An Update on the Wealth Management Market in the Philippines: Rising Optimism

Apr 27, 2021

The Philippines has always been one of those economies and markets that has perhaps promised more than it has delivered. But there is considerable optimism that the private sector, the regulators and the government are more aligned than ever in wanting to promote the financial sectors as the country's population grows so rapidly, as the mass affluent are rising fast and as they attempt to bring more of the massive offshore wealth of the rich and super-wealthy back onshore. The result is a gradually more diversified range of products and solutions onshore and a broader range of private banks and independent wealth firms, some of the alliances between international names and powerful local financial institutions with the reach across the country's vast lands and many thousands of islands.

A group of local and international experts assembled for the virtual Hubbis Digital Dialogue of April 20 to consider how and where the wealth management market is developing, set against the backdrop of other ASEAN countries, and where there needs to be great progress. Understanding the key drivers and current competitive environment is vital for the positioning of the local and international players as they jostle for prominence in what is certainly a market of huge potential. And the opportunities are certainly there to grasp – the Philippines has both a huge and a very young and fast-expanding population, the third youngest in Asia. GDP growth has been robust for many years, the pandemic aside, and the country is increasingly international in outlook. However, a key challenge for local private banks in the past has been the lack of products, which drove clients offshore, especially to nearby Hong Kong. Local private banks and the plentiful international competitors moving onshore are intent on offering an open platform and as many new products as the regulators might permit. Nevertheless, the reality is that regulation continues to lag the market needs, and the regulators continue to be rather cautious in opening the market to a wider array of products. This shortage of onshore investment products and solutions, as well as the shortage of onshore vehicles through which to access offshore assets, are core reasons for more international banks moving onshore, either flying their own flag, or partnering with major local banks and institutions, rather than sticking to their old models of flying bankers in and out. The EAMs/IAMs/multi-family offices plying their trade out of Singapore and Hong Kong also see considerable opportunity in the Philippines and have been expanding their presence in tune with the market's potential. But there is an acknowledged shortage of wealth management expertise in every market in Asia, and this is especially true in the Philippines. Aside from investments, the life and health insurance markets are evolving there, and insurance companies diversifying their distribution models, enhancing the diversity of sales through their agents, through bank distributors, and increasingly via online Fintech companies. Technology is a major area of concern and potential, with the need to invest smartly and productively considered to be of paramount importance. Our panel of experts produced a lively and engaging discussion on these topics and more besides.

PANEL MEMBERS

- Stella Cabalatungan, Executive Vice President, Head of Private Bank - Relationship Management, BDO Private Bank

- Rafael Ayuste, Senior Vice President and Trust Officer, BDO Unibank

- Damien Piper, Regional Director, Asia, InvestCloud

- Vincent Magnenat, Chief Executive Officer, Asia, Lombard Odier

- Dr. Robert Ramos, First Senior Vice President, Trust Officer and Group Head of the RCBC Trust and Investments Group, RCBC

- Patrick Donaldson, Head of Market Development, Wealth Management – Asia Pacific & Japan, Refinitiv

The Key Insights & Observations

The Philippines' demographics are highly supportive of rapid growth

The Philippines is a Catholic country, and has enjoyed dramatic population growth, and still is, driving the demographics forward, which is of course driving the economy and private wealth generation. The bulk of the Philippines population is below 40 years old, and domestic consumption is still the major engine of GDP growth. We are heading toward a very large middle class, the mass affluent segment is rising, and we are growing the domestic wealth industry to attract more HNW and UHNW wealth back onshore. In short, there is immense opportunity ahead.

Issues of mortality and the pandemic have encouraged more structured thinking

An expert reported how 2020 was a very good opportunity to further develop the bank's trustee business and develop more trust structures for customers. While clients have historically been more transactional rather than thinking about wealth management in the wider context of estate planning and trust structures for the transition of wealth down the family generations., the pandemic served as a catalyst for clients to really start thinking about generations to come, about structures, about strategies for transferring wealth and really talking about and organising effective estate planning.

Local incumbents need some help from the regulators

The regulations in the Philippines make it very difficult for local players to compete with the foreign counterparts, the offshore private banks. Accordingly, the local incumbents need greater liberalisation in order to offer a greater variety of offshore products and funds, delivered locally, in order to keep more wealth onshore, or draw more of the offshore wealth back onshore.

Regulation needs sorting out; it is too cumbersome and needs some consolidation

On the same topic, it is well known for many years that there are simply too many regulators in the Philippines and that as soon as possible there should be more consolidation amongst the different bodies in order to help liberalisation and therefore the modernisation of the financial world including wealth management. Will that happen any time soon? Not likely, but pressure should be applied reasonably in order to encourage the existing bodies to take a more pro-future approach.

