Asia’s Private Clients and the Evolution of Private Market Investments

Mar 5, 2023

What is the state of demand today in Asia for private market assets, why, and how is the wealth management industry developing its offering? Is now the right time for private clients to diversify further to private equity or debt? Has the supply of funding from all types of sources inclined the game more towards those prepared to finance private assets? These were the big questions put to our panel of experts in the Hubbis Digital Dialogue of February 16. They looked in-depth at the evolution of the private markets, looking from a 360-degree perspective at the pluses and minuses, they analysed where the market is heading and how the Asian wealth management community is positioning itself for the current and anticipated market environment. We have selected some of the key insights from those experts in this review.

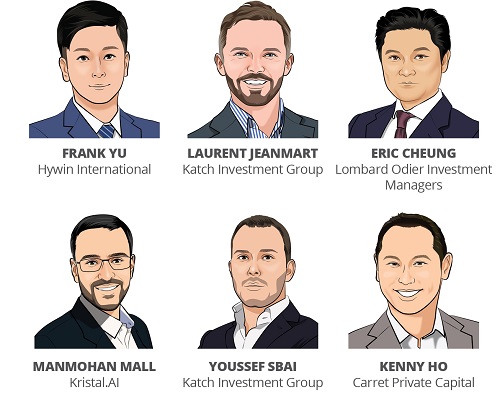

The Panel:

- Kenny Ho, Managing Partner & Founder, Carret Private Capital

- Frank Yu, Head of Private Markets, Hywin International

- Laurent Jeanmart, Chairman & Partner, Katch Investment Group

- Youssef Sbai, Investment Director RE Private Debt, Katch Investment Group

- Manmohan Mall, Head, Private Markets & Family Office, Kristal.AI

- Eric Cheung, Investment Director of Private Equity, Lombard Odier Investment Managers

These are some of the questions the panel addressed:

- The Big Picture – are volatility, inflation, and global geopolitical uncertainties in the public markets driving more Asian private clients to the private equity and debt markets, or has demand decreased?

- What are the key attractions of private assets compared to public market investments?

