the future. “Tokenisation of assets is not a problem, we have seen wines tokenised, we have seen a Picasso painting tokenised, and so forth,” he said. “But unless you have the platform to trade these tokens, then they don’t necessarily have the value they should have. I hope that the platforms allow more trading, more volume, and that there's more liquidity, so that in the future, you really have an alternative to what we currently have in the market. Then it will be much bigger than it is today, and will rise to challenge the cryptocurrency market, which is huge.”

The Hubbis Post-Event Survey

What are the key hurdles to overcome for your bank or WM firm to help guide private clients effectively through the universe of digital assets?

- Reduced volatility.

- Improve the reputation around money laundering and speculation.

- Better regulatory guidance on the treatment of such assets.

- Understanding the key factors which move the pricing of these assets.

- Education and knowledge that these assets are secure.

- We need to be sure the client actually understands what it is he is buying. Can he/she keep it safe and does custody work properly?

- Improve the aura of trust in the industry.

- Elevate this from what looks like gambling to many.

- Poor quality research leadership, too much reliance on external news and rumour.

- Greater professionalism and far better communication amongst those purporting to be industry professional. Sometimes, the more we hear, the less we understand, as there is a lot of gobbledygook jargon spoken about these assets.

- Industry leaders should elevate their ability to pain a clear picture of how price movements are being driven, of the state of regulation, and key settlement and compliance issues.

- There is definitely interest but the key hindrances are lack of proper education and professionalism, and the seeming lack of legitimate and well-organised trading intermediaries and exchanges.

Has your bank/firm been working with investors on digital tokens representing other physical assets, such as real estate, fine wine collections, collectible art and why or why not?

Comment: The replies were emphatic that thus far there is virtually no activity taking place. The reasons cited include far too much effort for little reward, it is far too early to take these concepts seriously, there is little or no demand, they are outside the advisory and product mandates, there is not enough expertise in-house, and wealthier investors prefer the underlying assets rather than their virtual and fragmented representations.

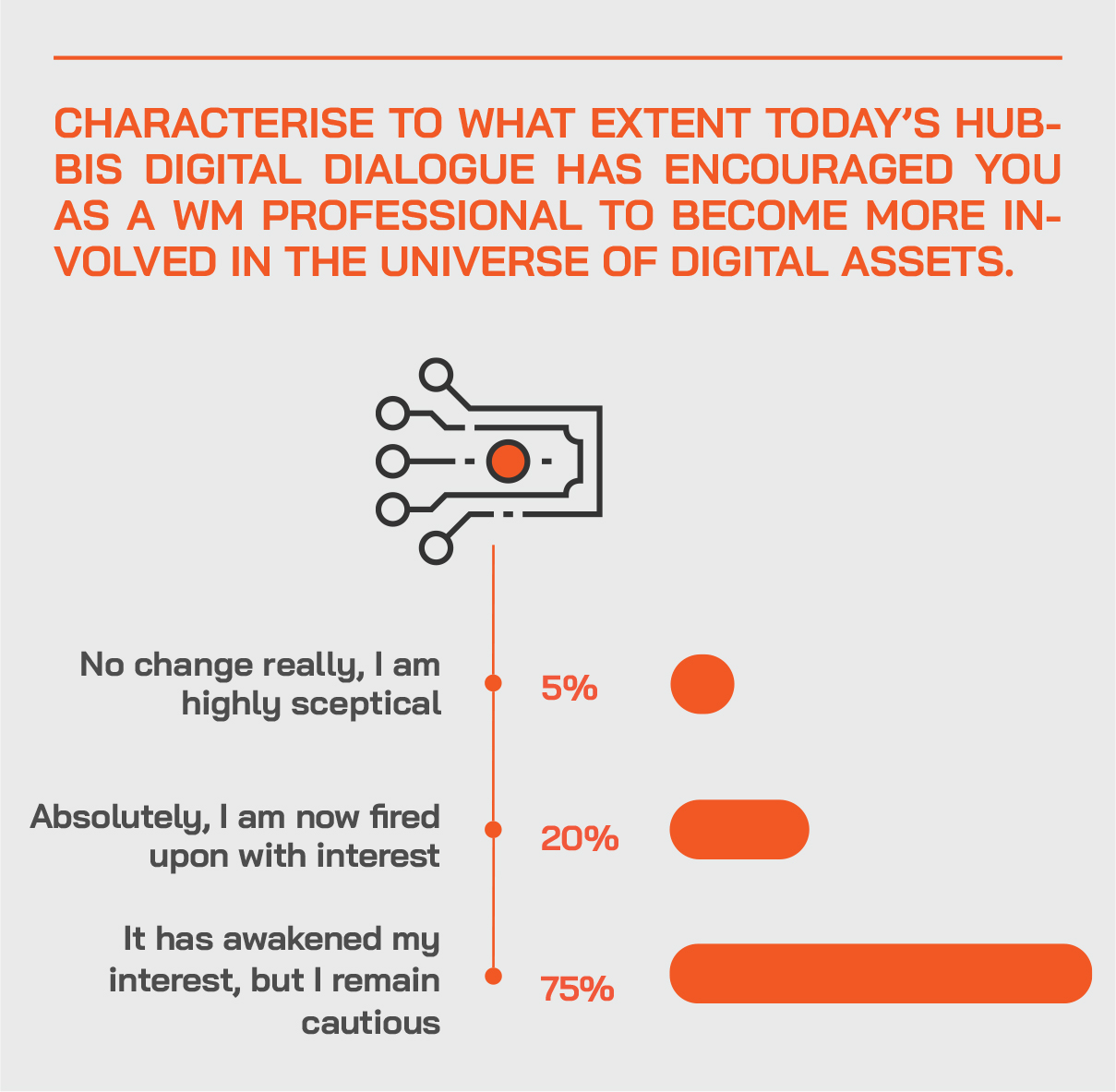

Leveraging the ecosystem

The discussion closed with a guest explaining that the discussions are nowadays less ‘should we or shouldn’t we’ and more and more about how the clients, the banks and other wealth firm, are looking for speed to market, and in many cases, that comes down to the right partnering or leveraging components from other service providers, such as technology firms, or others, he explained. “And it's good to see that even many of the crypto native firms that originally started up in the US are here now in APAC as well; we see more such entrants here as the market advances. We are now so busy in this area, especially consulting on the operating model, the controls, the governance, and other key areas so that the core trust is built and maintained, as this already large market expands even further in the years ahead.”