By way of example, in the fund/trust segment, there are three regulators, one for the mutual funds, that's the Securities and Exchange Commission, then unit trusts are under the Central Bank and life-related products under the Insurance Commission. There are ongoing talks about achieving greater harmonisation, but thus far, there is not yet a clear direction in terms of a single regulatory framework for all the different pooled funds in the market today. “The long and short of that, “ concluded one guest, “is, we are hopeful, the changes will happen, but I don't think it's going to happen anytime soon. “

The offerings must become more interesting and relevant to the next generation clients

With so much of the huge and rapidly expanding population under the age of 40, and with wealth in the mass affluent space growing apace in recent years, the wealth industry must rapidly adjust its products, services and delivery to the nextgen clients. This is especially true as the pandemic has encouraged more of the older, founder or perhaps second-generation holders of wealth to transfer more assets, more responsibility or perhaps both to the nextgens.

Pandemic and lower rates drive clients to funds, safety and quality

Another expert reported that 2020 was a banner year for the fund business for the retail sector for pooled investment vehicles. “As a product provider, we create UITFs or unit trusts for our clients; we also have segregated portfolios for our retail clients, “ this expert reported. “We hit 1 trillion Pesos of AUM around July of last year, making us the largest trust entity in the Philippine market. The pandemic forces clients to look at quality, and there has been a shift from money in deposits with falling rates to unit funds, money market, bonds when they are available, and even equities. “

Diversification

With local interest rates falling – 10-year government bonds now yield just around 4.4% whereas it was around 8.2% in 2018 – an expert noted that diversification of holdings was taking place at a faster pace, with a shift into funds, bonds and also directly into selected equities.

Elevate the offering, boost the value of your advice

A guest highlighted the need to elevate the WM offering locally and broaden it far beyond the old transaction-driven client behaviour norms of before. Clients need a far more holistic approach to their wealth planning, estate planning and investments, rather than the rather ad hoc approach of yesteryear.

Growth ahead, and more development required

A guest reported that they estimate the domestic wealth management is growing more than 10% per year, and that there is a lot of liquidity. A more holistic and structured approach to wealth planning and investments will help further boost the market.

Number one, the wealth sector needs to transition to a digitised model. “Obviously, a lot of us have specific offerings that will allow clients to access these products digitally, “ a guest observed. “And it's important that the RMs still talk to these clients on a face-to-face basis. But one thing that has been seen during this particular time, clients don't mind transitioning to the digital space. The second thing we see right now is that clients are more cognizant of products abroad; clients are looking for new services that they can access. So, if we can combine the two, that would be a positive step forward. “