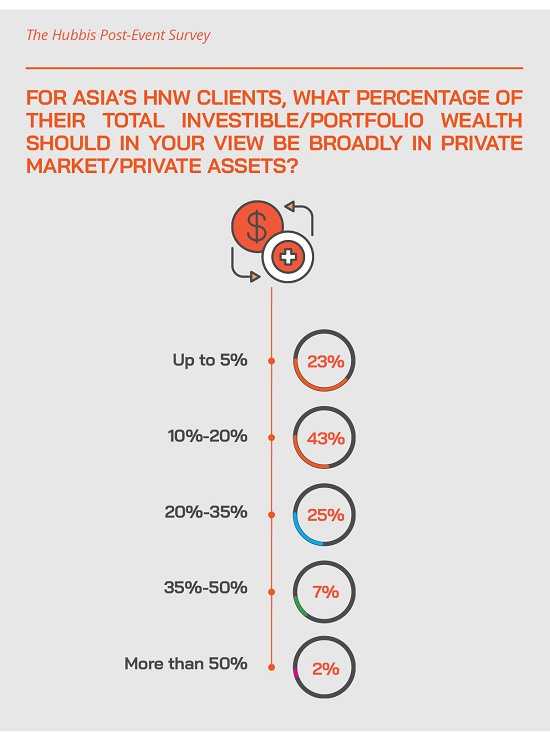

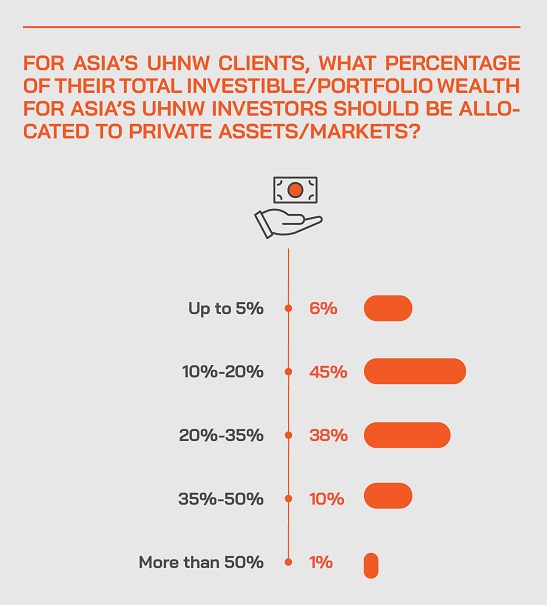

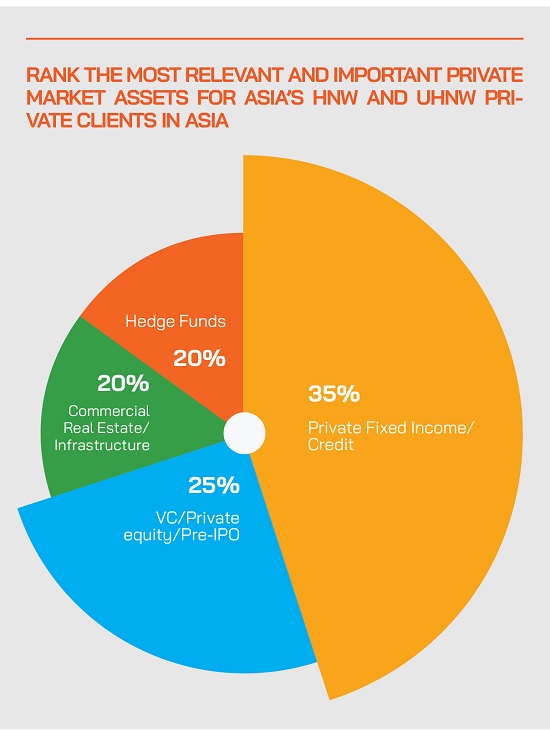

- Which types of private clients in Asia are driving this trend, and looking ahead, what sort of allocations should HNW and UHNW investors be making to private assets as a percentage of their total portfolios?

- In the private equity market – spanning from VC to pre-IPO funding, what are the key opportunities today and what are the key criteria investors need to consider?

- In the private debt markets – spanning from senior to subordinated, trade finance and much more – what types of deals are Asian clients buying into, and why?

- What about other private assets, for example, real estate or alternatives?

- Do ESG and sustainability play a significant or growing role in private markets?

- What is the wealth management community doing to boost its private markets proposition and offerings?

- What are the benefits of private debt in Real Estate and the specific appeal of senior loans?

- ESL strategy during uncertain times => Value-added aspects

- ESG: ESL support to regeneration projects and energy efficiency

Setting the Scene

In recent years, an increasing number of private clients in Asia have been seeking to diversify their portfolios by including longer-term private asset investment strategies of all types, from plain vanilla early and later-stage private equity, to private debt of all types, private commercial real estate deals, hedge fund strategies, and so forth. Such assets can offer investors strong long-term performance potential, while their historical downside resilience and lower volatility compared to public market securities also help make this asset class attractive for portfolio diversification and, to some extent, for peace of mind.

The trend in Asia reflects a seismic global shift towards private markets amongst leading investment institutions – from sovereigns to pension funds - and also increasingly in the private wealth sector.

The Asian HNW and UHNW clients that are taking up more of such opportunities need a highly professional point of access via private banks, the independent wealth community and other key specialists. They need experts who can filter, package, promote and then monitor these investments, thereby opening the door to what are considerably more complex and longer-term holdings. For the wealth management community investing in building and delivering this expertise, the carrot is significantly higher fees than in the public markets.