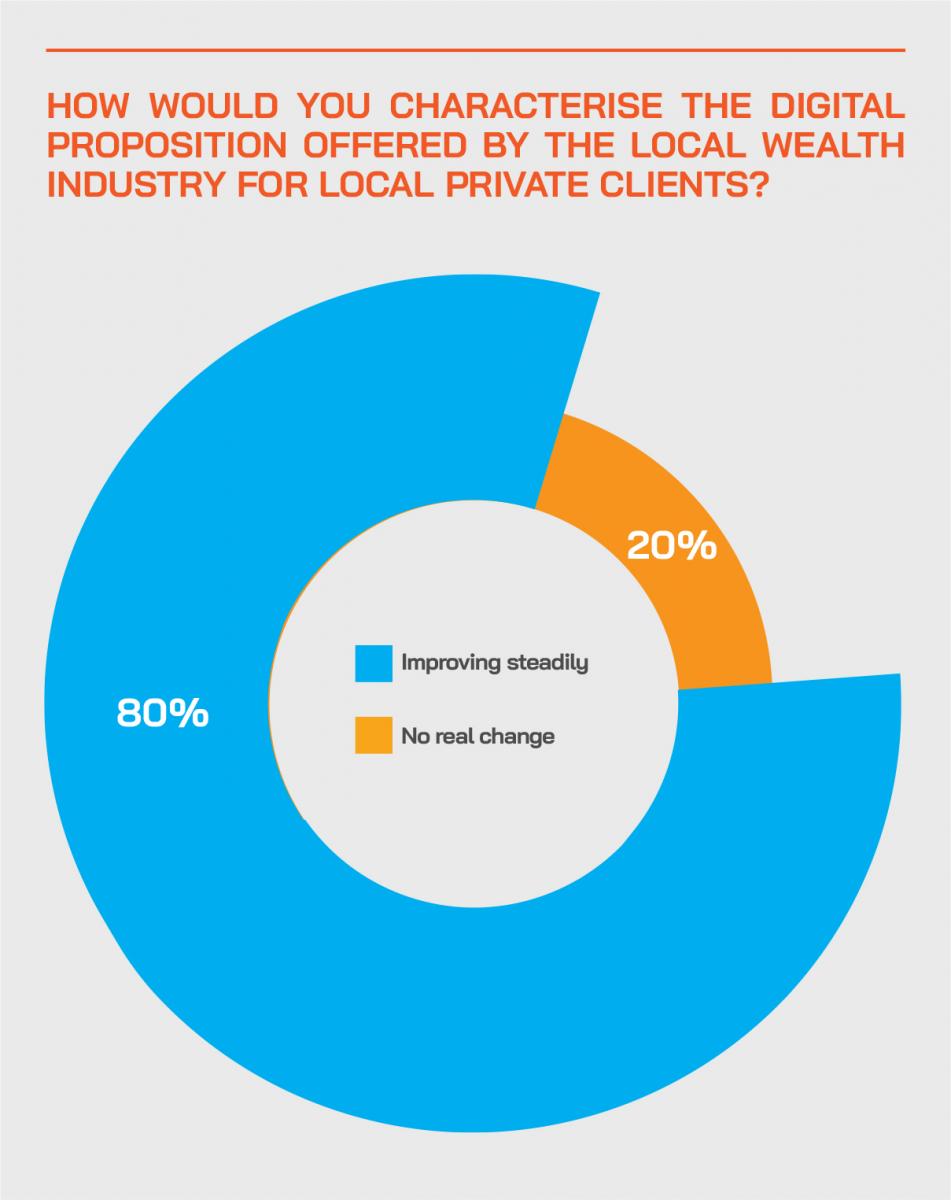

What the clients think about digital developments in-country – more to be done

A guest explained that they had conducted their own research into the market and with some key findings. He reported that two-thirds of investors recommend that the current wealth managers' digital setup is inadequate, meaning they think them below par. He said 20% of them consider switching providers for a better solution. And most interestingly, 80% or over three-quarters are looking for dynamic content. “What we mean by that is they're looking for kind of real-time insights into what they should be doing, what they should be looking at, such as choosing the right funds, whether domestically or worldwide, or selecting real ESG vehicles with the strongest ESG ratings. “

Lockdowns have hastened the need for digitisation

A banker explained how with lockdowns and uncertainties, the need for digital connectivity and solutions had risen dramatically. At the start of the lockdown last year, he explained, they had to close more than half of their branches, making a scary environment for customers, as they used to visit those branches to conduct all sort of simple or somewhat more complex transactions, for example redeeming a participation in a unit trust, or taking up life insurance, or perhaps just depositing cash into an account to buy a fund.

“At first, it was worrisome for them, “ he reported, “but we soon saw our clients coming together and embracing technology in a manner that we had not seen before. We can now have our clients process their transactions straight through, from contribution to subscriptions to redemptions; they can do everything online without having to step in a branch and that was a very powerful message that we drove across to our clients both the young and the not so young, particularly during the early part of the lockdown. “ He added that the trust of the ordinary Filipino in the digital protocol is not fully there yet, it might take a little bit more time for Filipinos to get used to using digital facilities for their investments, but great progress has been achieved.

Data and information are essential to the curation and delivery of optimised solutions

One expert in the field of data, data analytics and the delivery of a relevant and refined flow of such data to the RMs, advisors and clients highlighted how it is essential amidst a plethora of information to be able to refine data flows to be much more polished for the wealth management community, not only in the Philippines, but in the wider region as well, thereby helping in particular the advisors, relationship managers and portfolio managers arrive at the best decisions for their clients. “Feeding the right data and content is of paramount importance, “ he reported. “The Philippines is a key pillar in our expansion programme, as it is relatively less mature but with great potential for the services we can offer. “

Digitisation: a must-have

A guest highlighted the ongoing need for and opportunity in digitalising the wealth industry and the user experiences of the wealth management customers, both in the affluent space through to the high net worth space, and also for the RMs and advisors to tool them up and make more efficient. “The Philippines represents a huge opportunity; not only there is the huge population growth, which leads to the larger mass affluent market, but also a key demand to be able to service the customers holistically. Accordingly, we focus on how to advise that customer holistically and how to deliver solutions not just across wealth/investments, but also protection and insurance in one dialogue.

With so much wealth shifting to the nextgens and so many of those younger generations creating their own wealth, the digitisation of the wealth industry is an incredibly pressing priority. Simply, the digital natives amongst the millennial and even younger generations expect digitised wealth services. They also expect human connectivity and advice, but the RMs and advisors should be empowered by digital solutions and capable of delivering much of their support and advice digitally.

Moving the digital solutions and data flows into the modern world

A guest picked up on earlier comments that a majority of clients feel that their digital wealth experience is not good enough, and another view that there is still too much paper documentation. “Accordingly, these are reasons why some of the work we have been doing with global and regional and local banks is around key themes. The first is how can the digital experiences of a customer not be so much of the static experience that it is now, where at best, they might get a view of their portfolio and holdings? How can it become much more of an online collaboration between the relationship manager and the client? This is a lot more relevant these days since COVID, where they can't meet face to face, so how can you bring a face-to-face type engagement into the context of a virtual meeting room? “

Emulating the advances around the region's more sophisticated wealth markets

The wealth industry in the Philippines is clearly shifting gradually towards the norms seen in the global markets, in other words digital onboarding, then digitised lifecycle management of an account, and also to what he called contextualised advisory, which is essentially understanding what actions clients take and why, and tailoring relevant advice to those clients. He added that contextualised advisory is digitally enhanced or enabled advice. Whereas today the RM is rather guessing what the client is doing and why and then guessing what they might be interested in, with far greater use of data, the clients can be engaged on a more relevant level.

The Philippines – Update & Review of the Status of the Wealth Management Market

The Hubbis Post-Event Survey

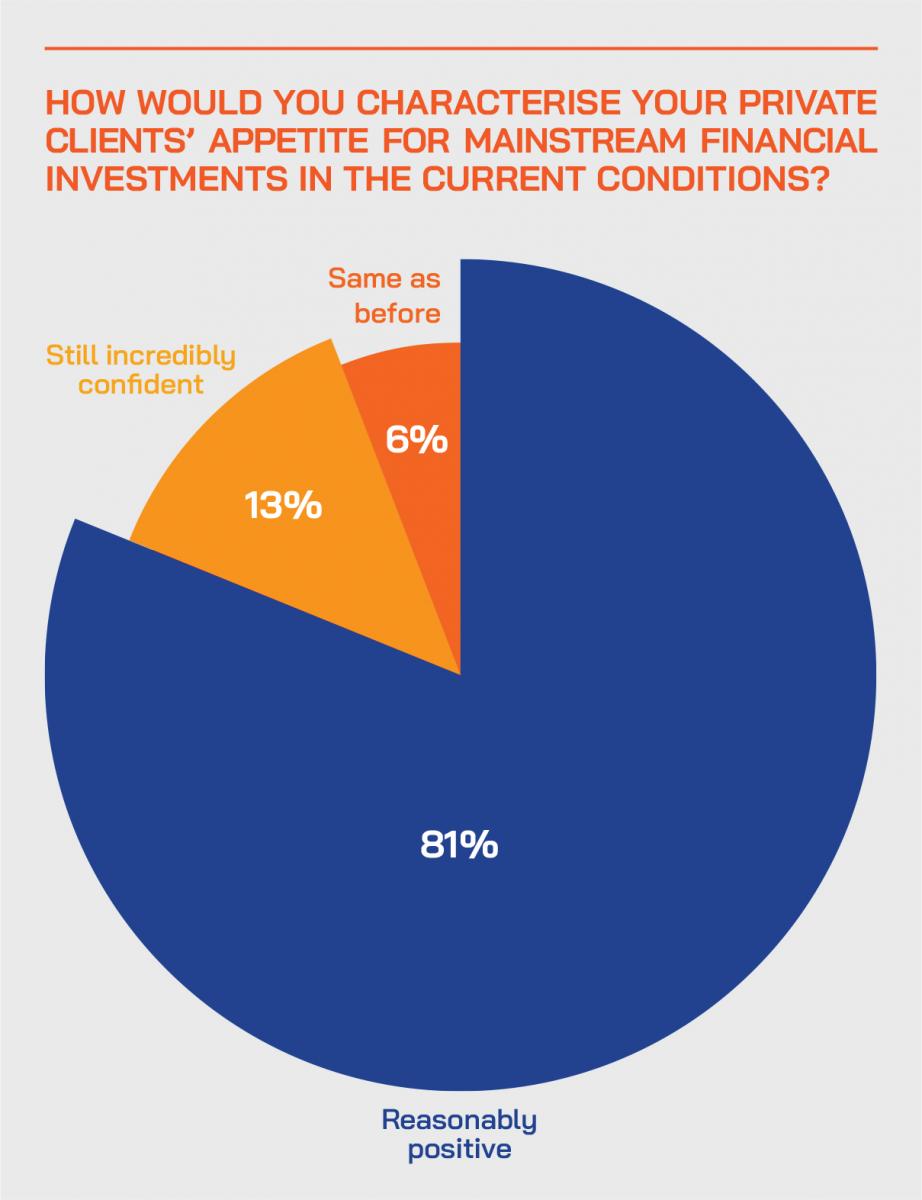

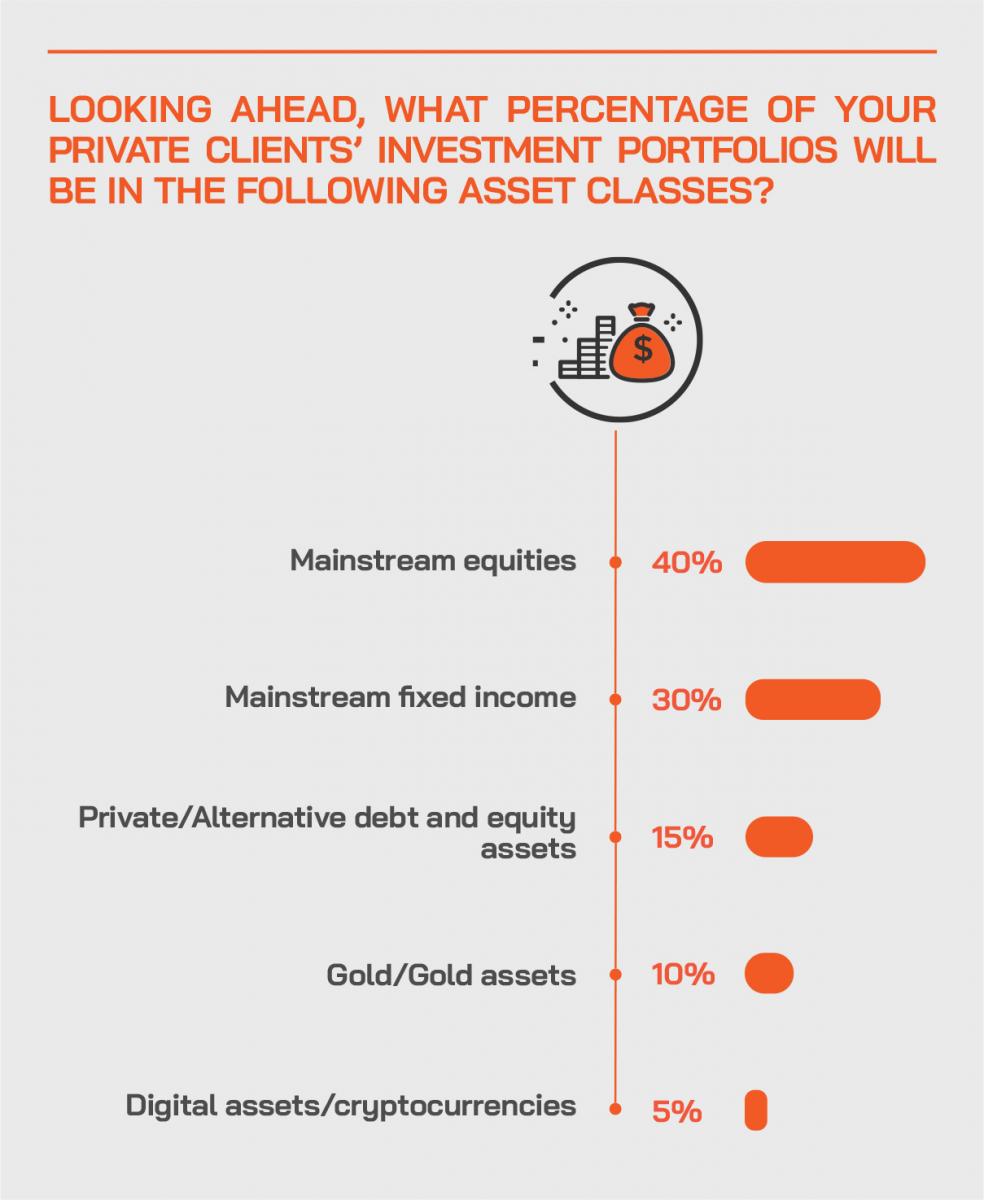

Hubbis sent out a very brief survey after the event, asking delegates for their views on a number of key topics of the discussion. We discovered that the mood is generally resilient regarding the appetite amongst private clients for mainstream portfolio investments. We found that 81% of respondents report their clients fairly positive about the mainstream public markets, and a lucky 13% incredibly confident about market prospects. In tune with this, we discovered that now clients are targeting a 40% allocation to equities, more than the last time we polled people in October last year, and 30% are targeting allocation to fixed income, which is lower than last year; the changes are due to a more positive climate for equities and falling bond yields.

Meanwhile, gold stands at around 10%, digital assets about 5% and alternative assets around 15%, which presents a very rational picture of allocation amongst wealthier clients in the current environment.