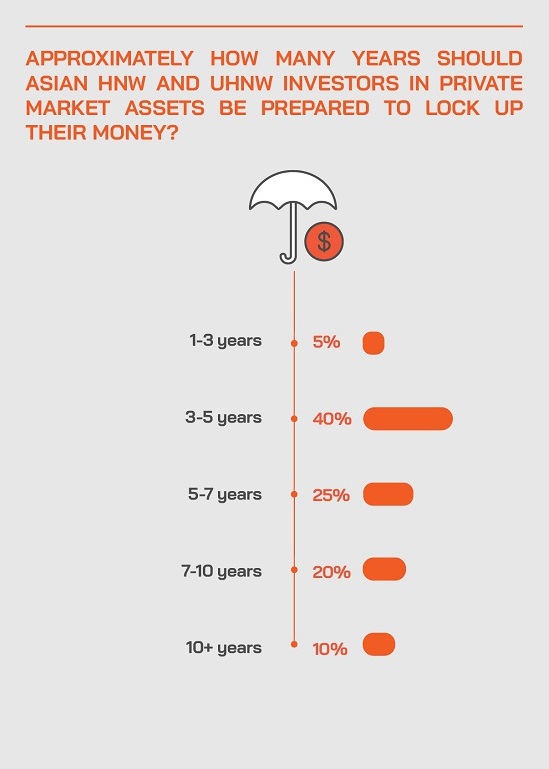

Diversification to private assets offers investors the chance to get into longer-term income and capital gain opportunities, albeit requiring a considerably longer time horizon due to the minimal liquidity available, although more and more deals are being structured to offer some modest liquidity throughout the general three to ten year holding periods. Naturally, due to the lower liquidity and longer holding times required, these deals more suit the upper HNW and UHNW segments, although access to private markets is also being democratised by slicing and dicing, sometimes even for mass affluent investors via digital assets/tokenisation.

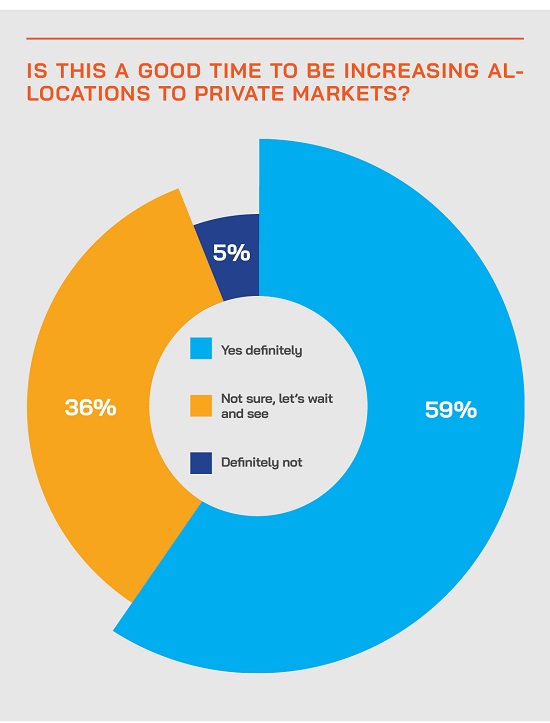

Entry prices to such opportunities dropped in sync with mainstream public market valuations, and the capital available has shrunk as the era of very easy money has been fading into the background. This presents a significant opportunity for the wealth management industry in the region to present their private clients – especially the family offices who are somewhat immune from the financial market vacillations – with some interesting deals, and investors to consider those opportunities perhaps in slightly less of a rush than when the market was roaring ahead in 2021 and the preceding several years.

Key Insights & Observations

Returns lead the way forward in the private markets universe, but patience is a prerequisite

A speaker opened by commenting that the momentum behind private assets had been driven by higher performance and lower volatility compared to many other asset public classes. “We recommend clients to spread their commitments over a number of investments over many years to build some diversification amongst vintages,” he explained. “Private equity requires a lot of patience from clients as well. They need to understand that in order to generate these returns and reap all the benefits, they must have a long-term horizon.”

He added that with so many companies in major economies being private – in numbers he cited 99% in the US by number – then the investors are gaining true access to the real economy, including some sectors that may not be captured by the public markets. “Many of our clients like private equity because they see this as a complementary asset class with listed bonds or listed equities,” he reported.

Expert Opinion - Eric Cheung, Investment Director of Private Equity, Lombard Odier Investment Managers: “Private assets provide a complementary exposure in a traditional portfolio of listed investments and should be used as a source of performance enhancement. An allocation to private assets is a function of liquidity constraints, returns expectations, and investment horizon. Clients typically work with us to determine a target allocation which takes into account their preferences.”

Private markets encompass a wide range of opportunities and private clients need to have their eyes wide open and work with genuine experts

A multi-family office head explained that private markets had become a very important part of their business and encompasses early and later stage private equity directly, and indirectly via private equity funds, hedge funds, and real estate “It is a significant competitive advantage for us to be able to provide access to such markets as a diversification tool,” he reported. “We have a lot more flexibility and the ability to look at a broader range of asset classes as well as, say midsize market deals where the private banks do not. It is an important part of our value proposition.”