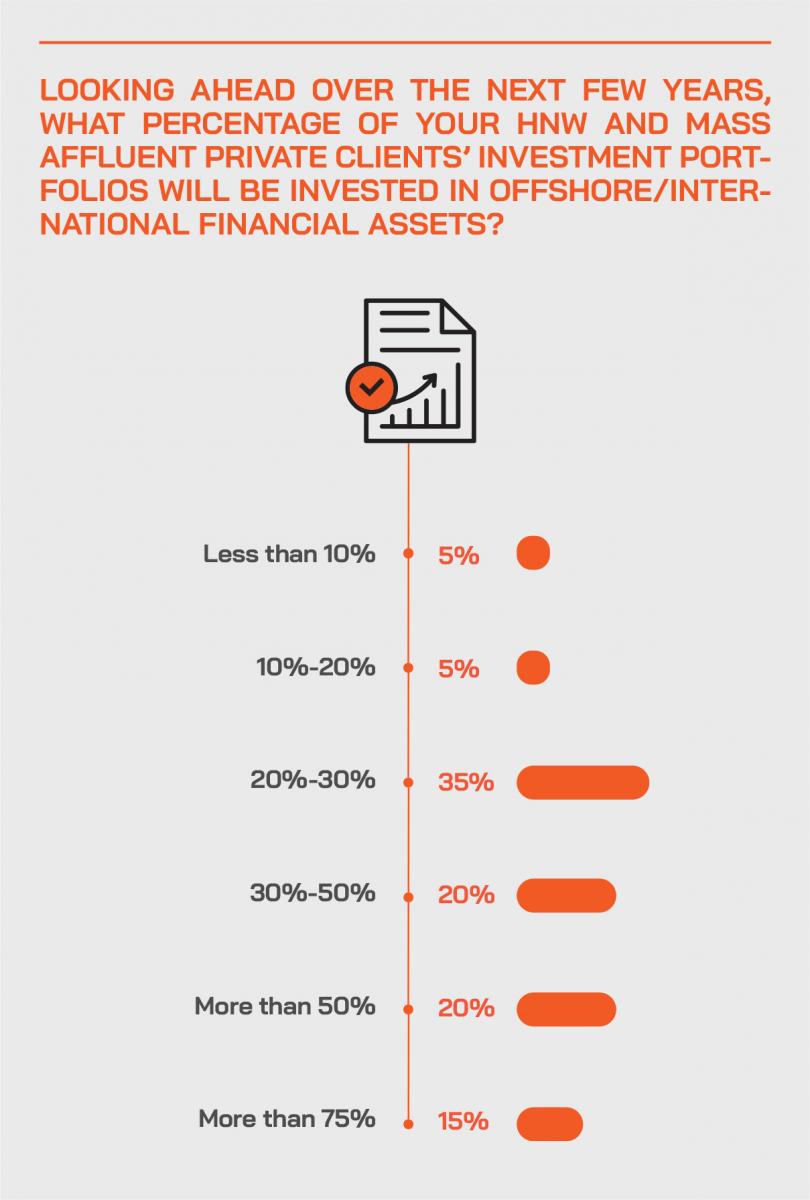

We found a continuing high appetite for offshore or international assets, partly due to the growth of feeder funds, partly due to the limited opportunities in the local market. The replies indicated some 55% of allocation would be to international assets, with 35% indicating that more than 50% would be allocated to overseas assets of different varieties.