He explained that their curation of deals is largely by working directly with the major funds and brand-name groups, rather than through bank intermediaries. “Frankly, the big names will always be easier to sell to family office type clients,” he reported. “We also spend a lot of time and effort to customise our solution to fit the client needs. We prefer putting clients directly into selected funds than the fund of funds approach.”

He also noted that they have expanded in the past six months into the real estate space. Taking debt exposures with a first lien on assets, roughly 50% LTVs and obtaining returns of 15% plus. “Asian clients like real estate, as we all know,” he said. “We have already done more than 10 deals with one of Asia's leading real estate PE firms, and they are working out well for our clients.”

Private debt and credit also represent a major opportunity for diversification, lower correlation, and higher returns with very manageable risk

A guest explained that his firm specialises in senior secured debt in the form of asset-backed lending, mostly in Western Europe, but also in Brazil, where they focus on factoring, which involves buying short term assets from companies. “We concentrate only on senior secured, with target returns between 8% and 16% net per annum. We focus only on the liquid end of the market.”

He explained that they invest in areas that the banks tend to ignore. “The banks are busy buying Treasury bonds and financing mortgages, and not greatly interested in helping SMEs grow, so there is a major gap there,” he said, adding that as a result there is a major disconnect, in that the returns from private markets are far greater than public for these assets, and the risk-reward profile is very compelling.

He added: “You get a product where you get paid much more for a given level of risk, and you have a degree of decorrelation, and achieves diversification in your portfolio. That is very valuable in a world where everything tends to be correlated, especially at times of higher volatility.”

He explained also that although yields on public debt and high yield have jumped as rates have risen, the risks are significant at the lower end of the credit spectrum. “Even though [public market] bonds are more attractive now, one needs to be reminded that, especially if you invest in high yield bonds, then you get a degree of correlation with the equities markets,” he elucidated. “In other words, the lower down you go in the quality of the bonds that you are buying, the more correlated these yields, and these bonds are going to be with your equity exposures.”

Expert Opinion - Manmohan Mall, Head, Private Markets & Family Office, Kristal.AI: “Overall, we believe the trends last year will benefit the private market space in the long run. The taming of irrational exuberance in private markets is often followed by a sharper focus on founder quality and business models, ultimately leading to a consistent outperformance shown by investments made during troughs of the private market cycle to significantly outperform those made during more normal times.”

Real estate is another key opportunity for private clients, but you must pick the winners carefully, structure securely and stay at the short end

Another expert from the same firm also offered his views, explaining that he handles European investments in real estate private debt, focusing on senior bridge lending across Europe backed by real estate assets, in the four core markets of the UK, France, Spain, and Germany.

He said they finance mainly developments or redevelopment projects, for example they might be approached by an experienced developer in France looking to acquire a building in order to refurbish it, redevelop it and needing a bridge loan for 6 to 12 months, before being up and running and then refinanced by the banks. “These are typically short-term and with the low LTVs of 60% to 65%, and sometimes considerably lower,” he reported. “We see the value of these assets grow during the period of the loan as the works progress.”

He explained that inflation, rising rates and cost-of-living issues in Europe had certainly changed market conditions. “As a result, we decided to shift into this value add aspect where instead of working with classic developers, we work more now with redevelopers, who are experts of their field, and we help them finance buildings that are acquired under usually market value,” he elaborated. “Low LTVs are the key here, and short durations, where we have a strong visibility. And we have strong security as the first rank mortgage, we have shared pledge of the SPV, and we have a pledge on the bank account of the SPV as well.

Digital delivery of private market deals is here for Asia’s HNW and UHNW clients

Explaining that their platform is essentially a digital version of a traditional private bank, a panellist said that for their HNW and UHNW clients, they have been delivering a full suite of private markets deals since around two years ago, including private equity, venture capital, and private debt funds, as well as real estate infrastructure. “More and more money is being deployed to private markets,” he reported. “The key metrics around their performance make this a very exciting investment proposition for the investor community, mindful also of the fact that there are illiquidity considerations that one needs to keep in mind.”

He said the opportunities are not only in equity, but also venture debt and also hybrid forms of investments, including the use of warrants. “We think the cycle should turn very soon, and that there is good value in the early stage investments even through the fund format,” he reported.