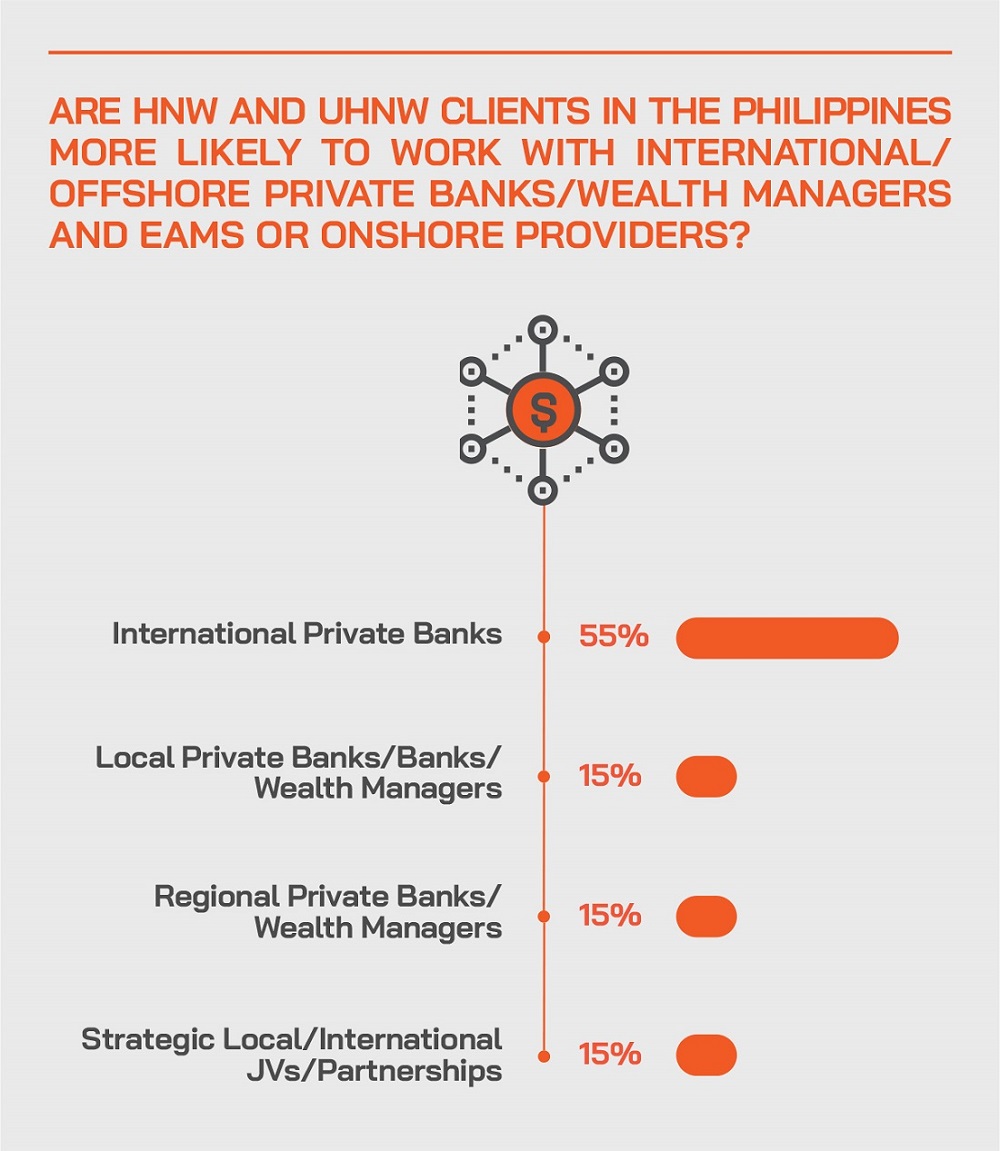

And this augurs well for the international private banks who are well-positioned to benefit from these trends, with 55% of replies indicating that their wealthy clients will prefer to work with the big, brand-name global institutions, with the rest of the business spread between some of the JVs or partnerships between local, regional and boutique overseas private banks, and with the local/international JVs/partnerships, which are reporting robust activity from their collective efforts.

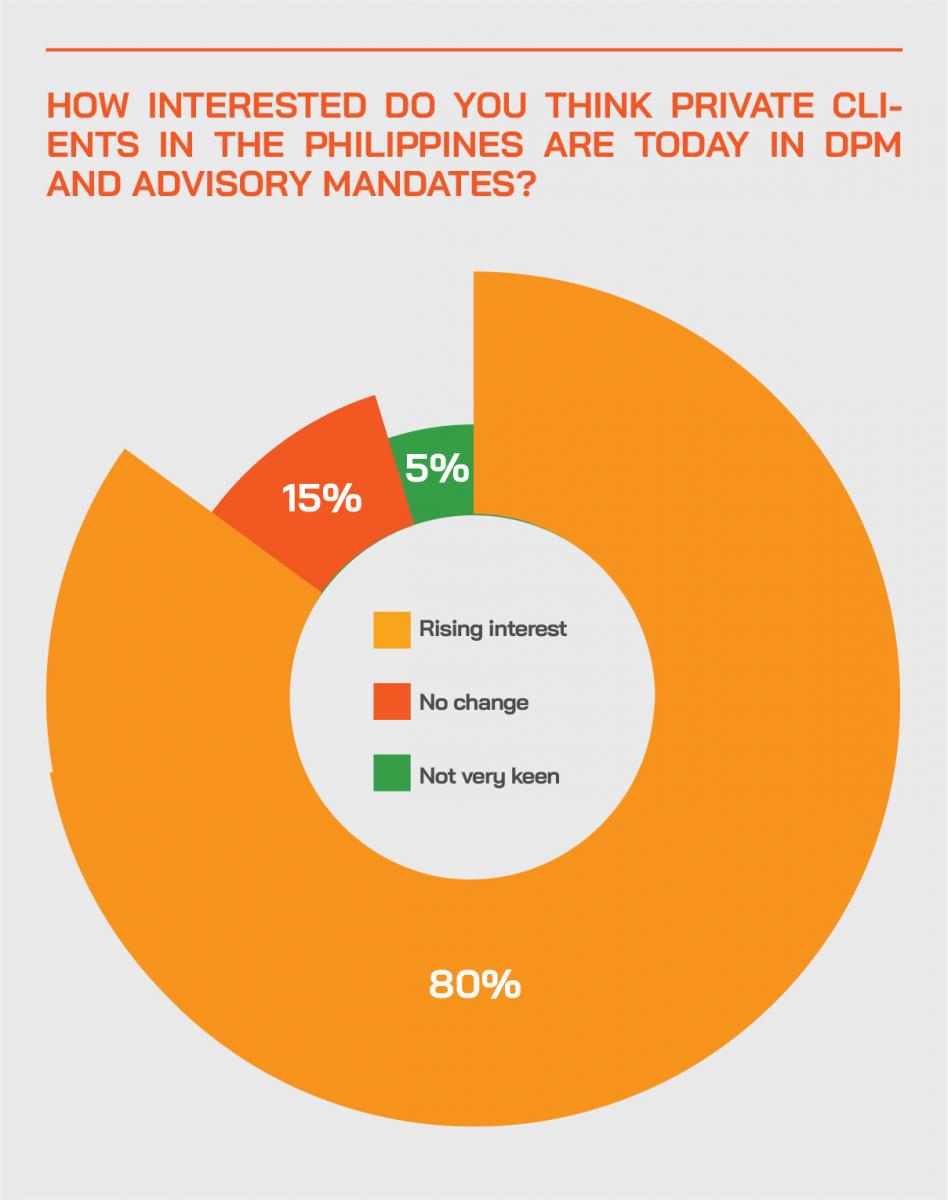

We saw that there is a strong rise in demand or at least interest in DPM and advisory, with 80% reporting strong and rising interest in this segment of activity. And we heard that the digital proposition is improving significantly broadly across the industry.