He elaborated on venture debt, noting that venture debt funds focus on the next level of the capital structure, providing debt to early-stage companies, usually along with an equity component attached. “For the owners and founders of these companies, they need capital but do not want to dilute today at current valuations, hence they raise debt with equity sweeteners.”

China beckons and private markets are attracting a rising tide of Mainland money

A guest told delegates how in the last six months roughly, Chinese investors had been putting more money into US PE and private debt. He explained that they had for some years been buying into Chinese unicorns that would later list in the US or Hong Kong, but such listings are on hold, hence the transition to US opportunities. “We have been developing a greater flow of such deals from the US for an eager investor base in China,” he said.

Funds of funds are the way forward for some private bank intermediaries

An expert highlighted their approach of delivering their private clients and institutions deals through their fund of fund platform. “Clients can access private equity either via one specific fund that they choose through the bank platform, or if they do not want to build their own portfolio, and they want us to do it for them, they will invest in to commingled funds of different types of geography with different types of strategy,” he reported. “We have, for example, been managing a venture capital fund of fund since 2011, or our clients can also invest directly into companies, and they can also go through some of our direct vehicles or co-investment vehicles.”

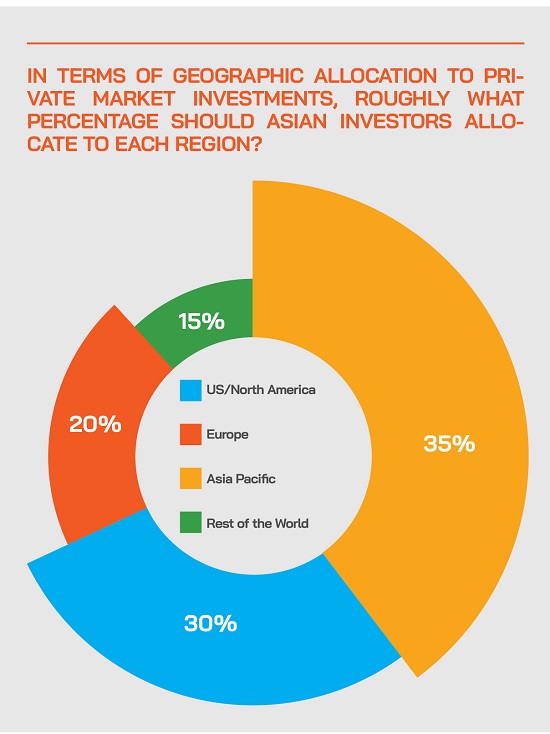

He explained that they tend to be overweight US and Europe, and they have a roughly 10% to 15% allocation to Asia.

In terms of liquidity, he explained that these investments are illiquid and therefore that clients need to properly assess their liquidity requirements before they decide on allocations. He said they help the clients with their projections and of course there is some return coming through each quarter, each half or each year. “And we project through some years ahead for the private equity capital calls,” he added. “It is very important to remember that it is not just the initial size of the ticket, but how much of these capital calls you can meet over time.”

He explained that their approach is very hands on with their clients, who need professional guidance and expertise to navigate these waters. “We are not just selling a product, we are selling a service, and the service that goes with the product is part of the education journey that the clients will go through when they invest in private assets or private markets,” he said.

Expert Opinion - Manmohan Mall, Head, Private Markets & Family Office, Kristal.AI: “We understand investing in the private market is complex. But it is an essential part of one's portfolio. During the current uncertain market condition, it’s imperative to diversify the portfolio by investing in less correlated asset classes. By providing a holistic solution under one roof, we at Kristal.AI aim to simplify the investment journey & cater to all the private market needs.”

Market conditions and timing – is this the right opportunity for private clients to invest or to take bigger exposures?

The panel turned their attention to timing and the prevailing market conditions, and timing.

A guest highlighted some disconnects, for example a wide range of political, economic and social ills in the UK, yet the stock market reaching new highs. “And what we see in private markets is the same thing, really, because in periods of stress, banks tend to lend less, they tend to be very careful, they step on the brakes,” he remarked. “But companies, developers, and founders need capital and might therefore present deals that are more appealing as there is less funding chasing them. In fact, we are seeing a deals that are more attractive than for some years, with good returns and comfortable risk profiles.”