Asset allocation advances into a more positive mind frame and greater professionalism

We saw from the post-event survey we conducted how there is great optimism about allocations to risk asserts than when we last conducted a survey some six months ago, and also how there is great allocation to international assets, and finally rising appetite for DPM and advisory mandates amongst wealth clients. This fits neatly to comments from one guest on the panel, who had earlier highlighted how 80% of performance comes from the asset allocation, and not so much from the products. “So, the asset allocation, the risk allocations are the key elements to deliver performance, “ he explained. “If for example, you have decided to invest into, let's say, a small and midcap product now because of the vaccine rollout in Europe, it's not so much the funds that you will pick that will make the difference, but this investment in that specific sector and geography. In short, the asset allocation is the key, and that is what we keep in mind, especially in our advice to clients.

Onshore or offshore assets? Offshore wins, and by a big margin

Much of the investible/portfolio wealth of the HNWIs and UHNWIs is largely offshore, even today, but there is still perhaps 70% plus onshore and seeking greater opportunities. That is a core rationale for some of the JVs and partnerships between offshore international private banks, especially the boutique Swiss brands, and strong domestic financial institutions and universal banks.

“There is a strong need to develop the local offering and we believe knowledge and skills transfer to local partners will help, and of course we need help from the regulatory side as well, “ a guest remarked. “We believe that combining the local expertise with the global expertise will really add value to the market. “

He explained that in partnership with their local partner, they had managed to build a far more comprehensive offering, including global investments, and the combination of the international skills and diversified product range and the local connectivity and local skills was proving a compelling proposition for onshore clients.

Seeking greater personalisation

The second challenge, this same expert reported, is addressing the problems that RMs face when effectively they have a more limited product set and then overcoming those issues. “We think that it's a lot more about using technology for personalisation. So, working with some of the largest banks in the world as well as some sort of more local banks, we have been applying machine learning, to nudge the relationship manager to reach out to the right customer at the right time with the right solutions, and then to have feedback loops on how those customers react to those. “

Rapid reaction forces

He also agreed with an earlier comment that asset allocation is crucial. “As we've seen over the last 6 months to 12 months, the market has been incredibly volatile, so how can a client, someone who might not know so much about wealth management, be boosted with tools like automated rebalancing as well as proactive alerts to keep them always in sort of the right line? And then how do we use content to make them feel more comfortable about that asset allocation? These are key themes we work on with the major banks and also the more regional, local banks.

Thematic investments, yield for income, globalisation of allocations

An expert pointed to the growth of thematic funds and asset allocation, but also to the ongoing strong demand for investments that provide regular dividend flows or interest income. He pointed to the ongoing internationalisation of allocation, especially now that there is differentiation in economic performance following different successes in the vaccination programmes. Other key trends include sustainability and ESG.

ESG matches specialist mandates

A guest agreed, noting that his bank was seeing a lot of corporate or institutional clients looking into the ESG, particularly when they talk to religious organisations, foundations and educational institutions. “The dominant theme is always revolving around ESG as part of their investment mandate, “ he reported.

Another expert agreed, commenting that the awareness of sustainability, ESG and impact investing is on the rise, especially amongst the Millennials, but the evolution is thus far rather limited locally, and still from an incredibly low base.

Family matters, family governance and planning for the future

A guest highlighted a study conducted amongst ultra-wealthy families in the region including the Philippines recently highlighted the importance of estate planning, sustainability and technology, with the nextgens driving much of the focus in all these areas.

Another banker highlighted how many Filipinos live around the world and how many of their family members are dispersed across the globe. “What does that mean? “, he pondered, rhetorically. “Well, the way you manage your money, the way you structure your wealth, the way you prepare the successions. These are the key topics, obviously, that we are talking with our clients locally. It is very important is to combine local and global knowledge.

He also explained that family and business governance are key topics of conversation these days. “I think Covid has also accelerated this trend to want to define the governance within the family, the business, the values, what will be the future of the firm. And if I may say, sustainability or ESG are therefore a big part of these discussions, as we believe that businesses can and will transition to a new future. There is a change in the economic model, coming to a model, which is secular, lean, inclusive and clean. We not only embrace these concepts, but we firmly believe sustainability will generate superior returns in the future. “