He observed that in the areas in which his firm invests for clients, there is no overcrowding currently, especially with the shortfall in capital available for other traditional sources, such as the banks. “There's a big space to be filled and more and more demand for capital,” he reported.

He explained that in private debt, there is more demand for the larger deals amongst the larger players coming into the market, and they tend to take debt with yields of between 7% and 12%. “That is still good, but the field we play in at 15% returns is smaller but with higher returns of 15% roughly,” he said. “Moreover, we can get a mortgage on an asset, and various levels of security on top of that, for example personal guarantees and additional collateral. It is a comfortable place to be right now.”

He also acknowledged that the rising interest rate environment had also narrowed the gap between public and private debt returns. “We need to be able to deliver a return premium that is fairly consistent with what people think is the additional risk and lower liquidity,” he elucidated. “But we focus on the short durations, and we believe these deals are significantly less risky than investing in a high yield bond.”

Another expert opined on what he called the “fairly severe inflationary environment overall”, noting that some investments such as in the infrastructure space are also hedges against ongoing inflation. More generally, he advised investors to factor in interim liquidity considerations for their investments in private equity.

There are several core elements of risk, said another panellist, namely interest rates inflation, liquidity, and geopolitical risk. “We find because of the performance pressure or liquidity risk, our institutional partners are often selling their equity assets at relatively low levels, but at the same time, our high-net-worth customers, our family office customers, they have a longer investment horizon, and they are absorbing some of those institutional sales.”

The evolution of the Asian private investor in private markets and the vital importance of working with genuine experts and professionals

A guest explained that institutions are the biggest investors into illiquid longer term private market investment opportunities, but very institutional-like family office investors have also become “major believers and supporters” of the private markets.

“More family offices, and more wealthy families are turning to professionals such as ourselves to help manage their family wealth, while they focus on the core family business and leave the wealth management to the professionals,” he reported. “We are seeing a lot of single-family office investors in these assets, and a rising number of MFOs.”

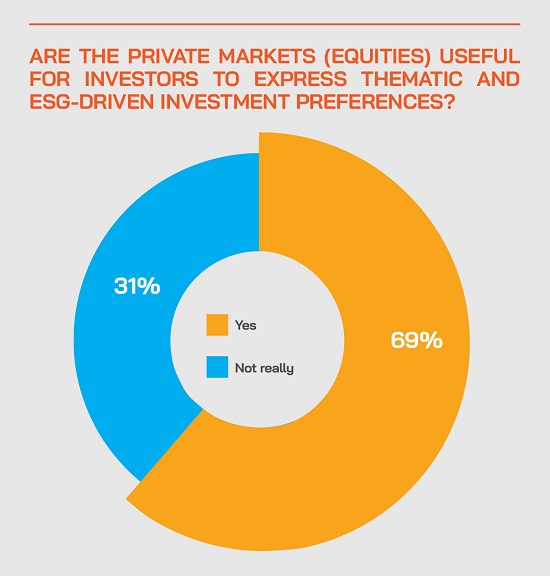

ESG is another focal point, especially for US and European investors, but increasingly also in Asia, a guest stated. “These are becoming very hot topics for investors, and they are often driving the decisions to invest in a fund, or even into alternative investments, focusing on the percentage of ESG certificated investments in these funds and portfolios,” he reported. As an example, this guest cited France’s considerable efforts in energy certification in real estate developments, and special social or other purposes for buildings.

Expert Opinion - Eric Cheung, Investment Director of Private Equity, Lombard Odier Investment Managers: “Sustainable investing in private markets has become more sophisticated and is now able to combine impact objectives with attractive financial returns. Today, the depth of the market facilitates the execution of our many investment convictions in sustainability. Our latest initiative is a global private assets fund investing in solutions that accelerate the transition towards a plastic circular economy.”

The final word went to an expert who explained that the choice of the professionals to help introduce and curate these private asset opportunities is also a vital element to risk mitigation and return enhancement.

“If you have a good equity manager that could add maybe a percentage points of additional value per annum to your portfolio,” he said. “Actually, one advantage of private assets is that this is a space that lends itself very well to adding value because there is genuinely a premium to research, a premium to origination, it is a very decentralised market, and information is difficult to obtain.” In other words, there is a premium on the right advisors and product providers to help evolve the right investments